PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Per Capita Milk Consumption Reaches 231 Liters

Per capita milk consumption in Pakistan reached 231 liters (231 Kg) in 2019, according to a new research report entitled ‘Asia – Whole Fresh Milk – Market Analysis, Forecast, Size, Trends and Insights’. It has almost doubled from 119 liters per person in 2011. Milk production in Pakistan is the second highest in Asia and the third highest in the world. Per capita milk consumption of 231 kg in Pakistan is the third highest in Asia, behind Uzbekistan's 339 Kg and Turkey's 281 Kg, according to the IndexBox report.

|

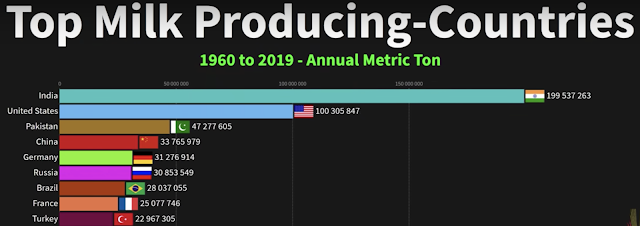

| Top Milk Producing Countries. Source: FAO |

Milk Production:

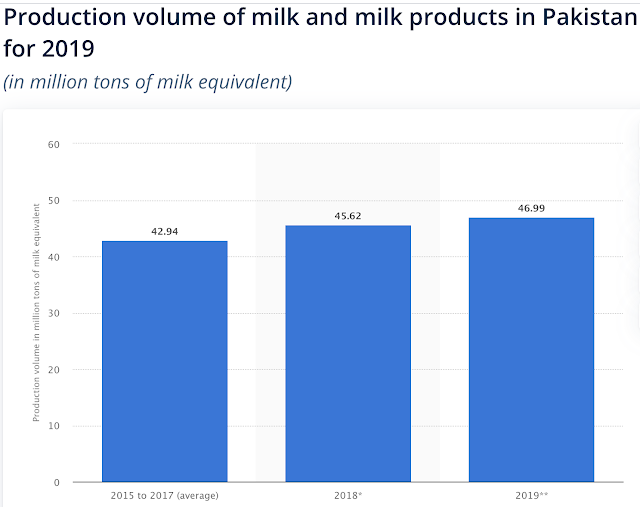

Pakistan produced 47 million tons of milk in 2019, the third largest in the world after top-ranked India's 198 million tons and the United States' 100 million tons. Pakistan’s milk production is projected to increase by an average of 3% a year due to an increase in the herd population. According to FAO projections, Asian production is expected to increase by 2% in 2020 due to expected growth in India, Pakistan, and China, while Turkey may experience a decline.

In value terms, India ($146.8B) led the market, alone. The second position in the ranking was occupied by Pakistan ($37.3B). It was followed by China.

|

| Milk Production Growth in Pakistan |

Milk Consumption:

Milk consumption in Pakistan in 2019 was 231 Kg per capita. It has grown an average of 3.2% a year in the last decade. From 2009 to 2019, the average annual rate of growth in terms of volume in India totaled +5.4%. The remaining consuming countries recorded the following average annual rates of consumption growth: Pakistan (+3.2% per year) and China (-1.2% per year).

Pakistan Dairy Sector:

Vast majority of milk producers in Pakistan are small farmers who own a few cows or buffaloes and sell unprocessed milk. However, commercial scale dairy farming is starting to grow in the country. Since the year 2000, corporate sector has seen the potential and jumped in with brand names like Dawood's Engro and Nestle's MilkPak. This has led to the enlargement of herds with imports of high-quality milk germ plasm, the productivity per animal, milk collection, processing and marketing, the supply of dairy inputs (machinery, equipment, feeds, semen, and elite dairy animals), and farmers knowledge, and skills on modern management practices.

