PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Insatiable Appetite For Energy

Pakistan's consumption of oil and gas has rapidly grown over the last 5 years, an indication of the nation's accelerating economic growth. Pakistan is among the fastest growing LNG markets, according to Shell 2017 LNG report.

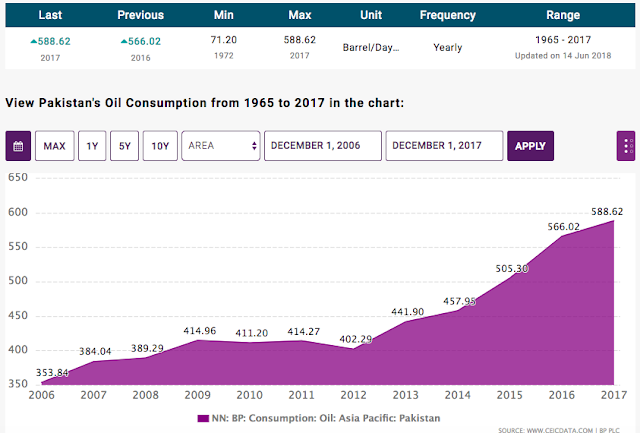

Pakistan Oil Consumption in Barrels Per Day. Source: CEIC.com |

Oil consumption in Pakistan has shot up about 50% from 400,000 barrels per day in 2012 to nearly 600,000 barrels per day in 2017. During the same period, Pakistan's gas consumption has risen from 3.5 billion cubic feet per day to nearly 4 billion cubic feet per day, according to British Petroleum data.

Pakistan is among the fastest growing LNG markets, according to Shell 2017 LNG report. The country has suffered a crippling energy shortage in recent years as demand has risen sharply to over 6 billion cubic feet per day, far outstripping the domestic production of about 4 billion cubic feet per day. Recent LNG imports are beginning to make a dent in Pakistan's ongoing energy crisis and helping to boost economic growth. Current global oversupply and low LNG prices are helping customers get better terms on contracts.

Pakistan Gas Consumption in Billions of Cubic Feet Per Day. Source:... |

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy has become the life-blood of modern economies. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era.

Every modern, industrial society in history has gone through a 20-year period where there were extremely large investments in the energy sector, and availability of ample electricity made the transition from a privilege of an urban elite to something every family would have. It seems that Pakistan is beginning to recognize it. If Pakistan wishes to join the industrialized world, it will have to continue to do this by having a comprehensive energy policy and making large investments in the power sector. Failure to do so would condemn Pakistanis to a life of poverty and backwardness.

Pakistan is heavily dependent on energy imports to drive its economy. These energy imports put severe strain on the country's balance of payments and forces it to repeatedly seek IMF bailouts.

Pakistan needs to develop export orientation for its economy and invest more in its export-oriented industries to earn the hard currencies it needs for essential imports including oil and gas. At the same time, Pakistan is stepping up its domestic oil and gas exploration efforts. American energy giant Exxon-Mobil has joined the offshore oil and gas exploration efforts started by Oil and Gas Development Corporation (OGDC), Pakistan Petroleum Limited (PPL) and Italian energy giant ENI.

Related Links:

Pakistan Oil and Gas Exploration

US EIA Estimates of Oil and Gas in Pakistan

Pakistan Among Fastest Growing LNG Markets

Methane Hydrate Release After Balochistan Quake

-

Comment by Riaz Haq on January 11, 2020 at 7:24am

-

Pakistan Energy Mix: Overview of Gas Sector (Upstream)

Pakistan imports almost 80% of its energy sources (oil, gas and LNG). GVS brings out a detailed report on Pakistan’s upstream sector to analyze country’s mammoth challenges. It examines how innovative policy making, better management and vision can still make a difference.

https://www.globalvillagespace.com/pakistan-energy-mix-overview-of-...

The country used 28.1 million TOE of petroleum products in FY18, with 85 percent imported. Currently, Pakistan has a total of 9 million gas consumers in the country, with an annual addition of 0.5 million consumers. Sindh by far has the country’s largest gas production at 943,644 MCFt (65%), Balochistan at 310,535 MCFt (22%), KPK at 151,178 MCFt (10%), and Punjab 53,580 MCFt (3%).

