PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Media Crisis: Facts and Myths

Pakistan's 88 billion rupee media industry is in the midst of a major shakeout after a long period of rapid double-digit growth since the turn of the century. Hundreds of journalists and other staff have lost their jobs. At least one TV channel, Waqt News, has closed while several others are downsizing. While such consolidation was long overdue after nearly two-decade long period of explosive growth, the PTI government's decision to reduce advertising budget, which constitutes nearly a quarter of all ad spending in the country, appears to be the main trigger. Those affected by consolidation are accusing the government of exercising press censorship by cutting its ad spending.

Rapid Growth:

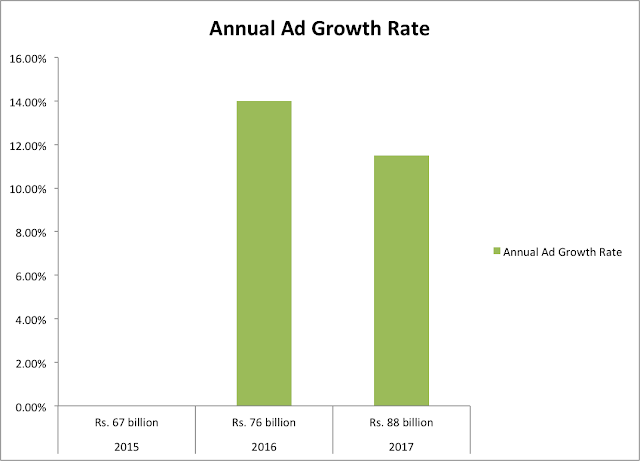

Rising buying power of rapidly expanding middle class in Pakistan drove the nation's media advertising revenue up 14% to a record Rs. 76.2 billion 2016 and another 12% to Rs. 88 billion in 2017, making the country's media market among the world's fastest growing media markets.

Industry Shakeout:

Massive commercial media growth in Pakistan has been most apparent in terms of private TV channels growing from just one in Year 2000 to over 100 today after President Musharraf's deregulation of electronic and other media.

Explosive growth with many new entrants is the fundamental business reason for the recent wave of consolidation and shakeout. Shakeout is a business term used to describe the consolidation of an industry or sector after it has experienced a period of rapid growth in demand followed by oversupply.

At least one TV channel, Waqt News owned by Nawai-Waqt Media Group, has closed while several others are downsizing. “We are trying to compile exact figures of the affected media persons. So far, we can say that around 1,000-1,500 workers have lost their jobs or faced cuts in salaries in the past few weeks,” Muhammad Afzal Butt, president of one the main factions of Pakistan Federal Union of Journalists (PFUJ) told The News Sunday (TNS) this week.

Government Spending:

About a quarter of Rs. 80 billion ad revenue comes from federal and provincial government ads in the media. Some of the TV channels receive as much as 50% of their revenue from the government.

"The government has cut its media spend by more than 70% and companies by almost 50%", according to a leading advertising agency owner who spoke to Dawn.

|

| Global Advertising Growth 2018. Source: Magna |

"The (federal) government used to spend some Rs. 10 billion on advertisements annually, which was increased up to Rs35 billion in the last years of the (Nawaz Sharif's PMLN) government," Fawad Chaudhry, federal minister of information, told The News Sunday (TNS). This tax-payers’ money, says the minister, was used by the previous government to bribe the media for favorable coverage.

Digital Adverstising:

Growing slice of the media ad spend is being claimed by online advertising with accelerating broadband penetration in Pakistan. Most recent data from Pakistan Telecommunications Authority shows that 62 million Pakistanis now subscribe to mobile broadband and this number is increasing by one to two million new subscribers each month.

Digital media spending rose 27% in 2015-16 over prior year, the fastest of all the media platforms. It was followed by 20% increase in radio, 13% in television, 12% in print and 6% in outdoor advertising, according to data published by Aurora media market research.

Summary:

Significant reduction in government spending on advertising has triggered a long-overdue shakeout after almost two decades of rapid media growth in Pakistan. About a quarter of Rs. 80 billion ad revenue comes from federal and provincial government ads in the media. Some of the TV channels receive as much as 50% of their revenue from the government. Hundreds of journalists and other staff have lost their jobs. At least one TV channel, Waqt, has closed while several others are downsizing. Those affected by consolidation are accusing the government of exercising press censorship by cutting its ad spending.

Here's a video discussion on Pakistani media business with Misbah Azam, Sabahat Ashraf and Riaz Haq.

