PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan: A Unique Lab For Mobile Banking Innovation

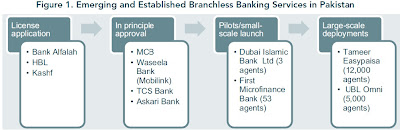

Spurred by a favorable regulatory and technology environment, Pakistan is witnessing dramatic growth in branchless banking, according to a March 14, 2012 report by the State Bank of Pakistan.

Here are some of the key indicators contained in the State Bank report:

1. Number of branchless banking accounts jumped 40 percent to 929,184 in October-December 2011 (Second quarter of FY2011-12) from the preceding three month period.

2. Total amount of branchless banking deposits surged 169 percent to Rs 503 million in Oct-Dec 2011 from July-September 2011.

3. Number of branchless banking transactions during the second quarter rose 30 percent to 20.6 million while the value of transactions showed a growth of 35 percent to reach Rs. 79,410 million.

4. Branchless banking agents network in Pakistan grew by 16 percent in the second quarter (October- December 2011) of current fiscal year 2011-12 to reach 22,512 agents covering the entire length and breadth of the country.

5. The average size of branchless banking transaction was Rs 3,855 while the average number of daily transactions was 228,855.

6. Bills payment and mobile phone SIM card top-ups remained the dominating activity in the quarter under review with 53 percent share in total number of transactions, followed by fund transfers and deposits with share of 39 percent and 8 percent respectively.

7. While P2P payments remained the most popular mechanism with 74pc share in the total funds transfer, mobile branchless banking is penetrating all areas of payments such as utility bills, Government-to-Person (G2P) and Person-to-Person (P2P) payments while scaling up other services relating to deposits and loans.

A 2011 report by World Bank's Consultative Group to Assist the Poor (CGAP) describes Pakistan's mobile banking as "a unique laboratory for innovation". Here's an excerpt from it:

"Branchless banking regulation was first introduced in Pakistan in April 2008. From the beginning, the State Bank of Pakistan (SBP) has taken a constructive regulatory approach by providing clear guidance and being willing to listen to businesses and adjust regulation where necessary. A variety of business models is emerging that involves a wide range of players, including mobile network operators (MNOs), technology companies, and even a courier business. (Notably, a bank remains ultimately liable to SBP in all the models.) The government is further encouraging innovation by piloting the use of branchless banking to distribute government payments. Taken together, these factors make Pakistan a unique laboratory for innovation."

In a country where only 22% of the population owns bank accounts and more than 62% owns mobile phones, mobile banking is proving to be the fastest way to promote financial inclusion considered by experts to be essential to lift people out of poverty. Benefits include easy access for rural customers to banking services through agents in villages without bank branches, better documentation of the economy, enlarging of the tax-base and efficiency of economic transactions.

Related Links:

Pakistan Ranks High in Microfinance

Media & Telecom Sector Growing in Pakistan

Pakistan's Financial Services Sector

Fighting Poverty Through Microfinance

-

Comment by Riaz Haq on December 24, 2015 at 9:46pm

-

Pakistan ranked 5th in financial inclusion by the Economist magazine's Economic Intelligence Unit (EIU):

Peru (90 points) and Colombia (86) remained the top two countries for financial inclusion. The Philippines was followed by India (71) and Pakistan (64), while Chile and Tanzania (62) tied at sixth and Bolivia and Mexico (60) tied at eighth. Ghana (58) rose in the ranks to clinch the 10th place.

Finishing at the bottom of the rankings were Haiti, Congo, and Madagascar.

“One of the key takeaways from the 2015 Microscope is that there is very little policy slippage around financial inclusion; new policies are being adopted and existing ones further implemented,” the report said, though citing concern on “limited” progress among nations with average gains of only two points for the year.

As for the Philippines, the country has yet to make more progress on providing credit access on a sizeable chunk of unbanked residents, alongside putting forward technology-assisted schemes for the financial system.

“While the Philippines has been a leader in promoting and creating an enabling environment for financial inclusion, there is still much to be done, as only 26% of adult Filipinos have savings accounts and only 10.5% have access to formal credit,” the study read.

“Challenges remain in terms of scaling market innovations, particularly in technology-driven initiatives. There is also a chronic need for financial education and consumer-protection initiatives across regulated and non-regulated institutions.”

http://www.bworldonline.com/content.php?section=Economy&title=p...

