PakAlumni Worldwide: The Global Social Network

The Global Social Network

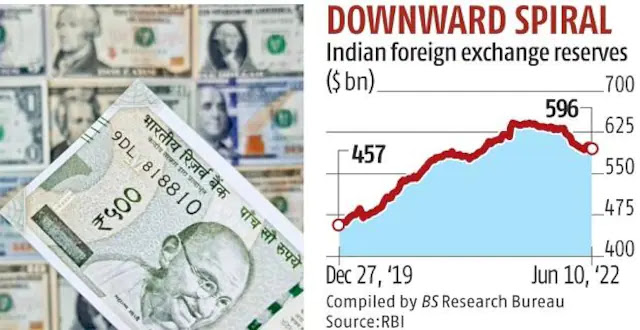

India's Forex Reserves Fall As Foreign Investors Head For The Exits

India's foreign exchange reserves are falling rapidly as foreign investors flee and the country's trade and current account deficits widen. More than $267 billion worth of India's external debt of the total $621 billion is due for repayment in the next nine months. This repayment is equivalent to about 44% of India's foreign exchange reserves. This combination of investors' exodus, widening twin deficits and short-term debt repayments has caused the Indian rupee to hit new lows. Unlike China and other nations that have accumulated large reserves by running trade surpluses, India runs perennial trade and current account deficits. The top contributor to India's forex reserves is debt which accounts for 48%. Portfolio equity investments known as “hot” money or speculative money flows account for 23% of India's forex reserves, according to an analysis published by The Hindu BusinessLine.

|

| India's Declining Forex Reserves. Source: Business Standard |

Investor Exodus:

Foreign portfolio investors have pulled out a whopping $33.5 billion from equity and $2.1 billion from debt segments of Indian financial markets, for a total net outflow of $35.6 billion from October 2021 to June 2022, according to data compiled by the National Securities Depository Limited. In the first half of this calendar year, the total net outflows were $29.7 billion.

It's not just the FPIs leaving India; a number of multinational companies are also pulling foreign direct investment (FDI) from India. Several big names including German retailer Metro AG, Swiss building-materials firm Holcim, US automaker Ford, UK banking major Royal Bank of Scotland, US motorcycle manufacturer Harley-Davidson and US banking behemoth Citibank have chosen to pull the plug on their operations in India or downsize their presence in recent years.

Widening Deficits:

India's finance ministry has warned of a growing twin deficit problem, with higher commodity prices and rising subsidy burden leading to an increase in both the fiscal and current account deficits. India's June trade deficit widened to a record high of $25.63 billion, mainly due to a rise in crude oil and coal imports, from $9.61 billion a year earlier. India's April-May fiscal deficit was $25.8 billion.

Summary:

India's current level of forex reserves is enough for less than 10 months of imports projected for 2022-23. But the country has had a structural current account deficit which has been funded by large capital inflows. The accumulation of forex reserves has been due to surplus in the capital account. Since late February, the foreign exchange reserves have declined by $36 billion. India still has large forex reserves but its economy is in the same boat as other emerging markets that run large and worsening trade and current account deficits. With declining forex reserves, India is likely to face headwinds as the US Federal Reserves raises interest rates to fight inflation.

Related Links:

Haq's Musings

South Asia Investor Review

India in Crisis: Unemployment and Hunger Persist After COVID waves

Food in Pakistan 2nd Cheapest in the World

Western Money Keeps Indian Economy Afloat

Pakistan to Become World's 6th Largest Cement Producer by 2030

How Has India Accumulated Large Forex Reserves Despite Perennial Tr...

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on July 12, 2022 at 6:31pm

-

$4.5b bailout for #Bangladesh: #IMF team to arrive tomorrow amid global #commodity price #inflation. If everything proceeds smoothly, the loan deal could be finalized by October this year https://www.thedailystar.net/news/bangladesh/news/45b-imf-loan-dele...

A delegation from the International Monetary Fund (IMF) is set to arrive in Dhaka tomorrow on a nine-day trip to discuss the government's request for a $4.5 billion loan in the form of budgetary support.

Rahul Anand, division chief in the IMF's Asia and Pacific Department, will lead the team during talks with the senior officials of the finance ministry, the central bank, the National Board of Revenue and the Economic Relations Division.

If everything proceeds smoothly, the loan deal could be finalised by October this year, said an official of the finance ministry yesterday.

The request for budgetary support comes to shore up the precarious foreign currency reserves, which yesterday stood at $39.8 billion -- the lowest since October 14, 2020.

