PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Actual GDP Estimated at $401 Billion in 2012

Even with the run-up (in KSE-100), Andrew Brudenell, manager of the HSBC Frontier

Markets fund (HSFAX) in London, says Pakistan is one of the cheapest

markets he follows, at about seven times earnings. He notes that

earnings growth has kept pace with the market. The firms, he adds, are

typically cash-rich, boast strong return on equity levels in the 20%

range, and pay good dividends. In Pakistan, the informal, cash-based economy for goods and services is larger than the formal economy. Barron's, November 17, 2012

Growing gap between dismal official economic statistics and consumption boom coupled with strong corporate profits in Pakistan is a challenge for many analysts around the world. Most believe that Pakistan's GDP is, in fact, much larger and growing faster than the government data indicates.

Informal Economy Estimates:

M. Ali Kemal and Ahmed Waqar Qasim, economists at Pakistan Institute of Development Economics (PIDE), have published their research on estimates of the size of Pakistan's informal or underground economy.

Kemal and Qasim explore several published different approaches for sizing Pakistan's underground economy and settle on a combination of PSLM (Pakistan Social and Living Standards Measurement) consumption data and mis-invoicing of exports and imports to conclude that the country's "informal economy was 91% of the formal economy in 2007-08". Here are the figures offered by the authors for 2007-8:

1) Formal Economy: Rs. 10,242 billion= $170 billion (using Rs.60 to a US dollar)

2) Informal Economy: Rs. 9,365 billion = $156 billion

3) Total Economy (Sum of 1 & 2): Rs. 19,608 billion = $326 billion

Assuming that the ratio of formal and informal economy remained the same in 2011-12, here are the figures for Pakistan's total economy as of the end of last fiscal year which ended in June, 2012 :

1) Formal Economy: $210 billion

2) Informal Economy: $191 billion

3) Total Economy: $401 billion

|

| Hypermart Lahore |

Naween Mangi of Businessweek in her piece titled "The Secret Strength of Pakistan's Economy" described how Pakistan's informal cash-based economy evades government's radar, illustrating it with the story

of a tire repair shop owner Muhammad Nasir. Nasir steals water and

electricity from utility companies, receives cash from his customers in

return for his services and issues no receipts, pays cash for his cable

TV connection, and pays off corrupt police and utility officials and

local politicians instead of paying utility bills and taxes.

Karachi Stock Market:

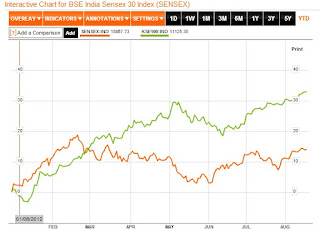

|

| Comparing Karachi and Mumbai Share Indexes |

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have helped the KSE-100 index exceed 16,000 level, a gain of 42.1% (33.2% in US dollar terms) year to date. In spite of this run-up in KSE-100, Andrew Brudenell, manager of the HSBC Frontier

Markets fund (HSFAX) in London, remains bullish on Pakistani equities, according to Barron's. Pakistan is one of the cheapest

markets he follows, at about seven times earnings. He notes that

earnings growth has kept pace with the market. The firms, he adds, are

typically cash-rich, boast strong return on equity levels in the 20%

range, and pay good dividends.

Conclusion:

While Pakistan's public finances remain shaky, it appears that the country's economy is in fact healthier than what the official figures show. It also seems that the national debt is much less of a problem given the debt-to-GDP ratio of just 30% when informal economy is fully comprehended. Even a small but serious effort to collect more taxes can make a big dent in budget deficits. My hope is that increasing share of the informal economy will become documented with the rising use

of technology. Bringing a small slice of it in the tax net will make a

significant positive difference for public finances in the coming years.

