PakAlumni Worldwide: The Global Social Network

The Global Social Network

Shale Revolution, Saudi Arabia, USA and Pakistan

The rise of the West was driven by the Industrial Revolution beginning in the 18th century. It has since been fueled by fossil fuels--initially coal and later with oil and gas. Coal was indigenous in Britain and America but it is highly polluting and left much of London and New York with a thick coat of soot on everything in sight. Oil burns relatively cleaner but much of it is in the Middle East, particularly in the Persian Gulf region. First Britain and then United States saw the significance of the region and sought to control its energy resource through dictatorial puppet regimes, many of which still survive with active support of the Western powers.

Recent US EIA report on vast shale oil and gas reserves (over a trillion barrels) in many countries, including Pakistan (9.1 billion barrels of oil and 105 trillion cubic feet of..., has prompted a warning to Saudi government from Saudi Prince Alwaleed Bin Talal. While the Prince's warning is about economic impact, I see much broader long term implications of it for the US-Saudi alliance and the power and influence of the Saudi royalty in much of the region and the rest of the world.

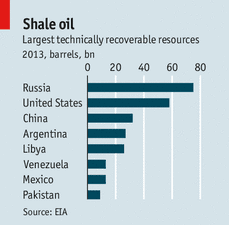

The top ten countries together have 345 billion barrels of shale oil reserves These include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels). Notable on this list are US and China, the top 2 consumers of oil in the world, both having vast shale oil reserves of their own.

In an open letter to Saudi Oil Minister Ali al-Naimi and other Saudi ministers, published on Sunday via his Twitter account, Prince Alwaleed said demand for oil from OPEC member states was "in continuous decline".

He said Saudi Arabia's heavy dependence on oil was "a truth that has really become a source of worry for many", and that the world's biggest crude oil exporter should implement "swift measures" to diversify its economy, according to news media reports.

Shortly after the Prince issued his warning, a report from OPEC published this week showed the group's oil export revenue hit a record high of $1.26 trillion in 2012. However, forecasts from the group raise doubts over whether that level of earnings can be sustained in the face of competition from shale oil.

Saudi Arabia, the world's biggest oil exporter, is now pumping at less than its production capacity because of declining consumer demand, Prince Alwaleed said in the letter.

Saudi dependence on oil stems from the fact that nearly 92% of the Saudi government budget this year comes from oil , according to Wall Street Journal. The growing shale oil production in the United States means Saudi Arabia will not be able to raise its production volume to 15 million barrels of oil per day, Prince Alwaleed said. Current capacity is about 12.5 million bpd; a few years ago the country planned to increase capacity to 15 million bpd, but then put the plan on hold after the global financial crisis in 2008.

Oil-rich Gulf nations like Saudi Arabia, Qatar, UAE and Iran have used their petrodollars to influence events in the Middle East and West Asia. They have funded their favorite sectarian groups to fight bloody proxy conflicts in Lebanon, Iraq, Pakistan and Syria. Saudis have bankrolled radical Sunni groups in Pakistan while Iran has financially backed Shia Hezbollah in Lebanon and other radical Shia groups in Iraq and Pakistan. Qatar, Saudi Arabia and UAE have supported pro-West elements to roll back democracy in Egypt.

Even if Saudis do heed Prince Alwaleed's warning and succeed in diversifying their economy, it is highly unlikely that the desert Kingdom would be able sustain its current power and influence over the long haul. This is going to be bad news for the rulers who will respond with violence to resist change. But it is potentially good news for the Saudi people and the Arab and Muslim world at large. It'll open up opportunities for reforms leading to positive changes in the Middle East and the surrounding region.

Related Links:

Haq's Musings

Pakistan's Vast Shale Oil and Gas Reserves

Saudi vs Turkish Influence in Pakistan

Shale Gas in Pakistan

Power Shift After Industrial Revolution

Pakistan Needs Shale Gas Revolution

Will Saudi Society Change Peacefully?