This is enough to cover about five months' import bills.

Typically, the World Bank and the IMF prescribe an import cover of three months, but in times of economic uncertainty, they advise keeping sufficient reserves to meet 8-9 months' imports.

Going forward, even though imports are slowly contracting, the elevated inflation levels around the world mean the odds of a slowdown in both remittance inflows and export orders, two sources of foreign currency for Bangladesh, are high.

The IMF officials will look into the impacts of the Russia-Ukraine war and escalated global commodity prices on the Bangladesh economy, the status of recovery from the global coronavirus pandemic and the government's large subsidy programme.

They will see whether the subsidy spending is justified and compare it with the other countries. If it is deemed excessive, the IMF mission may suggest ways to trim it.

Subsidy spending in the just-concluded fiscal year is Tk 66,825 crore, 24.1 percent more than the original allocation thanks to the spiral in fuel and fertiliser prices in the global market.

In this fiscal year's budget, Tk 82,745 crore has been earmarked for subsidy.

But considering the price trend of oil, gas, and fertiliser in the international market, the estimated spending can be 15-20 per cent higher than the initial estimates, said Finance Minister AHM Mustafa Kamal in his budget speech in June.

The Washington-based multilateral lender could tie in conditions for the loan package.

The conditions could include measures to increase revenue, lower subsidy expenditure, market-based exchange rate and lending rate, and reforms in the banking sector and tax administration, the finance ministry official said.

The government has already moved to tighten its belts though.

It has unveiled a relatively smaller budget for the current fiscal year, put on hold low-priority projects, suspended foreign tours of government officials, adjusted the prices of gas and diesel to some extent, and loosened the exchange rate policy.

The government has also signalled that it may raise the price of fuel oil and has proposed to the Bangladesh Energy Regulatory Commission to increase the electricity tariff to cut the subsidy burden.

Surjit Bhalla, executive director of the IMF for India, Bangladesh, Bhutan and Sri Lanka, who represented Bangladesh on the board of the Washington-based lender, is also set to visit Bangladesh separately.

-

Comment by Riaz Haq on July 13, 2022 at 8:13am

-

#Pakistan Reaches Agreement With #IMF to Resume Loan. $1.2 billion loan disbursement expected in August 2022. #economy https://www.bloomberg.com/news/articles/2022-07-13/pakistan-said-to...

---------

ISLAMABAD: In a major development, Pakistan and the International Monetary Fund (IMF) on Wednesday finally reached a staff-level agreement that revived the $6 billion Extended Fund Facility (EFF) programme for the country, Bloomberg reported.

https://www.thenews.com.pk/latest/973365-pakistan-imf-reaches-staff...

The move comes after the coalition government adhered to all "tough" conditions set by the global lender, including an increase in the price of petroleum products and energy tariffs, among others.

Sources told Geo.tv that the official announcement in this regard is expected soon.

The staff-level agreement will pave way for a $1.2 billion disbursement, which is expected in August.

Bloomberg reported that the disbursal would offer relief to Islamabad as the country's foreign-exchange reserves are depleting so much so that they can only cover less than two months of imports.

In June, Pakistan and the Fund staff achieved substantial progress to strike a consensus on budget 2022-23 after which the IMF shared a draft Memorandum of Economic and Financial Policies (MEFP).

-

Comment by Riaz Haq on July 13, 2022 at 9:25pm

-

Shoaib Daniyal

@ShoaibDaniyal

"Hasina’s internal problems are linked to external dependencies. Politically reliant on New Delhi, she is finding it increasingly difficult to manage the ramifications of India’s turn towards Hindu nationalism..." -

@PaliwalAvihttps://twitter.com/ShoaibDaniyal/status/1547304109115469824?s=20&a...

The ground under Sheikh Hasina’s feet is shifting

With elections in 2023 and debt repayment schedules kicking off in 2024, it seems only a matter of time for the veneer of stability to lose its sheen. The risk of dislocation of this so-called house of cards has only been rising in recent years.

Bangladesh’s foreign minister AK Abdul Momen arrived in India last month to fight political fires. But he found himself dealing with massive floods that hit Sylhet and Assam. Nature has its ways to convey that not all is well in India’s near-east. Far from the glitz about Bangladesh’s economic success, on display during the recent inauguration of the Padma Bridge, clampdown on Islamists, and shrewd management of big power rivalries, is a parallel potent reality of Prime Minister Sheikh Hasina’s authoritarianism, heightened polarisation, and economic distress. As an Indian official mentioned to me, and a Bangladeshi official echoed, Hasina “has built a house of cards”.https://www.hindustantimes.com/opinion/the-ground-under-sheikh-hasi...