Related Links:

Haq's Musings

Investment Analysts Bullish on Pakistan

Precise Estimates of Pakistan's Informal Economy

Pak Consumer Boom Fuels Underground Economy

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Pakistan's Circular Debt and Load-shedding

Hypermart Pakistan

-

Comment by Riaz Haq on November 20, 2012 at 10:26am

-

Here's a PakistanToday story on $258 million current account surplus for July-Oct 2012 period: KARACHI - Pakistan’s dollar-hungry current account balance continued to remain in the green zone during July-October FY13 by registering a surplus of $ 258 million. This surplus amounted to $ 432 million during first quarter of FY13, July-Sep, owing to what the official and unofficial quarters agree, receipts of war reimbursements from the United States in early August this year. On August 1, 2012, the Islamabad’s non-Nato allies in Washington had released to the cash-strapped Pakistan some $1.118 billion under the long-denied Coalition Support Fund (CSF) after a months-long strain in bilateral ties relaxed through an on-and-off process of negotiations between the two countries on civilian, military and intelligence level. The inflows, the SBP chief spokesman Syed Wasimuddin had confirmed, had put the country’s current account balance into a surplus since July. The central bank Monday reported that during the corresponding period of last year, July-Oct FY12, the country’s current account balance had marked a deficit of $ 1.655 billion. In percentage terms, the surplus constitutes 0.3 percent of the country’s gross domestic product (GDP) accounting for $ 82.232 billion. This is against a deficit of 2.1 percent last year. Senior analysts like Khurram Schehzad had also seconded the central bank’s view saying the positive was attributable mainly to the dollar inflows on account of CSF and Kerry Lugar from the US. The receipts under KLA have been meager with Washington reported to have transferred only Rs 20.356 billion during FY12 against a projected receipt of Rs 34.164 billion. Under the KLA, Pakistan has the US’s word for receiving a civilian aid of $ 7.5 billion till 2014, $ 1.5 billion per annum. However, the funds transfer under CSF augured well for the funds-starved Pakistan which, in FY12, had braved a current account deficit of over $ 4 billion, pushing the economic managers closer once again to a fresh IMF bailout package. During the period under review, the country’s trade balance remained subdued and registered a deficit of $ 5 billion against last year’s $ 5.398 billion. A break up of trade deficit shows that during the review months the country exported goods worth $ 8.210 billion compared to $ 8.105 billion in July-Oct of FY12. Compared with last year’s $13.503 billion, the imports totaled at $ 13.210 billion. Overseas Pakistanis also performed well by remitting $ 4.964 billion during the review period as against $ 4.315 billion last year. The State Bank says that the country on average receives over a billion dollars every month from Pakistanis working abroad. The disbursements from the foreign financers, another noteworthy indicator on the current account balance list, stayed however in the red zone by remaining confined to long-term project loans standing at $ 382 million. Last year, disbursements under the same head were recorded at $ 519 million. However, despite these positives the analysts believe that the economic managers have still a lot to worry about owing to the current poor dollar inflows into the country specially the foreign investment. http://www.pakistantoday.com.pk/2012/11/20/news/profit/green-light-...

-

Comment by Riaz Haq on November 20, 2012 at 2:12pm

-

Here's Bloomberg on outsize returns of KSE-100:

The KSE 100 Index, the benchmark for Pakistan’s $43 billion equity market, rose 7.3 percent in the past three years when adjusted for price swings, the top gain among 72 markets worldwide, according to the BLOOMBERG RISKLESS RETURN RANKING. Pakistan had lower stock volatility than 82 percent of the nations including the U.S. (SPX) Over five years, Pakistan’s risk- adjusted returns ranked eighth.

The country’s 190 million people are boosting purchases three times faster than Asian peers as higher rural incomes and record remittances outweigh fighting on the Afghan border, violence in Karachi that led to at least 2,100 deaths this year and power outages that sparked rioting. The region’s fastest earnings growth may increase economic stability, according to Karachi-based Atlas Asset Management Ltd. Foreign investors added to holdings for five straight months, lured by Asia’s lowest valuations and biggest dividend yields.

