PakAlumni Worldwide: The Global Social Network

The Global Social Network

Soaring Exports of Pakistan's Information Technology and Pharma Industries Amid COVID Pandemic

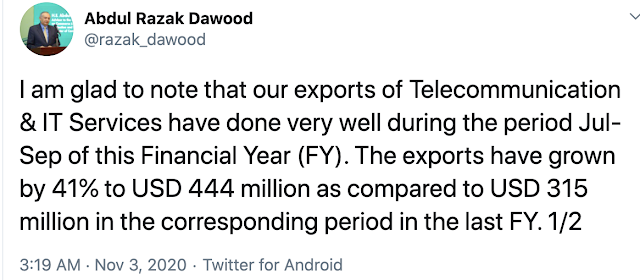

Pakistan’s IT exports increased by 44% during the first quarter (July, August and September) of the fiscal year 2020-21, according to a tweet by Razzak Dawood, Special Assistant to Prime Minister Imran Khan. Pharmaceutical exports saw 22.6% increase in the same period over last year. Pakistan's information technology and pharmaceutical exports are soaring by double digits amid the COVID pandemic, much faster than the overall exports.

|

| Razzak Dawood on IT Exports |

In Fiscal Year 2019-20 ending in June, 2020, the Information Telecommunication (IT) and IT enabled Services (ITeS) export remittances surged 23.71% to $1.230 billion from $994.848 million during the same period in the prior year, according to Pakistan Bureau of Statistics as reported by Pakistani media.

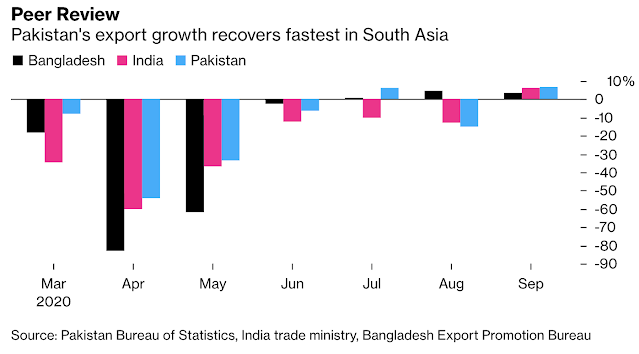

With several major brands moving production to Pakistan amid the COVID19 pandemic, the country's exports have grown at a faster pace than those of Bangladesh and India, according to Bloomberg News. Pakistan's total textile shipments rose 7% in September, compared with India’s 6% and Bangladesh’s 3.5%.

|

| South Asia Region's Exports. Source: Bloomberg |

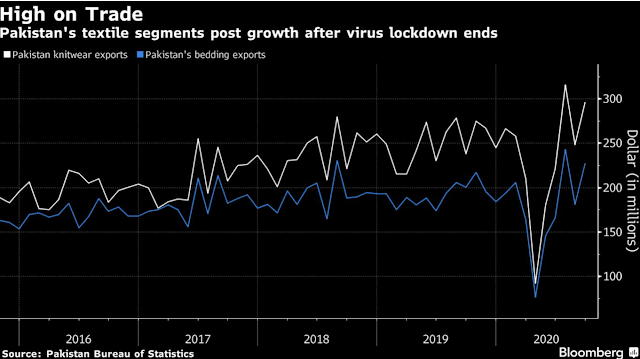

“Pakistan has seen orders shifting from multiple nations including China, India and Bangladesh,” said Shahid Sattar, secretary general at the All Pakistan Textile Mills Association, in an interview with Bloomberg's Faseeh Mangi. “Garment manufacturers are operating near maximum capacity and many can’t take any orders for the next six months.”

|

| Pakistan's Textiles Growth. Source: Bloomberg |

Bloomberg attributed Pakistan's export surge to Prime Minister Imran Khan’s administration to be the first in South Asia to ease the COVID19 lockdown after controlling the spread of the disease. It helped draw companies like Guess Inc., Hugo Boss AG, Target Corp. and Hanesbrands Inc.

|

| IPO Spree in Karachi Stock Market. Source: Bloomberg |

|

| Covid19 Cases in Pakistan. Source: Our World in Data |

|

| Pakistan Monthly Quantum Index of Manufacturing. Source: PBS |

Cement Sales:

Pakistan is once again experiencing a construction boom with new incentives under Naya Pakistan Housing Program. Monthly cement sales rose to near all-time high of almost 5 million tons in July 2020 as construction activity picked up in both housing and CPEC-related projects.

