PakAlumni Worldwide: The Global Social Network

The Global Social Network

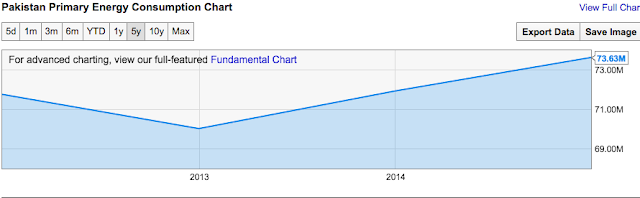

Pakistan Experiencing Strong Growth in Energy Consumption

Pakistan's energy consumption grew by 5.7% in 2015, faster than the 5.2% increase in neighboring India that claims significantly faster GDP growth. Primary energy consumption growth in a country is often seen as a strong indicator of its GDP growth. Ever since the advent of the industrial age, energy has become increasingly important as a driver of farms, factories, communication, transportation, construction, retail and other sectors of the economy. In addition to energy, other important economic indicators include cement and steel consumption, auto sales and air travel which are also growing significantly faster in Pakistan than in India.

Pakistan Primary Energy Consumption Trend (Source: British Petroleum) |

Primary Energy Consumption:

According to British Petroleum Statistical Review of World Energy released in June 2016, the primary energy consumption in Pakistan rose to 78.2 million ton oil equivalent (MTOE) in 2015, compared with 73.2 MTOE in 2014 confirming greater economic activity. It was the third fastest growth in energy consumption in Asia. Only the Philippines (9.7%), Vietnam (9.6%) and Bangladesh (8.7%) saw faster growth than Pakistan's.

Domestic Cement Demand:

All-Pakistan Cement Manufacturers’ Association reported cement industry sold 33 million tons in domestic market in fiscal year 2015-16, posting a robust growth of 17.01 per cent compared to the 28.2 million tons sales during the same period in 2015.

Local Auto Production:

Domestic auto production in Pakistan jumped by 21.57 percent (vs 2.58% growth in India) in fiscal 2016 compared to fiscal 2015, according to data from Pakistan Automobile Manufacturers Association. The data collected by Pakistan Bureau of Statistics (PBS) noted that as many as 168,363 jeeps and cars were manufactured during July-May (2015-16) while 138,490 units were produced last year(July-May 2014-15).

Rising Steel Demand:

Pakistan is experiencing 30% growth in steel imports, according to the State Bank of Pakistan. Local steel production is about 6 million tons. In addition, Pakistani imports of steel this year could surpass $2 billion as China-Pakistan Economic Corridor CPEC-related projects ramp up.

Air Travel Growth:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Mobile Broadband Uptake:

Mobile broadband subscriptions have rocketed from zero to over 30 million in just two years since 3G/4G service rollout in Pakistan. Rapid growth is continuing with over 1 million new subscribers are signing up for 3G and 4G services every month. An equal or larger number of smartphones are are being sold.

Summary:

A whole series of indicators from auto and steel to manufacturing and construction and telecom services are confirming that economic growth is accelerating in Pakistan. Among the reasons for this growth are significantly improved security situation, political stability and soaring Chinese foreign direct investment (FDI) in CPEC related energy and infrastructure projects. These indicators are attracting investors who have already made Pakistan Stock Exchange the hottest shares market in Asia. KSE-100, Pakistan's main shares index, is up 18% year-to-date compared to 6% increase in India's BSE-30 index. The challenge for Pakistan is to continue to improve security and political stability to reassure investors of superior returns from their investments in the country.

Related Links:

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

-

Comment by Riaz Haq on March 14, 2017 at 8:46am

-

#Pakistan's #oil demand jumps 13% on low prices, growing #economy - Oil | Platts News Article & Story. #energy http://www.platts.com/latest-news/oil/singapore/pakistans-oil-deman... …

Pakistan's oil consumption from July 2016 to February 2017 jumped 13% year on year, owing to lower petroleum product prices and higher economic activity, driven by GDP growth, foreign investment and greater political stability.

Pakistan's economy expanded 4.2% in 2016, foreign investment has continued to grow -- attracted by the multi-billion dollar China-Pakistan Economic Corridor project -- and improvements in the country's security front, following the government's efforts to combat terrorism, have also led to economic gains and additional investment.

Oil sales during the first eight months of the current fiscal year rose 13% year on year to 16.67 million mt, according to data from oil marketing companies and the Pakistan's Oil Companies Advisory Committee. Pakistan's fiscal year runs from July to June.