“Stocks are very cheap and there are some very good businesses in Pakistan,” said Andrew Brudenell, whose HSBC Frontier Markets Fund has returned 18 percent this year, beating 92 percent of peers tracked by Bloomberg, and holds more shares in the country than are represented in benchmark indexes. “We still think there’s some positive growth to come from the markets.”

Earnings in the KSE 100 index advanced 45 percent during the past year, the largest gain among 17 Asian equity indexes, and this month hit the highest level since Bloomberg began tracking the data in 2005.

Consumer spending in Pakistan has increased at a 26 percent average pace the past three years, compared with 7.7 percent for Asia, according to data compiled by Euromonitor International, a consumer research firm. While the growth in Pakistan may slow to 6.6 percent in 2012, it will still exceed the 5.3 percent pace in Asia, according to Euromonitor estimates.

Engro Foods Ltd. (EFOODS), a Karachi-based seller of dairy products, reported a 214 percent jump in net income for the third quarter, while Unilever Pakistan Ltd. (ULEVER), a unit of the world’s second- biggest consumer-goods company, had a 36 percent gain, according to data compiled by Bloomberg.

Dividends in Pakistan have also climbed at the fastest pace in the region. Payouts increased 49 percent in the past 12 months, giving the KSE 100 index a dividend yield of 6.6 percent, double the 3.3 percent average in Asia, Bloomberg data show.

-----------

Foreign investors have purchased a net $153 million of Pakistan shares since the beginning of July, according to data from the Karachi Stock Exchange. Overseas holdings amount to about 20 percent of the bourse’s free float, or shares available for trading, according to Adnan Katchi, the head of international equity sales at Arif Habib Ltd.Bond investors are also growing more confident. Pakistan’s international debt, rated Caa1 at Moody’s Investors Service, or seven levels below investment grade, has returned 32 percent this year, according to JPMorgan Chase & Co.’s Next Generation Markets Index. Yields hit a two-year low of 8.5 percent on Oct. 26.

----

The country is luring more of the world’s biggest consumer brands as spending increases. Debenhams Plc (DEB), the U.K.’s second- largest department-store chain, and Nine West Group Inc., a seller of women’s shoes and handbags owned by New York-based Jones Group Inc. (JNY), opened their first Pakistan outlets this year.....

http://www.bloomberg.com/news/2012-11-20/pakistan-stocks-best-as-vi...

-

Comment by Riaz Haq on November 24, 2012 at 6:36pm

-

Here are some excerpts of an interesting Op Ed in The Nation newspaper by former finance minister Shaukat Tarin:

Despite all the gloomy news and events that has started to define Pakistan, our national resilience remains intact. However, the question that is one every one’s mind is for how long?

Let’s start with the positives (yes there are always some!) of Present Day Pakistan;

• CP Inflation while high is showing signs of becoming range bound;

• Foreign Remittances continue to rise (the PRI scheme launched under my stewardship has borne fruit with remittances expected to cross the $l2b annual mark this year);

• We have finally started to debate/define our role in the devastating ‘War on Terror” and the end game of Afghan conflict has started to be played out.

• Pakistan’s banking system remains insulated from the Western banking meltdown.

• Booming Agrarian economy, despite devastating floods; with corporate sector moving into dairy, live-stock and value added processing.

• While most of the rest of the world is ageing our population is getting younger

• Democracy is still holding on!

However, we are far from the country we all aspire. The negative list (so to speak) is long, makes a somber reading, but largely includes:

• Lack of governance and transparency (lack of meritocracy).

• Unrelenting and crippling energy shortages.

• Lack of Scale/infrastructure to support GDP growth.

• Security and Law and order situation (Perception twice as worse as reality with the reality bad enough especially in Karachi and Quetta)

• Weak Social Sector reforms/indicators.

• Increasing friction amongst state institutions.

---

... the economic and social sector performance of Pakistan has also been severely impacted by the following:1) Inability of the successive governments to balance their budgets by increasing tax to GDP ratio, reducing non-development expenses and losses of the Public sector enterprises.