|

| Pakistan Cement Sales. Source: Bloomberg |

Car Sales:

Gasoline sales in June, 2020 hit new record and local car deliveries rose to about 10,000 units as people returned to work after easing of lockdown in May, 2020. Kia Motors Corp.’s local unit is planning to add a second shift at its factory in Karachi from January.

|

| Pakistan Car Sales Recovery. Source: Bloomberg |

Multiple Sectors Growing:

Sectors including food, beverages & tobacco, coke & petroleum products, pharmaceuticals and non metallic mineral products saw an increase in production in July 2020. Muzzammil Aslam, chief executive officer at Tangent Capital Advisors Pvt., was quoted by Bloomberg as saying, “It has surprised everybody". Aslam expects Pakistan economy at 4%-5% in current fiscal year, higher than the government’s 2.1% target. “The growth is led by an aggregate demand push.”

Summary:

Pakistanis have defied all foreign and domestic doomsayers, including media, activists and think tanks of all varieties. Pakistan has successfully fought off the deadly COVID19 virus and begun to bounce back economically. Pakistan’s IT exports increased by 44% during the first quarter (July, August and September) of the fiscal year 2020-21, according to a tweet by Razzak Dawood, Special Assistant to Prime Minister Imran Khan. Pharmaceutical exports saw 22.6% increase in the same period over last year. With several major brands moving production to Pakistan, the country's exports are rebounding faster than its peers in South Asia. Moody's rating agency has raised Pakistan's economic outlook from "under review for downgrade" to "stable". Pakistan's Planning Minister Asad Umar is talking of a "V-shaped recovery". Monthly cement sales have rebounded to pre-pandemic level, fuel sales have increased, tax collection is up, exports are rising and the Karachi stock market is booming again. Prime Minister Imran Khan and Army Chief General Javed Bajwa have been on the same page in tackling the health and economic crises faced by Pakistan. Contrary to the critics of Pakistan's civil-military ties, Khan-Bajwa cooperation has been one of the keys to the country's success in dealing with the twin crises.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Pharma Industry

COVID19 in Pakistan: Test Positivity Rate and Deaths Declining

Construction Industry in Pakistan

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Is Pakistan's Response to COVID19 Flawed?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Coronavirus Antibodies Testing in Pakistan

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on November 18, 2020 at 7:19am

-

State Bank of Pakistan Fiscal Year 2020 Report:

https://www.sbp.org.pk/reports/annual/arFY20/Chapter-02.pdf

In the other private services segment, net ICT

exports jumped by 36.0 percent YoY, to US$

784 million (Table 2.19). Within this, software

consultancy services and computer software

witnessed growth of 23.0 percent and 48.3

percent respectively. Importantly, the jump in

exports was more pronounced in the second

half of FY20.44 Amid the “Great Lockdown”,

the rise in ICT-related services exports

indicated that Pakistani firms were able to

benefit from the rise in global demand for

these services. Social distancing measures

adopted by governments may have further

boosted demand for online services in work-from-home arrangements.

-

Comment by Riaz Haq on November 18, 2020 at 4:26pm

-

#Pakistan in #4G download speed 51% faster than #India's. Both showed a growth in #internet download speeds over last year, with India growing by nearly 12% and Pakistan's download speed grew 24%. #mobile #Broadband #telecoms https://www.thehindu.com/sci-tech/technology/india-trails-pakistan-...

India came second to Pakistan in terms of mean download speed over a mobile phone in the July to September period of 2020.

Pakistan showed nearly 40% faster mobile download speed than India last quarter, according to Internet access analytics firm Ookla.

In terms of mean upload speed, India stood last among the South Asian countries at nearly 4 Mbps. Bangladesh stood third for download speed and second for upload speed.

Both India and Pakistan showed a growth in internet download speeds over the year, with India growing by nearly 12% compared with the same period last year. Pakistan's download speed grew 24% this quarter compared with last year.

In terms of 4G LTE performance, Pakistan outperformed India with its mean download speed over 4G being 51% faster than India's.

India's mobile data speeds is said to be one of the slowest in the world, trailing Pakistan, Nepal, South Korea and Sri Lanka, according to Ookla's Speedtest Global Index. Ookla ranked 138 countries based on internet speeds and India ranked 131st.