Motor gasoline sales increased to 4.36 million mt, up 20% year on year, while demand for high speed diesel increased 15% to 5.46 million mt, the data showed.

"Sales of both products moved north due to significantly lower prices and lower availability of compressed natural gas in the transport sector," said Muhammad Saad Ali, research analyst with Karachi-based brokerage Inter Market Securities.

The price of Pakistan's motor gasoline peaked in October 2013 at Rupees 114 ($1.1)/liter compared with Rupees 73/liter currently, while high speed diesel was at Rupees 117/liter versus the current price of Rupees 82/liter.

Sales of furnace oil also increased to 6.21 million mt from July 2016 to February 2017, up 10% year on year, driven by higher consumption by the power generation sector amid lower water levels and weak hydroelectric production.

CONSUMPTION OUTLOOK

Looking ahead, Pakistan's oil products demand is expected to see substantial growth over the next three years because of rising per capita income, higher automotive sales and growing foreign investment, according to data from energy experts and analysts.

"We believe that oil marketing companies' sales will increase in the backdrop of active transportation activity owing to projects near the China-Pakistan Economic Corridor, rising auto-financing loans and higher per capita income," said Ayesha Fayyaz, research analyst at Karachi-based brokerage Shajar Capital Ltd.

Gasoline demand is expected to increase to 10.9 million mt in the fiscal year ended June 30, 2020, from 5.8 million mt in the year ended June 2016.

The forecast is well above earlier estimates made by Pakistan's Oil Companies Advisory Committee, expecting gasoline demand to reach 8.78 million mt by 2019-20.

"Motor gasoline and high speed diesel sales will continue to be driven by improving macroeconomic factors, and rising sales of cars, bikes and rickshaws," analyst Umair Naseer of Karachi-based Topline Securities said.

"Under CPEC, there will be construction of road infrastructure and industrial units. This, we believe, will lead to an increase in transportation activity and higher gasoline and diesel demand," Naseer added.

The outlook seems less promising for furnace oil, Fayyaz said.

"We are conservative about the volumetric growth in furnace oil due to the expansion of the LNG and hydroelectric power sectors," she said.

-

Comment by Riaz Haq on March 14, 2017 at 8:53am

-

India’s 2016 Oil Demand Jumps 11% To Record Highs

http://oilprice.com/Latest-Energy-News/World-News/Indias-2016-Oil-D...

India’s economic growth and rising income pushed up vehicle sales and fuel demand last year, with oil consumption soaring 11 percent to the highest on record, according to oil ministry data.

India’s oil products consumption increased to 196.5 million tons last year from 177.5 million tons in 2015, with transport fuels gasoline and diesel making up more than half of the country’s oil products consumption. The increase was driven by rising income, which is encouraging people to buy more passenger cars, scooters and three-wheelers. In addition, the road transportation sector is also growing fast.

Gasoline demand jumped 12 percent last year while consumption of diesel increased by 5.6 percent.

FGE expects oil prices this year at between $50 and $60 per barrel, which is expected to drive “robust growth in transport and consumer fuels in India,” the analyst noted.

In September of 2016, India’s Petroleum Minister Dharmendra Pradhan said that he expected the demand for crude oil in the country to rise in excess of 11 percent for 2016, thanks to “better monsoon rains” and growth in economic activity. In 2015, India recorded an increase of 11 percent in the consumption of oil, versus projections for a rate of 7-8 percent. Year 2016 should see a higher increase, Pradhan said in September of 2016.

According to an India Energy Outlook by the International Energy Agency (IEA), demand for oil in India is expected to grow at the fastest pace through 2040, compared to any other region or country. Demand for oil is seen rising by 6 million bpd to reach 9.8 million bpd in 2040.

-

Comment by Riaz Haq on March 26, 2017 at 10:19am

-

#Pakistan Iron/Steel mfg output up 17.46%, electronics up 13.5%, pharma up 7.5%, autos up 6.9% in 7 months of FY17 https://www.thenews.com.pk/print/192907-LSM-posts-348-percent-growt... …

In January, LSM output edged up 1.08 percent over the same month last year and rose 2.78 percent as compared to December 2016. Iron and steel production was also the highest (28.02pc) among all the main industries in January, closely followed by engineering products (27.69pc).