Sindh also has three of the current largest fields producing gas, Mari, Qadirpur, and Kandhkot. Sui gas field in Balochistan, discovered in 1952, was Pakistan’s first and largest gas field found so far, had around 13 TCF of gas. It currently only has one TCF remaining and is nearing the completion of its life. These five fields represent over 50 percent of Pakistan’s recoverable reserves.

Gas Consumption

Pakistan has experienced major energy crises in the past decade as a result of expensive fuel sources, suffering from chronic natural gas shortages in the winter and electricity shortages in the summer, all exacerbated by the circular debt, and insufficient transmission and distribution systems over the past several years.

Roughly, 50 percent (about 105 million people) of Pakistan’s population still use biomass for cooking because of low electricity and gas supply. Natural gas plays a significant role in the energy matrix of Pakistan. In 2018, natural gas accounted for an estimated 30 percent of Pakistan’s primary energy consumption, petroleum at 35 percent, and coal at 16 percent.

Pakistan is the 20th largest gas consumer of the world, with an established natural gas industry since the 1950s. However, ironically Pakistan’s gas consumption is nearly the same as in France, which is a developed and industrialized country [with a GDP ten times bigger than Pakistan].

Natural gas consumption has increased from 1,377,307 MMCFt to 1,454,697 MMCFt. RLNG imports have increased to 313,902,345 MMBtu. There was a time when Pakistan was self-sufficient in gas. However, increased domestic demand over time, fueled by cheap mispricing of the natural resource, creation of the CNG motor vehicle industry, lack of alternative fuels, and diminishing production have resulted in increased amounts of imported gas.

In FY18, approximately 7.7 million TOE LNG gas was imported. Currently, Pakistan has over 9 million domestic consumers of gas, and these are growing by over 8% each year. The majority of domestic consumers, around 5.4 million, are based in Punjab; that account for 60 percent of the total domestic gas consumers, Sindh has 35 percent of the country’s domestic consumers at 2.6 million.

-

Comment by Riaz Haq on April 15, 2020 at 5:04pm

-

The primary energy supply amounts to over 70 million Tonnes of Oil Equivalent (TOE) (70X7.33=513 million barrels). Oil and gas are by far the dominating sources with a share of 80%. Oil is imported from the Middle East mainly Saudi Arabia, gas from Iran. In addition, Pakistan is consuming Liquefied National Gas (LNG), Liquefied Petroleum Gas (LPG) and coal. Pakistan has currently, 4 power plants with a total capacity of 755 MW; additional 3 are under construction.[4] Nuclear power accounts for around 1.9% of the total installed capacity in Pakistan.[5] Hydropower has a share of 13% whereas other renewable energies only play a minor role.

https://energypedia.info/wiki/Pakistan_Energy_Situation

The government is supporting the use of LPG for cooking resulting in rapid investment in production, storage and establishment of auto stations of LPG. During the FY 2016, an approximate investment of PKR 2.38 billion has been made in the LPG supply infrastructure whereas total investment in the sector until Feb 2016 is estimated at about PKR 22.33 billion. During the FY 2016, the regulatory body OGRA has issued 12 licenses for operational marketing of storage and filling plants, 37 licenses for construction of LPG storage and filling plants, 20 licenses for Construction of LPG auto-refuelling stations and one license for storage and refuelling of LPG was issued. Further, one license for construction of production and storage of LPG facility is also issued by OGRA which shall result in improving supply and distribution of LPG as well as create job opportunities in the sector.[4]

-

Comment by Riaz Haq on June 29, 2020 at 7:19am

-

#Pakistan's Energas seeks approval to start spot #LNG imports of liquified natural #gas cargoes from July as the country looks to buy cargoes from the spot market to plug its #energy deficit. Energas looking to partner with ExxonMobil for imports. https://www.spglobal.com/platts/en/market-insights/latest-news/natu...

Cities like Karachi are facing severe power shortages. Consumers are subject to power cuts, ranging from two to eight hours every day, as power producers claim to be short of gas and furnace oil supplies, Khan said.

"According to our estimates, the current shortfall of gas for power generation in Karachi and other major cities in Pakistan would range between 200 MMcf/d to 300 MMcf/d", he added.