India is one of the largest markets in the world for smartphones. It also has access to the one of the cheapest data rates around the globe. The findings also come at a time when operators worldwide compete to roll out the fastest internet service there could be - 5G.

-

Comment by Riaz Haq on November 22, 2020 at 10:04am

-

#Pakistan #consumer companies' profits soar 86% YoY in 3QFY20. By category, consumer discretionary firms posted 206% YoY jump in profitability, followed by 75% YoY increase in consumer staples & 48% YoY rise in #pharma earnings.- Profit by Pakistan Today

https://profit.pakistantoday.com.pk/2020/11/19/consumer-companies-p...

These firms took the lead where revenues were up 39pc YoY as compared to -64pc YoY in 2Q2020 mainly due to increase in volumetric sales given (1) pent-up demand from previous quarter amidst Covid-19 lockdown and (2) low-interest rates, Topline securities stated.

Total Car and Pak Elektron Limited (PAEL’s) appliances sales increased by 8pc YoY & 30pc YoY, respectively in 3Q2020.

The overall gross margins for this segment increased by 1.98ppts YoY to 8.1pc, led by Pak Suzuki Motor Company Limited (PSMC) +6.06ppts and followed by Thal Limited (THALL) +5.39ppts. Margins of all others in this segment were down in the range of 0.2ppts YoY to 3.63ppts YoY.

Pharmaceuticals

Sales of Pharmaceuticals’ segment witnessed an improvement of 26pc YoY mainly due to resumption in OPDs and regular health care services, which were halted due to the risk of patients getting infected by Covid-19.

GlaxoSmithKline Consumer Healthcare (GSKCH) +35pc YoY and GlaxoSmithKline Pakistan Limited (GLAXO) +32pc YoY led sales increase.

Topline Securities stated that all our sample companies in the pharmaceuticals segment reported a decline in gross margins, with the exception of Abbott Laboratories (Pakistan) Limited (ABOT), which reported increase of 10.7ppts YoY to 35pc from 25pc mainly due to better sales mix i.e. increase in high margin nutrition segment sales.

A notable decline in gross margins within pharmaceuticals’ was witnessed in (1) GlaxoSmithKline Consumer Healthcare (GSKCH) -4.9ppts YoY due to adverse sales mix and procurement of raw material at higher prices and (2) AGP Limited (AGP) -4.8ppts YoY amid one-off provisioning of Covid-19 testing kits.

Staples

The sales for this segment increased by 23pc YoY. All companies within the staples segment reported increase in sales except for Bata Pakistan Limited (BATA) -13% YoY due to lower volumetric sales as educational institutions opened after Sep 15, 2020 in phased manner.

Notable increase in sales was witnessed in Unity Foods Limited (UNITY) +176pc YoY due to addition of new product lines along with capacity expansion.

Gross margins of consumer staple companies were up by 0.86ppts YoY to 27.8pc during 3Q2020.

Overall profitability of consumer companies was up by 41pc QoQ led by Consumer Discretionary firms again which turned in profits of Rs4,105mn in 3Q2020 as compared to losses of Rs1,479mn in 2Q2020.

According to Topline Securities, Overall sales during 3Q2020 increased by 37pc QoQ mainly due to increase in revenues of Consumer Discretionary +144pc QoQ amid higher volumetric sales driven by pent-up demand and low interest rates.

Turnover of Pharmaceuticals’ and Consumer Staples firms were also up by 14pc QoQ and 7pc QoQ, respectively.

The overall gross margins were down by 3.7ppts QoQ to 21.1pc amidst Pak Rupee devaluation by 2pc QoQ which the companies were unable to immediately pass on to the final consumers, the Topline securities said.

-

Comment by Riaz Haq on November 30, 2020 at 7:33am

-

#Karachi stocks soar. #KSE100 up 261.73 points, or 0.64%, to close at 41,068.82 points.MCB, OGDC join MSCI stock index. #Tech(+57 points), banks(+50 points), oil and gas marketing (+48 points), cement (+36 points), exploration and production (+25 points). https://tribune.com.pk/story/2274129/market-watch-stocks-advance-on...

In the morning, while taking cue from Friday’s trading session, the market opened lower and fell sharply in early trading. Fortunately, the negative momentum did not last long and bulls jumped back and wiped out all the losses including those suffered by the market on Friday.

At close, the benchmark KSE-100 index recorded an increase of 261.73 points, or 0.64%, to settle at 41,068.82 points.

