PakAlumni Worldwide: The Global Social Network

The Global Social Network

Unconventional Gas Production Marks New Milestone For Pakistan

First tight gas well producing 15 million cubic feet per day of natural gas is on line at Sajawal gas field in Kirthar block in Sindh province, according to a report in Express Tribune. This marks a major milestone in development of unconventional hydrocarbon energy sources in Pakistan. Sajawal gas field is located 110 km south east of Karachi, Pakistan. It puts Pakistan in an exclusive club of just a few nations producing unconventional natural gas.

The tight gas well in Kirthar belt is being operated jointly by Poland's Polskie Gornictwo Naftowe i Gazownictwo (PGNiG) and Pakistan Petroleum Limited (PPL).

The state-owned Sui Southern Gas Company (SSGC) is buying gas from the joint venture at $6 per million BTUs (half the price agreed for Iranian gas) for distribution through its network in southern Pakistan. SSGC is laying a 52-kilometre-long pipeline at an estimated cost of Rs 325 million, carrying gas from the Suleman Range to the Nooriabad industrial estate.

First tight gas production launch in Sajawal is a very significant milestone for Pakistan. It augurs well for the future of both tight and gas production in the country because there are similarities in how both are extracted. Pakistan is endowed with huge deposits of both---105 trillion cubic feet (TCF) of shale gas and at least 33 trillion cubic feet of tight gas. In addition, Pakistan is also blessed with 9.1 billion barrels of shale oil which is also extracted in a similar way.

Pakistan's current demand for natural gas is about 1.6 trillion cubic feet per year. Even if consumption triples to 5 trillion cubic feet per year, the current known reserves of over 150 trillion cubic feet of conventional and unconventional gas are sufficient for over 30 years.

Wells for both of these unconventional resources (tight and shale) must be "hydraulically fractured" (fracked) in order to produce commercial amounts of gas. Operator challenges and objectives to be accomplished during each phase of the Asset Life Cycle (Exploration, Appraisal, Development, Production, and Rejuvenation) of both shale gas and tight gas are similar, according to a paper on this subject. Drilling, well design, completion methods and hydraulic fracturing are somewhat similar; but formation evaluation, reservoir analysis, and some of the production techniques are quite different.

The current technology known as hydraulic fracturing or fracking was developed in the United States and it has spawned shale oil and gas revolution increasing supplies and reducing gas prices. The Chinese are now working on further cutting costs to make the equipment and technology more affordable.

Like the shale gas revolution in the United States, tight gas is transforming China's gas production - accounting for a third of total output in 2012 -- and will form the backbone of the country's push to expand so-called "unconventional" gas production nearly seven-fold by 2030, according to Reuters. The speed and size of the boom has exceeded forecasts and has been led by local firms developing low-cost technology and techniques, already being rolled out by Chinese companies in similar gas fields outside of China. Pakistan can benefit from the Chinese in its efforts to increase tight and shale gas and oil production.

Related Links:

Haq's Musings

Why Blackouts and Bailouts in Energy-Rich Pakistan?

US EIA Estimates 9.1 Billion Barrels of Shale Oil in Pakistan

Pakistan's Vast Shale Gas Reserves

Abundant, Cheap Coal Electricity

Twin Energy Shortages of Gas and Electricity in Pakistan

Pakistan Energy Security Via Shale Revolution

-

Comment by Riaz Haq on July 18, 2013 at 11:35pm

-

An Express Tribune story says ENI wants $14 an mmBTU for shale gas.

http://tribune.com.pk/story/577736/too-hot-to-handle-govt-rejects-s...

I think the ET correspondent has misunderstood the figure.

The COST (not price) calculation I have seen from ENI is $14 per boe (barrel of oil equivalent).

Each boe has 5.55 mmBTU energy. So $14 per boe works out to about $2.53 per mmBTU.

http://www.ppepca.com/pdfs/presentations/Scope_of_Tight_Gas_Reservo...

Of course, the price would be significantly higher than the cost production to incentivize investors.

ENI proposes putting the floor at $42 per boe which translates into $7.57 per mmBTU cost plus some additional profit margin.

It also suggests using oil price as reference and shows a graph that puts gas price at $10 per mmBTU when oil price is $100 a barrel.

