PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Gas Reserves

Reports of new gas reserves of 40 trillion cubic feet (upped to 105 TCF in 2013 by US EIA) are specially welcome at this moment in Pakistan when it is facing a very serious and growing energy crisis. The US Energy Information Administration (EIA) puts the estimates even higher at 51 trillion cubic feet. Even if the demand doubles from the current one trillion cubic feet a year to two trillion cubic feet a year, the estimated current gas reserves can last as long as 30 years or more.

Pakistan is particularly heavily dependent on natural gas for its energy needs. Demand for natural gas in Pakistan has increased by almost 10 percent annually from 2000-01 to 2007-08, reaching around 3,200m cubic feet per day (MMCFD) last year, against the total production of 3,774 MMCFD, according to Pakistani official sources. But, during 2008-2009, the demand for natural gas exceeded the available supply, with production of 4,528 MMCFD gas against demand for 4,731 MMCFD, indicating a shortfall of 203 MMCFD.

The gas supply-demand imbalance is expected to grow every year to cripple the economy by 2025, when shortage will be 11,092 MMCFD (Million standard cubic feet per day) against total 13,259 MMCFD production. The Hagler Bailly report added that Pakistan's gas shortage would get much worse in the next two decades if it did not bring on any alternative sources.

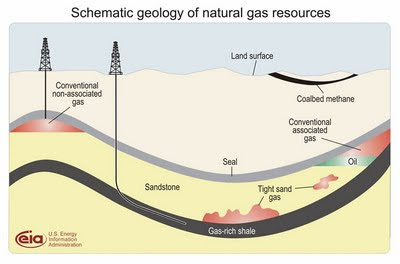

Shale gas offers an alternative source for energy-starved Pakistan. Rough estimates indicate the presence of at least 33 trillion cubic feet of unconventional gas reserves trapped in tight sands, according to an ENI Pakistan report. Another report by Shahab Alam, technical director of Pakistan Petroleum Concessions, puts the estimate at 40 trillion cubic feet of tight gas reserves in the country. These unconventional gas reserves are in addition to the remaining conventional proven gas reserves of over 30 trillion cubic feet.

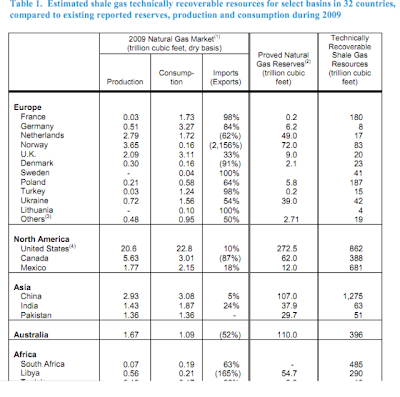

With the pioneering work done in the United States on deep drilling and hydraulic fracturing (fracking) to extract hydrocarbons from shale rock, it is now estimated that the US alone has over 1000 trillion cubic feet of recoverable unconventional gas, according to the Wall Street Journal. Unlike the bulk of world's conventional natural gas reserves that are found in Russia, Iran, Venezuela and Qatar, the shale gas reserves have been discovered in rock formations spread across many parts of the world, including Australia (396 TCF), China (1275 TCF), North America (1931 TCF), South America (1225 TCF), Europe (639 TCF), South Africa (485 TCF), India (63 TCF) and Pakistan (51 TCF). Many energy analysts argue that tapping these new hydrocarbon resources could be a game-changer in terms of global economics and geo-politics.

Increased production of gas from shale in the US has created a glut, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $4.23/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

Under the new policy, exploration companies will be offered 40-50% higher prices for the extracted gas compared with the $4.26/Btu price announced in Exploration and Production Policy 2009. Companies which succeed in recovering gas from tight fields within two years will get 50% hike over the 2009 price and if it takes more time they will get only a 40% hike on the 2009 price. As an added incentive, the leases for the fields will now be for 40 years instead of 30 in the 2009 policy, the official said.

Even with the higher prices for the tight gas offered to the exploration companies, it is estimated that Pakistan will have to pay a maximum of $6.50/Btu for the gas compared with $12.30/Btu for gas imports, according to a report by Platts.

