PakAlumni Worldwide: The Global Social Network

The Global Social Network

Record Auto Profits and Sales in Pakistan

Indus Motor Company earned Rs. 4.3 billion in net income on sales of Rs. 75 billion in 2011-12, representing an increase 57% in net income and 25% in total revenue over previous year. The company that is 37.5% owned by Japan’s Toyota Motors sold over 55,000 cars during the financial year that ended on June 30, 2012, its highest ever for a single year. Both revenues and profits were the highest in the company’s history in Pakistan, according to media reports.

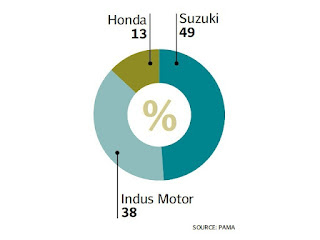

Pakistan's total car market was about 235,000 units in July 2011-June 2012 period.

The domestic auto industry sold 178,753 cars, 23% more than last year. The rest of the demand was met by imports of 55,000 cars in fiscal year 2012, representing an increase of 50% over last year.

In addition to durables like automobiles, companies in FMCG (fast moving consumer goods) sector are also expected to report strong sales and earnings this year. Engro Foods has emerged emerged as the supercharged FMCG player with over 400 percent in bottom line in 2011, grabbing fourth position after Nestle, Unilever and Rafhan, and outpacing National Foods. The sector growth has been particularly well supported by strong rural consumption in recent years.

Here are a few key points excerpted from a recent Businessweek story on rise of the rural consumer supported by higher crop prices in Pakistan:

1. Unilever and Colgate-Palmolive Co. are sending salespeople into rural areas of the world’s sixth most-populous nation, where demand for consumer goods such as Sunsilk shampoo, Pond’s moisturizers and Colgate toothpaste has boosted local units’ revenue at least 15 percent.

2. “The rural push is aimed at the boisterous youth in these areas, who have bountiful cash and resources to increase purchases,” Shazia Syed, vice president for customer development at Unilever Pakistan Ltd., said in an interview. “Rural growth is more than double that of national sales.”

3. Consumer-goods companies forecast growth in Pakistan even as an increase in ethnic violence in Karachi has made 2011 the deadliest in 16 years for the country’s biggest city and financial center.

4. Nestle Pakistan Ltd. is spending 300 million Swiss francs ($326 million) to double dairy output in four years, boosted sales 29 percent to 33 billion rupees ($378 million) in the six months through June. “We have been focusing on rural areas very strongly,” Ian Donald, managing director of Nestle’s Pakistan unit, said in an interview in Lahore. “Our observation is that Pakistan’s rural economy is doing better than urban areas.”

5. Haji Mirbar, who grows cotton on a 5-acre farm with his four brothers, said his family’s income grew fivefold in the year through June, allowing him to buy branded products. He uses Unilever’s Lifebuoy for his open-air baths under a hand pump, instead of the handmade soap he used before. “We had a great year because of cotton prices,” said Mirbar, 28, who lives in a village outside south Pakistan’s Matiari town. “As our income has risen, we want to buy nice things and live like kings.”

6. Sales for the Pakistan unit of Unilever rose 15 percent to 24.8 billion rupees in the first half. Colgate-Palmolive Pakistan Ltd.’s sales increased 29 percent in the six months through June to 7.6 billion rupees, according to data compiled by Bloomberg. “In a

generally faltering economy, the double-digit growth in revenue for

companies servicing the consumer sector has come almost entirely from

the rural areas,” said Sakib Sherani, chief executive officer at

Macroeconomic Insights Pvt. in Islamabad and a former economic adviser

to Pakistan’s finance ministry.

7.6 billion rupees, according to data compiled by Bloomberg. “In a generally faltering economy, the double-digit growth in revenue for companies servicing the consumer sector has come almost entirely from the rural areas,” said Sakib Sherani, chief executive officer at Macroeconomic Insights Pvt. in Islamabad and a former economic adviser to Pakistan’s finance ministry.

7. Unilever is pushing beauty products in the countryside through a program called “Guddi Baji,” an Urdu phrase that literally means “doll sister.” It employs “beauty specialists who understand rural women,” providing them with vans filled with samples and equipment, Syed said. Women in villages are also employed as sales representatives, because “rural is the growth engine” for Unilever in Pakistan, she said in an interview in Karachi. While the bulk of spending for rural families goes to food, about 20 percent “is spent on looking beautiful and buying expensive clothes,” Syed said.

