PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Gas Reserves

Reports of new gas reserves of 40 trillion cubic feet (upped to 105 TCF in 2013 by US EIA) are specially welcome at this moment in Pakistan when it is facing a very serious and growing energy crisis. The US Energy Information Administration (EIA) puts the estimates even higher at 51 trillion cubic feet. Even if the demand doubles from the current one trillion cubic feet a year to two trillion cubic feet a year, the estimated current gas reserves can last as long as 30 years or more.

Pakistan is particularly heavily dependent on natural gas for its energy needs. Demand for natural gas in Pakistan has increased by almost 10 percent annually from 2000-01 to 2007-08, reaching around 3,200m cubic feet per day (MMCFD) last year, against the total production of 3,774 MMCFD, according to Pakistani official sources. But, during 2008-2009, the demand for natural gas exceeded the available supply, with production of 4,528 MMCFD gas against demand for 4,731 MMCFD, indicating a shortfall of 203 MMCFD.

The gas supply-demand imbalance is expected to grow every year to cripple the economy by 2025, when shortage will be 11,092 MMCFD (Million standard cubic feet per day) against total 13,259 MMCFD production. The Hagler Bailly report added that Pakistan's gas shortage would get much worse in the next two decades if it did not bring on any alternative sources.

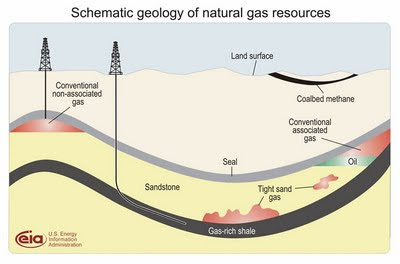

Shale gas offers an alternative source for energy-starved Pakistan. Rough estimates indicate the presence of at least 33 trillion cubic feet of unconventional gas reserves trapped in tight sands, according to an ENI Pakistan report. Another report by Shahab Alam, technical director of Pakistan Petroleum Concessions, puts the estimate at 40 trillion cubic feet of tight gas reserves in the country. These unconventional gas reserves are in addition to the remaining conventional proven gas reserves of over 30 trillion cubic feet.

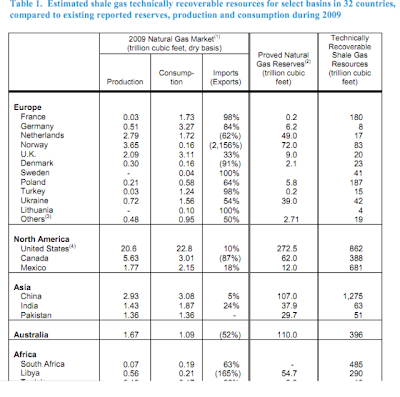

With the pioneering work done in the United States on deep drilling and hydraulic fracturing (fracking) to extract hydrocarbons from shale rock, it is now estimated that the US alone has over 1000 trillion cubic feet of recoverable unconventional gas, according to the Wall Street Journal. Unlike the bulk of world's conventional natural gas reserves that are found in Russia, Iran, Venezuela and Qatar, the shale gas reserves have been discovered in rock formations spread across many parts of the world, including Australia (396 TCF), China (1275 TCF), North America (1931 TCF), South America (1225 TCF), Europe (639 TCF), South Africa (485 TCF), India (63 TCF) and Pakistan (51 TCF). Many energy analysts argue that tapping these new hydrocarbon resources could be a game-changer in terms of global economics and geo-politics.

Increased production of gas from shale in the US has created a glut, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $4.23/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

Under the new policy, exploration companies will be offered 40-50% higher prices for the extracted gas compared with the $4.26/Btu price announced in Exploration and Production Policy 2009. Companies which succeed in recovering gas from tight fields within two years will get 50% hike over the 2009 price and if it takes more time they will get only a 40% hike on the 2009 price. As an added incentive, the leases for the fields will now be for 40 years instead of 30 in the 2009 policy, the official said.

Even with the higher prices for the tight gas offered to the exploration companies, it is estimated that Pakistan will have to pay a maximum of $6.50/Btu for the gas compared with $12.30/Btu for gas imports, according to a report by Platts.

