PakAlumni Worldwide: The Global Social Network

The Global Social Network

Shining India Story Unravels as BRIC Man O'Neill Expresses Disappointment

For at least two years in a row, BRIC has, in the words of SGS's Albert Edwards, stood for Bloody Ridiculous Investment Concept, not an acronym for populous emerging markets of Brazil, Russia, India and China as Goldman Sachs' Jim O'Neill saw it ten years ago.

In fact, O'Neill has himself expressed disappointment in India, one of the BRICs, a designation that has boosted foreign investment in India and helped accelerate its economic growth since 2001.

"All four countries have become bigger (economies) than I said they were going to be, even Russia. However there are important structural issues about all four and as we go into the 10-year anniversary, in some ways India is the most disappointing," said O'Neill as quoted by Reuters.

Noting India's significant dependence on foreign capital inflows, Jim O'Neill went further and raised a concern about the potential for current account crisis. "India has the risk of ... if they're not careful, a balance of payments crisis. They shouldn't raise people's hopes of FDI and then in a week say, 'we're only joking'". "India's inability to raise its share of global FDI is very disappointing," he said.

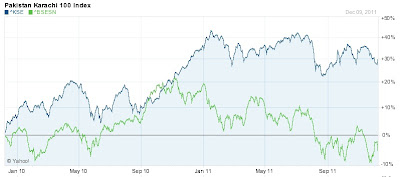

United Nations data shows that India received less than $20 billion in FDI in the first six months of 2011, compared to more than $60 billion in China while Brazil and Russia took in $23 billion and $33 billion respectively. Stocks in all four countries have underperformed relative to the broader emerging markets equity index, as well as the markets in the developed nations. Pakistan's KSE-100 has significantly outperformed all BRIC stock markets over the ten years since BRIC was coined.

As India's twin deficits continue to grow and the Indian rupee hits record lows relative to the US dollar, there is pressure on Reserve Bank of India to defend the Indian rupee against currency speculators who may precipitate a financial crisis similar to the Asian crisis of 1997.

In addition to Jim O'Neill, a range of investment bankers are turning bearish on India. UBS sent out an email headlined "India explodes" to its clients. Deutsche Bank published a report on November 24 entitled, "India's time of reckoning."

"Suddenly everything seems to be coming to a head in India," UBS wrote. "Growth is disappearing, the rupee is in disarray, and inflation is stuck at near-record levels. Investor sentiment has gone from cautious to outright scared."

India's current account deficit swelled to $14.1 billion in its fiscal first quarter, nearly triple the previous quarter's tally. The full-year gap is expected to be around $54 billion.

Its fiscal deficit hit $58.7 billion in the April-to-October period. The government in February projected a deficit equal to 4.6 percent of gross domestic product for the fiscal year ending in March 2012, although the finance minister said on Friday that it would be difficult to hit that target.

As explained in a series of earlier posts here on this blog, India has been relying heavily on portfolio inflows -- foreign purchases of shares and bonds -- as a means of covering its rising current account gap. Those flows are called "hot money" and considered highly unreliable.

Indian policy makers face a significant dilemma. If they do nothing to defend the Indian currency, the downward spiral could make domestic inflation a lot worse than it already is, and spark massive civil unrest. If they intervene in the currency market aggressively by buying up Indian rupee, the RBI's dollar reserves could decline rapidly and trigger the balance of payment crisis Goldman Sachs' O'Neill hinted at.

Related Links:

Karachi Tops Mumbai in Stock Performance

India Returning to Hindu Growth Rate

-

Comment by Riaz Haq on January 21, 2012 at 1:59pm

-

Karachi stocks jump almost 7% on tax policy news, reports Daily Times:

The Karachi stock market was dominated by bullish sentiment during the week as news regarding the proposals sent by Securities and Exchange Commission of Pakistan (SECP) to the Ministry of Finance pertaining to capital gains tax (CGT), withholding tax (WHT) and disclosure of the source of income created positive investor sentiment.