The size of the opportunity for selling dairy products in Pakistan has attracted significant investments from European giants like Nestle, FrieslandCampina and Unilever. Commercial dairy farms like JK Dairy.

Pakistan Agriculture Output:

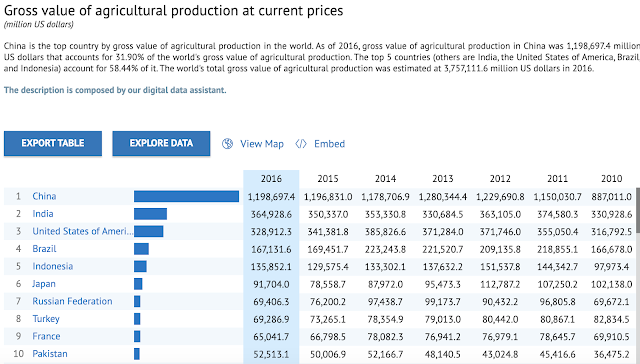

As of 2016, Pakistan's agriculture output is $52.5 billion, the 10th largest in the world in terms of gross value of agricultural production at current prices, according to Food and Agriculture Organization (FAO). China leads with $1.2 trillion in agricultural output, followed by India's $365 billion, United States with $329 billion, Brazil's $167 billion, Indonesia $135 billion, Japan's $91 billion, Russia's $69 billion, Turkey's $69 billion, France's $65 billion and Pakistan's $52 billion.

|

| Top 10 Countries by Agriculture Output. Source: FAO |

Summary:

Pakistan is among the world's largest dairy producing and consuming nations. Pakistan produced 47 million tons of milk in 2019, the third largest in the world after top-ranked India's 198 million tons and the United States' 100 million tons. Per capita milk consumption in Pakistan reached 231 Kg in 2019. Pakistan’s milk production is projected to increase by an average of 3% a year due to an increase in the herd population. Vast majority of milk producers in Pakistan are small farmers who own a few cows or buffaloes and sell unprocessed milk. However, commercial scale dairy farming is starting to grow in the country. Overall, Pakistan's agriculture output is the 10th largest in the world.

Related Links:

Haq's Musings

South Asia Investor Review

Chicken Cheaper Than Daal

Meat Industry in Pakistan

Bumper Crops and Soaring Tractor Sales in Pakistan

Meat and Dairy Revolution in Pakistan

Pakistanis Are Among the Most Carnivorous

Eid ul Azha: Multi-Billion Dollar Urban-to-Rural Transfer

Pakistan's Rural Economy

Pakistan Leads South Asia in Agriculture Value Addition

-

Comment by Akhtar Hussain on October 22, 2020 at 2:45pm

-

Amazing Stats !!

Thank you.

-

Comment by Riaz Haq on October 23, 2020 at 7:51pm

-

Pakistan produced in 2018:

67.1 million tons of sugarcane/ 5 million tons of sugar (5th largest producer in the world, behind Brazil, India, China and Thailand);

25.0 million tons of wheat (7th largest producer in the world);

10.8 million tons of rice (10th largest producer in the world);

6.3 million tons of maize (20th largest producer in the world);

4.8 million tons of cotton (5th largest producer in the world);

4.6 million tonnes of potato (18th largest producer in the world);

2.3 million tonnes of mango (including mangosteen and guava) (5th largest producer in the world, only behind India, China, Thailand and Indonesia);

2.1 million tons of onion (6th largest producer in the world);

1.6 million tons of orange (12th largest producer in the world);

593 thousand tons of tangerine;

550 thousand tons of tomatoes;

545 thousand tons of apple;

540 thousand tons of watermelon;

501 thousand tons of carrot;

471 thousand tons of date (6th largest producer in the world);

-

Comment by Riaz Haq on January 4, 2021 at 10:40am

-

Dysfunctional Horticulture Value Chains and

the Need for Modern Marketing Infrastructure:

The Case of Pakistan

https://www.adb.org/sites/default/files/publication/534716/dysfunct...