Although it does burn much cleaner than coal and oil, the process of extraction of shale gas in Pakistan, or anywhere else, is not without risks, particularly risks to the environment. In the United States, there have been many reports of ground water contamination from chemicals used to fracture rocks, as well as high levels of methane in water wells. In the absence of tight regulations and close monitoring, such pollution of ground water could spell disaster for humans and agriculture.

Given Pakistan's heavy dependence on natural gas for energy and as feedstock for industries such as fertilizer, fiber and plastics, it's important to pursue shale gas fields development under reasonably tight environmental regulations to minimize risks to the ground water resources.

Related Links:

Haq's Musings

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

-

Comment by Riaz Haq on August 7, 2013 at 9:37pm

-

Here's a Daily Times on oil and gas drilling in 2012-13 in Pakistan:

Exploration and production drilling activities in financial year (FY) 2012-13 was the highest-ever development drilling in Pakistan as total 62 wells were drilled, up 82 percent on yearly basis, analysts said on Tuesday.

Meanwhile target of 105 wells for FY 2013-14 is modest and leaves room for improvement, said Fawad khan an analyst at Foundation Securities.

Pakistan has achieved highest-ever development drilling with total 62 wells in FY 2012-13, registering 82 percent yearly increase. The sharp pickup in activity is driven primarily by private sector and should lead to modest increase in production, as most of the drilling is concentrated in low-yielding wells in Badin.

United Energy Group (UEG-Chinese exploration and production giant)) has emerged as the largest contributor to Pakistan drilling programme with over 43 percent drilling in FY 2012-13. Once again stratigraphic traps in Badin received huge focus on exploration. UEG efforts to unlock the potential in Badin block and new exploration leases are bearing fruits out of 17 exploration wells, UEG found hydrocarbons in at least 12 wells.

Oil and Gas Development Corporation (OGDC) and Pakistan Petroleum Limited (PPL) are yet to touch their full potential on drilling activity. OGDC has drilled only 24 wells in FY 2012-13, up 41 percent on yearly basis, but still below start of the year drilling target of 29 wells.

Khan said available details on FY 2013-14 drilling suggest both PPL and OGDC have not set significantly higher drilling target. Total industry drilling target is set at 105 wells like FY 2012-13. UEG will lead drilling with 55-60 wells drilling programme.

Ongoing exploration in high profile Zin block (OGDC), exploration drilling in Tal at Kot (particularly POL) and complete results on exploration wells in Gambat South (PPL) can bring significant reserve and production upside.

A number of important development projects are slated to come online during FY 2013-14, which are important for materialisation of overall earnings and production targets.

Khan particularly highlighted the Gas Processing Facility at Makori, development drilling in Makori East and Nashpa and progress on second phase production ramp-up on Kunnar Pasakhi Deep (KPD) field.

He estimated FY 2013-14 earnings growth for OGDC, PPL and POL of 36 percent, 28 percent and 32 percent driven by 15 percent, 6 percent and 11 percent volume growth respectively.

Despite a swift bidding round for 60 exploration leases following approval of 2012 E&P policy, actual award of leases has faced certain regulatory hiccups in certain cases. This can potentially delay the impact of new policy on drilling programme, which typically takes at least three years to materialise. Just to recap, 2012 policy offered 26percent, 100 percent higher oil/gas prices over 2001 policy pricing.

Government initially offered attractive conversion terms for areas under previous policies but later on changed certain conditions. Through award of 57 blocks, the government received minimum work commitment of $372 million.http://www.dailytimes.com.pk/default.asp?page=2013%5C07%5C17%5Cstor...

-

Comment by Riaz Haq on January 10, 2014 at 7:52am

-

Here's an Express Tribune story on Pakistani guar:

Indian and Pakistani farmers growing a lesser-known crop called guar or cluster bean made a lot of money in 2012. A surge in global demand on the back of guar’s use in shale fracking pushed up the price manifold. Farmers were netting more profit than they would by planting paddy or even cotton.

In India, which meets 85% to 90% of global guar demand, it was given the status of a cash crop as more and more area came under plantation.

But while business magazines and newspapers were sharing stories about the crop changing lives of poor farmers in Indian Rajasthan, little was said about Pakistan, which meets 10% to 15% of world’s supply.

However, that is about to change.

photo 17_zpsd6a28f44.jpg

“Traders are under the impression that our guar is somehow inferior to India’s,” said Aamer Sarfraz, the founder of Indus Basin Holding, which invests in agribusiness. “We have scientific evidence that this is not the case.”