Related Links:

Advertising Revenue in Pakistan

The Other 99% of Pakistan Story

-

Comment by Riaz Haq on July 29, 2019 at 4:26pm

-

Lack of diverse media ownership leads to censorship in Pakistan says new report

Study ties lack of pluralism to censorship and falling standards

https://globalvoices.org/2019/07/29/lack-of-diverse-media-ownership...

Aided by lax legal restrictions, Pakistan is a “high-risk country” in terms of media pluralism as more than half of mass media ownership is concentrated in the hands of a few — a model which has resulted in closure of businesses, a fall in journalism standards and rise in censorship, says a new research study.

These findings, coupled with the ruling party's increasingly hostile attitude towards journalists that are critical of government institutions, have led to the deterioration of the country's once-vibrant media environment and paved the way for continued threats to press freedom.

The research study by Reporters Without Borders (RSF) and Freedom Network looked at a number of factors when assessing risks to Pakistan's media pluralism, including media audience concentration, cross-media ownership concentration, regulatory safeguards, political control over media outlets and net neutrality.

Riaz Haq

@haqsmusings

#Pakistan #media media ownership concentrated in a few hands, aided by lax legal restrictions on cross-media ownership. Top 4 news #television channels in Pakistan (Geo News 24%, ARY News 12%, PTV News 11% and Samaa TV 7%) at the end of 2018 was 68.3%. http://pakistan.mom-rsf.org/en/findings/concentration/ …

Who owns the media in Pakistan| Media Ownership Monitor

Most of the ownership of top 40 – by audience share – news television channels, radio stations, newspapers and news websites in Pakistan are concentrated in only a few hands...

pakistan.mom-rsf.org

3

9:36 AM - Jul 19, 2019

Twitter Ads info and privacy

See Riaz Haq's other Tweets

The report found that the top four television channels, radio stations, newspapers and news websites had over 50 percent of the country’s entire audience share.

In addition, unbridled “cross-media ownership concentration“, which measures concentration across media sectors, has allowed more than 68 percent of market control to stay in the hands of eight media organizations. These organizations (Jang, Express, Dunya, Nawa-i-Waqat, Samaa, Dawn, Dunya, ARY) — and the government — have a significant presence in more than one media sector.

According to the report, the current legal framework does not prevent cross-media ownership and the country's regulatory bodies are accused of failing to ensure a “level playing field” and “fair competition” in the market.

The Pakistan Electronic Media Regulatory Authority (PEMRA), which is responsible for regulating radio, television, and distribution services of electronic media in the country, is often accused of being more of a media content regulator than a media industry regulator. According to the report:

…instead of regulating the industry, the regulators have traditionally concentrated on content monitoring and censoring media on the behest of state institutions and governments”.

In addition, PEMRA only has regulatory control over private-sector media and its ordinance excludes existing and future operations of any government-controlled media. This infrastructure has helped to create an environment where the government has the power to exercise control over the media without many checks.

According to the report, the state influences the functioning of the media market by “discrimination” in the distribution of state advertisements. The state has long remained one of the most important sources of funding for the country’s private broadcast and print media. It generally distributes advertisement on the basis of audience share; however, violations have often been reported with ad volumes being reduced for certain media houses “as a tool of punishment”.

-

Comment by Riaz Haq on August 3, 2019 at 9:57am

-

Modi government freezes ads placed in three Indian newspaper groups

https://www.reuters.com/article/us-india-media/modi-government-free...

India’s government has cut off advertisements to at least three major newspaper groups in a move that executives and an opposition leader said was likely retaliation for unfavorable reports.

Critics have said that freedom of the press has been under attack since Prime Minister Narendra Modi’s government first took office in 2014 and journalists have complained of intimidation for writing critical stories.

Now the big newspaper groups, which have a combined monthly readership of more than 26 million, say they are being starved of government ads worth millions of rupees that began even before Modi was elected to power last month with a landslide mandate.

“There is a freeze,” an executive at Bennett, Coleman & Co that controls the Times of India and The Economic Times, among the country’s biggest English-language newspapers, said. “Could be (because of) some reports they were unhappy with,” the executive said, seeking anonymity because he was not authorized to speak to the press.

Around 15% of the Times group’s advertising comes from the government, the executive said. The ads are mostly government tenders for contracts as well as publicizing government schemes.

The ABP Group, which publishes The Telegraph that has run reports questioning Modi’s record on everything from national security to unemployment, has seen a similar 15 percent drop in government advertisements for around six months, two company officials said.

“Once you don’t toe the government line in your editorial coverage and you write anything against the government, then obviously the only way they can penalize you (is) to choke your advertising supply,” the first ABP official said.