Total cereal production in the country increased to 38.34 million

MT in 2016 from 25.99 million MT in 2001, registering a growth of

47.52%. More than 70% of this growth was contributed by growth

in yield, while the rest was contributed by growth in cultivated land.

The country produced 6.64 MT vegetables and 5.89 MT of fruits in

2001, which increased to 9.77 MT and 6.8 MT, respectively, in 2015.

Yields of fruits and vegetables remain low. For example, yield

of potato (in tons per hectare) in Pakistan is significantly lower

compared to European countries like Belgium, the Netherlands,

Spain, and Turkey; and the United States (US) (Figure 2). Overall,

growth of yield played a small role in the growth of production of

fruits of vegetables during 1990–2016.3

Total production of potato, onion, and tomato was about 6.23 MT

in 2015, which accounted for about 64% of quantity and about 70%

of value of all vegetables produced in Pakistan. Punjab, Sindh, Khyber

Pakhtunkhwa, and Balochistan provinces accounted for 83%, 1%,

9%, and 7%, respectively, of total potato production. Shares of these

provinces in total tomato production were 9%, 10%, 45%, and 26%,

respectively. Sindh (40%) and Balochistan (28%) led in total onion

production, followed by Punjab (21%) and Khyber Pakhtunkhwa (11%).

Pakistan exports different types of fruits and vegetables. The value

of the country’s export of fruits and vegetables in 2016–2017 was

about $568 million. Per capita consumption of fruits and vegetables

in Pakistan is low compared to Europe and America, and roughly at

par with South Asian comparators like Afghanistan and Bangladesh.

In 2013, per capita consumption of fruits was only about 29

kilograms (kg) in Pakistan compared to 95 kg in Europe and 105 kg in

the US. Per capita consumption of vegetables was 26 kg in Pakistan

compared to 115 kg in the European Union and 114 kg in the US in

the same year.4

Current Horticulture Value Chain

Several players are involved in different segments of the horticulture

value chain in Pakistan.

Collection and Shipment

Majority of the farmers sell their produce at wholesale markets. Most

farmers contract out fruit orchards during the flowering stage to the

middlemen, commission agent, and/or wholesalers who provide

loans to the farmers over the course of production. Vegetables and

fruits are transported by the same cart or truck from farms to the main

markets in the absence of specialized vehicles for specific products.

The same vehicle is used for many other purposes including animal

transportation. Recently however, reefer trucks have been introduced

on a limited scale in some parts of Pakistan. In the absence of direct

access of carrier vehicles to the farms, farmers gather their products

in a convenient spot along the roadside for pickup. When middlemen

or contractors are involved, it is their responsibility to collect and

transport the produce. The unsold or unauctioned produce in one

market is sent to other markets in the same locality.

Fruits and vegetables are packaged using local materials before

shipment. In most cases such packaging fails to preserve the

freshness and quality of the products. Another problem is absence of

cooling and packaging centers, and inadequate cold storage facilities

to preserve the produce at or near the wholesale markets. More than

555 cold storage units have been identified in Pakistan with about

0.9 million MT storage capacity, against more than 15 million MT of

production of fruits and vegetables. There are no available cooling

and packaging houses, and cold storage facilities close to the farms

that can be used by the producers.

-

Comment by Riaz Haq on January 4, 2021 at 10:41am

-

Dysfunctional Horticulture Value Chains and

the Need for Modern Marketing Infrastructure:

The Case of Pakistan

https://www.adb.org/sites/default/files/publication/534716/dysfunct...

