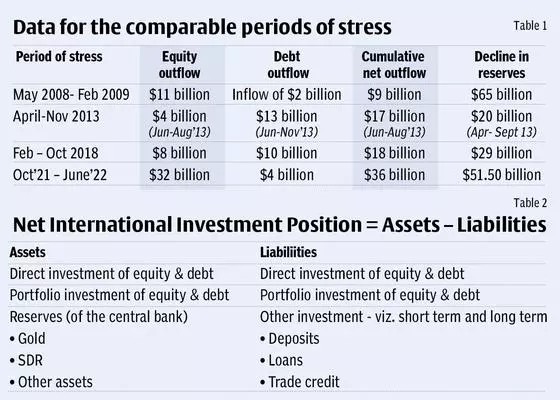

India has witnessed outflows of $29 billion in 2022 YTD ($27 billion in equity and $2 billion in debt). Alongside, India’s foreign exchange reserves have declined from a peak of $642 billion as of October 29, 2021, to $590.50 billion in June 2022, a fall of $51.50 billion. There seems no stopping these trends in the immediate future.

While the large decline in forex reserves is comparable to that of previous episodes of stress (Table 1), there is an air of comfort that the current level of forex reserves are large enough to cover almost 12 months of imports, whereas in the previous episodes of 2008, 2013 and 2018 it used to be between seven and nine months.

However, the key question is whether the metric of import cover reflects adequacy of reserves? It is prudent to measure the adequacy of reserves with reference to the dynamics that prevails in the accretion of the reserves.

India has had a structural current account deficit which has been funded by capital inflows. It is common knowledge that the accretion of forex reserves has been due to surplus in capital account.

India’s reserves built on net capital surpluses therefore presents a double whammy as reserves have to fund the import bill, with around 27 per cent of imports in value composed of oil, and the constant stream of capital outflows.

Therefore, the use of import cover as a measure of adequacy of reserves is not appropriate in the Indian context and one has to look at the adequacy of reserves from the point of view of International Investment Position or IIP.

What is IIP?

IIP is a summary statement of the net financial position of a country viz. net of, the value of financial assets of residents of an economy that are claims on non-residents and, gold held in reserve assets and liabilities of the residents of an economy to non-residents.

Assets comprise direct and portfolio financial investments of residents outside India plus reserve assets. Liabilities are direct and portfolio investments made by non-residents into India (Table 2). Positive IIP indicates that the country’s assets are more than liabilities while negative IIP means that the country’s liabilities are more than assets.

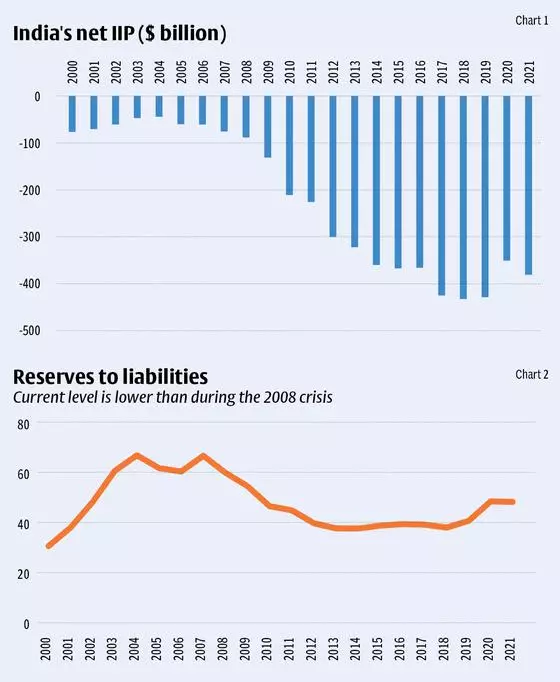

India is a net IIP negative country with its liabilities exceeding assets (Chart 1).

Not robust enough

Looking at the reserves-to-IIP ratio in India, it is observed that the current level is not as robust as it prevailed at the time of the Global Finance Crisis of 2008. In addition, a look at the reserves to liabilities ratio shows that it has been steadily below 50 per cent since 2010 (Chart 2).

Out of $1.3 trillion of liabilities within IIP, as of December 2021, approximately 30 per cent comprises short-term debt and portfolio investments. In absolute terms, outstanding portfolio investments is $277 billion and short-term debt of $110 billion. Which takes the cumulative portfolio and short-term debt to around $390 billion.

Against the backdrop of $591 billion of reserves, it leaves a cushion of $199 billion, which at the current rate of $60-63 billion of imports leaves an import cover around 3.25 months.

Thus, import cover is not an appropriate metric to measure the adequacy of reserves for a country like India. Import cover must be looked in conjunction with IIP which gives a true picture of the adequacy of reserves.

In the present situation, thinking of a robust import cover of reserves alone without taking IIP and liabilities into context indicates “a glass half full”.

The writer is Chairman of SYFX Treasury Foundation. Views are personal

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network