The second ABP official said that there had been no communication from the government, and the company was looking to other sources to plug the gap.

“Press freedom must be maintained and it will be maintained despite these things,” the official said. Both also sought anonymity.

-

Comment by Riaz Haq on January 27, 2022 at 7:12pm

-

Can Pakistan's corrupt media be checked? - Committee to Protect Journalists

by Mazhar Abbas

https://cpj.org/2012/06/can-pakistans-corrupt-media-be-checked/

This corruption within the media is spreading like a cancer, and there seems to be no antidote. If it is not checked, it could prove fatal for the media industry. We must take steps to address this problem ourselves. If not, Pakistan’s journalists could lose the credibility they have earned from years of struggle.

-

Comment by Riaz Haq on January 27, 2022 at 7:13pm

-

Not 'Lifafa', Pakistani media has a new name: 'Basket Journalists'. Thanks to a leaked audio

https://theprint.in/go-to-pakistan/not-lifafa-pakistani-media-has-a...

New Delhi: A new leaked audio between Pakistan Muslim League (N) Vice President Maryam Nawaz and party leader Pervaiz Rashid is fuelling the Pakistani public’s anger towards the media.

While the politicians can be heard purportedly scheming to control independent media, the audio claims that certain journalists will receive ‘baskets’ from former prime minister Nawaz Sharif. The ‘aam aadmi’ of Pakistan now have a new name for those who are betraying public trust: ‘Bas

-

Comment by Riaz Haq on January 27, 2022 at 7:15pm

-

Journalist Saleem Safi accuses #PMLN and #NawazSharif of corrupting #Pakistan #media with "Lifafa" (Checkbook) #Journalism in #Pakistan. #Lifafa #corruption https://youtu.be/YoqA_W0qJ8o via @YouTube

-

Comment by Riaz Haq on February 11, 2023 at 8:22pm

-

Ad revenue in Pakistan

https://aurora.dawn.com/news/1144596#:~:text=OOH%20ad%20revenue%20i...(5%25).

Total Ad Revenue Rs. 88.73 billion in 2021-22

Total ad spend (revenue) has increased by Rs 13.09 (17%); in FY 2020-21, it increased by 17.04 (29%).

---------

In FY 2020-21, the combined revenues of Facebook, Google and YouTube accounted for 85% of the total ad spend on digital; this year, they account for 87%.

----------

TV ad revenue increased by Rs 4.64 billion (14%).

Digital ad revenue increased by Rs 3.15 billion (19%).

Print ad revenue increased by Rs 0.21 billion (2%).

OOH ad revenue increased by Rs 3.7 billion (44%).

Brand Activation/POP ad revenue increased by Rs 1.26 billion (50%).

Radio ad revenue increased by Rs 0.07 billion (5%).

Cinema ad revenue increased by Rs 0.06 billion (60%).

TV percentage share decreased by 1.4.

Digital percentage share increased by 0.27.

Print percentage share decreased by 2.19.

OOH percentage share increased by 2.51.

Brand Activation/POP percentage share increased by 0.93.

Radio percentage share decreased by 0.17.

Cinema percentage share increased by 0.05.

------

TV percentage share decreased by 1.4.

Digital percentage share increased by 0.27.

Print percentage share decreased by 2.19.

OOH percentage share increased by 2.51.

Brand Activation/POP percentage share increased by 0.93.

Radio percentage share decreased by 0.17.

Cinema percentage share increased by 0.05.

-----------------

Compared to FY 2020-21, the rankings of the Top Three newspapers remain the same.

Most newspapers have registered slight increases in their revenues.

-------

Compared to FY 2020-21, the Top Five channels have retained their positions.

In FY 2020-21, Radio Awaz Network was #7; this year it is #9.

In FY 2020-21, FM 105 was #9; this year it is #7.

-----------

Compared to FY 2020-21, the rankings of the Top Seven channels remain unchanged.

In FY 2020-21, PTV Home was #8 and Samaa was #9. This year, their positions are inverted.

In FY 2020-21, PTV Sports was #14. This year, it is #10.

-------

In FY 2020-21, the combined revenues of Facebook, Google and YouTube accounted for 85% of the total ad spend on digital; this year, they account for 87%.

-------------

Compared to FY 2020-21, the rankings of Lahore (#1), Karachi (#2) and Hyderabad (#8) remain the same.

In FY 2020-21, Rawalpindi, Faisalabad, Gujranwala, Islamabad and Multan were #3, #4, #5, #6 and #7, respectively. This year, they are #4, #5, #7, #3 and #6.

---------

Product categories that were introduced this year are Real Estate (#1) and Retail/Online (#5).