Negative Impacts of the Current Value Chain The negative impacts of the current value chain can be assessed in terms of the low share of farmers in consumer prices . Usually producers get 15% to 20% of the retail price. Production of perishables like potato, onion and tomato suffers from a major setback every 3–4 years. Usually two or three good harvests are followed by a bad harvest. Besides, natural factors like unfavorable weather also negatively affect production. Producers do not get price dividends when production is low, shooting the retail price. Benefits of high retail prices are disproportionately expropriated by the middlemen. When there is a market glut where perishables and their prices fall, producers suffer as their share in retail prices also falls significantly. Sometimes producers throw away their perishable produce to protest their low prices. It emerged from discussions with the traders in Badami Bagh Ravi Link wholesale market that producers’ share in retail prices is inversely related with the perishability of the crop. Both seasonal and spatial price fluctuations of fruits and vegetables are high in Pakistan. For instance, in 2017, the price of 100 kg of tomato in Lahore fluctuated between 1,450 Pakistan rupees (PRs) to PRs13,150, or more than 800%. In the same year, price fluctuation for fresh potato was between PRs1,550 to PRs4,300 for 100 kg, or 177%. The annual cost of price fluctuations of fruits and vegetables is estimated to be about $825 million. Postharvest losses in fruits and vegetables due to mishandling of the perishable product, poor transportation, and inadequate storage facilities and market infrastructure account for about 30%–40% of total production. The annual value of postharvest losses of potato, tomato, peas, cauliflowers, carrots, turnip, radish, brinjal, squash, okra, onion, grapes, and mango in Balochistan, Khyber Pakhtunkhwa, Punjab, and Sindh, valued at the respective 2016 provincial wholesale prices, is about $700 million to $934 million. An alternative estimate suggests that a reduction of around 75% of the current postharvest loss, when valued at export premium prices, would be equivalent to an annual saving of approximately $1.13 billion.

Due to low economies of scale, lack of synergies and collaboration among traders, high loading and unloading time, and hightransportation cost, overall marketing cost is very high. A reduction of marketing cost by $0.025 per kilogram would save about $55 million annually in the Ravi Link wholesale market in Lahore. It is difficult to comply with food safety, sanitary, and phytosanitary standards with the current value chain. The income and corporate tax revenues foregone due to the current value chain and marketing structure are also potentially high. Current Situation of the Main Wholesale Markets in Lahore The situation of four wholesale markets located in Lahore were analyzed, namely, (i) Badami Bagh Ravi Link, (ii) Akbari Mandi, (iii) a fish market at Urdu bazaar, and (iv) a flower market in Sughian Pul Shekhopura Road. The key findings are as follows. Physical Limitations The main problem is inadequate space for activities, forcing the commission agents and wholesalers to operate in open spaces with consequent spoilage. The average size of stalls is about 16 square meters only, which makes sorting, grading, and display of products difficult. Most of the corridors and offices in the premises have little active ventilation as required by international standards.

-

Comment by Riaz Haq on March 7, 2021 at 9:56am

-

Speaking at a Karachi Chamber of Commerce and Industry webinar in December, Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Husain stressed the importance of looking beyond the textile sector and diversifying Pakistan’s exports. Otherwise, he warned, we will remain “stuck” at 25 to 30 billion dollars in exports per year.

https://www.dawn.com/news/1611075

“If we can capture just one percent of the Chinese market by providing components, raw materials [and] intermediate goods to the Chinese supply chain,” he had said, “we can get 23 billion dollars in exports to China, which is very favourably inclined towards Pakistan...”

From the looks of it, others were on the same page as Husain. Last month, it was reported by China Economic Net (CEN) that China will import dairy products from Pakistan. The Commercial Counsellor at the Pakistan Embassy in Beijing, Badar uz Zaman, told CEN that Pakistan got this opportunity due to its high quality dairy products, available at a low price.

Pakistan is the fourth largest milk producer globally, Zaman pointed out.

Indeed, the country’s dairy industry has great potential and can prove to be ‘white gold’ for Pakistan. Unfortunately, the sector is currently struggling due to various reasons but, if its export potential is realised, it can transform not only the sector itself but Pakistan’s economy as well.