Engineering sector’s output, however, slid 0.54 percent in July-January, while textile sector – having the largest weight in the LSM basket – registered the lowest 0.29 percent growth during the period. Textile output marginally increased 1.23 percent in January.

The PBS data showed that electronics sector was the second after iron and steel in terms of growth in the seven months with 13.49 percent, followed by non-metallic products (7.78pc), pharmaceutical (7.57pc), automobiles (6.91pc), paper and paper board (6.61pc), food, beverages and tobacco (4.79pc) and rubber products (0.38pc).

The sectors, which posted decline in production in July-January FY17, included wood products (95.82pc), followed by leather products (17.54pc), chemicals (2.13pc) and coke and petroleum (0.67pc).

The LSM’s quantum indices are based on data from Oil Companies Advisory Committee (OCAC), ministry of industries and provincial bureau of statistics. Ministry of industries, which logs production stats of 36 items, recorded 3.78 percent increase during the July-January period of 2016/17.

The ministry recorded the highest production growth in tractors’ output. Total 25,983 were manufactured during the period, up 79.42 percent over the corresponding period last year. The second significant percentage growth (54.93pc) was recorded in production of trucks, followed by billets/ingots (29.65pc), buses (26.19pc), sugar (22.25pc) and motorcycles (20.09pc). Mills produced 2.893 million tonnes of sugars in July-January FY17 as compared to 2.366 million tonnes in the corresponding period of FY16.

Provincial bureau of statistics, which measures outputs of 65 products across the country, registered 3.48 percent rise in the period under review. Production of deep freezers jumped 52.64 percent to 53,509 units, followed by electric fans (27.94pc), refrigerators (22.59pc), woolen and carpet yarn (18.91pc), electric bulbs (16.37pc) and electric meters (15.71pc).

OCAC, which calculates production of 11 petroleum products, registered a marginal 0.29 percent increase in outputs. Production of liquefied petroleum gas rose 10.49 percent to 276.687 million litres. Motor spirits’ output soared 8.66 percent to 1.438 billion litres. Jute batching oil production increased 5.68 percent, followed by jet fuel oil (3.83pc) and high speed diesel (1.67pc).

Diesel oil production, however, fell 44.51 percent in July-January FY17 over the corresponding period of FY16, followed by solvant naptha (18.78pc), kerosene oil (13.27pc) and lubricating oil (2.49pc).

https://www.thenews.com.pk/print/192907-LSM-posts-348-percent-growt...

-

Comment by Riaz Haq on April 4, 2017 at 8:02pm

-

#Pakistan: domestic demand for cement up 6.7% in Feb 2017. First 8-month FY17 domestic cement consumption up 9.12% http://www.cemnet.com//News/story/161268/pakistan-domestic-demand-u... …

Total cement sales in Pakistan in February 2017 were 3.435Mt, down by 0.41 per cent from 3.449Mt during the corresponding month of last year, according to the All Pakistan Cement Manufacturers Association (APCMA).

Domestic cement sales reached 3.181Mt, up 6.7 per cent YoY. While domestic sales rebounded in February, exports saw a 45 per cent drop. Exports reached 0.254Mt, representing a 45.7 per cent fall when compared with February 2016.

On cumulative basis, during the first eight months of the fiscal year the country dispatched 26.339Mt cement, showing an overall growth of 6.4 per cent over the corresponding period of last fiscal. During this period the domestic consumption increased by 9.12 per cent, but exports declined by 8.54 percent.

APCMA once again urged the government to take effective steps to stop the penetration of Iranian cement in Pakistani markets on the strength of significant under-invoicing and misdeclaration. A proper vigilance and accountability system needs to be put in place to stop cement smuggling into the country. Government should also increase import duty for import of clinker and cement to protect the local industry, said APCMA.

-

Comment by Riaz Haq on April 11, 2017 at 10:42am

-

#India's fuel consumption grows at slower rate of 5% in FY17. #energy #oil

http://www.business-standard.com/article/markets/india-s-fuel-consu...

India's fuel consumption grew at a slower rate of five per cent in the previous financial year ended on March 31 as diesel demand slowed.

The world's third largest oil consumer saw demand for fuel and petroleum products rise to 194.2 million tonne in 2016-17, up from 184.6 mt in the previous financial year, according to the data from Petroleum Planning and Analysis Cell (PPAC) of the oil ministry.

The demand growth was slower than 11.5 per cent recorded in 2015-16 when consumption had jumped to 184.67 mt from 165.5 mt in the previous year.