8. Colgate-Palmolive, the world’s largest toothpaste maker, aims to address a “huge gap” in sales outside Pakistan’s cities by more than tripling the number of villages where its products, such as Palmolive soap, are sold, from the current 5,000, said Syed Wasif Ali, rural operations manager at the local unit.

9. Palmolive's detergents Bonus Tristar and Brite are packed in sachets of 20 grams or less and priced as low as five rupees (6 cents), to boost sales among low-income consumers hurt by the fastest pace of inflation in Asia after Vietnam. Unilever plans to increase the number of villages where its products are sold to almost half of the total 34,000 within three years. Its merchandise, including Dove shampoo, Surf detergent and Brooke Bond Supreme tea, is available in about 11,000 villages now.

10. Telenor Pakistan Pvt. is also expanding in Pakistan’s rural areas, which already contribute 60 percent of sales, said Anjum Nida Rahman, corporate communications director for the local unit of the Nordic region’s largest phone company.

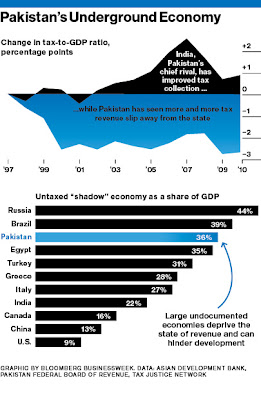

Undeterred by the gloom and doom reports in the media, Pakistani consumers are continuing to spend and private consumption has now reached 75 percent of GDP. It rose 11.6% in real terms in 2011-12 compared with just 3.7% growth a year earlier , according to Economic Survey of Pakistan. In fact, many analysts believe that Pakistan's official GDP of $220 billion is understated by as much as 50%, buttressing a recent claim by the head of Karachi Stock Exchange that Pakistan's real GDP is closer to $300 billion.

I believe that even a modest effort to increase tax collection can significantly improve Pakistan's state finances to support higher public sector investments in energy, education, health care and infrastructure.

Related Links:

Haq's Musings

Pakistan's Underground Economy

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

-

Comment by Riaz Haq on August 11, 2012 at 8:32am

-

Here are some excerpts of BMI's Q3-2012 auto report for Pakistan:

The Pakistan Autos Report provides industry professionals and strategists, corporate analysts, auto associations, government departments and regulatory bodies with independent forecasts and competitive intelligence on Pakistan's automotive industry.

The Pakistan autos sector continues to present a mixed picture as we approach the end of the country’s fiscal year in June 2012. While the outlook for passenger cars and pick-ups remains robust, with strong growth seen in both production and sales year to date, the country’s sluggish commercial vehicle sector and plunging farm tractor sector are acting as brakes on the progression of the wider vehicle industry.

According to figures from the Pakistan Automotive Manufacturers Association (PAMA), for the nine months ending March 31 2012, a total of 154,573 four-wheeled vehicles (passenger cars, trucks, buses,

LCVs, jeeps, pick-ups and tractors) were produced in Pakistan, marking a 9% decline on the 169,743 four-wheeled vehicles produced in 9MFY11. Over the same period, a total of 156,877 four-wheeled vehicles were sold in Pakistan, down 5% on the 164,820 four-wheeled vehicles sold in 9MFY11.The main cause of the drop in both sales and production was the government’s decision in March 2011 to impose a 16% general sales tax on tractor purchases, which were previously GST-exempt. This saw demand from farmers collapse over H1FY12, leading to Fiat’s tractor production dropping by 236% y-oy over the six-month period, while Massey Ferguson’s tractor output was down by 109% y-o-y.

Since that time, the government has revised its decision, reducing the GST levied on tractor sales down to 5% as of January 2012. This reduction in GST has had a swift impact on both production and sales from Fiat and Massey Ferguson. From a year-low of just four tractors produced in January 2012, Fiat had returned to over 2,000 units produced in March 2012. Similarly, Massey Ferguson has returned production to over 4,000 in March 2012, from a year-low of 963 in November 2011. At the same time,

monthly sales figures have improved from a year-low of just 369 for January 2012 (for both Fiat and Massey Ferguson) to 6,229 as of March 2012. However, with the government still planning to increase GST on tractors to 10% in 2013 and then to 16% in 2014, it remains to be seen what effect these staggered tax hikes will have on tractor sales over the medium term.Without the negative impact of the GST rise, then FY12 would have been a very strong year for the Pakistani auto sector. As it is, there is now scope for the industry to make back some of its losses by yearend,