According to the Food and Agriculture Organisation at the United Nations, in the last three decades, global milk production has increased by more than 59 percent, from 530 million tonnes in 1998 to 843 million tonnes in 2018.

This rise in global milk consumption is an opportunity for countries such as Pakistan to earn foreign exchange by exporting milk and dairy products to countries which have insufficient milk production. According to a Pakistan Dairy Association estimate, with support from the government, Pakistan can earn up to 30 billion dollars from exports of only dairy products and milk.

-

Comment by Riaz Haq on May 27, 2021 at 9:00pm

-

Despite bumper wheat crop Pakistan still not food secure

Amjad Mahmood Published May 27, 2021

https://www.dawn.com/news/1625954

THIS season the country has reaped an all-time high wheat output of 28.75 million tonnes, two million tonnes more than the target of 26.78 million tonnes. The government claims the milestone has been achieved through a 3.25 per cent increase in the area under wheat, a favourable weather throughout the season that helped grow a healthy grain and repel yellow rust attack, and employing of more intensive labour as well as improved farm input use by the growers in the wake of a better price they had secured for their crop last year.

If one goes by the official data, though some experts suspect the official figure saying it lacked any substantial reason in support of the yield boost, the country is far from achieving its food security even with this record output of grain, the main staple food of the population.

The Federal Committee on Agriculture (FCA) has estimated that the country will need 29.50 million tonnes, including one million tonnes of strategic reserves, of wheat to feed its people until the next harvest. The Pakistan Agriculture Research Council (PARC) estimates per capita consumption of wheat at 125 kg per annum as grains make up on an average 60pc of daily diet of an ordinary citizen. The recently released results of the 2017 census put the national population figure at over 220.5 million. This means the country has enough wheat to meet its food security and with import of around 500,000 tonnes of grain it will be able to maintain its strategic reserves as there are about 324,000 tonnes of carryover stocks.

But this simple calculation excludes three factors: the need for more than one million tonnes of seed for the next plantation, staple food requirements of close to 1.4 million registered Afghan refugees in the country, and smuggling of approximately 300,000 tonnes of wheat to Afghanistan each year. To meet these needs, the government will have to import over 1.5 million tonnes more wheat taking the total import to over two million tonnes to make the country food secure for the year [the federal food ministry has announced plans to import four million tonnes of grain]. This will give a headache to the foreign exchange-starved government already worried at the rising food import bill.

The National Price Monitoring Committee (NPMC) that recently met under the chair of Finance Minister Shaukat Tarin tasked National Food Security & Research Minister Syed Fakhar Imam and Industries Minister Khusro Bakhtyar to look for options to bring down the volume of food imports.

The government’s worries are not implausible. For nature may not be supporting all the time. As one sees that during the last decade there had thrice been a substantial decline in the expected wheat output: -6.9pc in 2012, -3.44pc in 2015, and -3.19pc in 2019. Also the increase in wheat acreage has come at the cost of the area under sugarcane and cotton crops. And the cut in the acreage of the two cash crops means costlier import of the sweetener and white lint to meet domestic needs. A Catch-22 position for the government.

The only solution to the situation lies in improving crops per acre yields. Dr Javed Ahmad, Director of the Ayub Agricultural Research Institute, Faisalabad, says the seed varieties developed by AARI have genetic potential of nine tonnes per hectare yield but certain factors are reducing the yield to one-third of the potential. Non-availability of certified seed and lower than needed fertiliser intake are the two major reasons he puts forth behind the poor wheat production as compared to neighbouring India and China which are harvesting four and six tonnes per hectare, respectively.

-

Comment by Riaz Haq on June 25, 2021 at 5:24pm

-

Speaking at a Karachi Chamber of Commerce and Industry webinar in December, Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Husain stressed the importance of looking beyond the textile sector and diversifying Pakistan’s exports. Otherwise, he warned, we will remain “stuck” at 25 to 30 billion dollars in exports per year.

https://www.dawn.com/news/1611075

“If we can capture just one percent of the Chinese market by providing components, raw materials [and] intermediate goods to the Chinese supply chain,” he had said, “we can get 23 billion dollars in exports to China, which is very favourably inclined towards Pakistan...”