His company United Guar, which was set up in 2012 in Islamabad, is already exporting guar gum, which is basically seed in powder form.

Besides being backed by investors like Tim Draper, one of the leading venture capitalists in Silicon Valley, United Guar has now successfully raised capital from China’s leading private equity firm, IDG Capital and Baron Lorne Thyssen, a prominent European industrialist.

United Guar runs a state-of-the-art plant in Faisalabad. And now it has Halliburton’s veteran Dr Lewis Norman on board as VP technology.

Pakistani traders complain that they get a low price because of low viscosity in their guar. However, Sarfraz says that’s ‘all nonsense’.

“In a test carried out in a leading US oil and gas lab, it was found that samples of Pakistani guar seed can in fact produce a premium grade gum,” he said.

Guar gum is made from seeds and it is increasingly being used by oil and gas drilling companies, which need high viscose material like the guar gum to crack open shale formations to allow petroleum to flow.

photo 18_zpsfbfbfacb.jpg

This drought-tolerant crop, grown almost entirely in the subcontinent, has traditionally been used as animal feed and a vegetable.

Pakistan expected harvest of over 250,000 tons in 2013, highest in 18 years, after more land came under cultivation following a spectacular rise in price in the last two years, traders say.

“The problem is not with our seed. The processing facilities are old here and that is what undermines the quality,” he said.

Pakistan has 11 companies making guar split with Pak Gum Industries being the largest producer. Most of the processing facilities are 20 to 30 years old.

Already dealing with a network of rice farmers under a contract farming arrangement, Sarfraz says the same approach is being made to cultivate long-term relationship with guar growers.

“It is really a poor man’s crop. Some of the big farmers actually rebuked us for even suggesting that they should grow guar,” he said.

The company is building a network of growers by paying them on time, eliminating the role of intermediaries, supplying the inputs and compensating for the transportation cost. It is specifically focusing on Thal region.

Sarfraz has initially set a target of exporting 30,000 tons of guar gum.

Guar and guar products’ export from Pakistan was just $29 million in 2006-07. It shot up to a record high of $152 million in 2011-12 before coming down to $139 million, still more than many other items.

It is hard to estimate the exact size of the cultivated area as guar is sown in far-flung arid and semi-arid areas of Punjab, Sindh and Khyber-Pakhtunkhwa. Most of the production comes from Sargodha and Tharparkar.

But according to the Pakistan Bureau of Statistics, guar was cultivated over 154,821 hectares in 2008-09.

Published in The Express Tribune, January 10th, 2014.http://tribune.com.pk/story/657018/pakistans-guar-is-as-good-as-ind...

-

Comment by Riaz Haq on August 25, 2015 at 10:01pm

-

#Pakistan Petroleum reports gas, condensate discovery in Gambat South. #Sanghar #Sindh http://www.worldoil.com/news/2015/8/25/pakistan-petroleum-reports-g... …

KARACHI, Pakistan -- Pakistan Petroleum Limited, operator of the Gambat South Block with a 65% working interest, has announced another gas and condensate discovery at its Kabir X-1 exploration well in Sanghar District, Sindh, Pakistan.

Kabir X-1 was spud on April 24 and reached final depth, of 4,020 m, on June 28. Based on wire line logs, potential hydrocarbon bearing zones were identified in the Basal Sand of the Lower Goru formation.

During initial well testing, Kabir X-1 flowed at 1.94 MMscfgd along with 253 bcpd on a 16/64-in. choke.

Currently, well testing is underway to evaluate the potential of the discovery.

-

Comment by Riaz Haq on October 13, 2015 at 9:49am

-

#Austrian company OMV finds new gas reserves in #Sindh #Pakistan http://tribune.com.pk/story/972132/austrian-company-finds-gas-reser... …

Austrian oil and gas company, OMV, claimed to have discovered new gas reserves at the Latif exploration block in Sindh, a press release issued by the company stated.

The Latif South-1 well had a gas throughput of 2,500 barrels of oil equivalent (boe) a day during testing, the company said in a statement.

“We are very pleased with this exploration success. The appraisal and development of this discovery will potentially enable us to enhance the production in Pakistan,” OMV Executive Board Member responsible for Upstream, Johann Pleininger, said.