Although it does burn much cleaner than coal and oil, the process of extraction of shale gas in Pakistan, or anywhere else, is not without risks, particularly risks to the environment. In the United States, there have been many reports of ground water contamination from chemicals used to fracture rocks, as well as high levels of methane in water wells. In the absence of tight regulations and close monitoring, such pollution of ground water could spell disaster for humans and agriculture.

Given Pakistan's heavy dependence on natural gas for energy and as feedstock for industries such as fertilizer, fiber and plastics, it's important to pursue shale gas fields development under reasonably tight environmental regulations to minimize risks to the ground water resources.

Related Links:

Haq's Musings

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

-

Comment by Riaz Haq on January 11, 2013 at 10:53pm

-

Here's ET on hydrocarbon potential in FATA and KP:

PESHAWAR:

The Federally Administered Tribal Areas (Fata) and Frontier Regions (FR) have enormous reserves of minerals, oil and natural gas that can augment economic activity in the war-torn areas, a research project concluded.

Talking to The Express Tribune ‘Source Rock Mapping and Investigation of Hydrocarbon Potential (SRMIHP)’ Project Coordinator Dr Fazal Rabi Khan said that exploration and excavation of oil and gas will introduce a new era of development and prosperity in the tribal areas.

“There can be many job opportunities created for people in the tribal belt if mineral exploration and extraction is pursued properly,” said Khan, who is also the chairman of the Geology Department in Abdul Wali Khan University Mardan (Palosa Campus).

The project was launched in 2008 under an agreement between the Fata Development Authority and National Centre of Excellence in Geology University of Peshawar. The project, which was completed at an estimated cost Rs40 million, was completed in June 2012.

Khan said that their objectives include identifying hydrocarbon generating rocks and its distribution in the region, preparing a geo-database regarding hydrocarbon potential and generating a systematic data to attract oil and gas companies for exploration.

The project has successfully collected, processed and digitised the data as a result of which, 80% of the project area has been mapped digitally. “This mapping has led to the discovery of seven new oil and gas seepages.”

He added that 11 oil and gas exploration companies have reserved 16 blocks in Fata, which go across from FR Peshawar and Kohat to Khyber, Orakzai, Bannu, Tank and up to North and South Waziristan.

He said that recently 17 oil and gas exploration companies initiated their operations in Khyber, Orakzai, North and South Waziristan agencies as well as in FR Peshawar, Kohat, Bannu, Tank and DI Khan.

Khan said that Mari Gas Company, HYCARBEX Inc, Oil and Gas Development Company, Tullow, Saif Energy, MOL Pakistan Oil and Gas, Orient Petroleum International, Pakistan Petroleum, ZHEN, ZAVER and others are currently working in Fata.

Oil and Gas Development Company (OGDC) will start drilling in these areas for the exploration of oil and gas reservoirs. The chairman said that the foreign oil company, Tullow, has obtained a licence for the exploration of oil and gas in North Waziristan Agency and Bannu, while MOL has shown interest in Khyber Agency, Kohat and Peshawar.

“Although law and order problems can become a hindrance, the project can be managed considering its importance,” he added.

Khan elaborated that the process in Fata would not only help overcome the energy crisis but will also give a big boost to efforts for the socio-economic development of the region. Khyber-Pakhtunkhwa is teeming with minerals and Fata is a new oil estate, he said. “In the next five years, this province will produce more oil than Dubai and as far as shortage of gas is concerned, the hills of FR Tank are full of it.”

He said Governor Masood Kausar has also taken keen interest in the project. “The best news for the tribal areas is that there are large reserves of natural resources and foreign and local companies interested in its extraction can exploit the resources,” said Kausar.

http://tribune.com.pk/story/484440/new-hope-springs-fata-fr-regions...

-

Comment by Riaz Haq on January 18, 2013 at 11:32pm

-

Here's a Eurasia report on oil and gas in Pakistan's FATA region:

According to an OilPrice.com Energy Intelligence Report, Pakistan’s tribal areas are believed to have massive reserves of oil and natural gas—which Pakistani officials have suddenly become very keen to demonstrate. But this is a highly restive, war-torn area where one right move could make all the difference, and one wrong move could ignite a conflict with irreversible consequences.