In its report, Arif Habib Limited stated that the market opened on a negative note, touching intra-day low of 137 points during the session. However, the banking sector took the front seat and lifted the benchmark index. Cumulatively, the index put together an increase of 308 points.

“MSCI’s semi-annual index changes, which were made earlier in November, came into effect today (Monday),” the report said, adding, “resultantly, MCB from the banking sector and Oil and Gas Development Company and Pakistan Petroleum from the exploration and production sector saw brisk activity.”

Although international crude oil prices were down on concerns over OPEC+ meeting scheduled for Monday and Tuesday, where deferring oil supply increase in the first quarter of 2021 would be discussed, Pakistan State Oil also reacted to the prospect of share swap arrangement, as proposed by the Petroleum Division, to settle circular debt among public sector entities in the energy chain.

Sectors contributing to the performance included technology (+57 points), banks (+50 points), oil and gas marketing (+48 points), cement (+36 points) and exploration and production (+25 points).

Individually, stocks that contributed positively to the index included TRG Pakistan (+49 points), Pakistan State Oil (+39 points), MCB (+22 points), UBL (+20 points) and Lucky Cement (+20 points).

Stocks that contributed negatively were Bank AL Habib (-16 points), Engro Corporation (-16 points), Pakistan Tobacco (-11 points), Fauji Fertiliser (-11 points) and K-Electric (-7 points).

JS Global analyst Maaz Mulla said Pakistan Stock Exchange showed slight signs of recovery as the KSE-100 index touched intra-day high of +308 points. It closed the session at 41,069, up 262 points.

A total of 389 million shares were traded during the day. Top contributors to the total volume were Hum Network (-9.6%), TRG Pakistan (+7.5%), Pakistan Refinery (+4.2%), K-Electric (-2.9%) and Unity Foods (+0.8%) with a cumulative 184 million shares changing hands.

“A rally was witnessed in the technology sector where TRG Pakistan (+7.5%), NetSol (+6.8%) and Avanceon (+5.9%) gained ground,” he said.

The steel sector also enjoyed the upward trend where Aisha Steel Mills (+4.2%), International Steels (+3.7%), Amreli Steels (+2.8%), International Industries (+2.4%) and Mughal Iron and Steel (+2.6%) closed in the green.

“On the news front, Pakistan and the Asian Development Bank (ADB) signed a $300 million policy-based loan agreement to help promote macroeconomic stability through improved trade competitiveness and export diversification,” Mulla added.

“Moving forward, we expect the market to remain bearish due to political uncertainty and global rise in corona cases. Hence, we recommend investors to avail themselves of any opportunity to buy on dips,” the analyst said.

Overall, trading volumes dropped to 388.6 million shares compared with Friday’s tally of 397.8 million. The value of shares traded during the day was Rs14.1 billion.

Shares of 368 companies were traded. At the end of the day, 230 stocks closed higher, 122 declined and 16 remained unchanged.

-

Comment by Riaz Haq on December 2, 2020 at 7:49am

-

#Pakistan’s #IT #exports, #tech stocks set to boom in next decade. Pakistan’s IT exports, estimated at $1.2 billion in 2019, grew by 46% in Q1FY21. KASB investment analyst: “We think there is an opportunity of 10x growth in IT exports". https://profit.pakistantoday.com.pk/2020/12/01/pakistans-it-exports... via @Profitpk

With more than 20,000 graduates entering the workforce each year in the technology sector and a prevailing pool of more than 300,000 IT engineers in the world’s fourth fastest growing freelance market, Pakistan’s technology exports have the potential to reach $10 billion from the present $1.2 billion in the next 10 years.

A recent report on Pakistan’s IT sector published by Karachi-based securities brokerage firm Khadim Ali Shah Bukhari Securities (KASB) argues that the technology sector has the most promising outlook in Pakistan and trends point towards a healthy contribution of IT to the overall exports and significant representation of technology stocks in the public market.

In addition to the burgeoning talent pool, Pakistan has a large and young English speaking population that gives it a competitive edge like India. India’s present IT exports are about 49 per cent of its total exports whereas Pakistan’s IT exports are around 4pc of the total exports.

“Moreover, the internet has made the virtual migration of labour much easier. Many of the fortune 100 companies and leading technology unicorns engage outsourced technology talent from Pakistan,” the report notes.

Pakistan’s IT exports, estimated at around $1.2 billion in 2019, grew by 46pc in Q1FY21. “We think there is an opportunity of 10x growth in IT exports,” the KASB report argues.