-

Comment by Riaz Haq on July 14, 2022 at 7:25am

-

#India’s #economy can’t compete with #China’s — & that should worry #US policymakers. #Biden administration must be alarmed by the recent decisions by several foreign corporations to either pull out of the Indian market or put their long-term plans on hold https://thehill.com/opinion/international/3557750-indias-economy-ca...

BY HUSAIN HAQQANI AND APARNA PANDE

The Biden administration must be alarmed by the recent decisions by several foreign corporations to either pull out of the Indian market or put their long-term plans on hold. The U.S. has, for years, hoped to assist India’s rise as a way of checking China’s growing power. But even though India is the world’s fastest growing major economy, its economic policies continue to disappoint American, European and Japanese officials and investors.

Western democracies, which see India as a natural ally, believe that India would be able to deliver on its economic and military potential only if it attains higher growth rates. That, in turn, would only be possible with larger inflows of foreign investment and further opening of India’s markets. Although India’s economy is expected to grow at 8 percent in 2022 and at 6.9 percent in 2023, it is less than the 12.5 percent and 8.5 percent originally forecast by the International Monetary Fund (IMF).

India’s growth is attributed to its large consumer market rather than to increased foreign direct investment (FDI). Indians seem content that India’s exports are high, its stock market is doing well and India’s vibrant middle class is indulging in what economists call post-pandemic “revenge spending.” But India’s Western partners see India as “a challenging place to do business,” according to the U.S. State Department’s 2021 Investment Climate Statement.

According to Heritage Foundation’s 2022 Index for Economic Freedom, India ranks 27 among 39 countries in the Asia–Pacific region, with an overall score below the regional and world averages.

From the perspective of the U.S. and India’s Western partners, it is a matter of unrealized expectations. India cannot catch up with China without overcoming the large gap in the relative size of their economies. China currently has a nominal GDP of $17.7 trillion while India’s GDP stands at only $3.1 trillion. On the other hand, India is expected to surpass China as the world’s most populous country in 2023, raising its domestic challenges of providing food, education and employment for an expanding young population.

Given its economic gap with China, and the needs of its growing population, it would seem reasonable that India would want to attract FDI. But between 2019 and 2021, the share of global FDI inflows to India have shrunk, from 3.4 percent to 2.8 percent. Meanwhile, China’s share of global FDI rose from 14.5 percent to 20.3 percent.

Even though the U.S., Europe, Australia and Japan all see India as their future partner, their corporations are either pulling out or reducing the size of their operations in India. Swiss building-materials firm Holcim, Royal Bank of Scotland, Harley-Davidson and Citibank have already announced plans to downsize or leave India.

German retailer Metro AG is selling off its Indian operation after two decades. Both Ford Motor Company and Tesla announced they had put on hold plans to make electric vehicles (EVs) in India. This decision, at a time when the Indian government is championing renewable energy, is related to India’s high tariff and tax barriers.

This week, French spirits group Pernod Ricard, maker of Chivas and Absolut, announced a decision to place new Indian investments on hold because of “everlasting” tax disputes with local authorities that date back almost 30 years.

-

Comment by Riaz Haq on July 14, 2022 at 7:26am

-

#India’s #economy can’t compete with #China’s — & that should worry #US policymakers. #Biden administration must be alarmed by the recent decisions by several foreign corporations to either pull out of the Indian market or put their long-term plans on hold https://thehill.com/opinion/international/3557750-indias-economy-ca...

BY HUSAIN HAQQANI AND APARNA PANDE

Some $100 million in assets of Amway, the American multi-level marketing company that sells health, beauty and home care products, have been frozen by Indian law enforcement while the company is investigated for ostensibly “operating a pyramid scheme.” Ironically, the company has done business in India for three decades with the same business model of direct selling.

Moreover, Ricard is not the only international business facing taxation challenges in India. IBM has had $865 million stuck in an escrow account since 2009 while a tax dispute over retroactive tax meanders through India’s legal system. India could have used IBM’s nearly $1 billion if put to productive use.

Two U.K.-based companies – Telecom giant Vodafone and energy company Cairn –were hit with large capital gains tax demands based on legal changes after mergers or acquisitions. The Indian government took one decade to rollback its retroactive taxation policy, only after India lost two cases at the World Bank’s International Center for Settlement of Investment Disputes (ICSID) and The Hague tribunal.