although tractor production and sales will still be down sharply year-on-year. Our current forecasts call for a total of 205,335 vehicles produced in Pakistan in FY12 and 203,504 vehicles sold.Looking at manufacturers, Pak Suzuki has had a very strong year, profiting to some extent from the difficulties being experienced by Honda Atlas, which had to temporarily suspend local production of the City and Civic models owing to a lack of spare parts from parent company Honda following the Thai flooding. Indeed, while Honda Atlas saw a 37.5% fall in production over 9M11, to 7,798 units and a 43.3% fall in local sales, to 7,999 units, Pak Suzuki saw a 26.2% increase in production, to 65,692 units and a 36.9% increase in local sales, to 68,722 units. The third local passenger car manufacturer, Indus Motor (Toyota/Daihatsu) has seen essentially flat performance over FY12 to date, with production up by 0.7%, at 36,549 units and sales up by 1.5%, at 36,000 units.

http://www.researchandmarkets.com/reports/2200999/pakistan_autos_re...

-

Comment by Riaz Haq on August 11, 2012 at 8:48am

-

Here's a BR report on Pakistan tractor industry:

Currently, Millat Tractors and Al-Ghazi Tractors Limited are two of the largest producers of tractors and other agricultural implements within the country, with their total production of tractors standing around 65 thousand units at the end of FY11. With an annual installed capacity of 75 thousand units, the tractor manufacturing industry has been performing relatively consistently over the last few years contributing towards the upgradation of local farming practices. With the number of tractors in agricultural use in Pakistan rising from 5,500 in 1961 to 470,000 in 2007 according to World Bank data, the number of local producers engaging in selective mechanisation has also been on a consistent rise. However, the start of the current fiscal year brought bad news for both manufacturers and farmers as a hike in GST on tractor sales brought down production by a staggering 70 percent resulting in negative growth of 2.2 percent in production during this period. With tractor sales dipping as low as 78 percent month-on-month at one point and just 771 units being sold in December 11 as compared to the 3,625 units sold during the previous month, the industry faced a severe crisis with thousands of unsold tractors parked at factories and dealership networks across the country. The government subsequently announced a cut back in GST to a modest 5 percent in January 2012, following which sales have risen up sharply once again. With total units sold jumping from a dismal 369 in January to 8,906 in February following the tax cut, the sectors productivity is on the rise again. Further abetments have been provided in the form of incentives provided to small farmers aiding them in tractor purchases through different schemes such as the Sindh Tractor Scheme where the government distributed six thousand units to farmers at subsidised rates during April-May12. Moreover, the future for the tractor industry looks robust in the future with Millat Tractors already having booked 25 thousand units for the next six months, according to a report compiled by IGI Securities. This news bodes well for all stakeholders as the net return of these investments into mechanisation of agricultural machinery has always been positive in terms of crop output. What is essential at this point is to reiterate the importance of long-term policy commitments by the government to ensure that upgradation of farming practices is made within the reach of the average local producer. In a country where demand for increased food production follows logically from an ever increasing population, facilitating primary producers in obtaining machinery to increase output should be of consummate importance. Consequently, with the terms of the current Auto Industry Development Programme expiring at the end of June 2012, it is suggested that the Government should undertake new initiatives to foster dissemination of tractors and other farm machinery in the country.

http://www.brecorder.com/br-research/44:44/2607:tractor-sales-foste...

-

Comment by Riaz Haq on August 15, 2012 at 8:18am

-

Here's a Businessweek story on Pakistan Lucky Cement reporting record profits:

Lucky Cement Ltd. (LUCK), Pakistan’s largest producer of the building material, said full-year profit surged 71 percent to a record as an increase in domestic sales offset a decline in exports.

Net income was 6.78 billion rupees ($71.8 million), or 20.97 rupees a share, in the 12 months ended June 30, compared with 3.97 billion rupees, or 12.28 rupees a share, a year earlier, the Karachi-based company said in a filing to the stock exchange today. Analysts forecast profit of 6.81 billion rupees, according to the average of 11 estimates compiled by Bloomberg.

Local sales rose 7 percent, while overseas shipments slipped 4.7 percent to 2.25 million tons, the company said in the statement. Lucky derived 62 percent of its revenue for the year from domestic sales and 38 percent came from exports, it said. The company expected sales at home to boost earnings for the year ended June, Chief Financial Officer Abid Muhammad Ganatra said in an interview in March.