Furthermore, the announcement in the KSE regarding the visit of Finance Minister Hafeez Shaikh on the last trading day also provided impetus to the market as he is expected to announce some major changes to the CGT regime.

The Karachi Stock Exchange (KSE) 100-share index gained 760.22 points or 6.9 percent to close at 11, 774.68 points as compared to 11,014.46 points of the previous week.

“The 100-share index rallied 6.9 percent during the week, highest since April 03, 2009 (146 week high),” said JS Sec analyst Naveed Tehsin. “However, foreigners remained net sellers, offloading shares worth $3.7 million.”

Positive expectations related to the CGT issue ruled the market sentiment, while continuing global economic crisis and uncertain domestic political environment failed to dampen investor confidence, he said and added that moreover, the circular debt adjustment worth Rs 150 billion through issuance of Term Finance Certificates (TFCs) and the raid by Competition Commission of Pakistan (CCP) at All Pakistan Cement Manufacturers Association (APCMA) office were the major highlights of the week.

News regarding the proposals sent by SECP to the Ministry of Finance pertaining to CGT, WHT and disclosure of the source of income created positive investor sentiment.

The government of Pakistan has decided to adjust circular debt worth Rs 150 billion through issuance of TFCs. Reportedly the banks have agreed to subscribe to these issues that is likely to provide relief to the energy and banking sectors by converting loans of the energy companies into TFCs. Despite this news, banks and electricity sectors underperformed the market by 2.8 percent and 3.6 percent, respectively.

The daily turnover increased 456.69 percent to close at 178.42 million shares as against 32.05 million shares of the previous week.

“Stocks closed bullish during the week with record high trades on the last trading day of the week,” said Arif Habib Investments Ltd Director Ahsan Mehanti. “Hopes of good news regarding CGT issues supported the market while positive revision in Pakistan economic growth estimate to 4 percent, recovery in global stocks, foreign interest in blue chips and statement issued by White House on US, Pakistan to work together to reset ties played a catalyst role in the bullish sentiment at KSE.

http://www.dailytimes.com.pk/default.asp?page=2012\01\22\story_22-1-2012_pg5_16

-

Comment by Riaz Haq on January 22, 2012 at 10:57am

-

Chinese banks bail out India's Reliance, according to International Financing Review:

Anil Ambani’s Reliance Communications has been saved from a potential financing crunch by a surprise US$1.1bn loan from a group of Chinese state-owned banks. RComm will use the new funds to repay a US$1.2bn convertible bond issue due for redemption on March 1, putting an end to fears of a potentially devastating default.

The loan has raised eyebrows as a rare instance of Chinese support for one of India’s biggest business groups. China Development Bank, Export-Import Bank of China, Industrial and Commercial Bank of China and other Chinese lenders provided the entire refinancing, according to an announcement from RComm on January 17.

RComm “will benefit from an extended loan maturity of seven years and attractive interest cost of about 5%”, said a company press release.

The new loan comes as European banks – RComm’s traditional relationship lenders – are scaling back exposure to Indian borrowers. RComm has taken a hit from India’s ongoing telecoms corruption scandal, with police questioning chairman Anil Ambani last year, and its existing syndicated loans feature prominently on axe sheets in circulation from European banks.

However, bankers with direct knowledge of the matter said that, in return for the loan from the Chinese policy banks, RComm was expected to purchase equipment from the country’s PC companies, such as Huawei and ZTE Corp.

“Chinese banks have a lot of cash and they tend to throw it around, but they only do so when there is something packaged with it,” said a veteran loans banker in Singapore. “It is a great deal for Reliance Communications as it provides another source of liquidity when traditional ones are drying up. However, there was more in it than just pure returns that incentivised the Chinese lenders.”