The challenges notwithstanding, India’s large size and location continue to make it a prized market for foreign businesses. Air India, the formerly state-run airline now owned by Tata Group, announced plans to overhaul its entire fleet of 300 narrow-body jets in one of the largest orders in commercial aviation history. Boeing and Airbus are the leading contenders for this deal. Access to the large Indian consumer market is a dream, as is the hope for a stake in the upgradation of India’s civilian and military infrastructure.

But, by and large, Western hopes of a modern, fast-growing, prosperous and free market-oriented India have not been realized at the pace predicted by some in the first few years of the 21st century. India’s current rate of economic growth is woefully inadequate for India’s domestic goals as well as the objective of becoming a serious rival to global economic juggernaut, China. The latter makes India’s economic policies a strategic concern for U.S. policymakers.

-

Comment by Riaz Haq on July 15, 2022 at 7:40am

-

#Indian Bonds Will Suffer Most In #Asia In A #US #Recession Scenario. “Downside risks to EM Asia currencies mean that foreign investor confidence could be sharply declining.” https://www.bloomberg.com/news/articles/2022-07-14/india-bonds-will...

US recession risks are reverberating across the emerging Asian debt complex and nowhere is this more apparent than in Indian sovereign bonds.

Rupee debt has proven to be the most sensitive to an inversion of the US curve in the past and this time is unlikely to be different, according to a Bloomberg study which analyzed four episodes dating back to 2005. In each instance, India’s benchmark yields climbed an average 11 basis points in the 10 days before longer-term US rates fell below those on shorter-dated maturities.

US recession risks are reverberating across the emerging Asian debt complex and nowhere is this more apparent than in Indian sovereign bonds.

Rupee debt has proven to be the most sensitive to an inversion of the US curve in the past and this time is unlikely to be different, according to a Bloomberg study which analyzed four episodes dating back to 2005. In each instance, India’s benchmark yields climbed an average 11 basis points in the 10 days before longer-term US rates fell below those on shorter-dated maturities.

The threat of a US downturn is the latest risk confronting Indian bonds after a weakening rupee and accelerating inflation propelled benchmark yields to the highest in over two years in June. A slowdown in the world’s biggest economy may exacerbate the pressure from outflows, after global funds sold the notes for five months through June.

There may be little respite for rupee bonds in the near term. Overnight indexed swaps are pricing in another 150 basis points of rate hikes from the Reserve Bank of India over the next 12 months as retail inflation has remained above the central bank’s 2%-6% target for six straight months.

-

Comment by Riaz Haq on July 15, 2022 at 10:33am

-

#India’s World-Beating Growth Isn’t Creating #Jobs. #Unemployment rate is hovering around 7% or 8%, up from about 5% five years ago. The labor force participation rate has dropped to just 40% of the 900 million #Indians of legal age. #Modi #BJP #Hindutva

https://www.bloomberg.com/news/articles/2022-07-15/why-india-s-worl...

No other major economy has been expanding as fast as India lately, beating both China and the US. But beyond the headlines lies the grim reality of rising unemployment. The nation of 1.4 billion people isn’t creating enough jobs for its growing workforce, despite campaign promises by Prime Minister Narendra Modi to make it a priority. Output is increasing as a result of pandemic-related government spending while the private sector sits on the fence, deterred by dim conditions for new investment. Meanwhile, pandemic-related disruptions and rising inflation are making it harder for everyone to get by. Tensions boiled over in June when angry youth facing bleak job prospects blocked rail traffic and highways in many states for days, even setting some trains on fire.

The unemployment rate in India has been hovering around 7% or 8%, up from about 5% five years ago, according to the Centre for Monitoring Indian Economy, a private research firm. At the same time, the workforce shrank as millions of people dejected over weak job prospects pulled out, a situation that was exacerbated by Covid-19 lockdowns. The labor force participation rate -- meaning people who are working or looking for work -- has dropped to just 40% of the 900 million Indians of legal age, from 46% six years ago, according to the CMIE. By comparison, the participation rate in the US was 62.2% in June.

-

Comment by Riaz Haq on July 15, 2022 at 1:49pm

-

Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2010 U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

India gdp growth rate for 2021 was 8.95%, a 15.54% increase from 2020.

India gdp growth rate for 2020 was -6.60%, a 10.33% decline from 2019.

India gdp growth rate for 2019 was 3.74%, a 2.72% decline from 2018.

India gdp growth rate for 2018 was 6.45%, a 0.34% decline from 2017.

https://www.macrotrends.net/countries/IND/india/gdp-growth-rate

--------

Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2010 U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

Pakistan gdp growth rate for 2021 was 6.03%, a 7.36% increase from 2020.

