PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistani Entrepreneurs Growing Against All Odds

Growing at more than 55% a year and collectively employing 41,000, the winners of Pakistan Fast Growth 100 contest were announced by Harvard-based Allworld Network last week. Of these 100 entrepreneurial companies, 70 also qualified for the Arabia500, putting Pakistan in second position after Turkey with 117 winners.

AllWorld was co-founded by Harvard Business School Professor Michael E. Porter, Deirdre M. Coyle, Jr., and Anne S. Habiby with the aim to bring visibility to growing companies in emerging markets to increase their odds of success. Any private, non-listed, company with rapid sales growth and an ability to demonstrate results with audited financial statements was invited to compete for a spot on the inaugural Arabia500 which includes Pakistan and Turkey in addition to the emerging economies of the Middle East and North Africa.

Each Pakistan entrepreneur ranked in the top 100 has grown an average of 40 percent annually between 2008 and 2010, created an average of 200 jobs per company, and is succeeding in industries from web technology to transportation, food to textiles, and construction to consulting, according to an AllWorld press release. With an average age of 42, nearly all of them plan to establish another entrepreneurial venture within the next two years.

Dr Abdul Hafeez Shaikh, Pakistan’s Minister for Finance, is quoted as saying that “the strong performance of Pakistani companies in Arabia500 illustrates that in spite of the challenges there continues to be strong business and investment opportunity in Pakistan. Pakistani companies in Arabia500 are surfacing new horizons for growth and quickening the pace of economic development and regional integration.”

The fastest growing company from Pakistan, E2E Supply Chain Management, grew at nearly 2000 percent between 2008 and 2010, with 2010 revenues above $50 million and 297 employees. Of the Arabia500 winners from 15 countries, E2E was the third fastest growing. Taking the second spot for Pakistan was Exceed Private Limited with a growth rate of 1,320 percent and 90 employees, and in sixth position overall on the Arabia500.

Pakistan also had the highest number of women entrepreneurs on the Arabia500, and Luscious Cosmetics of Pakistan topped the list of the fastest growing Arabia500 women entrepreneurs with growth of 392 percent and 82 employees.

Complimenting the Pakistan100 winners at the Awards Ceremony held in Lahore, AllWorld co-founders Deirdre Coyle and Anne Habiby urged the Pakistan100 to go further “When no one expected much, the Pakistan100 broke records for growth, transparency and competitiveness. They are the personification of what every country dreams of having. Now raise the bar higher and build Pakistan as a leading entrepreneurial nation.”

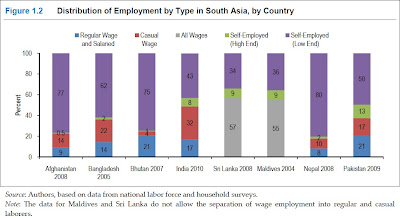

A recent World Bank report titled "More and Better Jobs in South Asia" said that 63% of Pakistan's workforce is self-employed, including 13% high-end self-employed. Salaried and daily wage earners make up only 37% of the workforce.

Even if one chooses to consider just the 13% who are high-end self-employed as entrepreneurs by choice, it puts Pakistanis among the most entrepreneurial people in the world.

The winners of Pakistan100 entrepreneurs are truly inspirational. They epitomize the Pakistani nation's extraordinary resilience and reaffirm that Pakistan's best days are ahead.

Related Links:

Pakistani Entrepreneurs Survive Downturn

Pakistan Leads in Entrepreneurship Indicators

Microfinance to Fight Poverty in Pakistan

Pakistani Entrepreneurs Summit in Silicon Valley

Social Entrepreneurs Target India, Pakistan

Urbanization in Pakistan Highest in South Asia

Start-ups Drive a Boom in Pakistan

P.I.D.E. on Entrepreneurship in Pakistan

Light a Candle, Do Not Curse Darkness

Pakistan Tops Job Growth in Pakistan

-

Comment by Riaz Haq on May 24, 2012 at 8:34am

-

Here's a Bloomberg report on Pakistan's plans for small cap company shares market:

Pakistan may set up a stock exchange for small companies to raise capital as part of government plans to provide more financing channels for Asia’s fifth-smallest economy and as initial public offerings dry up.