Read: Iran has not much gas for sale, Pakistan must act swiftly

The company also said that the Latif South-1 well had a gas throughput of 2,500 barrels of oil equivalent a day during testing.

“This discovery has opened up new exploration opportunities in the area,” the company said, adding that “further appraisal work is needed to confirm the size of the discovery.”

OMV’s global production was 309,000 boe a day last year, the company, which has a 33.4 per cent stake in the Latif exploration licence, said. Its partners are Pakistan Petroleum Ltd (PPL) and Italian energy group Eni, which hold 33.3 per cent each.

OMV Pakistan, a wholly-owned subsidiary of OMV Exploration & Production GmbH, started exploration activities in the desert area of Sindh in 1991 and is amongst the largest international natural gas producers in Pakistan in terms of operated volumes.

As a key investor in the oil and gas sector in the region, OMV also holds a 10% stake in Pak-Arab Refinery Limited (PARCO), a joint venture between Pakistan and Abu Dhabi.

Pakistan is currently pursuing two major projects of gas import, including the Iran-Pakistan (IP) pipeline project, which will supply 750 million cubic feet of gas per day (mmcfd) to Pakistan and the volume will be enough to generate 5,000MW of electricity.

Read: After nuclear deal, Pakistan and Iran seek to increase trade

Pakistan faces over 7,000-megawatt power shortfall in the peak summer season that causes blackouts in many areas and cripples life and business. Estimates suggest that the energy shortage strikes 3% off economic growth every year.

In addition to electricity shortages, the country endures gas scarcity that reaches its peak in winter when even domestic consumers are left scrambling for the vital heating and cooking fuel.

-

Comment by Riaz Haq on October 18, 2015 at 11:56am

-

Below is Pakistan energy report published by Oilprice.com

Pakistan is the sixth most populous country in the world. Due to a variety of factors there is a major gulf between Pakistan’s energy potential and its ability to achieve that potential. And that is clearly illustrated in the country’s natural gas sector.

While Pakistan’s conventional natural gas reserves – 24 trillion cubic feet – are declining, the country is sitting on an estimated 105 trillion cubic feet of shale gas. For now, there are too many obstacles to expect much development in Pakistan’s unconventional sector, but there are still opportunities for gas drillers in the country.

One of the largest gas producers is OMV (VIE: OMV). And OMV just announced a major new natural gas discovery on October 12 from its Latif South-1 well, located in the Latif block of Sindh Province. The test well posted some promising figures, with flows of 2,500 barrels of oil equivalent per day (boe/d). OMV believes that the discovery opens up new opportunities in the region. The Austrian company will continue to appraise the well and assess its holdings to confirm the size of the gas discovery. The well drilled by OMV is located just 25 kilometers south of the Latif gas field, and as such, it is well positioned to tie into existing infrastructure, such as gas processing facilities.

OMV holds a 33.4 percent stake in the project, along with its joint venture partners Pakistan Petroleum Limited (OTCMKTS: PKKKY) with a 33.3 percent stake, and a subsidiary of Italian oil giant Eni (NYSE: ENI), controlling the remaining 33.3 percent position.

OMV is also processing 2D and 3D seismic surveys in the Kalat block this year.

OMV is one of the larger operators in Pakistan, producing from several gas fields, including Sawan, Miano, Latif, Tajjal, and Mehar. The company produces around 400 million cubic feet per day (mmcf/d) (or 65,000 boe/d) from its processing plants in Sawan, Kadanwari and Rehmat, which OMV says is about equal to 10 percent of Pakistan’s total gas supply.

OMV also has a stake in eight exploration licenses (five of which it is the operator) and six licenses in the development and production phase.http://cdn.oilprice.com/images/tinymce/ada3372-min.jpg" alt="Pakistan1" width="443" height="247" class="CToWUd a6T"/>

One of the other most important gas operators in Pakistan is Eni. Eni’s holdings are mostly south of OMV, also in Sindh Province. Eni produced 248 million cubic feet of natural gas per day in Pakistan at the end of 2014.