This is not the first instance of such an arrangement. Late last November, Sasan Power, the project company for the Sasan ultra mega power plant and a subsidiary of RComm affiliate Reliance Power, completed a US$2.2bn refinancing, including a US$1.114bn 13-year tranche. Bank of China, CDB and Chexim took US$1.06bn of that tranche, for which Chinese export credit agency Sinosure provided cover.

That was the first Indian loan to which Chinese lenders had committed such large amounts, after they began to take lead roles on Indian deals in 2007. Prior to Sasan Power, the take of Chinese lenders as MLAs on Indian deals amounted to just US$218.26m from six transactions in three years.

More redemptions loomingBankers warned, however, that the Chinese loan was unlikely to provide a template for other Indian companies to follow.

“The names that have trade links with the PRC will appeal more to the Chinese banks. Those that think they can meet the criteria are being marketed to the Chinese banks,” said a banker with a foreign bank in Mumbai.

More than two dozen Indian companies in the BSE-500 index face redemptions on foreign currency convertible bonds worth a combined Rs330bn (US$6.5bn) at end-March 2013, according to brokerage Edelweiss. These include RComm’s US$925m outstanding CB, which the loan will repay.

Entities without ties to China must look elsewhere and may have to rely on Indian banks to overcome their refinancing pressure.

For example, Orchid Chemicals & Pharmaceuticals is in the market, through sole bookrunner Axis Bank, for a US$100m 6.5-year loan that will partly refinance a CB issue of US$170m coming due in mid-February. The facility, marking Orchid’s debut in the offshore loan markets, pays a top-level all-in of 490bp over Libor, based on an average life of five years....

http://www.ifre.com/chinese-lenders-bail-out-rcomm/20044964.article

-

Comment by Riaz Haq on January 22, 2012 at 2:10pm

-

Chinese banks bailing out Indian company, according to the Wall Street Journal:

Reliance Communications Ltd. opened a window this week. India's second-largest mobile phone carrier by number of subscribers was under pressure to refinance $1.18 billion of foreign-currency convertible bonds. In the current market, that looked like a stiff challenge, as lenders in the U.S. and Europe struggle with their deteriorating economies.

Enter a consortium of Chinese banks to bail out the Indian company with a loan paying just 5%. The deal gives the banks the sort of exposure to India's fast-growing communications space that Chinese companies couldn't get otherwise. New Delhi routinely blocks Chinese business seeking a piece of India's strategic industries such as telecommunications, technology or energy. The government typically cites quality-control issues or national security, though political posturing is perhaps a more likely cause.

Yet the Reliance loan deal puts the Chinese banks in a strong position over a prominent Indian business. It might also help China Inc. get more leverage in the Indian economy.

Still, politics shouldn't cloud the positives for India. The deal is a savior for Reliance, whose share price is nearly 87% below the conversion price set on the bonds four years ago. Moreover, the loan means China, through its state-owned banks, now has a significant stake in the success of an Indian telecommunications giant.

Beyond Reliance, a host of Indian companies are in need of capital this year to fulfill expansion plans or repay debt. But traditional funding channels are drying up, local markets are jittery and interest rates are by no means cheap. Under those circumstances, more Chinese money may find a warm welcome in India.

http://online.wsj.com/article/SB10001424052970204468004577168443270...

-

Comment by Riaz Haq on January 30, 2012 at 6:31pm

-

India’s total external debt has risen to $326 billion while forex reserves have dipped to $293 billion, according to a report in the Indian Express:

...The composition of capital inflows shifted in favour of debt, with a rise in the proportion of short-term flows. If the pace of FDI inflows does not pick up once again and FII equity inflows revert to the decelerating trend, CAD may have to be largely financed through debt creating flows in the coming quarters. Recent pick up in FII flows has been mainly on account of investment in debt instruments.