The report further outlines that in the public market in Pakistan, technology stocks have under-representation and account for 1.8pc of the total market cap.

This trend was typical of most emerging, or perhaps all markets, until the last decade, the report notes, underlining that over the last ten years, there has been a swift sector shift from E&P and financials into technology.

“Technology, which was 1.5pc in 1997, now accounts for 32pc of the MSCI Emerging Markets Index. Seven out of the top 10 companies in MSCI EM Index are technology companies, including all of the top six,” it reads.

Extrapolating on the trends, the report argues that a similar shift will happen in Pakistan over the next ten years that will be driven by both growth in the market caps of existing companies as well as new IPOs of digital businesses.

“The interest is starting to grow which is evident by the successful IPO of TPL Trakker and the 194pc increase in the share price of Systems Ltd, the largest listed company,” it adds.

Technology stocks undervalued in Pakistan

Even for the technology stocks that are listed, the KASB report argues that the said stocks are grossly undervalued. “Sell side consensus is tracking historical PE multiples, DCF, dividends or even book values to value growth based technology companies,” it says.

Consequently, there is mispricing, which is visible both while comparing Pakistani companies with regional peers and also while comparing valuations of the public with private market capital raise rounds in Pakistan.

The report noted that the stock value of two of the largest publicly-traded IT companies in Pakistan, Systems Limited and The Resource Group (TRG), was undervalued by at least by 45pc and 214pc respectively.

“While the stock has outperformed the KSE100 Index by 132 per cent year to date and the market has started to value in IBEX and Afinti, it [TRG] still remains massively undervalued compared to the portfolio valuations,” the report stated.

The report attributed the undervaluation of stock to tepid effort on investor relations and limited disclosures by the company [TRG].

-

Comment by Riaz Haq on December 2, 2020 at 10:26pm

-

The (Pakistani) government has decided to set up the Special Technology Zones Authority (STZA) through the promulgation of an ordinance aimed at giving 10-year tax exemption to zone developers and enterprises.

https://tribune.com.pk/story/2274272/govt-to-set-up-technology-zone...

Sources said that the government had decided to give incentives to the technology zone developers. The developers would be exempt from all customs duties and taxes for a period of 10 years from the date of signing of a development agreement on capital goods, including but not limited to materials, plant, machinery, hardware, equipment and software, imported into Pakistan for consumption within zones by the authority and zone developers.

The government would also give tax exemption to zone enterprises. They will also be exempt from all customs duties and taxes on capital goods for a period of 10 years from the date of issuance of licence by the authority.

The cabinet, in its meeting held on November 24, was informed that a meeting regarding creation of STZA was held at the Prime Minister’s Office on November 5, 2020.

The goal behind the creation of such zones was to provide institutional and legislative support for the technology sector with internationally competitive and export-oriented structures and ecosystem, in addition to developing collaboration between the academia, researchers and technology industry.

This would help create jobs in the technology sector and capitalise on youth dividend. The creation of the authority would also provide an environment, which would attract foreign direct investment, apart from improving the quality of domestic technology products and services, and fostering innovation.

-

Comment by Riaz Haq on December 5, 2020 at 8:48am

-

#Pakistan #exports jump 7.67%to $2.161bn in Nov. Growth in home #textiles (20%), #pharma (20%), rice (14%), surgical goods (11%), stockings & socks (41%), jerseys & pullovers (21%), women’s #garments (11%)and men’s garments (4.3%)- DAWN.COM

https://www.dawn.com/news/1594128

Pakistan’s exports grew for the third consecutive month in November to $2.161 billion, up 7.67 per cent from $2.007bn in the corresponding month last year, data released by the Pakistan Bureau of Statistics showed on Friday.

The increase in exports is mainly driven by double-digit growth in proceeds from textile and non-textile commodities. Meanwhile, during the month under review, imports also increased 7pc leading to a slight increase in trade deficit.

Data showed a significant growth has been seen in the exports of home textiles (20pc), pharmaceutical products (20pc), rice (14pc), surgical goods (11pc), stockings & socks (41pc), jerseys & pullovers (21pc), women’s garments (11pc) and men’s garments (4.3pc), as compared to Nov 2019.

Between July to November, exports slightly increased by 2.11pc to $9.737bn, from $9.536bn over the corresponding months of last year.

ARTICLE CONTINUES AFTER AD

Exports in the new fiscal year started on a positive note but witnessed a steep decline of 19pc in August before rebounding in September, October, and November.