Khan said industrial power demand has picked up sharply as the lockdown, which was imposed some time back in a bid to fight the spread of the coronavirus, ended.

"The private sector has the ability to secure prompt supplies of molecules [LNG], whereas the government has to follow a set procedure of tendering that can take a minimum of 45 days to 60 days," Khan said.

He said the government has asked power projects to produce electricity on diesel due to a shortage of gas in the country. If private companies were allowed to secure LNG on a prompt basis, they could pass on significant cost benefits to end consumers.

"In today's market, power generation on diesel would cost Pakistani Rupees 18/unit while we would be able to produce electricity at about 60% less – Rupees 8/unit to be specific," Khan said.

Pakistan currently has two operational LNG terminals – Elengy Terminal, having a capacity of 600 MMcf/d, and Gasport Pakistan Ltd., also having a capacity of 600 MMcf/d. The government currently pays $500,000/d in capacity charges on a use-it-or-lose-it basis.

"Construction of more terminals would allow for greater competition but in my personal opinion, the country needs one or two additional terminals. The objective should be to support development of larger terminal capacity for current operational needs and future demand growth", Khan said.

With Pakistan turning to be one of the fastest growing LNG markets since it first started importing in 2015, with imports rising to 8.4 million mt in 2019 from 6.8 million mt in 2018, analysts say there is an urgent need to speed up import capacity expansions, which have been planned to absorb incremental inflows.

S&P Global Platts Analytics forecasts LNG imports to rise to 9.3 million mt in 2021, if Pakistan can bring in another FSRU relatively quickly. Imports are expected to exceed 17 million mt by 2025.

-

Comment by Riaz Haq on July 21, 2020 at 7:54am

-

#Pakistan confirms large #oil-#gas discovery in #KPK. Pakistan imports 80% of its oil-gas needs costing $13 billion a year. Pakistan's total oil production is 89,000 barrels per day & 3,936 million cubic feet per day (mmcfd). Annual demand is rising 8%. https://gn24.ae/a2e28c2962dc000

Pakistan has discovered new deposits of oil and gas in the Kohat district of Khyber-Pakhtunkhwa province.

The discovery was reported by state-owned firm, Pakistan Oilfields Ltd. (POL), at the exploratory well in Tal Block, Mamikhel South-01. Tal Block is considered one of the largest hydrocarbon producing blocks in the country.

“Well test has shown 3,240 barrels of condensate per day, 16.12 mmscf (million standard cubic feet) of gas per day, and 48 barrels of water per day,” POL announced in a notification on Pakistan Stock Exchange (PSX). “Actual production may differ significantly from the test results.”

POL holds 21 per cent stake in the Tal Block while Pakistan Petroleum Ltd. (PPL) and Oil and Gas Development Company (OGDC) each own 28 per cent.

MOL Pakistan, a fully owned subsidiary of Hungarian multinational oil and gas exploration firm MOL Group and which has about 8.4 per cent in the Tal Block also shared the news of “significant” gas and condensate reserves in Pakistan.

“I am delighted to announce that we have made another discovery in Pakistan,” Berislav Gaso, MOL Group’s exploration and production Executive Vice-President, said. “This new discovery has de-risked an exploration play in deeper reservoir in the Tal Block, leading to new upside opportunities. The Mamikhel South-1 discovery will also help to improve the energy security of the country from indigenous resources.”

PROMISE OF MUCH MORE

The Mamikhel South-1 exploratory well in the Tal Block, achieved a flow rate of 6,516 barrels of oil equivalent per day during testing, the company said. This marks MOL’s 13th discovery in Pakistan and the 10th discovery in the Tal Block. MOL is one of the key LPG and gas producers in Pakistan.

The current discovery comprises about 15 per cent and 5 per cent of Tal Block’s present total oil and gas production respectively, reports suggest. Mamikhel South is soon expected to be added to production due to its proximity to another field.

Experts have welcomed the news of recent discovery, but also called for the exploitation of unconventional oil and gas assets - such as shale oil and shale gas - as well as inviting foreign companies to boost the country’s oil and gas sector.