From the looks of it, others were on the same page as Husain. Last month, it was reported by China Economic Net (CEN) that China will import dairy products from Pakistan. The Commercial Counsellor at the Pakistan Embassy in Beijing, Badar uz Zaman, told CEN that Pakistan got this opportunity due to its high quality dairy products, available at a low price.

Pakistan is the fourth largest milk producer globally, Zaman pointed out.

Indeed, the country’s dairy industry has great potential and can prove to be ‘white gold’ for Pakistan. Unfortunately, the sector is currently struggling due to various reasons but, if its export potential is realised, it can transform not only the sector itself but Pakistan’s economy as well.

According to the Food and Agriculture Organisation at the United Nations, in the last three decades, global milk production has increased by more than 59 percent, from 530 million tonnes in 1998 to 843 million tonnes in 2018.

This rise in global milk consumption is an opportunity for countries such as Pakistan to earn foreign exchange by exporting milk and dairy products to countries which have insufficient milk production. According to a Pakistan Dairy Association estimate, with support from the government, Pakistan can earn up to 30 billion dollars from exports of only dairy products and milk.

Unfortunately, this potential is being wasted. As per statistics provided by the Pakistan Dairy Association, livestock and dairy currently make up approximately only 3.1 percent of Pakistan’s total exports; which would mean about a mere 0.68 billion dollars in FY2020.

-

Comment by Riaz Haq on January 28, 2022 at 10:39am

-

Improving milk production and its marketing in rural Sindh, Pakistan

https://www.marketscreener.com/news/latest/Improving-milk-productio...

SAGP (World Bank funded Sindh Agricultural Growth Project) established 484 livestock management training departments for its beneficiaries, which included both farmers and members of government institutions in charge of trainings, and the project rehabilitated 121 veterinary units.

To date, approximately 5753 farmers have benefited from livestock management trainings. The 203 Livestock Department staff equipped to deliver trainings will continue to provide extension services during field visits for vaccination and treatments to villages. Moreover, over 100 farmers and the staff of the Livestock Department were trained to implement artificial insemination to contribute to the breed improvement program, and utrasound training was offered to 76 beneficiaries. 18 beneficiaries beneficiaries have had the opportunity to visit state-of-the-art livestock training centers overseas: to Zimbabwe to observe Holistic Land and Livestock Management design and implementation; to Turkey to learn Dairy Farming practices, Dairy Machinery preparation factories; camel farming in the UAE; and Kenya's established dairy value chain.

SAGP has helped in rescuing the unique traits of the two main breeds of the cows found in Tharparkar district. One is 'Thari' and the other is 'Concrej.' Regarding this matter, Dr. Ashok Kumar said, "Tharkparkar cattle is losing its original traits by crossing with other breeds. Now we have promoted it through Artificial Insemination."

An Artificial Insemination Training Center at Tandojam is making a difference in restoring the original traits of Sindh's native breeds. Dr. Abdullah Sethar, deputy director, said, "This Artificial Insemination Center was developed in August 2019. We started offering Artificial Insemination training here. We have already trained 762 families, veterinarians, paramedics, and breeders in this center."

Trainings have also helped improved milk production. Previously, cows produced around 4.1 liters of milk and buffaloes produced 5.2 liters. By following the best practices learnt during various trainings, farmers increased the production of milk to 5.1 and 6.9 liters, respectively.

Beneficiary Abdul Aleem Soomro commented on how adopting new techniques resulted in a high milk yield. He said, "Our local cows had low milk yield. A practical demonstration was given to us and we changed our ways of breeding livestock. This has already started creating noticeable results."