Pakistan gdp growth rate for 2020 was -1.33%, a 3.83% decline from 2019.

Pakistan gdp growth rate for 2019 was 2.50%, a 3.65% decline from 2018.

Pakistan gdp growth rate for 2018 was 6.15%, a 1.72% increase from 2017.

https://www.macrotrends.net/countries/PAK/pakistan/gdp-growth-rate

-

Comment by Riaz Haq on July 15, 2022 at 6:54pm

-

#India’s current account #deficit expected to deteriorate in FY23. The country’s #trade deficit widened to USD 45.18 billion in April-June 2022 period as compared to USD 5.61 billion recorded in the corresponding period of last year. #Modi #BJP #economy

https://newsroompost.com/business/indias-current-account-deficit-ex...

The widening of current account deficit has depreciated the Indian rupee against the US dollar by 6 per cent since January of 2022, and is on the brink of touching 80 mark.

New Delhi India’s current account deficit, meaning a shortfall between the imports and exports, is expected to deteriorate in 2022-23 if recession concerns do not lead to a sustained and meaningful reduction in the prices of food and energy commodities, the Ministry of Finance said in its latest Monthly Economic Review report.

Softening of global commodity prices may put a leash on inflation, but their elevated levels also need to decline quickly to reduce India’s current account deficit.

A sudden and sharp surge in gold imports amid wedding season, as many weddings were postponed to 2022 from 2021 due to pandemic-induced restrictions, is also now exerting pressure on the trade deficit, it said.

The country’s trade deficit widened to USD 45.18 billion in April-June 2022 period as compared to USD 5.61 billion recorded in the corresponding period of last year.

In order to alleviate the impact, the government recently hiked the customs duty on gold from present 10.75 per cent to 15.0 per cent.

“The deterioration of current account deficit could, however, moderate with an increase in service exports in which India is more globally competitive as compared to merchandise exports,” it said.

The widening of current account deficit has depreciated the Indian rupee against the US dollar by 6 per cent since January of 2022, and is on the brink of touching 80 mark.

“The depreciation (in rupee), in addition to elevated global commodity prices, has also made price-inelastic imports costlier, thereby making it further difficult to reduce the CAD,” it said.

A depreciation in rupee typically makes imported items costlier. India’s forex reserves, in the six months since January 2022, have declined by USD 34 billion.

However, the momentum in the Indian economy is holding up better than expected, despite commodity price shocks in the last four months, the report added.

“After a sluggish start, the seasonal rainfall has picked up and it is geographically well dispersed. That is good news too.”

-

Comment by Riaz Haq on July 19, 2022 at 6:37am

-

#India's #Rupee Hits Weakest Level Ever Against the #US Dollar. The #Indian #currency has lost about 7 percent of its value against the #dollar this year, a victim of higher #energy prices and #economic uncertainty. #Russia #Ukraine #Modi #Hindutva #BJP https://www.nytimes.com/2022/07/19/business/economy/rupee-dollar-re...

The Indian rupee touched the weakest level on record against the dollar on Tuesday, another victim of higher energy prices and a stronger greenback.

The rupee has lost about 7 percent of its value against the dollar this year as India has spent more to import sources of energy like crude oil, natural gas and coal. Prices of those commodities have climbed after Russia invaded Ukraine.

Another factor behind the decline of the rupee is uncertainty about the global economy that has, in turn, propelled the dollar to a 20-year high against the currencies of its major trading partners. Investors have pulled money out of India and other developing countries and poured it in to the United States, where the Federal Reserve is raising interest rates aggressively to tame inflation.

“A lot of it is dollar strength rather than rupee weakness,” said Rahul Bajoria, the chief economist for India at Barclays. “It still feels like on a relative basis the rupee has done a lot better,” he said, pointing to the steeper declines in the value of the euro and the British pound against the dollar.

On Tuesday, the rupee briefly crossed 80 to the dollar for the first time. The Reserve Bank of India intervened in the market, as it has in recent months, to bid up the currency, according to local media reports.

Like in much of the world, inflation has slowed economic growth this year in India. Reserve Bank officials responded by unexpectedly raising rates in May, and then again in June, to 4.9 percent. But inflation remains around 7 percent, putting pressure on household budgets.

Prime Minister Narendra Modi’s government has cut taxes on fuel and restricted exports of wheat and sugar. And it has bought more Russian oil, which has become cheaper following sanctions imposed by the United States and Europe.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 5 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network