For now, the area remains unexplored and it was only in 2008 when Pakistani geologists began to study the area in earnest, with the support of the local authorities. The results of this research were collected, processed and digitized in June 2012. The geologists discovered seven new oil and gas seepages during the mapping. The geologists also claim that 11 oil and gas exploration companies have already reserved 16 blocks in Fata.

Geologists say the area, bursting at the seams with gas, is poised to become a ‘new oil state’ whose production could rival Dubai’s in only five years.

The interest is evident from: 1) seventeen companies have initiated operations in Khyber, Orakzai, North and South Waziristan, Peshawar, Kohat, Bannu, Tank and Dera Ismail Khan), 2) Tullow has been active in Pakistan since 1991, but since 2008 it has sought to transfer its Asian licenses to focus on Africa and the Atlantic Margin, 3) other players include Mari Gas Company (Pakistan), HYCARBEX (part of American Energy Group ), Saif Energy (Pakistan), MOL Pakistan Oil and Gas, Orient Petroleum International (Ocean Pakistan/Cayman Islands), ZHEN (China), and others and 4) Oil and Gas Development Company (OGDC) of Pakistan is set to begin exploratory drilling in the area soon.

The report has also talked about Gwadar port. In terms of infrastructure, China has been the chief architect, and investor. China has already invested around $300 million in the deepwater Gwadar Port close to Gulf of Oman.

Construction began in 2002 and the goal was to make this port a transit hub for landlocked countries (Afghanistan and Central Asia) and to boost transit from the Persian Gulf to East Africa. China plans to invest a total of $1.6 billion in the port—so far it’s cost $200 million to build the first three berths, which can handle $2 billion in cargo annually.

Despite its capacity, cargo has been slow to move through this port, largely because it’s not connected to the rest of the country.

http://www.eurasiareview.com/19012013-tapping-into-pakistans-massiv...

-

Comment by Riaz Haq on February 24, 2013 at 7:38am

-

Here's a BR report on unconventional oil ad gas policy in Pakistan:

Advisor to Prime Minister on Petroleumand Natural Resources Dr. Asim said that Pakistan offers great potential in the oil and gas sector and the government is doing its part by introducing new policies to meet the rising energy demand .

He was presiding over a seminar organized by the Petroleum Institute of Pakistan (PIP), a representative body of the oil and gas industry, on the topic "Shale Gas Potential in Pakistan" on Saturday.

The purpose of holding this seminar was to create awareness aboutpotential and challenges of shale gas in Pakistan and establish PIP'sprofessional standing in view of assisting the government on dealing with the energy crises in the country.

The forum consisted of 150 distinguished guests from the oil and gas fraternity including government officials, media personnel and students from Karachi's top universities/colleges.

Dr. Asim Hussain said he has been advocating the need to balancecountry's energy mix, which currently is heavily dependent on natural gas.

He stated that the US Energy Information Administration have estimated 51 TCF Shale Gas Reserves in Pakistan, while as estimated reserves for Low BTU Gas are 2 TCF and that of tight gas are 40 TCF.

He added that Shale Gas exploration is high technical and costly, therefore, in order to encourage its exploration, pilot projects are planned.

The Ministry of Petroleum and Natural Resources will facilitate E&P Companies wishing to explore shale gas, by granting special concessions through transparent process and based on merit.

Chairman PIP Asim Murtaza Khan stressed on PIP's role as an effective energy sector advisory body, supporting government and industry in Pakistan todevelop a progressive and sustainable roadmap to meet present and futurechallenges.

He said that PIP is planning to hold series of seminars in nearfuture. The big ticket items that will be discussed and which need theimmediate attention will be the "LPG Outlook in Pakistan", "Fast-trackingimports of LNG", "Refining Vision 2020", "Energy conservation" and"Restructuring of the Pakistan's gas sector".

http://www.brecorder.com/pakistan/business-a-economy/107602-pakista...

-

Comment by Riaz Haq on March 24, 2013 at 10:47pm

-

Here's a Dawn story on oil and gas discoveries in Pakistan:

Following a lacklustre period of several years, when things remained quite on the oil and gas exploration sector, in the face of heightened security situation and circular debt issues, the oil and gas fields have started to buzz with activity.

