PakAlumni Worldwide: The Global Social Network

The Global Social Network

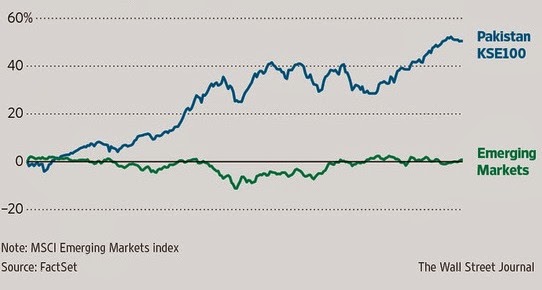

Karachi's KSE-100 Shares Index Handily Beats Emerging Market Indices in 2013

Karachi's KSE-100 Stock Market Index was up 49.4% (37% in US$ terms) in 2013, beating all but four stock indices in the world. It handily beat Morgan Stanley's MSCI emerging market index which remained essentially flat. By comparison, India's main stock index rose just 8.89% in the same period. The remaining three BRIC countries--Brazil, Russia and China-- all saw their key stock indices decline in 2013.

|

| KSE-100 vs MSCI Emerging Markets Index Source: Wall Street Journal |

This is a continuation of the bullish trend seen in 2012 when KSE-100 also rose nearly 50% to top all Asian market indices. As of December 31, 2013, KSE-100 is up 329% since the end of 2008. It is being driven mainly by rapid growth in revenue and profits of the listed companies. Even after the strong run-up, the market still remains cheap—currently trading at over nine times trailing 12 month earnings—a common valuation measure used by stock analysts, according to Wall Street Journal.

|

| World Stock Indices Performance 2013 Source: Seeking Alpha |

Dubai finished up the most in 2013 with a gain of 107.69%. Japan was up the fourth most with a gain of 56.72%, making it the best performing G7 country. The US ended up in 9th place globally with a gain of 29.6%. Of the other G7 countries, Germany finished third with a YTD gain of 25.48%, followed by France (17.99%), Italy (16.56%), the UK (14.43%) and Canada (9.55%), according to Seeking Alpha.

The fresh investor optimism in 2013 was triggered by the election of Prime Minister Nawaz Sharif whose government is seen to be business-friendly by investors and businessmen. His finance minister Ishaq Dar claimed that Pakistan's gdp growth accelerated to 5% in July-Sept quarter in 2013. It was driven by large-scale manufacturing (LSM) which grew 12.76 per cent in September 2013 from a year ago.

"Pakistan has a fairly diverse economy with a large and young population that needs to be fed and supplied basic infrastructure such as electricity," Wall Street Journal quoted Caglar Somek, global portfolio manager at Caravel Management in New York, as saying. He manages around $650 million of investments.

"If you find the companies that supply those basic needs, growing at double digit with high profitability, you can buy them at valuations that are on average 30% to 40% cheaper than their emerging market peers," said Mr. Somek.

Since the general elections of May, 2013, Pakistan has seen smooth power transfer from one civilian government to another. Other major transitions include the change of President, Army Chief and the nation's powerful Chief Justice of the Supreme Court.

Power cuts are now less frequent after payment of power generation companies overdue bills by the federal government. Financing has been closed on several power projects, including ADB financing of a major coal-fired plant in Jamshoro and Chinese loans for the nation's largest nuclear power plant planned for Karachi.

Progress on economic front, however, is not matched by similar progress on the security front which remains the biggest concern for the future of the country and its economy. What is needed is a comprehensive anti-terrorism strategy and plan of action soon.

Related Links:

Haq's Musings

Foreign Investment Up, Load-shedding Down in Nawaz Sharif's First 1...

Pakistan to Beg and Borrow Billions More in 2013-14

Power Companies Profits Soar at Taxpayer's Expense

Does Nawaz Sharif Have a Counter-terrorism Strategy?

Pakistan's Tax Evasion Fosters Aid Dependence

Pakistan's Vast Shale Oil and Gas Reserves

Pak IPPs Make Record Profits Amid Worst Ever Load Shedding

Global Power Shift Since Industrial Revolution

Massive Growth in Electrical Connections in Pakistan

Finance Minister Ishaq Dar's Budget 2013-14 Speech

-

Comment by Riaz Haq on January 8, 2014 at 6:52pm

-

Here's a News report on KSE shares performance:

KARACHI: Pakistan equities attracted about 11 percent of total net inflow of $3.7 billion (as of Dec 5, 2013) seen in frontier markets in 2013 and remained the most lucrative market for foreign investors, a report released on Tuesday said.