In FY 2020-21, Beverages, FMCGs and Telecoms were #1, #2 and #3, respectively. This year they are #2, #3 and #4.

In FY 2020-21, Fashion and Electronic Appliances were #4 and #5 respectively. This year, they are #6 and #7.

----------

Compared to FY 2020-21, the rankings of all the elements remain the same.

-

Comment by Riaz Haq on February 12, 2023 at 10:42am

-

TV Viewership Trends

FY 2021-22

https://aurora.dawn.com/news/1144667/tv-vieweship-trends-fy-2022-23

Compared to the previous fiscal year, the average number of viewership hours decreased by 14%.

Viewership ranges between 3.3 and 2.7 hours a day; it is highest in Karachi (3.3 hours) and lowest in Non-Metro Punjab and Urban Balochistan (2.7 hours).

Compared to the previous fiscal year, viewership has decreased across Pakistan, except in Non-Metro Sindh.

Entertainment channels (40%), unmatched channels (26%), and news channels (19%) have the highest market share. Last year, unmatched channels had the highest share (40%), followed by entertainment channels (36%) and news channels (14%), respectively.

All Genres:

Viewership has decreased among all SECs:

SEC A: Viewership has decreased by 13%.

SEC B: Viewership has decreased by 12%.

SEC C: Viewership has decreased by 9%.

SEC D: Viewership has decreased by 15%.

SEC E: Viewership has decreased by 19%.

Viewership is highest in SEC E; this was the case last year.

Entertainment Channels:

Viewership has increased or decreased among most SECs:

SEC A: Viewership has increased by 2%.

SEC B: Viewership has decreased by 3%.

SEC C: Viewership has increased by 1%.

SEC D: Viewership has decreased by 9%.

SEC E: Viewership has decreased by 9%.

Viewership is highest in SEC C; last year it was highest in SEC E.

Unmatched Channels:

Viewership has decreased among all SECs:

SEC A: Viewership has decreased by 49%.

SEC B: Viewership has decreased by 47%.

SEC C: Viewership has decreased by 38%.

SEC D: Viewership has decreased by 45%.

SEC E: Viewership has decreased by 41%.

Viewership is highest in SEC E; this was the case last year.

News Channels:

Viewership has increased among all SECs:

SEC A: Viewership has increased by 15%.

SEC B: Viewership has increased by 17%.

SEC C: Viewership has increased by 17%.

SEC D: Viewership has increased by 35%.

SEC E: Viewership has increased by 11%.

Viewership is highest in SEC B; this was the case last year.

Children's channels:

Viewership has increased or stayed the same among most SECs:

SEC A: No change

SEC B: No change

SEC C: Viewership has increased by 22%

SEC D: Viewership has increased by 12%

SEC E: Viewership has decreased by 8%

Viewership is highest in SEC E; this was the case last year.

Sports Channels:

l Viewership has increased among all SECs:

SEC A: Viewership has increased by 167%.

SEC B: Viewership has increased by 120%.

SEC C: Viewership has increased by 100%.

SEC D: Viewership has increased by 150%.

SEC E: Viewership has increased by 125%.

l Viewership is highest in SEC B; last year it was the highest in

SECs B and C.

Movie Channels:

Viewership has stayed the same among most SECs:

SEC A: No change.

SEC B: No change.

SEC C: No change.

SEC D: No change.

SEC E: Viewership has decreased by 33%.

Viewership is highest in SECs B, C, D and E; last year it was the highest in SEC E.

Regional Channels:

Viewership has decreased or stayed the same among all SECs:

SEC A: No change.

SEC B: Viewership has decreased by 50%.

SEC C: No change.

SEC D: Viewership has decreased by 50%.

SEC E: No change.

Viewership is highest in SEC E; Last year, it was the highest

in SECs C, D and E.

Cooking Channels:

Viewership has stayed the same compared to the previous year.

Music Channels:

Viewership has decreased or stayed the same among

most SECs:

SEC A: Viewership has decreased by 33%.

SEC B: No change.

SEC C: No change.

SEC D: Viewership has decreased by 50%.

SEC E: No change.

Viewership is highest in SEC A; this was the case last year.

Religious Channels:

Viewership has decreased in all SECs by 100%.

NB:

Figures in this section are based on data collected from Medialogic’s Hybrid Panel which covers 100+ cities and towns and 3,000+ reported households.

Cable penetration in Pakistan’s urban areas stands at 97%.

The data is primarily based on urban regions in Pakistan, and the target audience is limited to C&S individuals only

Numbers have been rounded up in certain instances.*

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network