To promote exports of textile products, the Ministry of Commerce on Friday released Rs1.78bn for the textiles sector under Drawback of Local Taxes and Levies (DLTL) scheme. “I hope this will resolve the liquidity issues of our exporters and enable them to enhance exports”, said Adviser to PM on Commerce and Textile Razak Dawood.

He said the DLTL for non-textile sector are also being released shortly. Razak also disclosed that the export of animal casings from Pakistan to Japan has resumed after a ban of four years. “I commend the efforts made by our trade section in Tokyo. I advise our trade missions to actively engage with importers,” he said.

“I urge exporters to take benefit of this opportunity and move full speed ahead”, the adviser added.

In FY20, exports fell by 6.83pc or $1.57bn to $21.4bn, compared to $22.97bn the previous year. Data shows visible improvements in export orders from international buyers, mainly in the textile and clothing sectors since May.

On the other hand, imports also rose by 7.77pc in November to $4.229bn, as against $3.924bn over the corresponding month of last year. During 5MFY20, the overall import bill slightly increased by 1.29pc to $19.422bn, up from $19.175bn over the corresponding months of last year.

The continuous decline in imports has provided some breathing space to the government in managing external accounts despite a downward trend in exports. However, imports are now expected to increase further in the coming months following the abolishment of regulatory duty on imports of raw materials and semi-finished products.

In FY20, the import bill witnessed a steep decline of $10.29bn or 18.78pc to $44.509bn, compared to $54.799bn in the previous year.

The country’s trade deficit also went up by 7.88pc in November, mainly due to a growth in imports proceeds. In absolute terms, the trade gap stood at $2.068bn, as compared to $1.917bn over the corresponding month of last year.

In the first five months, the trade deficit edged up 0.48pc to $9.685bn, as against $9.639bn over the last year. During FY20, it narrowed to $23.099bn, from $31.820bn.

-

Comment by Riaz Haq on December 5, 2020 at 10:19am

-

After sluggish growth, Pakistan’s economy is poised to bounce back in 2021, reports Pakistan Strategy Report 2021 by the Arif Habib Limited (AHL) Research.

https://www.brecorder.com/news/40037736

As per the report, the surge in economic activity plus attractive valuations could bring 20 percent growth sending the Pakistan Stock Exchange (PSX) index to 52,000 by December next year.

“Led by strong earnings growth, economic growth, broadly stable external position, and cheap valuations, we expect the KSE-100 Index to generate a lucrative total return of 28pc (USD-based: 23pc) during CY21 taking index level to 52,000 by Dec’21,” the report said.

The report was of the view that it expects the economic activity in Pakistan to continue the robust pace it has shown over the last couple of months.

The GDP growth is expected at 1.8 percent during FY21. Whereas, The Current Account, while swinging into a deficit, is expected to be manageable (-0.9pc of GDP), attributable to consumption-driven, import-dependent GDP, the report stated.

The report expects no significant depreciation of the currency with PKR/USD 168 expected by Dec’21, owing to orderly market conditions, continued robust inflows from remittances and improved exports.

Housing finance, construction package and TERF (subsidized investment scheme for industries which expires on December 2020) are some of the government’s efforts to fuel investment activities in the country, it said.

The G20 debt relief and low-interest rates would allay the stress off debt servicing expenditure, the report pointed out.

Talking about the Sectoral Outlook; the report stated that in the cement sector, aggregate demand revival and government incentives for the construction industry should help propel dispatches growth. Whereas, in the auto sector, the stability in the PKR/USD parity, and strong volumes growth amid demand revival and low-interest rates should stimulate bottom-line of companies.

-

Comment by Riaz Haq on December 16, 2020 at 7:45am

-

The country’s big industries grew at a pace of 5.5% in the first four months of current fiscal year, which is in line with government’s expectations of economic recovery but the index still stands below pre-coronavirus outbreak levels.

https://tribune.com.pk/story/2276112/lsm-grows-55-raising-hopes-of-...

The Large-Scale Manufacturing (LSM) sector registered a cumulative growth of 5.5% in July-October of current fiscal year, reported the Pakistan Bureau of Statistics (PBS) on Tuesday.

October was the second successive month when the index grew over the previous month, raising hopes that the momentum could continue in the midst of the second wave of Covid-19 in Pakistan.

