PakAlumni Worldwide: The Global Social Network

The Global Social Network

State of Entrepreneurship in Pakistan

A recent report by the Center for Entrepreneurial Development (CED) of the Institute of Business Administration (IBA) finds that Pakistanis are less entrepreneurial than their counterparts in the majority of 59 member nations of Global Entrepreneurship Monitor (GEM), according to Express Tribune newspaper. The report says that the new business ownership rate, which is the percentage of owner-managers of a business that is three to 42 months old, is 2.7% in Pakistan, "considerably less" than the average rate for factor-driven economies (11.8%).

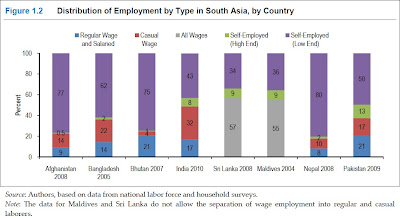

The results of this IBA CED study, as reported by the media, run counter to the findings of a recent World Bank report titled "More and Better Jobs in South Asia" which shows that 63% of Pakistan's workforce is self-employed, including 13% high-end self-employed. Salaried and daily wage earners make up only 37% of the workforce.

Even if one chooses to consider just the 13% who are high-end self-employed as entrepreneurs, it's still much higher than the 2.7% figure reported by CED, and higher than the 11.8% average reported for factor-driven economies covered by GEM.

It seems to me that this discrepancy stems from a very narrow and limited definition of entrepreneurship used in the IBA study which ignores the following realities:

1. The rapid urbanization from massive ongoing rural-to-urban migration in... is spawning a whole generation of small entrepreneurs who end up working for themselves as small vendors selling their wares on the streets and independent service providers who do basic chores like cooking and cleaning for dozens of clients. Each of these individuals is an entrepreneur by definition. Some of them have also found their way to other nations in Europe and the Middle East where they are earning a good living as street vendors. I saw a recent example of a Pakistani street vendor in Italy who earned enough to send his children to universities....a luxury he didn't have himself.

2. There are many small groups of men and women who are starting businesses at home in both urban and rural areas of the country to sell groceries, sew clothes, raise animals for milk, grow and sell fruits and vegetables, cater cooked food, etc. These small entrepreneurs are managing to put food on their families' tables and put children through good schools. Some of them are being funded and trained by microfinance institutions like Kashf Foundation and others.

People at academic institutions like the IBA who talk about entrepreneurship must research examples like Kraft Foods and Carl's Junior, both of which had humble beginnings on the streets of the United States.

James L. Kraft started Kraft foods by selling milk and cheese from a horse-drawn cart in Chicago in 1903; its first year of operations was "dismal", losing US$3,000 and a horse. Today, Kraft Foods is a multi-billion dollar multinational corporation selling a variety of food products around the globe, including Pakistan.

Carl's Jr, a multi-national fast food giant which operates Hardy's restaurants in Pakistan, began life as a hot dog stand in southern California 1941 with $311 in capital. One cart grew to four, and within five years, Carl's Drive-In Barbecue opened with hamburgers on the menu.

I believe that most Pakistanis are not risk-averse. What is lacking is a supportive environment to help nurture millions of small entrepreneurs to enable them to realize their dreams. The efforts of microfinance sector need to be supported by both the public and private sector through skills training, mentoring and greater funding. Each of us who can afford to help can do so by joining microfinance networks like Kiva.org to lend to such entrepreneurs in Pakistan.

Related Links:

Pakistani Entrepreneurs Survive Downturn

Pakistan Leads in Entrepreneurship Indicators

Microfinance to Fight Poverty in Pakistan

Pakistani Entrepreneurs Summit in Silicon Valley

Social Entrepreneurs Target India, Pakistan

Urbanization in Pakistan Highest in South Asia

Start-ups Drive a Boom in Pakistan

P.I.D.E. on Entrepreneurship in Pakistan

Light a Candle, Do Not Curse Darkness

-

Comment by Riaz Haq on January 4, 2012 at 8:17pm

-

Pakistan's Monis Rahman of Rozee.com makes the Forbes Top 10 list of Asian entrepreneurs under age 50. The list includes big names like Jack Ma of Alibaba.com

-

Comment by Riaz Haq on October 31, 2013 at 9:06am

-

Maha is the inventor of a ‘Piezoelectric Shoe’ (a customized engineered shoe that converts the daily mechanical energy of the walk into electrical energy) along with her team in NUST, Islamabad. The shoe charges low voltage mobile batteries up to 3-4 volts.

http://lesjeunesentrepreneursduglobe.tumblr.com/post/65601505554/me...

-

Comment by Riaz Haq on November 17, 2013 at 10:17am

-

Here's an APP report on US helping promote entrepreneurship in Pakistan:

ISLAMABAD, Nov 17 (APP): The United States is ready to cooperate with Pakistan for entrepreneurship development in the country to put it on the path of sustainable economic growth, said Advisor to US President on Entrepreneurship and Founding Managing Director of MIT Entrepreneurship Center Ken Morse on Sunday. “Entrepreneurship offers best option to Pakistan for engaging its youth in productive activities and to create more jobs,” he said while addressing the business community here.

He said Pakistan should celebrate entrepreneurship day to create awareness in society and motivate its youth for becoming entrepreneurs.

He was of the view that Pakistan should focus on encouraging its youth towards entrepreneurship to help them have respectable jobs and help promote economic growth.