Pakistan relies on imports for about 80 per cent of its energy requirements, spending nearly $13 billion a year on crude oil and gas. The country’s total oil production stands at 89,000 barrels per day (bpd) and 3,936 million cubic feet per day (mmcfd). Demand is increasing by 8 per cent a year.

-

Comment by Riaz Haq on July 21, 2020 at 8:26am

-

#DiamerBhashaDam, world's tallest dam at 272 meters, will change #Pakistan's destiny by addressing its #energy & #water problems. Located in #GilgitBaltistan, it will store 6.4 million acre-feet of water, generate 4,500 MW of cheap #renewable #electricity https://global.chinadaily.com.cn/a/202007/20/WS5f14f269a31083481725...

Project, to be ready in 2028, expected to meet water, energy needs in Gilgit-Baltistan region

A new mega project in northern Pakistan is expected to meet both water and energy needs of the region, according to officials and experts.

Work on the construction of Diamer Bhasha Dam near Chilas, a city in the Diamer district in the Gilgit-Baltistan region, has started.

"Diamer Bhasha Dam is set to change the destiny of Pakistan by addressing its energy and irrigation problems," Faisal Vawda, Pakistan's federal minister for water resources, said. "It's Pakistan's lifeline."

The dam's reservoir will be 272 meters in height, and it is said to be the tallest roller compact concrete dam in the world.

Roller compacted concrete is a special blend of concrete that has the same ingredients as conventional concrete but in different ratios, and with a partial substitution of fly ash for Portland cement. This reduces thermal loads on the dam and reduces chances of thermal cracking.

The dam has a proposed spillway with 14 gates and five outlets for flushing out silt. The diversion system comprises two tunnels and a diversion canal. It will also include the construction of powerhouses.

Asim Saleem Bajwa, chairman of China-Pakistan Economic Corridor Authority, said the dam will generate 4,500 megawatt of hydroelectric power.

It was a historic moment as Prime Minister Imran Khan kicked off the construction work on Diamer Bhasha Dam, he said. "Around 16,000 jobs will be created during the construction of the dam."

Imran Khan officially launched the construction work on Wednesday, with Pakistan's Chief of Army Staff Qamar Bajwa by his side.

The biggest

"Diamer Bhasha Dam will be the biggest dam in Pakistan's history," the prime minister said while addressing the public during the launch. "The dam will benefit the country both economically and environmentally, especially the people of Gilgit-Baltistan," he said.

The multibillion-dollar project is estimated to be completed in 2028. It is a multipurpose project that will be used for water storage, flood mitigation, irrigation and power generation.

"This is no ordinary project. There is a reason why both Pakistan's prime minister and the army chief were present at the site for the project launch. It will have an impact on Pakistan's economy, security and politics," said Ahmed Quraishi, a senior fellow at Project Pakistan 21, an independent research organization based in national capital Islamabad.

Feather in the cap

It is another feather in the cap for the Chinese engineers who are known for undertaking challenging international projects, he said.

The project is being jointly constructed by Power China and Pakistan's Frontier Works Organization.

The Water and Power Development Authority of Pakistan approved the award of civil works for construction of the dam and the 21-MW Tangir Hydropower Project to the joint venture partners.

The two companies signed a contract in June with a local company for the construction of the diversion system, main dam and access bridge as well as the hydropower project.

"We are grateful to our all-weather friend China for its support in the construction of the mega project," said Faisal Vawda, the water resources minister.

Quraishi said the technical specifications of the project suggest it will be something that engineers worldwide will be studying due to the region's terrain. "China's experience in the dam construction is unparalleled," he said.

-

Comment by Riaz Haq on November 18, 2020 at 6:27pm

-

#Pakistan, #Russia agree to raise #Islamabad’s share in equity of NSGP to 76%. Planned 1,100 Km North-South Gas #Pipeline from #Karachi will transport 1.6 billion cubic feet of re-gasified #LNG per day with a diameter of either 52 inches or 56 inches. https://nation.com.pk/19-Nov-2020/pakistan-russia-agree-to-increase...