Eni made several key natural gas discoveries in recent years, including the Lundali in the Sukhpur Block, about 270 miles north of Karachi. In 2013, Eni’s Lundali-1 well had an impressive flow rate of 33 million cubic feet per day (mmcf/d). That followed a previous discovery made a year earlier in the Badhra Block. That discovery held an estimated 300 to 400 billion cubic feet of natural gas. The bulk of Eni’s focus is on the Bhit/Bhadra block (40 percent stake), Sawan (23.68 percent stake), and Zamzama (17.75 percent stake). Eni is also partnered with Pakistan’s state-owned oil company, as well as a subsidiary of Kuwait’s state-owned oil company. Premier Oil (LON: PMO) holds small stakes in these fields as well.http://cdn.oilprice.com/images/tinymce/ada3373-min.jpg" alt="Pakistan2" width="446" height="341" class="CToWUd a6T"/>

Problems and Opportunities

For companies like OMV and Eni, Pakistan offers an interesting opportunity. The demand for natural gas is huge. In fact, the country is starved for new sources of gas, creating a captive market for operators.

But Pakistan is riddled with problems and is a tough place to do business. Energy is one area where the country faces a serious crisis. Pakistan is woefully deficient in reliable electricity, and power outages shave 2 percent off of GDP. It pays a dear price for imported energy. Millions of Pakistanis resort to wood for heat and fuel, plaguing the country with a massive deforestation problem.

The Pakistani government has implemented some measures to incentivize shale development. However there are several problems holding back investment. First, the geography is complex and infrastructure is inadequate. That raises the cost of development. Second, Pakistan regulates the price of natural gas in order to insulate the public, but that discourages investment as producers can’t realize adequate compensation.

To make up for the shortfall in natural gas, Pakistan constructed an LNG import terminal in Karachi, and the country signed a deal with Qatar to import 200 mmcf/d of LNG.

Outside Interests

Pakistan is desperately trying to solve its energy shortfall, which creates opportunities for drillers. But it is also looking abroad with the help of some outside entities, not all of which are primarily concerned with Pakistan’s wellbeing.

Pakistan is at the crossroads of some geopolitical jockeying. Two competing pipeline projects have been on the drawing board for years but are inching forward. The U.S. backed Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline would connect Caspian Sea natural gas through Southeast Asia. There is also the Iran-Pakistan pipeline, which, following the nuclear deal with Iran and the pending removal of sanctions, is also in the works. The U.S. opposes the Iran-Pakistan project, but China is helping push it forward. Both projects would help ease the natural gas deficit in Pakistan, but the country will have to navigate competing pressure from China, the U.S., and Iran.

The government of Pakistan appears to prefer the Iranian route, due to its lower cost. The project could provide enough gas to erase the country’s electricity generation deficit. Also, Pakistan has a close alliance with China, making the project the obvious choice. China is planning an array of infrastructure projects, including roads, rail networks, deepwater ports, and pipelines.

The Asian Development Bank (ADB) is supporting infrastructure development in Pakistan, providing the country with $1.2 billion in financial assistance each year between 2015 and 2019. The investment will focus on energy, transport, agriculture, natural resources, water, and urban infrastructure.

Outlook

Pakistan has large natural gas reserves, albeit reserves that are in decline. The pent up demand in the country is massive. With millions of people without access to modern forms of energy, natural gas is sorely needed. Pakistan is also the second largest market in the world for natural gas vehicles, so demand for gas is not just for electricity and industrial purposes. Right now, blackouts are a regular occurrence, and shortfalls are made up from imports of LNG. But if the country can help E&P companies to develop domestic gas resources, the demand is a certainty.

Still, infrastructure constraints are real, and will hold back development. So will the high cost of production, coupled with regulated prices that cap returns on investment. This report did not even touch on the security concerns facing Pakistan, which throw up yet more red flags.

But a lot is about to change. New pipelines are in the works. Pakistan has no choice but to move rapidly to try to expand access to energy, as the security of the country depends on it. In recent years the government has raised the regulated price of gas to incentivize exploration and reduce the burden on the treasury. That will likely continue, although in fits and starts.

For investors, the opportunities are limited. Eni is a sizable producer, but is too large of a company to gain exposure. Other companies are state-owned. OMV is probably the best bet, as they are one of the largest producers in Pakistan while still being a mid-cap company. Their recent gas discovery near existing assets is a positive sign. Still, given all the problems in Pakistan, proceed with caution.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network