PakAlumni Worldwide: The Global Social Network

The Global Social Network

Top Global Investor Sees "Brighter Future For Pakistan"

Joseph Mark Mobius of Templeton Emerging Markets Group sees "many reasons for a brighter future for Pakistan". Mobius, armed with B.A. and M.S. degrees in Communications from Boston University, and a Ph.D in economics from MIT, is a top global fund manager with a good track record of investing in emerging markets.

In a blog post titled "Building Corridors to the Future in Pakistan", an obvious reference to China-Pakistan Economic Corridor (CPEC), Mobius says he and his team "have been investing in Pakistan for a number of years, and see it as an overlooked investment destination with attractive valuations due to negative macro sentiment". It should be noted that Karachi Stock Exchange listed companies' average price-earnings multiple of just 10 is less than half of regional markets such as Mumbai with PE ratio of over 20.

In addition to new foreign investment in CPEC and low PE ratios, Mobius offers the following key reasons for his bullish outlook for Pakistan:

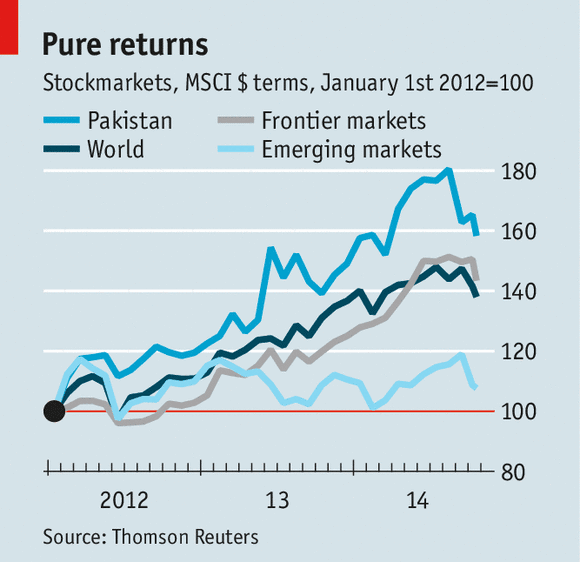

1. The Pakistani stock market has been one of the top-performing markets in the last five years (ended June 2015).

2. The MSCI Pakistan Index has more than doubled with a 129% return during that time frame, compared with a 45% return for the MSCI Frontier Index and 22% increase in the MSCI Emerging Markets Index in US dollar terms.

3. Even after KSE-100 strong performance, valuations of Pakistani stocks still remain relatively attractive. As of end-June 2015, the trailing price-to-earnings ratio of the MSCI Pakistan Index was 10 times, versus 11 times for the MSCI Frontier Index and 14 times for the MSCI Emerging Markets Index.

4. Pakistan government efforts on expenditure control and divestments have been positive, but the government will need to remain committed to the economic and structural reform program.

5. An internal anti-terrorism drive was made in the wake of the tragic Peshawar incident in December 2014, which targeted schoolchildren. Mobius thinks these efforts need to be maintained over the longer term to develop a better security climate for businesses and the society as a whole.

6. In the political environment, delays in the implementation of reforms or deterioration in the political or security situation could adversely impact the country’s macroeconomic development and fiscal position, hinder investment and weaken investor confidence.

Bottom line for Mobius: Despite a number of ongoing challenges, there are "many reasons for a brighter future for Pakistan".

Related Links:

China Deal to Set New FDI Records in Pakistan

Post Cold War Realignment in South Asia

Haier Pakistan to Expand Production From Home Appliances to Cellpho...

Pakistan Bolsters 2nd Strike Capability With AIP Subs

Pakistan Starts Manufacturing Tablets and Notebooks

-

Comment by Riaz Haq on September 25, 2015 at 4:54pm

-

The Asian Development Bank (ADB) has lowered its projection of GDP growth rate for Pakistan at 4.5 percent compared to officially envisaged target of 5.5 percent for the current fiscal year 2015-16.

However, the ADB projected slashing down inflationary pressures as it would come down to 5.1 percent for ongoing financial year. According to Asian Development Outlook (ADO) for 2015-16 released by the ADB on Tuesday, stating that inflation is now expected to be slightly higher in FY2016 than in FY2015 as oil prices recover. The ADB’s update sees lower inflation standing at 5.1 percent than forecast earlier of 5.8 percent, but inflationary pressures may come from food prices pushed higher by possible supply shortages following floods in July 2015. Monetary policy is expected to remain supportive.

About GDP growth rate, the ADB states that it is expected to edge up to 4.5% in FY2016, assuming continued low prices for oil and other commodities, the expected pickup in growth in the advanced economies, and some alleviation of power shortages.