Demand for diesel, the most consumed fuel in the country, grew by 1.8 per cent to 74.6 mt in 2016-17. Diesel consumption has soared 7.5 per cent in 2015-16.

Last financial year saw LPG sales move up by 9.8 per cent to 19.6 mt as government released two crore new connections for the poor.

Petrol consumption was up 8.8 per cent to 21.84 mt on the back of rise in two-wheeler and car sales. Jet fuel sales were up 12 per cent at 6.2 mt.

Kerosene demand however declined by a steep 21 per cent to 6.8 mt as government restricted supply of subsidised cooking fuel only to the identified needy. Also, LPG replaced it as a cooking fuel in many households.

During March, fuel demand fell 0.6 per cent to 17.35 mt.

Petrol sales were up 2.9 per cent at 2.1 mt but diesel consumption showed a marginal 0.3 per cent rise at 6.8 mt. LPG demand was too was up only 1.9 per cent while kerosene sales fell by a massive 26 per cent to 414,000 tonne.

While naphtha demand surged 1.8 per cent to 1.14 mt, sales of bitumen, used for making roads, was 12.2 per cent lower. Fuel oil use edged lower 23.4 per cent to 567,000 tonne in Mar

-

Comment by Riaz Haq on May 16, 2017 at 8:16am

-

#China building boom to churn out #Pakistan's largest steel IPO with #steel output growing 23% in 2016. https://www.bloomberg.com/news/articles/2017-05-15/china-building-b... … via @markets

Agha Steel Industries Ltd. is planning Pakistan’s biggest-ever private sector initial share sale this year to help boost output as China funds more than $55 billion in infrastructure projects across the nation and a buoyant stock market spurs investor demand.

The Karachi-based company plans to raise as much as 10 billion rupees ($95 million) selling a 25 percent stake, Executive Director Hussain Agha said in an interview. The sale will be the largest since the 12-billion rupees government stake sale of Habib Bank Ltd. in 2007, the country’s largest IPO yet.

Steel and cement makers in Pakistan are expanding to meet demand as the “One Belt, One Road” trade route financed by China spurs construction. The nation’s economy has grown at about 5 percent annually since 2013, encouraging Agha’s peers including International Steels Ltd. and Aisha Steel Mills Ltd. to lift production.

“You need roads, sky rises and housing,” said Agha. “Pakistan’s steel industry is in an infancy stage and growing at a massive pace -- the whole environment will change.”

Read more: Chinese Largesse Lures Countries to Its Belt and Road Initiative

The company will use the funds for $50 million expansion that will triple output to 500,000 metric tons within two years. Production will then double to a million tons by 2023, he said. Habib Bank has been appointed financial adviser while Arif Habib Ltd. and BMA Capital Ltd. were picked as book runners for transaction.

Pakistan’s steel output grew 23 percent to 3.6 million tons in 2016, the biggest gain among 40 nations, according to the World Steel Association. Agha Steel expects construction-grade steel, such as rebars and wire rods, to grow as much as 12 percent annually for the next three years.

The construction sector expanded 13 percent in year ended June 2016, more than twice the pace in the previous 12 months, according to State Bank of Pakistan’s annual report. Rapid urbanization and rising income levels has left the nation with an annual shortfall of 500,000 homes, according to real-estate developer Arif Habib.

“Real-estate is the main engine for this growth, it has really picked up,” said Ayub Khuhro, chief investment officer of Karachi-based Faysal Asset Management Ltd., which has about 8 billion rupees in stocks and bonds. “The government is also willing to protect companies with anti-dumping measures.”

-

Comment by Riaz Haq on May 18, 2017 at 7:26am

-

Indian media on Bunji and Bhasha dams in Gilgit Baltistan:

China To Invest $27 Billion In Construction Of Two Mega Dams In Pakistan-Occupied Gilgit-Baltistan

https://swarajyamag.com/insta/china-pakistan-plan-for-construction-...

China and Pakistan have inked a memorandum of understanding (MoU) for the construction of two mega dams in Gilgit-Baltistan, a part of India’s Jammu and Kashmir state that remains under latter’s illegal occupation. The MoU was signed during the visit of Pakistan’s Prime Minister Nawaz Sharif to Beijing for participation in the recently concluded Belt and Road Initiative.