Domestic consumption of cement “is expected to increase during the next financial year,” the company said in the statement, citing “spending on public development projects by the government in the view of upcoming national elections.”

Revenue gained 23 percent to 39.1 billion rupees, topping the average analyst estimate of 33.4 billion rupees. Sales volumes were 3 percent higher at 5.97 million tons, the company said.

Lucky shares fell 0.9 percent to 129 rupees at the close of trade in Karachi. The stock has rallied 71 percent this year, compared with a 34 percent gain in the benchmark Karachi Stock Exchange 100 Index.

http://www.businessweek.com/news/2012-08-15/pakistan-s-lucky-cement...

-

Comment by Riaz Haq on August 15, 2012 at 8:31am

-

Here's a Dawn report on Karachi stocks hitting 4 year highs:

Pakistan’s main stock market closed at a four-year high on Wednesday as investors cheered the central bank’s decision to cut its key policy rate, dealers said.

The Karachi Stock Exchange benchmark 100-share index gained 58.95 points, or 0.4 per cent, to close at 14,970.92, its highest close since April 2008. The volume of shares traded was 135.996 million.

“The positive trend in the market is because of the cut in the discount rate by the State Bank (of Pakistan) last week,” said Shuja Rizvi, a trader at Al-Hoqani Securities.

“The rise we saw today was a continuation of the rally on Monday.”

The State Bank of Pakistan in its monetary policy announcement on Aug 10 lowered its key policy rate from 12 per cent to 10.5 per cent.

In the currency market, the rupee strengthened slightly to close at 94.32/39 to the dollar, compared with 94.42/48 on Monday. Financial markets in Pakistan were closed on Tuesday for the Independence Day holiday.

Overnight rates in the money market closed lower at 8.50 per cent, compared with 10.40 per cent on Monday.

http://dawn.com/2012/08/15/pakistan-stocks-hit-four-year-high-rupee...

-

Comment by Riaz Haq on August 15, 2012 at 10:56am

-

Here's Gulf News on growth of upscale real estate developments in Pakistan:

Apart from ultra-modern residential and commercial projects undertaken on a massive scale, the concept of gated communities ensconced in the lap of extravagance isn’t just changing the dynamics of Pakistan’s luxury realty segment, but also the way residents of these projects are living in the country’s major cities like Karachi, Islamabad and Lahore. “The luxury property market in Pakistan has traditionally been unorganised and fragmented. However, the recent past has seen consolidation of a few developers who are stretching their capacities to the maximum to meet the growing market demand,” says Naveed Merchant, Managing Director, Merchant & Associates.

“REIT [real estate investment trust] regulations are in the process of formulation which will encourage large projects with sourced financing. While the Pakistan real estate market still lacks transparency and liquidity compared to more mature real estate markets, REITs would provide an opportunity to diversify the investor base in the sector through a regulated, tradable investment,” he says.

Nida Zahoor, Group Marketing Manager, Bahria Town, touted to be Asia’s largest private real estate developer, also vouches for this maturity in the market. “Generally the Pakistani luxury home buyer in this day and age, expects nothing but the best in quality. Most of them have travelled extensively to countries abroad, making them abreast with the latest trends in construction. Then there is also the growing middle class which is not as aware, but that too is changing over time” she says.

Zahoor says there is a shortage of one million homes in Pakistan with a 0.6 million (backlog) demand growing every year, which includes in it a large ratio of demand for luxury homes. In the next five years, predicts Zahoor, Pakistan will experience a tremendous growth in the luxury realty segment as awareness among the people, the trends, the policies by the government will give a fillip to this segment. So, what would Bahria Town’s benchmark project be? “It would be Bahria Golf City, Pakistan’s first ever branded luxury resort designed over a total area of 5.5 million square metres,” Zahoor says.

Bahria Golf City is expected to accommodate 18,000 people in about 7,500 housing units. “From architects such as BEAMS construction to Nayyar Ali Dada, interior designers such Wingchair, Cracknel landscape designers; and Kroll security consultants; we are working with the best in the world who have been involved in prestigious projects like the Burj Al Arab, KL towers, Atlantis Dubai and Jumeirah Beach Resort,” says Zahoor.