In the current financial year-to-date (July 1, 2012 to March 11, 2013) the country’s oil and gas sector has spudded as many as 56 wells. It represents a big leap over the 31 wells drilled in the same period last year. The sector has drilled 20 new exploratory wells as against 12 wells same time last year, depicting a significant increase of 67 per cent.

On the discovery side, the picture was a lot brighter than the earlier years as a total of 10 discoveries have been made by the sector in FY13 so far.

The sector’s drilling of a total of 56 exploratory and development (E&D) wells during the period also represents achieving 61 per cent of the full year target set at 91 wells. Even in that sphere, the sector fared better than the comparable period last year when only 41 per cent of the target 76 wells could be drilled.

“O&G sector’s focus continues to remain on the development wells”, says Nauman Khan, analyst at Topline Securities. Of the total wells drilled, 36 were development wells (representing 64 per cent of total activity). It reflected improvement over 19 wells or 61pc of total wells drilled in the comparable period last year.

Apart from the development wells, the activity on the exploration side also represented encouraging growth. Although, contribution of the exploratory wells had slightly declined to 36pc as against 39pc in the same period last year, the overall trend was heartwarming.

The sector spudded 20 exploratory wells, which was significantly more than 12 wells drilled in the comparable period last year while it represented 45pc of full year target of 44 wells.

Analyst said that amongst the listed companies, Pakistan’s largest oil and gas explorer, the Oil and Gas Development Company (OGDC) had drilled 13 wells which were 63 per cent higher than eight wells drilled last year. Included in those 13 wells, were two exploratory wells and 11 development wells.

Pakistan Petroleum Limited drilled five wells (one exploratory and four development), up from two development wells in the comparable period last year. However, with full year target of 16 wells (six exploratory and 10 development), sector watchers expect the drilling activity of the company to significantly intensify in the remaining of the year.

The third major oil and gas E&P company, the Pakistan Oilfields Limited drilled only one exploratory. In the comparable period last year, POL had drilled two exploratory wells.

Though much of the success eluded the E&P companies on the listed sector, the revival and discovery would benefit the country. The darkest hour for the sector came possibly in late 2010 and early 2011, when exploration and development work had started to limp.

According to the data compiled by Pakistan Petroleum Information Services (PPIS), 28 E&P companies in the country, that hold operator licences, together had drilled only 19 wells in first half of the year 2011, compared to 80 wells targeted for all of the FY11.Besides the poor security situation, the two major reasons for the underperformance of E&P companies were the nagging circular debt, which had affected the drillers’ liquidity thereby restricting their drilling portfolio and secondly, the continuation of the carry over wells of the earlier year that stalled companies from launching into new wells, keeping them focused on already drilled ground.

http://dawn.com/2013/03/24/oil-gas-sector-makes-10-discoveries/

-

Comment by Riaz Haq on May 3, 2013 at 10:47am

-

Here's an AFP report about discovery of new gas reserves near Karachi:

ISLAMABAD: Pakistan has discovered a new gas reserve in southern Sindh province that would help reduce acute gas shortages for industry and transport, the petroleum ministry said Friday.

Italian energy major ENI with joint venture partners Pakistan Petroleum Limited and Kuwait Foreign Petroleum Exploration Company made the discovery in the Kirthar Fold Belt region 270 kilometres (170 miles) north of Karachi.

"During the production testing gas flowed at 33 million cubic feet per day highlighting an excellent potential for the future for energy needs of the country," the ministry said in a statement.

Officials said that under an early production scheme, gas supply from the new reserve would be possible within three years.

Pakistan's Minister for Petroleum and Natural Resources Sohail Wajahat Siddiqui said that the discovery was "good news for the nation and the energy sector of Pakistan".

The discovery of new oil and gas reservoirs were "vital" to cope with the prevailing energy shortage in the country, Siddiqui said.

ENI has been in Pakistan since 2000 and is the country's largest producer, with an average production of 54,800 barrels of oil equivalent per day in 2011.

Pakistan has had an endemic energy crisis for years, characterized by frequent blackouts, which has crippled the economy.

