PakAlumni Worldwide: The Global Social Network

The Global Social Network

Indian Economy Shrank in USD Terms in 2012-13 as Global Economy Slowed

Sharp fall in Indian currency against the US dollar and slower economic growth have caused India's GDP for Fiscal Year 2012-13 to shrink in US $ terms to $1.84 trillion from $1.87 trillion a year earlier. The Indian rupee has plummeted from 47.80 in 2012 to 54.30 to a US dollar in 2013, according to Business Standard. Since this report was published in Business Standard newspaper, Indian rupee has declined further against the US dollar to Rs. 59.52 today. At this exchange rate, India's GDP is down to $1.68 trillion, about $200 billion less than it was in Fiscal 2011-12.

|

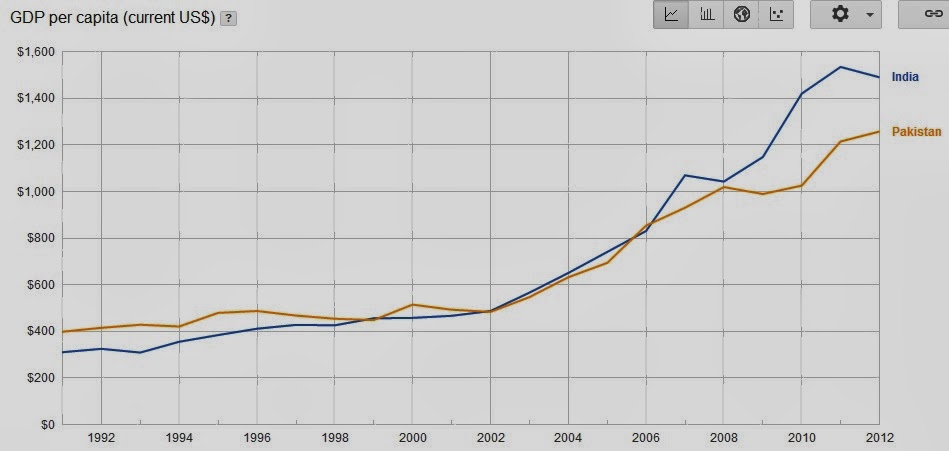

| Pakistan GDP Per Capita 1990-2012 Source: World Bank |

|

| Indian GDP Growth Rates 2004-2013 |

India's economy grew by 5.0% in 2012-13, its slowest annual rate in a decade, down from 6.2% last fiscal year. In the fourth quarter ending in March, gross domestic product grew by 4.8% year-over-year, slightly higher than the previous quarter when it expanded by 4.5%, according to Indian government data.

In the January-March quarter, the manufacturing sector increased output by just 2.6%, while production in the country's mines shrank by 3.1%.

Global ratings agency Standard and Poor's warned in May that India faces at least "a one-in-three" chance of losing its prized sovereign grade rating amid new threats to economic growth and reforms.

India's BBB-minus investment rating is already the lowest among BRICS and cutting it to "junk status" would raise the country's hefty borrowing costs.

The Organisation for Economic Cooperation and Development (OECD) this week lowered its projection of India's GDP growth this year to 5.3%, from 5.9% earlier.

Meanwhile, Pakistan's economy continues to struggle with its annual GDP rising just 3.6% to $252 billion ($242 billion at Rs. 100 to a USD exchange rate) in fiscal 2012-13, according to Economic Survey of Pakistan 2012-13 estimates based on 9 months data. The country is facing militancy and energy shortages impacting its economy.

Other world economies have also slowed down. US is slowly recovering but Europe is still struggling. BRIC growth rates are also slowing. China is slowing with its workforce aging and shrinking. In India, the slow pace of reform is hurting its growth, and Brazil and Russia are struggling with slowing demand for their export commodities.

Africa has replaced Asia as the continent with most of the world's fastest growing economies, according to The Economist magazine. The top 10 fastest growing economies in the world are: Macau, Mongolia, Libya, Gambia, Angola, Bhutan, China, Timor-Leste, Iraq and Mozambique.

China and the US , the two largest economies, still continue to be the bright spots and the main locomotives of the world economy, offering hope of global economic recovery.

Related Links:

Haq's Musings

India's Hyphenation: India-Pakistan or India-China?