-

Comment by Riaz Haq on July 19, 2013 at 10:12pm

-

Here's a brief tutorial from Shell on shale and tight gas:

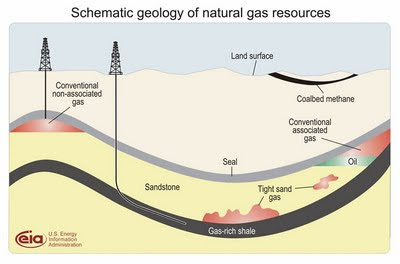

What is shale gas?Shale gas is a description for a field in which natural gas accumulation is locked in tiny bubble-like pockets within layered sedimentary rock such as shale. Think of it as similar to the way tiny air pockets are trapped in a loaf of bread as it bakes.

While geologists have known for decades that shale gas existed deep beneath many areas of the North American continent, traditional vertical oil and gas drilling methods were able to access only a small fraction of the gas within these formations. But recently, operational efficiencies and proven technology have come together to make shale gas both accessible and economically competitive.

To extract the gas from shale formations, Shell uses thoroughly tested technology in a responsible way.

What is tight gas?

While shale gas is trapped in rock, tight gas describes natural gas that is dispersed within low-porosity silt or sand areas that create a tight-fitting environment for the gas. How tight? Tight gas is defined (in the U.S.) as having less than 10 percent porosity and less than 0.1 millidarcy permeability.

Porosity is the proportion of void space to the total volume of rock. For example, fresh beach sand has around 50 percent porosity. Tight gas is held in pores up to 20,000 times narrower than a human hair.

Permeability is the ability of fluid to move through the pores. A person can blow air through a rock sample having about 1000 millidarcies permeability.

-------------

Horizontal drilling. This technology makes it possible for a well to be drilled vertically several thousand feet or meters, then curved to extend at an angle parallel to the earth’s surface, threading the well through the horizontal gas formation to capture more pockets of gas. From a central location Shell can drill multiple wells in different directions that penetrate the reservoir vertically or horizontally. This limits the number of drilling locations – known as well pads – on the surface.

S-shaped drilling. In some geological settings, it is more appropriate to directionally drill s-shaped wells from a single pad to minimize surface disturbance. S-shaped wells are drilled vertically several thousand feet or meters, then extend in arcs beneath the earth’s surface.

During drilling, mobile drilling units are moved between wells on a single pad. This avoids dismantling and reassembling drilling equipment for each well, making the process shorter and saving resources.

http://www.shell.us/aboutshell/shell-businesses/onshore/shale-tight...

-

Comment by Riaz Haq on July 26, 2013 at 6:23pm

-

Here's an ET report about a Canadian exploration company exiting Pakistan:

Canadian oil and gas exploration firm Niko Resources (Pakistan) Limited (NRPL) has decided to pack up and quit Pakistan apparently because of low wellhead gas prices that make it difficult to sustain operations.

NRPL, a subsidiary of Canada’s Niko Resources Limited, was exploring hydrocarbons in four offshore blocks in Indus namely Indus-X, Indus-Y, Indus-Z and Indus North. The company has collected 2,000 square kilometres of 3-D seismic data in these blocks.

“Now, Niko Resources has served a notice, announcing its decision to quit these four blocks and wind up the company in Pakistan,” an official said.

Niko is a Calgary-based independent international oil and gas company with operations in India, Bangladesh, Indonesia, Kurdistan, Trinidad, Madagascar and Pakistan.

It is one of the fastest growing companies in the industry with market capitalisation of over $5 billion in the Toronto Stock Exchange under the symbol NKO. The government of Pakistan had awarded the four blocks to Niko in March 2008 for offshore drilling.According to sources, low wellhead gas price for offshore fields was one of the key reasons which forced Niko Resources to stop operations in Pakistan.

“Drilling of an onshore well requires expenditure of $15 million whereas an offshore well needs spending of $80 to $100 million,” a source said, adding exploration companies working on offshore fields had been demanding more incentives to make drilling for oil and gas economically viable.

Sources revealed that Canadian High Commissioner to Pakistan met Federal Petroleum and Natural Resources Minister Shahid Khaqan Abbasi in the first week of July. During the deliberations, Abbasi asked the high commissioner to persuade Niko Resources to take back its decision of leaving Pakistan as the government “is now offering incentives for offshore drilling.”

In the new Petroleum Policy 2012, the price of gas discovered in the Offshore Shallow Zone will be $7 per million British thermal units (mmbtu), for Offshore Deep Zone the price will be $8 per mmbtu and for Offshore Ultra Deep Zone the price will be $9 per mmbtu.