The crisis is blamed on chronic mismanagement and corruption.

http://www.thenews.com.pk/article-99474-New-gas-reserves-discovered...

-

Comment by Riaz Haq on June 17, 2013 at 6:48am

-

Pakistan has more shale oil than Canada, according to the US Energy Information Administration (EIA) report released on June 13, 2013.

The US EIA report estimates Pakistan's total shale oil reserves at 227 billion barrels of which 9.1 billion barrels are technically recoverable with today's technology. In addition, the latest report says Pakistan has 586 trillion cubic feet of shale gas of which 105 trillion cubic feet (up from 51 trillion cubic feet reported in 2011) is technically recoverable with current technology.

The top ten countries by shale oil reserves include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels).

Pakistan's current annual consumption of oil is only 150 million barrels. Even if it more than triples in the next few years, the 9.1 billion barrels currently technically recoverable would be enough for over 18 years. Similarly, even if Pakistan current gas demand of 1.6 trillion cubic feet triples in the next few years, it can be met with 105 trillion cubic feet of technically recoverable shale gas for more than 20 years. And with newer technologies on the horizon, the level of technically recoverable shale oil and gas resources could increase substantially in the future.

-

Comment by Riaz Haq on July 9, 2013 at 10:13am

-

Here's a Polish report on Pak gas production:

Poland’s gas monopolist PGNiG may sport over 20 bcm in natural gas reserves of its Pakistani licenses and for now suspended the process of selling the licenses, acting CEO Miroslaw Szkaluba told PAP Polish news agency.

"The potential reserves of the two areas may exceed 20 bcm," Szkaluba said.

PGNiG holds 70% in the Kirthar license with reserves of some 12 bcm, and it received prolongation of a neighboring license, where it will start exploration works at the turn of the year, the official said.

For now, the company suspended works on selling the licenses.

Test production works in the country will take 22 months. In the initial stage, PGNiG expects to produce 0.1 bcm of gas annually.

http://www.polstock.pl/wse_market_news/pgnig_eyes_over_20_bcm_in_pa...

-

Comment by Riaz Haq on July 9, 2013 at 8:09pm

-

Here's a Daily Times report on 33 TCF of tight gas in Pakistan:

KARACHI: Pakistan has an estimated tight gas reserves of 33 trillion cubic feet (tcf) which are more than the existing estimated natural gas reserves of 27 tcf in the country, said the Deputy Managing Director (operations) of Sui Southern Gas Company (SSGC) Syed Hassan Nawab.

Hassan Nawab was delivering a presentation on “Natural Gas Industry in Pakistan: Progress and Prospects” at 7th International POGEE Conference 2011 for Oil and Gas and Energy Industry at Karachi Expo Centre on Wednesday. Joint Secretary Ministry of Petroleum and Natural Resources Raashid Bashir Maser was the chairman of the session. Referring to a report of Pakistan Petroleum Exploration and Production Companies Association (PPEPCA), Hassan Nawab said the country will have sufficient natural gas if tight gas is explored with the help of advanced technology. He pointed out that the government has prepared the draft policy for tight gas and it is currently with the Council of Common Interest (CCI) and this will be approved soon.

Quoting some of the incentives in the draft tight gas policy, he said that investors will be offered 40 percent premium on the current gas price for exploring tight gas. Similarly, 50 percent premium will be offered on current gas price to investors if they commission their project by December 2011.

Hassan Nawab said that Pakistan can also produce gas from Thar coal with the help of underground coal gasification (UCG) technology. There is a potential to produce 35 tcf of coalbed methane from Thar coal, he noted.

He said that the availability of natural gas can be enhanced through import of liquefied natural gas (LNG) from neighbouring countries like Qatar and Iran—through 3rd party arrangments. He said the country has a very large network of pipelines and the importer of LNG can pump this gas to their buyers in upcountry destinations.

http://www.dailytimes.com.pk/default.asp?page=2011%5C05%5C19%5Cstor...

-

Comment by Riaz Haq on July 9, 2013 at 8:24pm

-

Here's a Reuters' report on tight gas revolution in China:

SULIGE, China (Reuters) - At the heart of the vast desert region of Inner Mongolia, half a dozen young engineers from PetroChina <0857.HK> watch huge, flat screens in a brightly lit central control office that oversees 5,000 wells at China's largest gas field.