2) Negligible expenditures on education and health sectors to develop our most important asset i.e. human resource.

3) Creating a competitive environment of high economic growth by focusing on the productive sectors of our economy such as agriculture and manufacturing, and

4) Focusing on infrastructure and energy sectors to facilitate the economic growth.

Whereas, we have seen efforts in the past to address these weaknesses they have been at best weak and far between.

The present economic scenario is again infected by the same weaknesses i.e. large fiscal deficits, low expenditure on education and health, chronic electricity and energy shortages, lack of focus on the productive sectors resulting in high inflation, high unemployment and low economic growth. We all want a Pakistan which is economically prosperous, institutionally resilient and strategically oriented. In essence, we want to make Pakistan an economic welfare state. In my view, a key pre-requisite for an Economic Welfare State is to ensure that a country experiences equitable and sustainable growth for a prolonged period of time. Look at the examples of India and China where uninterrupted economic growth has changes the whole value proposition of these countries.

------------

To reduce our fiscal deficit we will have to increase our taxes. As I have said it many a times, all incomes will have to pay taxes and there cannot be any sacred cows. Agriculturists will have to pay their taxes and so should the retailers, real-estate developers stock-market and all professionals. Our tax to GDP is woefully inadequate at 9pc, where Sri Lanka is 17pc, India 19pc, China 21pc and Turkey 33pc. Before I left the government, there was a tax plan in place, which needs to be implemented. It will require a strong political will.....http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on November 26, 2012 at 7:07pm

-

Here's a News report on sizing Pakistan's informal economy:

Tax authorities have estimated that the size of informal economy stood in the range of 31.4 to 44 percent of gross domestic product (GDP), according to official documents of the Federal Board of Revenue (FBR).

The proposed amnesty scheme will give last opportunity to avail after approval of the parliament to those who are major beneficiaries of huge volume of black economy, it said.

“Unfortunately, Pakistan has a large percentage of underground economy. It is difficult to estimate the exact volume but different studies have estimated the size of underground / informal economy in the range of 31.4 percent to 44 percent of the GDP,” according to the documents.

The FBR’s working also referred other studies done in the past in order to give policymakers a candid comparison to reach the rationale decision.

Referring to the World Bank’s research done in July 2010, it said that the size of informal economy stood at 36.7 percent of GDP. The State Bank of Pakistan had estimated the size of informal economy at 27.3 percent in 2000s and 28.6 percent in 1990s.

According to the Global Financial Integrity Organization paper on Illicit financial flows from developing countries 2000-09 (December 2011), the illicit financial flows was estimated at $1,449 million.

According to the research conducted by Ali Kemal of Pakistan Institute of Development Economics (PIDE) for 2007-08, Pakistan’s formal GDP was half the GDP. However, it is still an underestimated figure since investment data is not adjusted. The informal economy is 91.4 percent of the formal economy, he revealed during the last PIDE conference held in Islamabad in November.

However, the FBR has informed the prime minister, the finance minister and other cabinet ministers that several countries in recent past have provided opportunity to whiten income in their respective countries.

http://www.thenews.com.pk/Todays-News-3-145048-Tax-authorities-esti...

-

Comment by Riaz Haq on November 29, 2012 at 6:00pm

-

Here's Daily Times on Mobilink's planned $1 Billion expansion:

A delegation of VimpelCom informed Prime Minister Raja Pervez Ashraf of plans for further investment of $1 billion in Pakistan for the enhancement of Mobilink’s nationwide mobile network. A delegation comprising senior management from VimpelCom, the parent company of Mobilink, called on the prime minister at the Prime Minister House, on Thursday. The delegation was headed by VimpelCom Group CEO Jo Lunder who apprised the prime minister on VimpelCom’s global operations and the significance of the Pakistani market for VimpelCom’s growth strategy. The prime minister also discussed VimpelCom’s outlook on current operating conditions within Pakistan, and was apprised of Mobilink’s existing investment of over $3.9 billion towards consolidating its position in Pakistan’s telecom sector.

http://www.dailytimes.com.pk/default.asp?page=2012\11\30\story_30-11-2012_pg5_2

-

Comment by Riaz Haq on December 18, 2012 at 8:15am

-

Here's NY Times on $688 million in US reimbursements to Pakistan:

The Pentagon quietly notified Congress this month that it would reimburse Pakistan nearly $700 million for the cost of stationing 140,000 troops on the border with Afghanistan, an effort to normalize support for the Pakistani military after nearly two years of crises and mutual retaliation.