The Securities & Exchange Commission of Pakistan may form the exchange or create a board within the bourse, Muhammad Ali, chairman of the regulator, said in an interview at Bloomberg’s office in Karachi yesterday. There haven’t been any listings on the Karachi Stock Exchange this year after four companies went public in 2011, according to the exchange’s website.

“So much creativity dies in this country without seeing the light of day because we can’t provide vehicles for financial capital,” said Ali, 43. “Unless this happens we won’t achieve corporatization, documentation of the economy or tax collection.”

Prime Minister Yousuf Raza Gilani’s government is seeking to get more revenue from an underground economy that employs more than three quarters of the nation’s 54 million workers and is worth as much as 50 percent of the $200 billion official gross domestic product. There are 60,000 registered companies and 3 million small- and medium-sized sole proprietors and partnerships, most of which are part of the underground economy.

The Karachi Stock Exchange 100 Index (KSE100) has surged 24 percent this year after the government eased rules on a capital-gains tax and demand for energy and building materials bolstered company earnings. The measure was little changed at 14,019.56 at 10:03 a.m. local time.

Huge PotentialThe stocks gauge, which slid 5.6 percent in 2011, is trading at 6.9 times estimated earnings, the lowest valuation in Asia, reflecting the country’s struggles to cope with militant attacks and political instability. The BSE India Sensitive Index trades at 12.4 times forward profit after gaining 3.1 percent this year.

“A platform for small businesses will allow investors to tap the potential of growing companies,” Farid Khan, who manages 65 billion rupees ($706 million) in stocks and bonds as chief executive of ABL Asset Management Co. in Karachi, said by telephone yesterday. “However, only selective institutions should be allowed to invest in these companies because these are higher risk concerns.”

Companies may be segregated into categories with rules allowing only larger investors to trade in riskier stocks, said Ali, who joined the agency in December 2010.

His commission has recommended changes in tax rates and also plans to amend the company law by next year to introduce different reporting requirements for smaller businesses that list on the exchange. There are 591 companies listed companies.

Bigger Tax NetThe SEC has also proposed that the 35 percent corporate tax rate be reduced and the 25 percent levy paid by unlisted businesses be raised to encourage public share offerings.

“If we have this fiscal change and a new law that differentiates between reporting requirements based on the size of the company, businesses will be corporatized in the country and that’s the way forward to document the economy and broaden the tax net,” said Ali, a former broker who led Indosuez W.I. Carr Securities in Karachi for six years.

Pakistan’s ratio of tax to gross domestic product was 8.6 percent in June, one of the world’s lowest, according to Macro- economic Insights in Islamabad. Only 25 percent of the economy is taxed if the undocumented sector is taken into account, Sakib Sherani, the chief executive officer of the economic research company, said by e-mail last month

---.http://www.businessweek.com/news/2012-05-24/pakistan-may-set-up-sma...

-

Comment by Riaz Haq on June 11, 2012 at 8:00am

-

Here's a BR story on State Bank governor encouraging Pak banks to finance SMEs:

KARACHI: Governor, State Bank of Pakistan, Yaseen Anwar has stressed upon the banks to give top most priority to SME banking with a view to ensuring uninterrupted flow of financial access to SME sector in the country.

Speaking at the signing ceremony of the project document between the State Bank of Pakistan (SBP) and Bank Alfalah under the DFID-funded Financial Inclusion Programme (FIP) at SBP, here Monday, he said the role of banks, especially of mid-tier banks, is crucial to ensure unhindered flow of financial resources to the SME sector which is the engine of economic growth in Pakistan.