-------------

On the capital account, recent policy measures have stimulated debt capital flows in the form of investments by FIIs in debt instruments and NRI deposits. Going forward, however, it would be necessary to reduce dependence on debt inflows and accelerate the reform process in order to ensure revival of equity flows as investors look for strong growth opportunities in an otherwise gloomy global environment, the RBI says.Widening current account deficit (CAD), diminishing capital flows and moderately deteriorating vulnerability indicators, notwithstanding improved net international investment position, warrant acceleration of the domestic reform process. The RBI feels this will encourage renewed equity flows.

Subbarao made it clear that close monitoring of the short-term external debt will be required in 2012-13. Given that both global and domestic scenario remains bleak, investors would generally tend to prefer shorter-dated government securities.

Capital flows

* In 2011, out of $8.65 billion foreign debt inflows, as much as $4.18 billion came in December while there was an outflow of $357 million from equity

* India’s total external debt has risen to $326 billion while forex reserves have dipped to $293 billion

* If the pace of FDI inflows does not pick up and FII equity inflows decelerate, CAD may have to be largely financed through debt creating flows in the coming quarters.

http://www.indianexpress.com/news/rbi-not-comfortable-with-rise-in-...

-

Comment by Riaz Haq on March 3, 2012 at 10:06am

-

Here are "Ten Things for India to Achieve its 2050 Potential", brought out by Jim O'Neill, Head Global Research at Goldman Sachs, and Tushar Poddar, V-P Research, Asia Economic Research Team at Goldman Sachs India, as reported by India's Economic Times:

1. Improve governance

2. Raise educational achievement

3. Increase quality & quantity of universities

4. Control inflation

5. Introduce credible fiscal policy

6. Liberalize financial markets

7. Increase trade with neighbors

8. Increase agricultural productivity

9. Improve infrastructure

10. Improve environmental quality

http://economictimes.indiatimes.com/quickiearticleshow/3137357.cms

-

Comment by Riaz Haq on March 17, 2012 at 10:53pm

-

Goldman Sachs' Jim O'Neill has reaffirmed his optimism about N-11 group of countries which includes Pakistan. Here's an excerpt from a Vancouver Sun story:

In his book, The Growth Map, O’Neill attempts to look beyond the original concept and expand on it. Hence his “Next 11”: Bangladesh, Egypt, Indonesia, Iran, South Korea, Mexico, Nigeria, Pakistan, the Philippines, Turkey, and Vietnam. However, O’Neill is quick to point out that not all of these countries are equally primed for investment.

This is a group of “very, very diverse countries,” he says. “On one level, I’m always quite embarrassed about the acronym N-11 because all it is ... is a phrase to describe the next 11 population countries after the BRICs, and that’s it.”

Indeed. The N-11 ranges from stalwarts of emerging-market investing, such as South Korea, Turkey, and Mexico, to countries that even the boldest investors tend to be wary of, such as Pakistan and Iran.

O’Neill posits that countries with huge populations and low gross domestic products per capita will be able to catch up to the developed world more quickly than they could have 50 or 100 years ago, as the economic centre of gravity shifts away from the West.

In order to assess countries’ capacity to generate sustainable growth, O’Neill has come up with a set of 13 variables (from education to rule of law to fiscal health to internet penetration) that combine to make what he calls a “growth environment score.” On this measure, the highest-scoring country, South Korea, tops every G8 country except one – Canada.

Read more: http://www.vancouversun.com/business/emerging-markets/Looking+beyon...

Another excerpt from UAE's The National:

Mr O'Neill, as one of the world's top economists and global chairman of Goldman Sachs' asset management business, has detailed answers for all the critics, although he does concede: "Maybe I'm too proud of my creation".

He was speaking in Dubai ahead of the Goldman Sachs Asset Management conference on the Middle East and North Africa, an annual gathering designed to work out the bank's broad investment approach to the region.

Whatever the critique of the Bric concept, there is no doubt it has become one of the guiding principles of economic and financial theory of the past decade, and has helped to change the way businessmen and financiers view the world.