Bahria Town isn’t the only player in the market, there are several interesting offerings such as Lake City, a 2,104-acre development on the outskirts of Lahore, which has a plan to have almost 4,000 residences, hundreds of shops, malls and dozens of office buildings. “When the project was envisaged in 2004, it was obvious that future developments in real estate in Lahore could only take place towards the south and south west. The trend in Pakistan, outside Karachi, is not towards vertical expansion but horizontal expansion,” says Farouk Khan, ED Coordination, Lake City Holdings and Rida Sarfraz, GM Marketing and Events, Lake City Holdings.

Besides, there are other attractive projects such as Defence Raya, a 400-acre development and The Centaurus, a project featuring a five-level shopping mall, two residential complexes, the corporate complex and a luxurious five-star hotel in Islamabad...

http://gulfnews.com/gn-focus/pakistan/luxury-property-market-soars-...

-

Comment by Riaz Haq on October 1, 2012 at 8:28am

-

Here's a Dawn report on Pakistan's declining inflation & rising stock market:

Pakistani stocks closed higher on Monday after the inflation rate hit a 33-month low, boosting the confidence of investors, traders said.

The Karachi Stock Exchange (KSE) benchmark 100-share index ended 0.80 per cent, or 123.91 points, higher at 15,568.73 – a four-year high – on total volume of 135.80 million shares.

“Investors are hopeful that because inflation came down sharply, there is a high probability that the state bank will reduce the interest rate,” said Mohammad Sohail, chief executive at Topline Securities.

The central bank is expected to announce a monetary policy decision on October 5.

Pakistan’s consumer price index (CPI) rose 8.79 per cent in September from a year earlier, the Pakistan Bureau of Statistics said on Monday.

The year-on-year rate in August was 9.1 per cent. On a month-on-month basis, the CPI increased by 0.79 per cent from August, according to the bureau.

In the currency market, the Pakistani rupee ended weaker at 94.88/94.94 to the dollar compared to Friday’s close of 94.75/94.80.

Overnight rates in the money market ended at 7.50 compared to 10.40 per cent on Friday.

http://dawn.com/2012/10/01/pakistani-stocks-close-at-four-year-high...

-

Comment by Riaz Haq on October 24, 2012 at 8:17am

-

Here's a Businessweek story on record profits for DG Khan Cement in Pakistan:

D.G. Khan Cement Ltd. (DGKC), Pakistan’s second-largest producer, reported a fourfold surge in net income on record prices of the building material.

Net income increased to 1.42 billion rupees ($14.8 million), or 3.23 rupees a share, in the three months ended Sept. 30, from 355.5 million rupees, or 0.81 rupee a year earlier, the Lahore-based company said in a filing today. Sales rose 15 percent to 6.1 billion rupees.

Cement makers have relied on price increases amid stagnant sales in the past five years, a move that led the country’s competition commission conduct searches in January this year to investigate price manipulation. Manufacturers of the building material were fined 6.3 billion rupees in August 2009 for price monopoly by the watchdog.

“Cement prices rising to a record saved the day as the quantity sold remained almost the same,” said Syed Asad Ahmed, analyst at IGI Finex Securities Ltd. in Karachi. Local prices on average rose 12 percent to a record 438 rupees per 50 kilogram bag (110 pounds) in the quarter versus 391 rupees in the same period last year, IGI’s Ahmed said.

D.G. Khan’s shares rose 1 percent to 52.30 rupees at the close of trading in Karachi. The stock has rallied 175 percent this year, compared with a 40 percent gain in the benchmark KSE100 index.

http://www.businessweek.com/news/2012-10-24/pakistan-d-dot-g-dot-kh...

-

Comment by Riaz Haq on October 26, 2012 at 10:27pm

-

Here's link to an interesting thread on Made in Pakistan products:

http://www.defence.pk/forums/military-photos-multimedia/156408-made...

LCD TV by TCL Nobel Flat Screens

-

Comment by Riaz Haq on March 12, 2016 at 8:19am

-

#Motorcycle production in #Pakistan reaches nearly 2m per annum. #Manufacturing http://www.dailytimes.com.pk/business/12-Mar-2016/motorcycle-produc... …

Lack of adequate transportation infrastructure, higher inflation and poor economy made the low-powered vehicles apex priority of Pakistanis as two-wheeler production increased by 10% to 19, 12,944 units in 2015.

"Lower oil prices and improved business environment has provided a much needed boost to motorcycle industry in the outgoing year as production went up significantly due to rising demand," said Association of Pakistan Motorcycle Assemblers (APMA) Chairman Mohammad Sabir Shaikh.