Pakistan Starts Tight Gas Production

-

Comment by Riaz Haq on October 17, 2013 at 11:05pm

-

Here's an excerpt of a Dawn piece on Saudi funding referring to EU data:

A recent report by the European Parliament reveals how Wahabi and Salafi groups based out of the Middle East are involved in the "support and supply of arms to rebel groups around the world." The report, released in June 2013, was commissioned by European Parliament's Directorate General for External Policies. The report warns about the Wahabi/Salafi organisations and claims that "no country in the Muslim world is safe from their operations ... as they always aim to terrorise their opponents and arouse the admiration of their supporters."

The nexus between Arab charities promoting Wahabi and Salafi traditions and the extremist Islamic movements has emerged as one of the major threats to people and governments across the globe. From Syria, Mali, Afghanistan and Pakistan to Indonesia in the East, a network of charities is funding militancy and mayhem to coerce Muslims of diverse traditions to conform to the Salafi and Wahabi traditions. The same networks have been equally destructive as they branch out of Muslim countries and attack targets in Europe and North America.

http://dawn.com/news/1029713/european-parliament-identifies-wahabi-...

https://docs.google.com/viewer?a=v&pid=sites&srcid=ZGVmYXVs...

-

Comment by Riaz Haq on September 13, 2015 at 7:39am

-

#SaudiArabia winning war on shale oil by producing more at lower prices. #shale #USA http://fw.to/W7QRFkl

If you believe all the recent stories about how Saudi Arabia is losing the price war it started against U.S. tight oil producers last year, the new Oil Market Report from the International Energy Agency offers a reality check. The Saudis are winning, though they're paying a heavy price for it.

The narrative about U.S. shale's resilience in the face of the Saudi decision to drive up production, prices be damned, centers on the American industry's ability to cut costs and use innovative technology to repel the brute force onslaught. There is a kind of David versus Goliath charm to this story, but the data don't bear it out. The IEA, the world's most respected independent source of information about the oil market, has changed its methodology for measuring U.S. output: It now polls producers, instead of relying on data from states. And the switch has caused the agency to revise production data for the first half of 2015, showing a noticeable slowdown.

The U.S. is still pumping more than it did last year, but the output is declining.

IEA data show monthly contractions of 90,000 barrels a day in July and almost 200,000 barrels a day in August. Output is dropping for all seven of the biggest U.S. shale plays. The IEA predicts that the U.S. production of light tight oil -- the type pumped by frackers -- will go down by 400,000 barrels a day next year, about as much as Libya currently produces. That drop will account for most of the 500,000 barrels a day drop in production outside the Organization of Petroleum Exporting Countries that the agency predicts for 2016. Production is also dropping in Canada: It's below 4 million barrels a day for the first time in 20 months.

The IEA doesn't believe shale oilers' incantations about drastically lower marginal cost of producing oil from already drilled wells. It points out that tight oil wells dry up much faster than traditional ones: Recent data show that output drops 72 percent within 12 months of startup and 82 percent in the first two years of operation. "To grow or even to sustain production levels requires continuous investment," the IEA report says. Low oil prices reduce frackers' access to the capital they need, and rig counts are falling again -- in early September the drop was the steepest since May.

The number of active rigs has fallen by 40 percent from a year ago. They are far more productive, because they are only being used in the most profitable locations, but that tactic has largely exhausted itself. A steeper production decline cannot be staved off for much longer.

None of this should come as a surprise. If there is one thing the Saudis know about, it's oil. They know all about the new technology used by U.S. shale, too: They work with the same international service companies and attend the same conferences. They did not make a dumb mistake gambling with their only economic advantage. The IEA reported: "On the face of it, the Saudi-led OPEC strategy to defend market share regardless of price appears to be having the intended effect of driving out costly, 'inefficient' production."

The perception that Saudi Arabia is losing the oil war is based on the absence of a spectacular rout in the U.S. -- the shale industry hasn't collapsed, right? -- as well as the Saudis' own fiscal difficulties. The kingdom is certainly running through its foreign currency reserves faster than shale oil output is falling:

So what, price wars are costly. And victory in them doesn't usually mean the complete destruction of the losing side. Rather, the Saudis seek submission.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 3 Comments

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network