Earlier, it was planned that the entire project will be executed with Russian funding, but after Supreme Court decision on the GIDC, the government of Pakistan has decided to provide maximum funding to the project. Now it has been decided that Pakistan’s share in the equity will increase to 76 percent while the Russian share will be 24 percent, said the source. Similarly, initially it was proposed that the pipeline of 1,100 kilometres was to be laid with a diameter of 42 inches with capacity to transport 1.2 billion cubic feet RLNG per day, however now Pakistan wants to increase of the pipeline to 1.6 bcfd with a diameter of either 52 inches or 56 inches.

The Russian delegation comprised of representatives from Ministry of Energy of Russian Federation, Embassy of Russian Federation in Pakistan and other Russian companies and corporations. The Pakistani side included representation from Ministry of Energy (Petroleum Division) of Pakistan, Ministry of Foreign Affairs, and Law and Justice Division and Inter State Gas Systems (Private) Limited. The talks were also attended by Minister for Energy and Special Assistant to Prime Minister on Petroleum.

--------

Pakistan and Russia have agreed to increase Islamabad’s share in the equity of North South Gas Pipeline (NSGP) (renamed to Pakistan Stream Gas Pipeline) to 76 percent while Moscow will fund 24 percent.

Similarly, it has also been agreed to rename the project from North South Gas Pipeline Project to Pakistan Stream Gas Pipeline (PSGP) Project.

The final approval to the proposed amendments in the inter-governmental agreement (IGA) on North South Gas Pipeline (NSGP) will be given in the 8th session of Pakistan-Russia JCC on NSGP project in December, official source told The Nation.

The Ministry of Energy (Petroleum Division) of Pakistan and Ministry of Energy of the Russian Federation held first Russia-Pakistan Technical Committee meeting from 16th to 18th November 2020 here on mutual cooperation for the development of North South Gas Pipeline Project.

Both sides agreed to sign a protocol for amendment in the Inter-Governmental Agreement (IGA) earlier signed in 2015 between both the governments to reflect the revised implementation structure of the project after requisite approvals from respective governments. The parties agreed in principle to implement the project through a special purpose company to be incorporated in Pakistan by Pakistan and Russian parties, wherein Pakistan will have the majority shareholding.

-

Comment by Riaz Haq on June 16, 2021 at 8:45am

-

#Pakistan #fuel demand to rise further in fiscal 2021-22 after record sales of 731,000 mt (million tons) in May 2021, up from 637,000 mt a year earlier in 2020 & 671,000 mt in April 2021. It's driven by #automobile ownership, #economy & #transport sector http://www.spglobal.com/platts/en/market-insights/latest-news/oil/0...

Pakistan's oil product imports over July 2020-April 2021 surged 26% year on year to 11.371 million mt, Pakistan Bureau of Statistics data showed.

"Due to rising industrial activity and normalization of consumerism [after COVID-19 lockdowns], we expect petroleum sales to remain on higher ground," Topline Securities analyst Shankar Talreja told S&P Global Platts.

Rising industrial activity was boosting diesel sales, while gasoline sales were strong amid an easing of COVID-19 lockdown measures, said senior investment analyst Shahrukh Saleem at AKD Securities, a Karachi-based brokerage house.

Retail prices low

The main driver of continued growth in motor fuel demand will be low retail tax rates on gasoline and diesel, which have kept prices for oil products in Pakistan low by international standards, market sources said.

Taxes on the retail pump prices of diesel and gasoline were lowered in fiscal 2020-21 to Pakistan Rupees 8.86/liter and Rupees 4.47/liter respectively from Rupees 30/liter for each earlier.

As a result, tax revenue from petroleum product sales fell to Rupees 369 billion over July 2020-March 2021 from the Rupees 460 billion forecast before the tax cut, and the average pump price of motor fuels rose just 8% over June 2020-May 2021, significantly trailing the sharp spike in motor fuel prices elsewhere in Asia over the same period

The price of FOB Singapore 92 RON gasoline, the most liquid gasoline benchmark in Asia, more than doubled from $36.36/b in June 2020 to $74.69/ mt in May 2021, Platts data showed

"The government is expected to continue providing stimulus to different sectors to support growth," Saleem said. "We expect the consumption of petroleum products to increase by 7% during the next fiscal year where retail fuels are expected to take the lead, increasing by 10%," he added.