India's Share of World's Poor Jumps as World Poverty Declines

Forget Chindia--Chimerica Will Rescue the World

World Bank on Poverty Across India

Superpoor India's Superpower Delusions

Are India and Pakistan Failed States?

India Home to World's Largest Number of Poor, Hungry and Illiterate

India Leads the World in Open Defecation

India Tops in Illiteracy and Defense Spending

Indians Poorer than sub-Saharan Africans

-

Comment by Riaz Haq on February 17, 2014 at 8:32am

-

Sri Lanka's per capita income has quintupled over the last two decades from about $700 to $3500, significantly outperforming all other South Asian economies. During the same period, Pakistan's per capita GDP has increased from $500 to $1300 while India's is up from $400 to $1400.

In addition to its high per capita GDP for the South Asia region, Sri Lanka has also excelled on Human Development Index (HDI), a key indicator of social development assessed each year by the United Nations Development Program (UNDP).

http://www.riazhaq.com/2014/02/sri-lanka-booms-as-india-pakistan-la...

-

Comment by Riaz Haq on February 17, 2014 at 3:49pm

-

Has the Indian economy shrunk over the last one year? A PTI press release states that India's economy is expected to grow to $1.7 trillion by the end of the financial year 2013-2014. But how much was the Indian economy's size previous year? In dollar terms was it less or higher than $1.7 trillion? Interestingly as per an IMF report, name World Economy Outlook published in April 2013, the Indian GDP for the financial year 2012 was $1.8 trillion and was expected to be $1.9 trillion for the financial year ended 2013-2014. Therefore from that perspective the Indian economy has not risen to $ 1.7 trillion but has actually shrunk in dollar terms from $1.8 trillion to $1.7 trillion at a time when it should have been ideally been $1.9 trillion. In terms of rupees, surely the value of the Indian economy has grown up to Rs 105.39 Lakh Crore from Rs 93.88 Lakh Crore in 2012-2013 (Read here).

Yet the shrinking in the dollar term is primarily because of major devaluation of the rupee over the last one year. From around the level of below 55, the rupee had a major fall to 68 to a dollar before having a substantial recovery to around 62 now. The considerable depreciation, which was predominantly because of a massive surge in Current Account Deficit (CAD), has to a certain extent arrested but other major concerns, which too have been responsible for the falling trust in rupee, do remain. Therefore apparently even though in rupee terms the Indian economy has gone up, it has not benefitted the economy and on the contrary, a falling value of rupee increases the cost of imports thereby increasing the cost of literally everything, which has a substantial import component, even when that product is manufactured in India. Such increase in costs, including that of the import bills of fuel and gold in addition to a host of other things, eventually result in inflation. While a certain proportion of the CAD was also due to incredibly high level of gold import, one cannot deny that policy paralysis, policy indecisiveness, lack of institutional clarity, issues of corruption, massive delays in clearance of projects and tax feud, each of these did play a role in making India's growth story a sad saga where even increase in the GDP in terms of rupee does not end up in helping the nation at large. Meanwhile efforts to contain inflation have always been with respect to tampering with the interest rate with the presumption that higher interest rate would induce more deposit and reduce expenditure thereby controlling inflation. For the last few years it has been proved that India's primary inflation is because of food prices and not because of organised industry. Therefore unless reforms are brought in the agriculture sector, India's issues of stubborn inflation will not go away. The supply side constraints created by inefficiencies in the supply chain of agricultural products with middlemen making huge profit at the cost of both the producer of agricultural products and end consumers, is hurting the economy a lot. In addition to this, the investment climate has to be improved with a clear cut policy directive. One has to give some credit to the Finance Ministry and RBI for containing the CAD and bringing it down to manageable levels, yet the problems of India will not be solved by that alone. If policy directives are one thing that is needed to be worked upon, the other key issue invariably is that of subsidy. India's gargantuan subsidies and populist policies, be it highly subsidized fuel oils, be it subsidy in fertilisers or be it the food security bill or employment guarantee scheme, each of these revenue expenditures essentially has become a drag on the economy with no sustainable asset development to compliment the money being spent.

Read more at: http://news.oneindia.in/feature/in-dollar-terms-has-the-indian-econ...

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 9 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network