The biggest proponent of putting foreign aid and military reimbursements to Pakistan on a steady footing is the man President Barack Obama is leaning toward naming as secretary of state: Senator John Kerry, Democrat of Massachusetts. Mr. Kerry, the chairman of the Senate Foreign Relations Committee, has frequently served as an envoy to Pakistan, including after the killing of Osama bin Laden, and was a co-author of a law that authorized five years and about $7.5 billion of nonmilitary assistance to Pakistan.

The United States also provides about $2 billion in annual security assistance, roughly half of which goes to reimburse Pakistan for conducting military operations to fight terrorism.

Until now, many of these reimbursements, called coalition support funds, have been held up, in part because of disputes with Pakistan over the Bin Laden raid, the operations of the C.I.A., and its decision to block supply lines into Afghanistan last year.

The $688 million payment — the first since this summer, covering food, ammunition and other expenses from June through November 2011 — has caused barely a ripple of protest since it was sent to Capitol Hill on Dec. 7.

The absence of a reaction, American and Pakistani officials say, underscores how relations between the two countries have been gradually thawing since Pakistan reopened the NATO supply routes in July after an apology from the Obama administration for an errant American airstrike that killed 24 Pakistani soldiers in November 2011.

-----------

Despite the easing of tensions in recent months, there are still plenty of sore spots in the relationship.

Lt. Gen. Michael D. Barbero, who heads the Pentagon agency responsible for combating roadside bombs, known as improvised explosive devices, or I.E.D.’s, told a Senate hearing last week that Pakistan’s efforts to stem the flow of a common agricultural fertilizer, calcium ammonium nitrate, that Taliban insurgents use to make roadside bombs had fallen woefully short.

“Our Pakistani partners can and must do more,” General Barbero told a Senate Foreign Relations subcommittee hearing.

American officials have also all but given up on Pakistan’s carrying out a clearing operation in North Waziristan, a major militant safe haven.

“Pakistan’s continued acceptance of sanctuaries for Afghan-focused insurgents and failure to interdict I.E.D. materials and components continue to undermine the security of Afghanistan and pose an enduring threat to U.S., coalition and Afghan forces,” a Pentagon report, mandated by Congress, concluded last week.

http://www.nytimes.com/2012/12/18/world/asia/pentagon-to-reimburse-...

-

Comment by Riaz Haq on December 31, 2012 at 5:07pm

-

Here's Dawn on KSE-100 among best performers in the world:

KARACHI: Pakistani stocks closed lower on Monday, although the market gained 49 per cent during 2012 and crossed 17,000 points for the first time.

The Karachi Stock Exchange’s (KSE) benchmark 100-share index ended 0.22 per cent, or 37.86 points, lower at 16,905.33.

The market’s rise was partly down to a substantial decrease in the interest rate, said dealer Samar Iqbal at Topline Securities.

Stocks that ended positively included Byco Petroleum, which rose 4.81 per cent, or 0.67 rupee, to 14.59 per share and Bank of Punjab, which was up 10.31 per cent, or one rupee, to 10.70 per share.

Stocks that fell included TRG Pakistan, down 0.7 per cent to 5.65 per share, and Fauji Cement, which fell 0.91 per cent to 6.53 per share.

In the currency market, the Pakistani rupee ended steady at 97.18/97.23 against the dollar, compared to Friday’s close of 97.17/97.23.