He said that the government has to end the cartelisation of Japanese car and motorcycle assemblers in order to flourish the local industry otherwise the industry would remain on sluggish trajectory in coming decades as well.

He urged the government to abolish imports regime and duty structure for various motorcycles parts, as the duty on imported parts should be the same at 25 % custom duty instead of existing five different structures.

Shaikh said the industry has enough capability to cater to the rising demand of two-wheelers by producing more than 4 million motorcycles per year. However, he added that the government's apathetic attitude towards this dynamic sector has put the industry on a slow track, which has restricted production to only 2 million per annum.

"About half of the parts of motorcycles are being made in Pakistan and half of them are imported from different countries while the local industry is capable to make full production if the government patronises the sector," Sheikh said, adding that the domestic motorcycle industry now completely dominates the local market and not even a single motorcycle has been imported since 2007-08.

Detailed assessment of Pakistan Bureau of Statistics (PBS) latest data reveals that the motorcycle production including locally made Japanese brand and Chinese made imported motorcycles' brand stood at 1,912,944 units in the 2015, registering 10% growth over the same period of last year to 1,743,039 units. In December 2015, total 156,415 motorcycles were produced in the country, registering 17% growth over the production of 134,230 motorcycles in December 2014.

Recently, Atlas Honda Limited has announced an investment of $100 million in the expansion of its motorcycle operations in Pakistan. The first motorcycle produced from the new line will arrive in the market by the beginning of October 2016. The expansion will lead to the generation of 1,800 direct jobs and 5,000 jobs at associated companies and parts manufacturers.

Shaikh told Daily Times that around 4 million of motorcycles are sold illegally in Pakistan due to which the national kitty is being deprived of huge revenue in terms of taxation. "Due to this lack of concern by law enforcement agencies, the national kitty is continuously missing huge revenue in terms of taxes and duties as many local motorcycles assemblers do not show sale of unregistered motorcycles in tax documents," he added.

The motorcycle production in the country is being run by about 100 motorcycle assemblers, including one dozen cottage manufactures, which produce less than 1,000 units.

-

Comment by Riaz Haq on April 4, 2017 at 7:53pm

-

#Volkswagen in Talks to Make Big Push Into #Pakistan With #Audi luxury cars & VW Commercial vehicles http://wardsauto.com/industry/volkswagen-talks-make-big-push-pakistan … via @wardsauto

ISLAMABAD, Pakistan – Volkswagen has made significant progress in talks to establish manufacturing operations in this South Asian port city of Karachi, a top government official says.

“Volkswagen Commercial Vehicles is in final talks with Premier Systems, the authorized importer of Audi vehicles in the country, to set up a manufacturing/assembly plant for its Amarok and T6 models and Volkswagen,” Tariq Ejaz Chaudhary, CEO of Pakistan’s Engineering Development Board, confirms to WardsAuto.

A senior official at Premier Systems adds VW is considering establishing production of Audi luxury vehicles in the country.

“Volkswagen Commercial intends to use the same plant Audi intends to build for the assembly of its own vehicles in Karachi,” the official says, adding VW plans to open about 40 dealerships across Pakistan to accommodate rising demand for its Amarok pickup and T6 vans.

The possible launch of the three vehicles in Pakistan’s market of 190 million people follows forecasted demand arising from the China-Pakistan Economic Corridor program of development projects backed by the Chinese government. A VW manufacturing presence also would be among the latest results of the business-friendly policies pursued by Prime Minister Nawaz Sharif.

The Amarok is a direct competitor to Toyota’s HiLux Revo and the T6 is a multipassenger van.

Wilhlem Kramer, a spokesperson for Volkswagen Commercial Vehicles, says no firm decisions have yet been made about an investment in Pakistan, saying only, “A global corporation such as Volkswagen continuously explores market potential – including in South Asia.”

Federal Commerce Minister Khurram Dastgir Khan confirms to WardsAuto that VW “is in talks with government of Pakistan to launch its passenger/commercial plants in Pakistan,” although he doesn’t comment on the status of the negotiations.

Another possible motive for VW to enter Pakistan is the scheduled July launch of refineries able to produce high-quality diesel fuel.

-----------

Other automakers considering production in Pakistan include Hyundai, which may form a joint venture with textiles manufacturer Nishat Mills; Kia, which may partner with Lucky Cement, one of the country’s largest cement makers; and Renault, which is in talks with India’s Ghandhara Nissan Motors to use its Karachi plant for car assembly.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 3 Comments

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network