He recently updated the concept to take in what he calls the Next 11 or N-11 economies: Bangladesh, Egypt, Indonesia, Iran, South Korea, Mexico, Nigeria, Pakistan, the Philippines, Turkey and Vietnam.

His visit took in the UAE and other GCC states, and prompted some typically down-to-earth observations on the region's potential.

"From the broad Middle East region, there are two countries that have the population size to eventually become big enough, or N-11: Egypt and Iran. Both are in our list already," he says.

"No individual GCC country could reach their potential. If you thought of the GCC collectively, then you might think of them as having Bric-like potential, but not alone."

Even the biggest GCC country, Saudi Arabia, with its population of an estimated 25 million, is not a candidate for the lists currently, mainly because it lacks the basic criterion of having an economy that is more than 1 per cent of global GDP, Mr O'Neill argues.

http://www.thenational.ae/thenationalconversation/industry-insights...

-

Comment by Riaz Haq on June 2, 2012 at 9:28am

-

Here's an Economist story "A Bric hits the wall":

INDIA’S economy has had some bad economic ideas inflicted on it over the past century, from imperial neglect to the cult of the village and big-ticket socialism. Maybe the concept of BRICs—a handful of emerging economies including India that were destined for fast growth—should be added to the list. It led to a bubble of complacency that is now being popped rather brutally. Growth in India was 5.3% in the three months to March—worse than the 6% expected, below the prior quarter and way below the close-to-double digit rates that were meant to be preordained and propel India to economic super-power status.

Other BRICs have slowed too, including China and Brazil. But India's GDP figures, the worst for at least nine years, will have a deep impact on the sub-continent. The country was meant to grow in its sleep—regardless of what happens in the rest of the world. A quick bounce back looks unlikely. The central bank has cut interest rates a little this year, but will struggle to loosen policy further given high inflation. The ruling coalition keeps on promising a bout of reforms to boost confidence, but it is so divided, its behaviour so erratic and its record of delivery so poor that few believe this will actually happen. Expectations for growth over the next couple of years will probably slip further, to 6%.

A 6%-growth-India raises three issues. For one, the old orthodoxy was that after liberalisation India had been on an accelerating path, driven by demographics and its high rate of savings and investment. A rival view is now likely to take hold. It notes that India has grown pretty consistently at 6% since the mid 1980s, with the exception of a faster period in 2004-2007. What looked like a step up in trajectory now looks like a one-off blip driven by a global boom, an uncharacteristic bout of tight fiscal policy and an unsustainable burst of corporate optimism. Political history may have to be rewritten too. The reformers of 1991, who include the present prime minister, have turned out to be not visionaries, but pragmatists without a deep commitment to liberalisation who have been unable to build a lasting consensus among voters and the political class in favour or reform.

Second, financial stability will become trickier. Nominal GDP growth (including inflation) has slipped to the low teens. This is still above the rate of interest India's government pays on its debt and thus in theory enough to avoid a debt spiral—despite high fiscal deficits running at almost a tenth of GDP. Government bond yields are artificially depressed because banks are forced to buy government paper and because the central bank has been buying bonds actively in the last six months. Although this can go on for a while, the stress is showing up in two different areas. One is the banking system where gross bad debts plus "restructured" loans have risen to over 8% of the total—a figure high even by western banks' standards. Bankers and the central bank argue that "restructured" loans are unlikely to result in large losses. But with lower growth more corporate borrowers will come under strain, as will the credibility of those reassurances.

----------

Perhaps growth will bounce back. And if it doesn't, perhaps public frustration will be expressed at the ballot box, creating a new, less complacent political climate. The view that India's democracy is a self correcting mechanism that steers the country back onto the right course when things go wrong, was an integral part of the bulls' view of India. Hopefully it is one idea from the boom that proves to be correct.http://www.economist.com/blogs/newsbook/2012/05/indias-economy

-

Comment by Riaz Haq on July 5, 2012 at 5:35pm

-

Here's a Wall Street Journal story on falling Indian rupee:

For almost a year, India's central bank has spent billions of dollars to support the beleaguered rupee. And yet the currency is Asia's worst-performing against the U.S. dollar over the past year.