Prospects for large-scale manufacturing remain subject to progress on power supply, the ADO stated. “Plans to build an economic corridor linking Kashgar in the People’s Republic of China to the Pakistani port of Gwadar were announced in April, and this mega project could significantly boost private investment and growth in the coming years,” the ADO further states.

Provisional GDP growth in FY2015 (ended 30 June 2015) matched the ADO 2015 forecast and stood at 4.2 percent. It was led by services as growth in manufacturing slowed. Industrial growth was hobbled by a slowdown in large-scale manufacturing to 3.3% owing to continued power shortages and weaker external demand. The resilience of small-scale manufacturing and construction sustained industrial growth at 3.6%. Agriculture growth remained modest at 2.9%. Private fixed investment slipped to equal 9.7% of GDP from 10.0% a year earlier because of continuing energy constraints and the generally weak business environment that has depressed investment for several years.

Headline inflation sharply declined in FY2015 and improved on the ADO 2015 projection. Inflation for both food and other items dropped significantly, reflecting adequate food supplies and the transmission into prices of lower global prices for oil and other commodities. The current account deficit narrowed in FY2015 from 1.3% in FY2014. The reasons were lower oil imports (which had been 35% of the total), larger inflows under the Coalition Support Fund, and robust workers’ remittances.

http://www.thenews.com.pk/Todays-News-2-342207-ADO-considers-plus-a...

-

Comment by Riaz Haq on October 1, 2015 at 4:12pm

-

#Pakistan’s forex reserves highest ever at US$20 billion: Ishaq Dar | BUSINESS - http://geo.tv https://shar.es/179q7s

Of the country’s total liquid reserves of $20.07 billion, $15.24 billion are held by the State Bank of Pakistan (SBP) while $4.83 billion are with the commercial banks.

He said receipts under various heads have materialized, pushing the level of foreign exchange reserves to over $20 billion. These receipts include proceeds from Euro Bond, tranche from International Monetary Fund (IMF), Coalition Support Fund (CSF).

Ishaq Dar said in February last year Pakistan’s foreign exchange reserves stood at $2.75 billion and at that time no one would have imagined that in a matter of such a small period of time these reserves would touch the present level.

-

Comment by Riaz Haq on October 9, 2015 at 5:52pm

-

#Pakistan's #KSE100 surges 1.12 pct in 4th bullish session | Business Standard News http://www.business-standard.com/article/news-ians/pakistan-s-kse-s... …

Pakistan's Karachi Stock Exchange (KSE) ended the week with fourth bullish session on the trot on Friday as investors bought fresh positions amid reports positive trade in international markets.

Japan's Nikkei surged by 1.64 percent or 297.50 points, Hong Kong's Hang Seng Index gained 0.46 percent or 103.89 points, whereas China's SSE Composite Index increased by 1.27 percent or 39.79 points on Friday.

Pakistan's benchmark KSE 100-Index skyrocketed by 1.12 percent or 374.03 points to 33,843.18 points on Friday when compared with 33,469.15 reported on Thursday.

During the four-day bullish run, the key Pakistani index has accumulated 1,058.24 points. During the week that ended October 9, the main index surged by 873.45 points as four out of five trading sessions ended in green zone.

The KSE All Share Index swelled by 1.15 percent or 268.16 points to 23,673.77 points, the KSE 30-Index augmented by 1.43 percent or 288.09 points to 20,383.82 points, whereas the KMI 30- Index ballooned by 1.47 percent or 833.91 points to 57,529.52 points.

During Friday's trading session, the key index moved in a range of 490.83 points as it hit an intraday high of 33,959.98 points as against an intraday low of 33,469.15 points.

Market volumes sized up by 38.89 percent or 69.696 million shares to 248.919 million shares on Friday when compared with trading of 179.222 million shares posted on Thursday.

During the week that ended on Friday, the top Pakistani bourse witnessed total volume of 875.514 million shares at average daily turnovers of 175.102 million shares.

Market capitalization improved by 1.14 percent or 81.422 billion rupees ($782.911 millions) to 7.233 trillion rupees ($69.555 billion) while trade value jumped by 41.19 percent or 4.050 billion rupees ($38.951 million) to 13.886 billion rupees ($133.522 million).

Among 399 active scrips on Friday, prices of 263 issues advanced, 110 declined, whereas values of 26 other companies stayed unchanged for the week.

Fauji Cement XD, Maple Leaf Cement, and TRG Pakistan Limited were the top traded companies with turnovers of 18.746 million shares, 16.895 million shares, and 15.677 million shares, respectively.

Island Textile was the top price gainer with increment of 43.60 rupees (41.92 cents) to 917.49 rupees ($8.82) while on the flip side Indus Dyeing led the major price shedders with decrement of 55.77 rupees (53.62 cents) to 1,059.73 rupees ($10.18).

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network