Creating more jobs

The project not only strengthened milk production and its supply chain in the Rural Sindh, but also benefitted people in other ways, by creating jobs in other sectors.

5753 MPG members were able to upgrade their skills through three trainings. Additionally, 40 milk sell points were established by MPG members, with each outlet staffed by three farmers from the center's local village. Each milk outlet has provided employment opportunities to the local village, as 149 milk technicians are employed to collect and dispatch milk across these MPG collection centers.

-

Comment by Riaz Haq on February 7, 2022 at 7:44am

-

FrieslandCampina Engro #Pakistan launches Pakistan–#Netherlands Dairy Development Centre at University of Veterinary and Animal Science in #Lahore. Pakistan's #dairy sector is the 4th largest in the world. #DairyMilk #livestock https://www.dairyreporter.com/Article/2022/02/07/frieslandcampina-e...

-

Comment by Riaz Haq on May 21, 2022 at 7:02pm

-

Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21

By Riaz Riazuddin former deputy governor of the State Bank of Pakistan.

https://www.dawn.com/news/1659441/consumption-habits-inflation

As households move to upper-income brackets, the share of spending on food consumption falls. This is known as Engel’s law. Empirical proof of this relationship is visible in the falling share of food from about 48pc in 2001-02 for the average household. This is an obvious indication that the real incomes of households have risen steadily since then, and inflation has not eaten up the entire rise in nominal incomes. Inflation seldom outpaces the rise in nominal incomes.

Coming back to eating habits, our main food spending is on milk. Of the total spending on food, about 25pc was spent on milk (fresh, packed and dry) in 2018-19, up from nearly 17pc in 2001-01. This is a good sign as milk is the most nourishing of all food items. This behaviour (largest spending on milk) holds worldwide. The direct consumption of milk by our households was about seven kilograms per month, or 84kg per year. Total milk consumption per capita is much higher because we also eat ice cream, halwa, jalebi, gulab jamun and whatnot bought from the market. The milk used in them is consumed indirectly. Our total per person per year consumption of milk was 168kg in 2018-19. This has risen from about 150kg in 2000-01. It was 107kg in 1949-50 showing considerable improvement since then.

Since milk is the single largest contributor in expenditure, its contribution to inflation should be very high. Thanks to milk price behaviour, it is seldom in the news as opposed to sugar and wheat, whose price trend, besides hurting the poor is also exploited for gaining political mileage. According to PBS, milk prices have risen from Rs82.50 per litre in October 2018 to Rs104.32 in October 2021. This is a three-year rise of 26.4pc, or per annum rise of 8.1pc. Another blessing related to milk is that the year-to-year variation in its prices is much lower than that of other food items. The three-year rise in CPI is about 30pc, or an average of 9.7pc per year till last month. Clearly, milk prices have contributed to containing inflation to a single digit during this period.

Next to milk is wheat and atta which constitute about 11.2pc of the monthly food expenditure — less than half of milk. Wheat and atta are our staple food and their direct consumption by the average household is 7kg per capita (84kg per capita per year). As we also eat naan from the tandoors, bread from bakeries etc, our indirect consumption of wheat and atta is 41kg per capita. Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Does this indicate better health? To answer this, let us look at how we devour ghee and sugar. Also remember that each person requires a minimum of 2,100 calories and 60g of protein per day.

Undoubtedly, ghee, cooking oil and sugar have a special place in our culture. We are familiar with Urdu idioms mentioning ghee and shakkar. Two relate to our eating habits. We greet good news by saying ‘Aap kay munh may ghee shakkar’, which literally means that may your mouth be filled with ghee and sugar. We envy the fortune of others by saying ‘Panchon oonglian ghee mei’ (all five fingers immersed in ghee, or having the best of both worlds). These sayings reflect not only our eating trends, but also the inflation burden of the rising prices of these three items — ghee, cooking oil and sugar. Recall any wedding dinner. Ghee is floating in our plates.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network