The fruitless efforts by the Reserve Bank of India shows how central banks, especially in emerging markets, often are powerless to manage pressures on their currencies if international market forces are ranged against them.

The rupee has been declining partly because of flight of capital from emerging markets, but also because of concerns over India's deteriorating financial health. The country's current-account deficit recently hit its highest level ever, and the federal government's heavy spending has widened its budget deficit.

------------

Things worsened for the rupee after March, when the Indian government introduced tax rules in the federal budget that could potentially hurt foreign investors. Spooked, foreign funds pulled money out of the economy.Between April and June, for instance, foreign institutional investors pulled out $350 million from Indian stocks versus net inflows of $1.15 billion in the same period a year earlier.

Meanwhile, the bank came under intense pressure from the government to cut rates. Growth in India fell to 5.3% in the first three months of 2012, its slowest rate in almost a decade.

In April, the central bank cut rates for the first time in three years. But it hasn't followed with additional cuts, citing inflation and currency risks.

In May, the bank stepped up its actions, ordering exporters to convert half their foreign-currency earnings held onshore into rupees within two weeks. The move failed to lift the rupee as exporters were able to keep their earnings overseas.

At other times, the government has raised hopes of enacting strong measures to boost the rupee, or foreign inflows, but failed to deliver.

"There have been a lot of dashed expectations," said Killol Pandya, head of fixed income at Daiwa Asset Management in Mumbai.

http://online.wsj.com/article/SB10001424052702303933404577504792500...

-

Comment by Riaz Haq on June 28, 2013 at 7:19pm

-

Here's a Business Standard report about Indian GDP shrinking on US $ terms:

The size of the country's gross domestic product (GDP) grew to Rs 100 lakh crore in 2012-13, about 11.7 per cent higher than the Rs 89 lakh crore a year before. However, it contracted in dollar terms due to the rupee's depreciation.

GDP at market prices (including indirect taxes) had grown 15.1 per cent in 2011-12.

The GDP size, at Rs 1,00,20,620 crore in 2012-13, is only just short of the advance estimate of Rs 10,028,118 crore issued in February this year by the Central Statistics Office.

In dollar terms, the economy's size fell to $1.84 trillion in 2012-13 against $1.87 trillion the previous financial year. It was so because the rupee depreciated to 54.3 against the dollar on an average in 2012-13, against 47.8 in 2011-12.

India's per capita income grew to Rs 68,757 in 2012-13, growing 11.7 per cent over Rs 61,564 the previous year. In dollar terms, per capita income fell to 1,266.2 in 2012-13 against 1,287.9 in 2011-12. (SECTOR-WISE QUARTERLY ESTIMATES OF GDP GROWTH FOR 2012-13)

According to recent estimates of the Organisation for Economic Co-operation and Development, India's economy has probably surpassed Japan for the third highest slot in world GDP, in terms of purchasing power parity (PPP) at 2005 prices. Both economies had seven per cent share in world output in 2011. However, OECD projected that in 2012 or a year after, India would replace Japan as the third largest economy. Also, India's economy might grow larger than the euro area in about 20 years.

However, in current prices, India's economic size might have shrunk a bit due to fall in the rupee value against the greenback. The OECD estimated that on PPP at current prices, India's share in world GDP was six per cent in 2010 and Japan's was seven per cent.

http://www.business-standard.com/article/economy-policy/rupee-fall-...

-

Comment by Riaz Haq on June 28, 2013 at 10:13pm

-

Pakistan's annual GDP rose to $252 billion (184.35 million pop times $1368 per capita) in fiscal 2012-13, according to Economic Survey of Pakistan 2012-13 estimates based on 9 months data.

http://www.finance.gov.pk/survey/chapters_13/executive%20summary.pdf

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network