Just a few years ago, two workers travelling in a truck would need three days to check conditions at 50 wells at the Sulige field, which spans 20,000 sq km (7,700 sq miles) in the middle of Maowusu, China's third-largest desert: now, the task can be done in just five minutes.

Remote Sulige, which means "uncooked meat" in Mongolian, is testament to China's success in developing its giant reserves of so-called "tight gas", part of a drive to dramatically boost consumption of cleaner burning natural gas to help replace dirty coal and costly oil imports.

Like the better-known shale gas revolution in the United States, tight gas is transforming China's gas production - accounting for a third of total output in 2012 -- and will form the backbone of the country's push to expand so-called "unconventional" gas production nearly seven-fold by 2030.

The speed and size of the boom has outstripped forecasts and has been led by local firms developing low-cost technology and techniques, already being rolled out by Chinese companies in similar gas fields outside of China.

Like shale gas, although less difficult to extract, tight gas is an unconventional deposit that needs special technology such as horizontal drilling or fracturing to free gas trapped in tiny cavities in rocks like sandstone.

Output of tight gas hit 30 billion cubic metres (bcm) in 2012 -- nearly a third of China's total gas output -- and is expected to rise to 100 bcm by 2030, leading an unconventional fuel boom ahead of shale or coal-seam gas.

"We found our own approach to develop tight gas," said Hu Wenrui, a former Petrochina vice president and a key architect behind developing the deposits. "With this, China's tight gas has entered the fast track."

Forecasts by the China Academy of Engineering (ACE) put 2020 output of tight gas at 80 bcm, more than a forecast 50 bcm of coalbed methane and 20 bcm of shale gas combined.

Despite the excitement over shale gas, of which China holds larger reserves than the United States, the world's top energy user has taken only baby steps to exploit the more complex deposits, drilling just 80 or so wells by the end of last year.

Its output of coal-seam gas continues to disappoint after two decades of development, reaching about 6.5 bcm in 2012.....

http://www.business-standard.com/article/reuters/tight-gas-china-s-...

-

Comment by Riaz Haq on July 9, 2013 at 10:34pm

-

Here's a Pakistan Times report on oil and gas drilling and production activities in Pakistan:

ISLAMABAD: The Ministry of Petroleum and Natural Resources has drilled 131 exploratory wells during the last five years to meet the growing needs of oil and gas in the country.

"It a fact that the production of oil and gas in the country is less than their demand. However, the government has taken numerous steps to enhance their production," official sources said on Saturday.

The sources said exploration licences for 30 blocks were granted during the year 2010. In the Petroleum Exploration and Production Policy - 2011, additional incentives have been offered to the investors for exploration of oil & gas in Pakistan, they added. The sources said the additional incentives would take care of extra risk taken by exploration and production companies for doing business under the prevailing security, law and order situation in the country.

They said presently 133 exploration licences had been granted for exploration of oil & gas in the country while 130 D&P leases were operative for the enhancement of production of oil and gas. Some 127 fields were producing 64,655 barrels of oil and 4215 Million Cubic Feet gas per day. They said efforts were also being made to put newly made discoveries on production during 2011-2013.

The sources said the completion of pending development projects would enhance daily oil and gas production, adding that enhanced exploration in all areas would add new oil and gas reserves by improving law & order and providing conducive environment to local and foreign companies.

A basin study has already been carried out to co-relate entire data of different basins which will help identify new play types while through state-of-the-art data repository centre, digitized data is also available to existing and new companies to participate in exploration which will help in expediting exploration of oil and gas.

The sources said concentrating on more exploration in deeper prospects and under-explored geological frontiers would add new reserves. A tight gas policy has been notified which will offer 40-50 per cent higher prices than petroleum policy- 2009 gas price to attract exploration companies to invest in tight gas fields, they added.

The sources said the country had estimated recoverable tight gas reserves of 24 TCF and initially 100-150 mmcfd would be added depending on its success rate. The Ministry of Petroleum and Natural Resources is also working on "Low Btu Gas Policy and Shale Gas Policy" to encourage the investors to exploit these reservoirs.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network