Ken Morse is member of a delegation visiting Pakistan. The other delegation members include Jason Pontin Editor in Chief MIT Technology Review, Ms. Deirdre Coyle Co CEO of All World Network.

The delegation members along with Azhar Rizvi Chairman FPCCI Standing Committee on Innovation visited Islamabad Chamber of Commerce and Industry to discuss the importance of entrepreneurship development for Pakistan.

Morse said 65 per cent of small hotels and single person stores in the US were owned by South Asians, which showed that they had great potential for this profession.

Speaking on the occasion, ICCI President Shaban Khalid briefed the delegation about the ICCI activities for entrepreneurship and youth development.

He said ICCI had formed a Young Entrepreneurs Forum (YEF) to focus on encouraging youth towards entrepreneurship adding YEF organizes workshops, trainings and mentorship programs for youth development as well as promotes the networking of young entrepreneurs at local and international level.

The YEF recently organized an Indo-Pak Young Entrepreneurs Bilateral at Islamabad to promote linkages in youth of both countries, he said adding both the sides signed a joint statement which also declared to establish a Peace University to promote people-to-people relations between the two countries.

Jason Pontin, Editor in Chief of MIT Technology Review, said entrepreneurship had been identified as one of the most important vehicles for economic wellbeing of individuals and communities and added that MIT Enterprise Forum Pakistan (MITEFP) had been established to develop an entrepreneurial eco-system in the country.

He was of the view that fostering entrepreneurship in Pakistan would create greater employment, growth and competitiveness in the country and engage youth in economic activities.

He said,” We are planning to start MIT Technology Review in Pakistan and its publication will highlight Pakistani entrepreneurs’ success stories at international level giving them an international exposure.”

Ms Deirdre Coyle Co, Chief Executive Officer of All World Network, said Pakistan had great potential for entrepreneurship and “we are trying to put Pakistani companies on global stage by announcing the ranking of 100 fastest growing companies of Pakistan.”

This would help Pakistani companies to get international recognition and we want to show the world that Pakistan is very much open to business and help change perception about it, she added.

She hoped that joining the All World ranking, Pakistani companies would get global visibility, attract new customers, investors and talent all over the world and become part of a prestigious group of successful entrepreneurs.http://www.app.com.pk/en_/index.php?option=com_content&task=vie...

-

Comment by Riaz Haq on March 14, 2015 at 4:29pm

-

Small is beautiful - unless you are a business that wants to grow. In which case, small is not so appealing. In Pakistan, where 90 percent of businesses are small or medium, challenges to scaling-up businesses have kept the private sector from realizing their full potential and contributing as much as they could to the economy. To help address a major constraint to the growth of small and medium enterprises (SMEs) in Pakistan, the U.S. Agency for International Development (USAID) is partnering with local banks to boost lending to SMEs. The new $60 million "U.S.-Pakistan Partnership for Access to Credit" was launched at last week's U.S.-Pakistan Business Opportunities Conference, as part of a larger bilateral government effort to boost trade and investment in Pakistan.

Finance is an important enabler of economic growth anywhere in the world. For Pakistan, which needs annual economic growth of at least 7 percent just to keep up with the number of youth expected to enter the labor market each year, this financing is important not only for the economy but for stability. Yet the private sector credit to gross domestic product (GDP) and financial depth ratios in Pakistan trail behind leading emerging economies.

In the SME segment, the volume of lending and types of financing tailored to SME needs have been very limited. A World Bank study found that only 16 percent of total credit in Pakistan went to SMEs. Moreover, about 70 percent of SME borrowing was used for working capital while only about 12 percent went toward long-term investment. Another survey shows only 11 percent of micro, small, and medium enterprises (MSMEs) in Pakistan report having access to finance, below the 15 percent international average and well below percentages reported in higher performing middle-income countries like Brazil and Turkey (30 and 48 percent respectively).

Despite these limitations, SMEs make an out-sized contribution to Pakistan's economy. The same World Bank study found that SMEs in Pakistan employ nearly 70 percent of workers in the manufacturing, services, and trade sectors and generate an estimated 35 percent of manufacturing's value addition. They also contribute over 30 percent of GDP and more than 25 percent of export earnings. Thus, alleviating a key constraint to their growth could lead to substantial increases in the number of jobs for Pakistan's large number of youth and greater income generation.

The new Partnership reflects a shared commitment to promote broad-based economic growth in Pakistan. Private sector investment was identified as an essential ingredient for growth in the Government of Pakistan's Vision 2025 strategy. The Partnership is part of a larger umbrella of U.S. support to SMEs in Pakistan to help them grow and expand into new markets. It will provide partner banks- Bank Alfalah, JS Bank, Khushhali Bank and First Microfinance Bank- with a loan portfolio guarantee through USAID's Development Credit Authority (DCA). The guarantee will lower the risk to the banks for lending in sectors they would otherwise perceive as being too risky. It will also encourage partner banks to extend longer-term loans and introduce credit products that address the needs of SMEs.

With more access to finance, small and medium businesses are poised to make even larger contributions to the Pakistan economy than they do now. The new U.S.-Pakistan Partnership for Access to Credit will make it possible for dynamic SMEs to be more than small and beautiful. After all, beauty is in the eye of the beholder and for businesses eyeing scale-up, there are few things more attractive than being able to grow.

http://www.huffingtonpost.com/borany-penh/eyeing-business-growth-in...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network