Lending support

Pakistan's motor fuel demand will also receive support indirectly from expansionary economic policies and higher automobile ownership.

The government has set an economic growth target for fiscal 2021-22 of 3.94%, sharply higher than the contraction of 0.4% reported in fiscal 2020-21.

"The government is expected to continue providing stimulus to different sectors to support growth," Saleem said.

"With the increase in automobile sales and expansion in economic activities, we expect demand for petroleum products to remain high," said Yousuf Saeed, head of research at Darson Securities.

"The sales of petrol were up due to tremendous growth in auto and two wheeler sales, by 54% [to 151,951 units ] and 34% [to 1.587 million units] respectively in the 10 months of the fiscal year from July 2020 to April 2021," said Fahad Rauf, head of sales at Ismail Iqbal Securities in Karachi.

-

Comment by Riaz Haq on June 24, 2021 at 7:02pm

-

PARCO OIL PIPELINE NETWORK in PAKISTAN:

https://www.parco.com.pk/our-business/transportation/pipeline-network/

PARCO’s cross-country network of pipelines, including those of its subsidiary – PAPCO, starts from Karachi and goes up to Machhike near Lahore, covering over 2000 kilometres. These pipelines have played a major contribution in protecting the environment of our country and reducing congestion on the roads by substituting thousands of tank lorries. As this silent river of fluid energy flowing underground, much of the noise, fatalities and pollution on the surface, thefts and contamination of the product have become a thing of the past.

KARACHI-MAHMOODKOT (KMK) PIPELINE

The 870-km Karachi-Mahmoodkot (KMK) Pipeline, commissioned in 1981, transports crude from Karachi to Mahmoodkot near Multan for its Mid Country Refinery. Its initial annual pumping capacity of 2.9 million tons has been upgraded and KMK is now capable of pumping up to 6 million tons per year.

MAHMOODKOT- FAISALABAD–MACHHIKE (MFM) PIPELINE

PARCO commissioned 362-km Mahmoodkot- Faisalabad–Machhike (MFM) Pipeline, in 1997 to transport refined products like diesel and kerosene to Faisalabad and Machhike near Lahore. MFM has designed pumping capacity of approximately 3.7 million tons per year.

WHITE OIL PIPELINE

The US$ 480 million, White Oil Pipeline is the mega infrastructure project owned by Pak Arab Pipeline Company Limited (PAPCO). After conversion of PARCO’s existing pipeline network for Crude Oil transportation, the White Oil Pipeline (WOP) is catering to transport diesel to the central regions of Pakistan; which account for almost 60% of the total Petroleum consumption in the country.

For the implementation of the 786 km White Oil Pipeline Project (WOPP) from Karachi to Mahmoodkot, a joint venture company, Pak-Arab Pipeline Company Ltd. (PAPCO) was created. PARCO holds a 51% majority share in PAPCO while Shell, PSO and TOTAL PARCO Marketing Limited hold 26%, 12% and 11% shares in equity respectively. The 26” dia White Oil Pipeline is designed for a capacity of 12 million tons per year, starting with 5 million tons in the initial years.

KORANGI-PORT QASIM LINK (KPLP) PIPELINE

The 22-km Korangi-Port Qasim Link (KPLP) Pipeline was laid by PAPCO, linking PARCO’s Korangi station with PAPCO’s Port Qasim station was commissioned in 2006. This tactical link has connected both the Karachi ports (Keamari & Port Qasim) with PARCO & PAPCO pipeline systems, providing flexibility in pipeline operations to receive crude as well as product from either port.

PARCO’s Pipeline System includes a network of highly sophisticated Telecommunication facilities and a comprehensive Supervisory Control And Data Acquisition (SCADA) System.

PARCO’s pipeline network is a critical and efficient life support system for the Central and Northern areas of the country. In addition to its strategic nature, it is contributing to the national exchequer not only through payment of attractive dividends, taxes and import duties but also by delivering major savings in freight expenses.