During the year, foreign fund managers bought $2 billion and sold $1.6 billion worth of equities, which resulted in net inflow of $398 million against $125 million in the previous year, said Asad Siddiqui, senior manager research at Topline Securities (Pvt) Limited while quoting a Morgan Stanley report.

As per the latest figures, foreign fund managers currently hold equities worth $4.4 billion in Pakistan, which makes up 36 percent of the free float (eight percent of total market cap). Current foreign holding is also the highest since 2008, when it was at $5.1 billion.

The market remained among one of the best performing frontier markets in the last two years. Out of 26 frontier markets as defined by MSCI (Morgan Stanley Capital International), Pakistan ranked 7th in the outgoing year 2013 with MSCI Pakistan gaining 38 percent, outpacing MSCI-FM growth by 17 percent. “This robust performance of Pakistan equities has raised many questions and now investors want to know where Pakistan stands against frontier markets on valuations,” Siddiqui said.

Over the past five years, Pakistan has traded at a discount of 32 percent to frontier markets, which has now shrunk to 20 percent. Despite this, Pakistan remains one of the cheapest markets amongst its MSCI-Frontier Markets peers from Africa, Asia and the Middle East.

Currently trading at price earning (PE) of 7.9x (multiples), Pakistan stands at 25 percent discount to Vietnam, the 2nd cheapest MSCI-FM market with 2014 PE of 10.6x. On the other hand, Pakistan trades at a discount of more than 50 percent against its most expensive FM peer like Kuwait, trading at 2014E PE of 16.9x.

Pakistan still remained one of the cheapest markets in MSCI-FM on the basis of PE and was therefore likely to attract interest from fund managers wanting exposure in markets that were resilient and not directly affected by global factors.

The KSE remained a part of middle-tier markets called emerging markets from 1994 till the crisis of 2008 then it lost its status and came in the level of basic markets called frontier markets, said one official of the KSE.

There is requirement of having three companies with each company having free-float capitalization of $898 million or above for becoming eligible for emerging market index and Pakistan market’s top nine companies contributed total market capitalization of $5,259 million but their free-float remained below the requirement. Average market capital of nine Pakistan companies was $584 million and their free-float is around 30 percent or around $175 million only.

Pakistan’s top nine companies with higher market capitalization included Oil and Gas Development Company Limited (OGDCL), MCB Bank Ltd, Fauji Fertilizer Co, Pakistan Oilfields, United Bank, Hub Power Co, Pakistan Petroleum Limited, Engro Corporation and National Bank of Pakistan...

http://www.thenews.com.pk/Todays-News-3-225092-Pakistan-among-top-p...

-

Comment by Riaz Haq on January 18, 2014 at 8:49am

-

Here's an Economist piece on the total worth of free-floating trade-able shares being so small that it;s comparable to the valuation of a single western corporation:

Investors love the promise of high returns from emerging-market equities, but there are not many of them to buy. Especially if you exclude stakes held by governments, the market capitalisation of bourses beyond the rich world is tiny. Just how tiny is apparent from the map below: in many emerging markets, the value of all the freely traded shares of firms that feature in the local MSCI share index (which typically tracks 85% of local listings) is equivalent to a single Western firm. Thus all the shares available in India are worth roughly the same as Nestlé; Egypt’s are equal to Burger King. This suggests that emerging economies need deeper, more liquid markets-and investors need more perspective.

http://www.economist.com/news/finance-and-economics/21594476-scarce...

-

Comment by Riaz Haq on January 31, 2014 at 8:33am

-

Japanese companies see Pakistan as the second best market for business growth in Asia, according to JETRO as reported by Pakistan Today:

Pakistan has been ranked second in the world in terms of business growth in a survey conducted by the Japan External Trade Organisation (JETRO).

The current survey – which examined records of 9,371 Japanese firms operating across the world – put Pakistan just behind Taiwan in terms of business generated leaving behind both India and Japan, media reports said.

The JETRO has been conducting such surveys since 2013. Pakistan’s data was generated from 27 Japanese firms doing business here. The results found that 74.1pc of the Japanese companies estimated operating profit in 2013, allotting second rank to Pakistan only after Taiwan (81.8pc).

Compared to this, 60.7pc Japanese firms in China and 45.8pc in India made operating profit in 2013. If the survey is any guide, not only have a majority of the already present Japanese investors in Pakistan posed confidence in terms of guaranteeing business opportunities, they have also declared their intentions to expand their business.

Kohat Tunnel and Indus Highway are two noteworthy projects being carried out with Japanese loan. Likewise, second biggest loan of $ 34 million has been given in four years by Japan for coping with the power crisis.