Out of 15 major industries, nine sectors again recorded a surge in production while output of six industries contracted in the first four months of current fiscal year compared to the same period of previous year, according to the PBS.

The government expects 2.5% contraction in the LSM sector in the current fiscal year, according to the Annual Plan 2020-21 released by the Ministry of Planning and Development on the eve of federal budget. But the Ministry of Finance’s estimates suggest that instead of contraction, the LSM sector may grow 1.4% in the fiscal year.

Because of better-than-expected output in the industrial and agriculture sectors, the Ministry of Finance now expects economic growth to remain in the range of 2.6% to 2.8% in the current fiscal year - better than the official target of 2.1%. The industrial sector, which was earlier projected to grow only 0.1% by the government, may now grow at a rate of 2.1%.

---

LSM recorded 6.7% year-on-year growth in October but the index was still below pre-coronavirus level of 160.2 points recorded in March this year.

On a yearly basis, the petroleum sector contracted 0.1% in October over the same month of previous year. Provincial bureaus also reported a nominal growth of less than 1% in 11 industries. On a month-on-month basis, the LSM sector showed 3.4% growth in October over September.

Prime Minister Imran Khan won the July 2018 elections on the promise of creating 10 million jobs and constructing five million homes at affordable prices but the promises have remain unfulfilled so far. With the current sluggish economic growth, there will be increase in poverty and unemployment in the remaining tenure of the government.

Pakistan needs 6-7% annual economic growth to reduce poverty and unemployment, according to independent economic experts.

Data collected by the Oil Companies Advisory Committee (OCAC) showed that 11 types of industries registered an average growth of just 0.1% in the first four months of current fiscal year.

The Ministry of Industries, which monitors 15 industries, reported 3.7% growth in the LSM output. Provincial bureaus reported a growth of 1.6% in 11 industries in four months, according to the PBS.

Sectors that posted growth during the July-October period included textile that grew 2.2% and non-metallic mineral products that soared 22.9%.

However, the output of power looms slumped 41.7% in four months, contrary to the media hype generated about utilisation of power looms at full capacity.

The fertiliser sector grew 6% whereas the food, beverages and tobacco group expanded 12.2% in the four-month period under review.

The manufacturing of chemical products increased 9.2%, paper and board 10.4% and rubber products 3.3%. The pharmaceutical sector registered a growth of 13.5% in the July-October period. Output of the coke and petroleum sector increased 1.6%.

Industries that registered a dip in manufacturing included the automobile sector, which saw a contraction of 1.6% but the pace of negative growth slowed down.

Iron and steel production fell 5.4%, electronics 23%, leather products 43%, engineering products 34% and wood products 64% during the July-October period.

-

Comment by Riaz Haq on December 18, 2020 at 8:48pm

-

Netsol Announces to Establish Its Own IT University

Posted 8 hours ago by ProPK Staff

https://propakistani.pk/2020/12/18/netsol-announces-to-establish-it...

This is encouraging news from the industry for software houses, professionals, and students alike. A university to be set up based on industry and academic coordination could serve the entire IT sector, which is always looking for graduates having skills in advanced fields of IT sector.

Presently, a majority of local universities except a few institutions do not produce graduates that meet the requirement of the local and foreign markets. Hence, a serious shortage of human resources always prevails in the sector.

According to industry estimates, as many as 25,000 graduates graduate from various universities per year in Pakistan. However, merely 5,000 graduates can meet the requirements of the industry regarding the needed skill sets and other practical qualifications.

Ministry of Information Technology and Telecommunication (MoITT) had previously planned to set up an authority on IT education last year under the then minister. However, there is no update on the continuity of the plan under the present minister.

Stakeholders of the IT industry said that professionals of various software houses could impart their knowledge at various institutions to bring reforms in IT education. However, they said that the universities are not willing to pay them competitive salaries.

Therefore, inexperienced teachers continue to teach various subjects of computer science to students through an outdated curriculum and obsolete methodologies.

Some big names in the IT industry usually set up their in-house training departments to meet the demand for human resources. However, this is not a long-term solution as far as the entire industry is concerned.

At present, the demand for the IT industry is exceeding 15,000 professionals every year, with over 5,000 highly-skilled professionals required in the latest technologies.

Companies have no choice but to pick up professionals from competing companies at higher offers of salary packages.

It is hoped that setting up an IT industry by a reputed IT company could make a difference in meeting the demand of the country’s IT companies in the future rather than money-making and degree-printing institutions.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 8 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network