PakAlumni Worldwide: The Global Social Network

The Global Social Network

PTI's New Economic Team Line-Up in Pakistan

Who are the members of Pakistan's top new economic leadership team? Who's Reza Baqir? Who's Shabbar Zaidi? Why were the changes necessary? Were the latest changes made to remove previous PMLN government's loyalists considered to be responsible for the current economic crisis? Did their policies and actions contribute to large twin deficits? Did the International Monetary Fund (IMF) force these changes as a condition for the country's bailout?

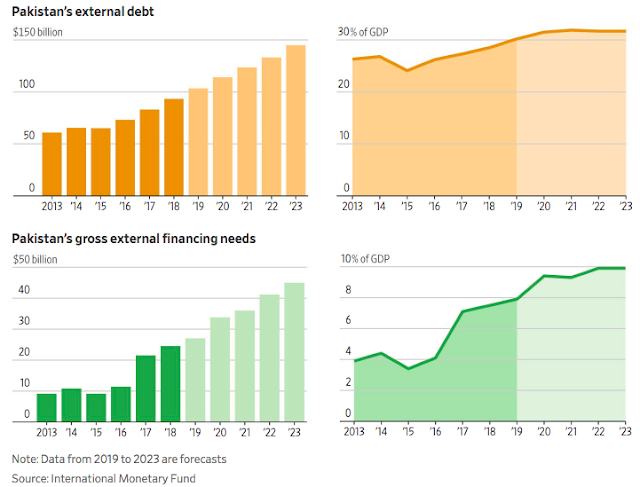

Pakistan's External Debt. Source: Wall Street Journal |

|

| Pakistan Current Account Deficit. Source: State Bank of Pakistan |

As Pakistan awaits the news of the discovery of large offshore oil reserves, what lessons should Pakistan learn from the governance failures in Venezuela? Is Venezuela suffering because of its government's hostility toward the United States? Will large oil reserves be a panacea for Pakistan's economic problems?

Viewpoint From Overseas host Faraz Darvesh discusses these questions with Sabahat Ashraf (ifaqeer) and Riaz Haq (www.riazhaq.com)

Related Links:

Can Pakistan Avoid Recurring IMF Bailouts?

Expectation of Massive Offshore Oil Discovery in Pakistan

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last...

Pakistan's $20 Billion Tourism Industry Boom

-

Comment by Riaz Haq on June 28, 2019 at 4:28pm

-

Fitch cuts growth for #Pakistan to 3.2% in FY2018/19 and 2.7% in FY19/20 with tighter monetary/fiscal policies. #CPEC will provide support to #economy. "Construction of many key CPEC projects has already started and will stretch over the coming years.” https://tribune.com.pk/story/2001719/2-fitch-chops-growth-forecast-...

Fitch Solutions, the US-based global research house, has revised down Pakistan’s economic growth forecast, believing tightening of monetary and fiscal policies under the International Monetary Fund (IMF) bailout would negatively impact GDP growth.

“We at Fitch Solutions, have revised our forecast for Pakistan’s real GDP (gross domestic product) growth for FY2018/19 (July-June) and FY19/20 to come in at 3.2% and 2.7% respectively, from 4.4% and 4.0% previously (versus the Bloomberg consensus of 3.3% and 3.5%),” the global research house said in a report on ‘Economic Analysis – IMF deal to weigh on Pakistan’s growth in the short run.’

“We believe that the bailout package from the IMF will see tighter monetary and fiscal policies in Pakistan, which will be negative for growth in the near term,” it said.

However, investment into the China-Pakistan Economic Corridor (CPEC) will continue to provide some support to the economy, it added.

After close to eight months of negotiations, Pakistan reached an agreement with the IMF in May for a $6 billion bailout package to address its balance of payment crisis. Following the agreement, the State Bank of Pakistan (SBP) increased the policy rate by 150bps.

Shortly after, the Ministry of Finance presented a budget in June with the aim of trimming Pakistan’s primary deficit to 0.6% of GDP in FY19/20, from 1.9% of GDP in FY18/19 according to the IMF’s estimates. “Given the tighter monetary and fiscal policies amid an already subdued economic growth outlook, we at Fitch Solutions have revised (down) our forecast for Pakistan’s real GDP growth,” it said.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Can Pakistan's JF-17 Become Developing World's Most Widely Deployed Fighter Jet?

Worldwide demand for the JF-17 fighter jet, jointly developed by Pakistan Aeronautical Complex (PAC) and China’s Chengdu Aircraft Industry Group (CAIG), is surging. It is attracting buyers in Africa, Asia and the Middle East. At just $40 million a piece, it is a combat-proven flying machine with no western political strings attached. It has enormous potential as the lowest-cost 4.5…

ContinuePosted by Riaz Haq on February 4, 2026 at 8:00pm — 1 Comment

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network