A mega $ 2 billion project of Karachi Circular Railway is also on the horizon soon and will be a big boost in Japanese interests in Pakistan.

“Media’s voice is louder than the findings of our survey,” said Naoyuki Maekawa, senior coordinator for South Asia in JETRO.

JETRO has been urging Japanese investors to benefit from the conducive business environment in Pakistan.

There are more than 20,000 Japanese companies in China and over 1000 in India. There is an increase of 100 Japanese companies in India every year, said JETRO official. Apparently, China is a hot destination for investors but many want to pull out due to various laws.

“It is easy to invest in China and difficult to pull out,” said Yoshiji Nogami, former foreign minister of Japan and currently President of Japan Institute of International Affairs.

While Pakistani laws are more favorable for foreign investors, nevertheless the country has so far been able to convince only 70 Japanese companies for investment, majority of them in manufacturing sector, automobile industry in particular.

Not only they noted growth in their existing business, 70.4% Japanese investors in Pakistan forecast further improvement in their business during 2014.

Business confidence exceeds 40 points in Cambodia, Myanmar and Pakistan, JETRO’s survey found explaining the feedback collected from Japanese investors already doing business in the respective countries.

http://www.pakistantoday.com.pk/2014/01/31/business/jetro-growth-su...

https://www.jetro.go.jp/en/reports/survey/pdf/2013_12_27_biz.pdf

-

Comment by Riaz Haq on October 2, 2014 at 5:22pm

-

A stock market that has about tripled in value in the last four years is not usually the first thing that comes to mind when global investors and business people think of Pakistan. The stock market has made great strides and some still consider it significantly cheaper value than its peer markets. Meanwhile, outsiders looking for signs that Pakistan is politically stabilizing will find mixed messages at the surface of the news.

-------

Mr. Mohammed Sohail, CEO of Topline Securities Pakistan, says:

The sit-in [that began in Islamabad on August 15] is gradually diluting because the two parties which started the gathering [the PTI and PAT] are there more than six weeks. The media coverage is declining. Investor focus has also shifted away and returned to business as usual. There was an initial correction of 8% to 9%, but now the market has recovered, and is where it was when these protests started. This shows the market is resilient.

The market stabilized in part because the military clarified they don’t intend to intervene or engage in any unconstitutional matter. These protests are democratic, as everyone in a democracy has a right to protest.

The government is now more transparent and more careful as a result of the protests. This is the beauty of democracy: the opposition criticizes the government in power and the government in power improves themselves. For example, the PTI has criticized Prime Minister Nawaz Sharif for having too many family members in important posts and I think this has been accepted as an issue the government will try to improve. Effective opposition criticism is a side of politics we expect to see more of in the future.

Frankly speaking, I see these protests as a major development. In 60 to 70 years, Pakistan has not seen pure proper democracy. If you look at other democracies, these type of protests and political exchange is normal. It is only six or seven years now that we have this proper democracy. This is really the first time in Pakistan’s history that we can have this kind of democratic interaction. When the opposition protests, it provides a lesson for the rulers to be more active, to think about all people.

------

Mr. Faisal Shaji, a research analyst at Standard Capital Securities in Pakistan, offers a different view:

The protests are in a way positive for real democracy in the country since it has created lot of awareness among the masses. The incidence of rigging is on a wide scale and accepted by all political groups. These protests were previously unthinkable. People think that the overall system is rotten and hence protestors are gaining strength.

The military handled the protests very wisely as the current chief of the army staff [COAS] is pro-democracy. The military wants political parties to resolve the issues politically. But we think the situation is going towards new elections that will use a biometric system of thumb impression which is the ultimate solution to the problem.

------

Mr. Sohail of Topline Securities maintains confidence in Pakistan’s capital markets moving forward:

Things that were held up due to the protests – IPOs, privatizations, reforms, the $800 million share sell of our largest oil and gas company OGDC – have now resumed. When the OGDC deal is executed, I think that will give a very clear signal to the international business community that the protests may still be going on, but investment and business already are operating as usual.

Pakistan is an unexplored market by most outside investors that is not marketed properly. Compared to peers, the market is very cheap. Pakistan’s markets trades at a price/earning multiple of 7.5 times; a 30% to 40% discount to Sri Lanka, Bangladesh, Nigeria and Vietnam. For me, from an investor’s point of view, the next 24 months look very positive for the equity markets.

http://www.forbes.com/sites/jonspringer/2014/10/02/investors-see-po...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 11 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network