"Though many banks in the market are trying to improve their market position in order to serve the sector more effectively, the current level of SME finance as well as an overall level of SMEs access to banking services remain unsatisfactory, and as such call for more serious efforts on part of the banks", SBP Governor added.

Anwar said that SME financing is very close to his heart due to its key significant contribution in the economic development of Pakistan. "The SME sector plays an important role in employment generation, poverty alleviation, and equitable distribution of resources and is the engine of growth", he added.

He pointed out there are 3.2 million economic establishments, of which 99% are SMEs, and SME sector represents over 90% of all enterprises and employs 75% of the non-agricultural workforce and contributes 30% towards the national GDP.

"However, despite its strong contribution in employment generation, exports, and national income, the SME sector is severely constrained in access to finance which is crucial for its growth", he added.

SBP Governor advised the banks to study the international examples of successful SME banking models which include Retail-based Model for Mass SME, Relationship-based banking, Advisory-based lending services, Segment-based Model, and Supply-chain linked Model.

Regrettably, he said that despite its immense significance and potential, the SME sector in Pakistan remains largely financially excluded, the current level of financing facilities to this sector stand at Rs 253 billion, constituting only 7% of the banks' total advances.

Anwar said that with the SBP- Bank Alfalah and International Finance Corporation (IFC) nexus, and the generosity of DFID, we can have more joint ventures of this sort in the future that would lead to a sustainable, sound and integrated financial system, characterised with ready access to finance, diversified loan portfolio and extended outreach to SMEs.

He said the State Bank, under the DFID-funded "Financial Inclusion Programme (FIP) will provide funding support to Bank Alfalah (BAF) in undertaking the IFC SME Advisory Project. "The main objective of the project is to create a symbolic podium which can position Bank Alafalah to cater to the financing needs of the SME sector including the S and M segments through a holistic banking and advisory services solution", he added.

SBP Governor said the SMEs need to be addressed through innovative credit assessment tools and techniques like credit scoring and capacity enhancement of the financial service providers, and an integrated approach to SME Banking. DFID and SBP are keen to upscale FIP to reach out the unbanked segments in Pakistan. Going forward, FIP funds will also be targeted to improve financial inclusion through SMEs banking, Anwar added....

http://www.brecorder.com/pakistan/banking-a-finance/61658-sbp-gover...

-

Comment by Riaz Haq on February 20, 2013 at 9:01am

-

Here's a PakistanToday report on SBP support of small businesses:

The State Bank of Pakistan's (SBP) Credit Guarantee Scheme (CGS) has helped small enterprises and farmers to access Rs 2.83 billion in bank financing over the last 18 months.

The Scheme (CGS) has facilitated financing in 105 districts across the country with 85 percent of loans provided to previously un-served/under-served clients in rural areas, of which 81 percent were subsistence farmers, said a SBP press statement on Wednesday.

Similarly, 91 percent of the loans under the Scheme were provided to small businesses with less than five employees of whom 90 percent were

Sole proprietors the statement added.Under the CGS, banks also focused on serving the lower end of the commercial banking market through smaller loans, with an average loan size of Rs 390,000 for agriculture and Rs 2.1 million for small enterprises. Specific to the needs of the clients, the durations ranged from less than one year to three years.

The Scheme through its support to previously un catered small rural enterprises is likely to enhance economic opportunities and increase employment in the rural areas of the country.

The Technical Committee of the bank during its annual review of the Scheme observed that despite the extensive geographic spread and a focus on under-banked segments, the participating banks demonstrated prudent lending practices reflected in an infection ratio of only 2.91 percent for agriculture and 1.07 percent for small enterprise loan portfolios, which are much lower than the industry averages.

It shall be noted that the CGS is monitored by the Technical Committee drawing membership from the UK's Department for International Development (DFID), SBP and the Pakistan Banks Association (PBA).

The Scheme is working in tandem with nine banks including big five banks which were selected after due screening by the Committee.

http://www.pakistantoday.com.pk/2013/02/20/news/profit/smes-farmers...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 11 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network