The two dams, called Bunji and Diamer-Bhasha hydroelectricity projects, will have the capacity of generating 7,100MW and 4,500MW of electricity respectively. China will fund the construction of the two dams, investing $27 billion in the process, a report authored by Brahma Chellaney in the Times of India has noted.

According to Chellaney, India does not have a single dam measuring even one-third of Bunji in power generation capacity. The total installed hydropower capacity in India’s part of the state does not equal even Diamer-Bhasha, the smaller of the two dams.

The two dams are part of Pakistan’s North Indus River Cascade, which involves construction of five big water reservoirs with an estimated cost of $50 billion. These dams, together, will have the potential of generating approximately 40,000MW of hydroelectricity. Under the MoU, China’s National Energy Administration would oversee the financing and funding of these projects.

-

Comment by Riaz Haq on August 16, 2017 at 8:23am

-

#Pakistan #Oil Ports Face Facilities Congestion As Imports Soar

https://www.porttechnology.org/news/pakistan_ports_face_traffic_crisis

Pakistan’s oil importing facilities at Karachi Port and Port Qasim currently face congestion because of port constraints as well as traffic on roads and at sea, according to Dawn.

The situation was created by inefficiencies in port handling and trouble with onward transit to the north, according to an unnamed government official.

Constraints included handling traffic increases, limited storage at ports, inability to use an oil pier, and long oil testing and sampling times.

Pakistan's Government is discussing building a new terminal at Port Qasim, on receiving a report advising on the congestion issue.

The report uncovered a need for added tank storage at Keamari.

A ban on new tank build at Keamari as well as land availability for this magnitude of storage development is a major limitation for the port, it found.

Oil handling facilities at the Port Qasim are expected to reach capacity at 2019-20 and government should plan to build a new terminal.

Over six months, ships collectively had faced added waiting time amounting to 274 days at the outer anchorage and 63 days on berth.

Already Ministers from Malaysia and Pakistan have agreed to form a joint working group on maritime cooperation that could develop Pakistani port terminals for transhipment.

Port Quasim is expanding, however. Recently port Qasim in Pakistan inaugurated its first state-of-the-art coal, clinker and cement bulk terminal.

-

Comment by Riaz Haq on September 22, 2017 at 10:29pm

-

#Pakistan large scale manufacturing posts 4 year high growth of 12.98% in July 2017 | http://thenews.com.pk

https://www.thenews.com.pk/print/231581-LSM-posts-four-year-high-gr...

Karachi: Large scale manufacturing sector posted a four-year high growth of 12.98 percent year-on-year in the first month of the current fiscal year on infrastructure-driven boom and growing auto demand.

Pakistan Bureau of Statistics (PBS) data on Thursday showed that iron and steel production climbed 46.36 percent in July over the same month a year ago, followed by automobiles (42.56pc) and non-metallic mineral products (37.95pc).

LSM output increased 12.78 percent in September 2017 over the same month of 2016. PBS statistics revealed that production of billets soared more than 74 percent YoY to 476,000 tonnes in July.

Production of tractors more than doubled to 5,087 units in July 2017 from 2,067 units in July 2016, while output of trucks, jeeps and cars, light commercial vehicles and motorcycles increased 24.4 percent, 55.75 percent, 16.03 percent and 26.46 percent, respectively.

Other sectors that recorded growth in July included engineering products (21.95pc), food, beverages and tobacco (19.02pc), pharmaceuticals (11.14pc), paper and board (11.23pc), wood products (10.95pc), chemicals (5.13pc), coke and petroleum products (4.87pc), rubber products (4.51pc), leather products (2.52pc) and textile (0.43pc).

Fertiliser and electronics sectors, however, recorded a flat production in July over the corresponding month a year ago. Large scale manufacturing grew 4.36 percent in July over June, according to PBS.

Industrial production grew 5.02 percent in the last fiscal year of 2016/17. LSM, accounting for 80 percent of the industrial sector’s 10 percent share in GDP, posted a four-year high growth of 5.6 percent in the fiscal 2016/17. Government set LSM sector’s target at 5.7 percent for FY2018.

Infrastructure development boosted demand of iron and steel products as well as cement, which are the key industries in the country. Auto sales have also been growing in the recent past as demand of heavy vehicles in China-funded development projects, uptake of passenger vehicles and rising sales of tractors for recovering agriculture sector speeded up production in the industry.