A bonanza of $1 per mmbtu has also been announced for the first gas discovery in the offshore field.

Abbasi told the diplomat that Pakistan had huge reserves of natural resources and there were ample opportunities for investment in the oil, gas and mineral sectors. “We welcome Canadian investment and technical support in the oil and gas sector in Pakistan,” he said.

Pakistan has a vast onshore and offshore sedimentary area covering 827,268 square kilometres, of which around 30% is being explored.

Owing to existing opportunities, transparent and predictable policies and presence of major international exploration firms like ENI and BHP, there is vast potential of investment in Pakistan, Abbasi said.http://tribune.com.pk/story/582361/calling-it-a-day-canadian-oil-an...

-

Comment by Riaz Haq on July 27, 2013 at 9:16am

-

Here's a link to Pakistan Petroleum Exploration and Production Companies Ass... detailing facts and data on activities in Pakistan:

-

Comment by Riaz Haq on August 12, 2013 at 9:17am

-

Here's Wall Street Journal on India's shale gas production efforts:

India is hoping to unlock its shale gas reserves, which are spread across wide and difficult to reach terrain, by inviting investments from private companies.

The country is believed to have about 63 trillion cubic feet of recoverable shale gas reserves, more than 20 times the size of the country’s largest gas deposit Reliance Industries500325.BY -1.44%’ KG-D6 block in the Krishna-Godavari basin off the eastern coast.

That’s enough to run the country’s gas-fired power stations for at least 20 years at current consumption rates, according to industry analysts.

But experts say it may take years for the country to access and realize profits from the valuable natural resource because of a lack of infrastructure, opposition to raising gas prices and paucity of information about exactly where to find the gas.

Minister of Petroleum Veerappa Moily and his top aides have repeatedly promised that the government is on the verge of finalizing a policy on shale gas exploration.

But slow assessment of the size and accessibility of actual reserves and how to price the gas, have hindered progress towards developing a roadmap for shale gas extraction.

Shale gas is trapped deep below ground between rocky formations and is hard to extract. But recent technological advances have made it possible to extract. Oil companies inject chemically-treated water at high pressure into the ground that helps to release the gas from underground, a process known as hydraulic fracturing or fracking.

------

The extraction of domestic shale gas deposits will be critical to India’s aim of zero energy imports by 2030, according to another petroleum ministry official. The country currently imports 75% of its energy requirements.

But even if contracts are simplified and gas prices are freed from government control, there are other obstacles standing in the way of extraction.

India’s gas reserves belong to the government rather than private landowners as in the U.S. so private operators must obtain government contracts to begin exploration instead of dealing directly with a landlord.

India also needs to map out the reserves accurately. Preliminary findings show that they are spread out predominantly over eastern and western parts of the country mainly in the western state of Gujarat and eastern states including West Bengal. There are also some isolated deposits in central India.

Experts say the bulk of the reserves in eastern India lack the necessary network of pipelines to transport the gas–a task that many private operators are wary about undertaking.

“There are plans to have connecting pipelines and build a major highway gas pipeline,” said B.K Chaturvedi, member for energy in the government’s policy think tank, the Planning Commission.

But he added that it would take at least four to five years from any policy announcement to actual production of fuel from domestic shale gas reserves.

http://blogs.wsj.com/indiarealtime/2013/06/11/why-india-cant-unlock...

-

Comment by Riaz Haq on April 12, 2014 at 10:50am

-

Modi on petroleum exploration in Pakistan: Referring to the exploration scope in the region, he said Pakistan has started exploring the area across the border for gas and petroleum products.

"Look across the border in Pakistan, they have started massive work in gas and petroleum sector, why can't we?" he asked.

"It is the same region. There is immense scope for gas and petroleum here. I am sure we can definitely find it here as well. It can give new strength to our nation."

Addressing the youths, he said there will be opportunities in the exploration work in future and asked them to prepare themselves for it.

"We have started a petroleum university in Gujarat and this is for youngsters. I would urge the youth here to go on Internet and search about petroleum university. I invite you to make full use of it," he said.

http://news.outlookindia.com/items.aspx?artid=836884

-

Comment by Riaz Haq on April 12, 2014 at 11:11pm

-

Here's a Dawn report on tight gas in Naushero Feroz in Sind:

KARACHI: The Pakistan Petroleum Limited (PPL) announced discovery of gas from Exploration Well, Naushahro Firoz X-1 in Naushahro Firoz Block, Sindh.