Overnight rates in the money market ended at 8 per cent compared to Friday’s close of 7 per cent.

http://dawn.com/2012/12/31/pakistani-stocks-gain-49-per-cent-during...

Here's Bloomberg on Asian markets:

Dec. 28 was the final trading day of the year in South Korea, Taiwan, Indonesia, Thailand, Vietnam and the Philippines. Thailand’s SET Index surged 36 percent this year, the biggest advance by any Asian benchmark gauge after Pakistan’s Karachi 100 Index.

http://www.bloomberg.com/news/2012-12-28/asian-stocks-rally-for-six...

-

Comment by Riaz Haq on January 17, 2013 at 10:19pm

-

Here's Bloomberg on informal savings and investment in Pakistan:

Ali has been selling wall clocks and wristwatches in a crowded Karachi market for 15 years. He’s been participating in savings circles with fellow shopkeepers for just as long, and has used the proceeds to buy a car and acquire a new store.

Now he’s a few months away from getting 400,000 rupees ($4,100) from a savings group of 16 shopkeepers into which he’s been paying 1,000 rupees a day for almost a year. He plans to put a down payment on an apartment. “This system is flawless,” says Ali, 35, who goes by one name. “You can never save this way without this binding commitment of making payments every day or every month. At banks there are hassles and procedures that waste time. This is simple. The organizer comes to collect the money himself, and because of the trust element, it’s a given that we’ll get the money.”

Millions of Pakistanis save billions of rupees in informal, interest-free savings circles called ballot committees—popularly known as BCs—run by housewives, students, office workers, shopkeepers, even high-society ladies. Each member of a group of trusted friends or relatives contributes the same sum daily or monthly to a pool for a predetermined length of time, usually one year. Through a ballot, each participant is allotted a number indicating his or her turn. Every month, one participant gets the pool total. Everyone on the committee keeps contributing until each member gets a pot of cash.

---

No one knows the origins of savings circles, but they’re found in Africa and Latin America as well as Asia. “This system has existed in South Asia as long as I’ve known, and it was started by low-income women who were financially insecure,” says Ashfaque Hasan Khan, dean at the business school of the National University of Sciences & Technology in Islamabad. “The purpose was to hedge against a problem or to pay for a son or daughter’s wedding.” In India a similar savings plan, called a chit fund, flourishes. The big difference is that India’s savings circles, after years of operating on their own, are now regulated by the government.

No estimates exist of the total amount of the funds collected by the committees. In Karachi alone, the All Karachi Traders Alliance Association estimates 10 million rupees pour into ballot committees on a daily basis. “The size and volume of the circles is on the rise because inflationary pressures mean people need more cash now to do the same things,” says Dean Khan of National University. Inflation in Pakistan is close to 8 percent. While the official savings rate is 10.7 percent of gross domestic product, it is probably higher thanks to the committees.

Another reason the ballot committees are flourishing is the low level of financial literacy in Pakistan and the reluctance of ordinary Pakistanis to take part in cumbersome banking procedures. “Coverage by bank branches is fairly limited, especially in rural areas,” says Sakib Sherani, chief executive officer at Macro Economic Insights, a research firm in Islamabad. “The ballot committees offer greater flexibility and avoid the hassle of traveling to a bank, keeping documentation, and paying service charges.”

Only 14 percent of Pakistanis use a financial product from a formal financial institution, according to a 2009 World Bank report. That compares with 48 percent for India. But when informal financial networks such as the BCs are taken into account, 50.5 percent of Pakistanis have access to finance, according to the report. ....

http://mobile.businessweek.com/articles/2013-01-17/in-pakistan-savi...

-

Comment by Riaz Haq on January 23, 2013 at 10:41pm

-

Here's an excerpt of an Op Ed in The News on issues with informal economy:

Concerns regarding informal economy generally arise on the following grounds: First, informal economy creates biases and economic distortions. Second, it does not contribute to the state kitty as the firms and businesses operating in the informal sector are not registered with the tax authorities. Third, a huge informal economy is indicative of low trust between the government and business agents, and lack of confidence in economic and business regulations, procedures and policies.