The bureau logs trend of industrial sector on the basis of statistics from Oil Companies Advisory Committee (OCAC), ministry of industries and provincial bureaus of statistics. Ministry of industries track production trend of 36 products, Oil Companies Advisory Committee monitors 11 oil, lubricant and petroleum products and provincial authorities measure output of 65 items nationwide.

OCAC registered a 4.87 percent YoY growth in July and edged up 2.51 percent month-on-month. Production of liquefied petroleum gas surged 75.5 percent YoY to 56.29 million litres. Kerosene oil output soared 66.5 percent to 14.78 million litres in July.

Diesel production soared 41.33 percent to 2.15 million litres, while motor spirits output increased 14.6 percent to 237 million litres in July. Ministry of industries recorded a growth of 16.66 percent YoY and 8.09 percent month-on-month, said Pakistan Bureau of Statistics.

-

Comment by Riaz Haq on October 7, 2017 at 5:30pm

-

Trafigura prompts Pakistan’s fuel retail monopoly to revamp

http://www.gulf-times.com/story/566568/Trafigura-prompts-Pakistan-s...

The government-owned Pakistan State Oil, which caters to almost half of the nation’s fuel needs, is looking to open 100 new convenience stores at some of its 3,500 fuel pumps after a successful trial programme two months ago, according to its chief executive officer Sheikh Imran Ul Haque.

Pakistan’s largest fuel retailer has a plan to entice motorists as its dominance is challenged by foreign competition: sell sugary drinks and snacks along with gasoline.

The government-owned Pakistan State Oil Ltd, which caters to almost half of the nation’s fuel needs, is looking to open 100 new convenience stores at some of its 3,500 fuel pumps after a successful trial programme two months ago, according to chief executive officer Sheikh Imran Ul Haque. PSO also wants to add as many as 70 new fuel outlets this year as companies, including Trafigura’s Puma Energy BV, enter South Asia’s second-largest economy.

“The whole game is bringing that customer in and emptying his pockets,” Haque said in an interview at the company’s headquarters in the port city of Karachi. The strategy is aimed at increasing the number of PSO customers from the current three million a day, he said.

Foreign entrants have been lured to Pakistan as a growing economy and a rising middle class creates demand for goods and services. Gasoline sales more than tripled to over 6.7mn tonnes in the fiscal year ended June since 2010, according to Shajar Capital Pakistan Pvt. With disposable income rising, the nation of more than 200mn people is also the world’s fastest growing retail market.

Trafigura’s Puma Energy plans to invest in Pakistani fuel retailer Admore Gas Pvt, while other local companies, such as Hi-Tech Lubricants Ltd and WAK Group, are planning to build gas stations for the first time. Puma, should the deal go through, will follow Vitol SA, the world’s biggest independent oil trader, which acquired a stake in Karachi-based Hascol Petroleum Ltd in 2015 and supplies most of its fuel. Vitol exercised an option to increase its stake in Hascol by a further 10% to 25% in July.

Shares rose as much as 1.6% to Rs435.99 in Karachi. The benchmark Karachi Stock Exchange was 1% higher as of 10am local time.

“We believe they are at inflection right now and hopefully going to grab market share from here,” said Suleman Rafiq Maniya, research head at Shajar Capital. “Hascol and the rest were taking the share basically the last three to four years.”

Haque, who joined PSO two years ago, is attempting to push the bureaucratic state-owned company into the future. The company expects to spend 40bn rupees ($379mn) in the next three years to add storage tanks, upgrade 200 of its oldest fuel stations – targeting those in tourist spots – while building about 70 new stations each year. In a first for the state-owned company, Haque also temporarily slashed prices to lure customers during the holy Islamic month of Ramadan this year.

Haque said PSO is now having to evaluate its fundamental sales options since half come from supplying furnace oil to power plants – a line of business that will be phased out by the end of 2019. Those plants will be replaced by gas- and coal-fired plants as Pakistan attempts to end crippling power shortages that have blighted industry and residents for decades, Prime Minister Shahid Khaqan Abbasi said in an August interview.

Haque expects industry furnace oil sales to decline by 0.5mn tonnes this fiscal year, but believes it will take about five-to-six years for the plants to go offline.

The company is also looking to get into refining in a nation that spent a fifth of its total import bill in the past fiscal year on petroleum products including petrol and diesel. Pakistan’s regulator in March approved the retailer’s plan to increase its stake up to 49% in Pakistan Refinery Ltd. The company will look at another joint venture refinery with a capacity of 250,000 barrels a day in five-to-seven years, said Haque.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network