-

Comment by Riaz Haq on June 24, 2021 at 7:03pm

-

Pakistan’s Gwadar loses lustre as Saudis shift $10bn deal to Karachi

https://www.ft.com/content/88cfe78b-517f-41d9-97d1-9f7f540f517c

Saudi Arabia has decided to shift a proposed $10bn oil refinery to Karachi from Gwadar, the centre stage of the Belt and Road Initiative in Pakistan, further supporting the impression that the port city is losing its importance as a mega-investment hub. On June 2, Tabish Gauhar, the special assistant to Pakistan’s prime minister on power and petroleum, said that Saudi Arabia would not build the refinery at Gwadar but would construct it along with a petrochemical complex somewhere near Karachi. He added that in the next five years another refinery with a capacity of more than 200,000 barrels a day could be built in Pakistan. Saudi Arabia signed a memorandum of understanding to invest $10bn in an oil refinery and petrochemical complex at Gwadar in February 2019, during a visit by Crown Prince Mohammad Bin Salman to Pakistan. At the time, Islamabad was struggling with declining foreign exchange reserves.

The decision to shift the project to Karachi highlights the infrastructural deficiencies in Gwadar.

A Pakistani official in the petroleum sector told Nikkei Asia on condition of anonymity that a mega oil refinery in Gwadar was never feasible. “Gwadar can only be a feasible location of an oil refinery if a 600km oil pipeline is built connecting it with Karachi, the centre of oil supply of the country,” the official said. There is currently an oil pipeline from Karachi to the north of Pakistan, but not to the east.

“Without a pipeline, the transport of refined oil from Gwadar [via road in oil tankers] to consumption centres in the country will be very expensive,” the official said. He added that at the current pace of development he did not see Gwadar’s infrastructure issues being resolved in the next 15 years.

The official also hinted that Pakistan’s negotiations with Russia for investment in the energy sector might have been a factor in the Saudi decision. In February 2019, a Russian delegation, headed by Gazprom deputy chair Vitaly A Markelov, agreed to invest $14bn in different energy projects including pipelines. So far these pledges have not materialised, but Moscow’s undertaking provided Pakistan with an alternative to the Saudis, which probably irritated Riyadh.

Arif Rafiq, president of Vizier Consulting, a New York-based political risk firm, told Nikkei that a Saudi-commissioned feasibility study on a refinery and petrochemicals complex in Gwadar advised against it. “Saudi interest has shifted closer to Karachi, which makes sense, given its proximity to areas of high demand and existing logistics networks,” he added.

Rafiq, who is also a non-resident scholar at the Middle East Institute in Washington, considers this decision by the Saudis as a setback for Gwadar, the crown jewel of the China-Pakistan Economic Corridor, the $50bn Pakistan component of the Belt and Road.

The Saudi decision “is a setback for Pakistan’s plans for Gwadar to emerge as an energy and industrial hub. Pakistan has struggled to find a viable economic growth strategy for Gwadar,” he said. Any progress in Gwadar in the coming decade or two will be slow and incremental, he added.

Local politicians consider the shifting of the oil refinery a huge loss for economic development in Gwadar. Aslam Bhootani, the National Assembly of Pakistan member representing Gwadar, said the move is a loss not only for Gwadar but for all of the southwestern province of Balochistan. He said he would urge the Petroleum Ministry of Pakistan to ask the Saudis to reconsider their decision.

The decision has shattered the image of Gwadar as an up-and-coming major commercial hub. In February 2020, the Gwadar Smart Port City Masterplan was unveiled, forecasting that the city’s economy would surpass $30bn by 2050 and add 1.2m jobs. Local officials started calling Gwadar the future “Singapore of Pakistan”.

-

Comment by Riaz Haq on June 24, 2021 at 7:29pm

-

Pakistan has a well-developed and integrated infrastructure for the transmission and

distribution of natural gas.

https://www.adb.org/sites/default/files/linked-documents/48307-001-...

Its natural gas pipeline system is about 145,633 kilometers (km) long,

of which 134,489 km are distribution pipelines and 11,144 km are high-pressure transmission

lines (footnote 5). Transmission and distribution of natural gas in the northern and central

regions of Pakistan is undertaken by Sui Northern Gas Pipelines Limited (SNGPL)6 while

Sui Southern Gas Company Limited (SSGC) covers the southern region of Pakistan where the

project is located (footnote 6).

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network