Fourth, informality retards a country’s subsequent economic development, because informal entrepreneurs cannot use their wealth as collateral for loans to finance investments. Fifth, informality has social costs as well. Almost all countries have social security plans, labour welfare laws and safety regulations for the welfare, security and protection of labourers working in factories and other workplaces. But such laws will be applicable to formal businesses as informal businesses hide their business activity from regulators.

But the key question is: what causes the ballooning of the informal economy? Various elements are responsible for a large informal economy. High formalisation costs, high taxation, huge regulatory burden and corruption, and poor enforcement are considered prime reasons of Pakistan’s informal economy. The costs of formalisation are both monetary and non-monetary. These costs may be prohibitively high.

According to the World Bank’s Doing Business Report 2013, a Pakistani entrepreneur must complete 10 procedures to start a business. These take at least 21 days. The cost involved in meeting the procedural requirements is 9.9 percent of per-capita income.

Simple back-of-the-envelope calculations show fulfilment of these requirements consumes your income of 36 days. Is the cost very high? To arrive at a conclusion let us analyse this in the light of some regional and developed countries. In the case of India, the total number of procedures involved is 12, the time involved is 27 days and the income earned by an average Indian in 182 days is spent in the fulfilment of procedural requirements.

For Sri Lanka, the total procedures are five and seven days are required, on average, while a Sri Lankan will earn the income required as start-up costs in 70 days. In the case of Bangladesh, seven procedures are involved and the time taken is 19 days, and an average citizen of Bangladesh would earn the money required to formalise the business in 92 days.

In the US the procedures involved are six and it takes six days to register your business. A US citizen can earn in five days the money required in the registration of his business. In the UK the number of procedures involved are 19, the days required to start a business are 13, and it takes the earnings of two-and-a-half days to cover procedural costs and formalities. For countries like Sweden, Finland and Switzerland, the start-up costs are much lower in terms of per-capita income.

Where do we stand in terms of start-up costs? Compared with the regional countries we do not lag behind as far as ease of starting business is concerned. Rather, Pakistan fares better. We lag behind the developed countries not in terms of number of procedures but in the time and costs involved in meeting the procedural requirements. Certainly, we need do to further improve our processes and reduce start-up costs, but the present start-up costs are not a big constraint for formalisation of a business. So formalisation costs we can be ruled out as a key reason for informality in Pakistan.....

http://www.thenews.com.pk/Todays-News-9-156136-Our-informal-economy

-

Comment by Riaz Haq on January 25, 2013 at 10:47pm

-

Here's a Dawn story on Pak tax collector urging wealthy to pay taxes:

LAHORE: Chairman Federal Board of Revenue (FBR) Ali Arshad Hakeem on Saturday issued a warning to tax evaders and said the FBR had located over three million citizens who had enormous wealth but had not been paying their taxes, DawnNews reported.

Speaking at a ceremony in Custom House, Lahore, Hakeem said out of a population of 180 million, only 800,000 people were paying their taxes.

He said tax evaders were being given 75 days’ time to fulfill their responsibilities as citizens after which their names would be added to the exit control list (ECL) and their national identity cards would also be blocked.

The FBR chief said Pakistan’s system of taxation was in dire need of reformation, adding that the country could not be run with the existing taxation system in place.

Hakeem added that Pakistan had one of the lowest tax-to-GDP ratios in the world.

He stressed that the country was in dire need of tax reforms and that the government should take immediate steps in this regard.

The FBR chief’s remarks come in the wake of the introduction of a controversial tax amnesty bill in the National Assembly.

The opposition says the bill is meant to provide opportunity to millions to whiten their black money whereas Finance Minister Dr Abdul Hafeez Sheikh has said that there were only 800,000 taxpayers in the country and the bill would bring a substantial number of people into the country’s tax net.

http://dawn.com/2013/01/26/fbr-chief-says-countrys-tax-system-needs...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 14 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network