In a filing with the stock exchange on Wednesday, under the disclosure of ‘insider information’ in terms of section 15D(1), the PPL reminded that it holds 90 per cent working interest in the well.

M Mubbasshar Siddique, company secretary for PPL, stated that the exploration well at Naushahro Firoz X-1 was drilled down to target depth of 3,773m(MD) within Chiltan Formation.

Based on gas shows encountered during drilling and wire line logs evaluation, a cased hole drill stem test (CHDST) was carried out.

The PPL informed that after acidization, the well flowed good quality gas at variable rates with the maximum of 11.2mmscfd with a flowing wellhead pressure of 2,635psi and a minimum of 1.7mmscfd with a flowing well head pressure of 375psi at a choke size of 32/64 inches.

PPL observes: “Preliminary analysis of the test data suggests the discovery to be the tight gas. However, further evaluation is required to determine the nature and commerciality of the discovery based on the geological, geophysical and engineering data collected during the drilling and testing of the well and also by drilling of additional well(s)”.

http://www.dawn.com/news/1095793/ppl-discovers-gas-in-naushahro-block

-

Comment by Riaz Haq on June 7, 2023 at 1:02pm

-

A review of Pakistani shales for shale gas exploration and comparison to North American shale plays

Author links open overlay panel Ghulam Mohyuddin Sohail a, Ahmed E. Radwan b, Mohamed Mahmoud c

https://www.sciencedirect.com/science/article/pii/S235248472200840X

Recent advancements in technologies to produce natural gas from shales at economic rates has revealed new horizons for hydrocarbon exploration and development worldwide. The importance of shale oil and gas has aroused worldwide interest after the great success of production in North America. In this study, different marine source rocks of Pakistan are evaluated for their shale gas potential using analogs selected from various North American shales for which data have been published. Pakistani formations reviewed are the Datta (shaly sandstone), Hangu (sandy shale), Patala (sandy shale), Ranikot (shaly sandstone), Sembar (sandy shale) and Lower Goru (shaly sandstone) formations, all of which are known source rocks in the Indus Basin. Available geological data of twenty-six wells (e.g., geological age, depositional environment, lithology and thickness), geochemical data (e.g., total organic carbon (TOC), vitrinite reflectance (Ro), rock pyrolysis analysis and maturity), petrophysical data (e.g., porosity and permeability) and dynamic elastic parameters estimated from logs (Young’s modulus and Poisson’s ratio) have been investigated. According to this study, the Pakistani shales are explicitly correlated with the most active shale gas plays of North America. The burial depths or geological position of the Pakistani shales are generally comparable to or slightly higher than the North American shales based on the available data. The thicknesses of the Pakistani (except for the Sembar shale) and North American shales fall in similar ranges. In terms of mineralogical composition, all of the Pakistani shales except the Ranikot and Hangu shales have quartz contents in the 40% to 50% range (approximately), which is similar to most of the North American shales. The high maximum TOC of the Hangu and Sembar shales (10%) is comparable to the New Albany, Antrim and Duvernay shales. The maximum TOC values for the Ranikot (3%), Lower Goru (1.5%) and Datta (2%) shales are lower than all North American shales. The TOC of Patal Shale (

5%–10%) is comparable to Fayetteville and Eagle Ford shales. The geological and geochemical parameters of all the Pakistani shales reviewed in this work are promising regarding their shale gas prospects. However, geomechanical data are required before conclusions on these shales’ economic production can be made with confidence.

-------------------

The exploitation of shale gas reservoirs may enhance gas production and reduce the severity of the ongoing energy crisis. The main challenge in Pakistan is to evaluate the shales using limited data and samples. That is why only a few companies are working on shale gas reservoirs in Pakistan now. The researchers need to assess and rank prospective Pakistani shales to entice companies to consider shale gas development. The geological characterization of Pakistani shales has been investigated by several authors (e.g., Warwick et al., 1995, Kazmi and Abbasi, 2008, Ahmad et al., 2012, Hakro and Baig, 2013, Jalees, 2014), but detailed work is required on geochemical, petrophysical and geomechanical characterization for assessing the actual potential of shales in Pakistan (Abbasi et al., 2014).

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network