-

Comment by Riaz Haq on September 18, 2016 at 4:47pm

-

#Pakistan’s rising #mobile wallet adoption. #financialinclusion #mobilemoney http://www.pakistantoday.com.pk/2016/09/18/business/pakistans-risin... … via @epakistantoday

Mobile wallets (Such as Telenor EasyPaisa, Mobilink Jazz Cash etc) are often heralded as an innovative source of financial inclusion for the unbanked. And rightly so, mobile wallet accounts bypass the necessity of building and staffing a bank branch, and it also relieves its account holder from making the effort of going to a bank branch. Similarly, at least for Pakistan, its registration requirements makes it an easier option than a regular bank account.

Pakistan’s Financial Inclusion strategy for2015 recognises the importance of mobile money in expanding “digital transactional accounts”, which the strategy recognises as a key driver. In this regard, the recent upsurge in the number of mobile wallet registration should be encouraging. Just to put it in perspective; as perdata from the State Bank of Pakistan, at the end of Jul-Sept 2012, the number of wallet accounts was at approximately 1.8 million, however by Jul-Sept 2015 the same has risen to 13 million.

It is definitely a heartening increase especially when seen from a financial inclusion angle. But it is important to consider the demographics of these new wallet owners, are they predominantly from the banked segment or the unbanked one? A relevant source for answering these questions is the Financial Inclusion Insights (FII) survey 2015 for Pakistan. The FII 2015 is a nationally representative survey with a sample of 6000 individuals. Besides covering other aspects of Pakistan financial inclusion landscape, the FII also provides interesting insights into the probable demographic composition of Pakistan’s wallet accounts.

To begin with, the FII 2015 predicts that most wallet owners already had bank accounts, more specifically only44% of mobile wallet owners did not have bank accounts. When seen as a proportion of their base samples, wallet owners with bank accounts constituted 8% of bank account holders, however, unbanked[1] wallet owners were only 0.61% of the unbanked sample.

So who are these unbanked wallet owners? And how are they different from the unbanked who did not opt for a wallet account?In the following paragraphs will go over a few significant differences between unbanked mobile wallet owners, and the unbanked who do not have a wallet account.

Awareness about mobile money seems to be low among this group as 45% of unbanked with no wallet accounts were simply unaware about any of mobile money brands out there. It won’t be wrong to assume that almost half of the unbanked with no wallet account don’t even know about the existence of a mobile money option.

Gender differences were also apparent, as FII 2015 predicts 77% of unbanked wallet owners to be male, and only 22% to be female. This might be because of cultural constraints in Pakistan that discourage

Mobile wallets (Such as Telenor EasyPaisa, Mobilink Jazz Cash etc) are often heralded as an innovative source of financial inclusion for the unbanked. And rightly so, mobile wallet accounts bypass the necessity of building and staffing a bank branch, and it also relieves its account holder from making the effort of going to a bank branch. Similarly, at least for Pakistan, its registration requirements makes it an easier option than a regular bank account.

Pakistan’s Financial Inclusion strategy for2015 recognizes the importance of mobile money in expanding “digital transactional accounts”, which the strategy recognizes as a key driver. In this regard, the recent upsurge in the number of mobile wallet registration should be encouraging. Just to put it in perspective; as perdata from the State Bank of Pakistan,at the end of Jul-Sept 2012, the number of wallet accounts was at approximately 1.8 million, however by Jul-Sept 2015 the same has risen to 13 million.

-

Comment by Riaz Haq on January 28, 2017 at 6:51pm

-

#ITU to open first ever #fintech center in #Pakistan in collaboration with #American researchers at U of #Washington

https://www.techjuice.pk/itu-to-open-first-ever-fintech-center-in-p...

Information Technology University (ITU) and Digital Financial Services Research Group (DFSRG) University of Washington (Seattle, USA) have signed a Memorandum of Understanding (MoU) to establish a pioneering FinTech center in Pakistan.

The agreement was signed by Dr. Umar Saif, Vice Chancellor Information Technology University (ITU) along with Dr. Richard Anderson, Head DFSRG and Professor, Department of Computer Science and Engineering, University of Washington. The aim of the research center is to take Pakistan forward in financial technology space by adopting digital financial services countrywide.

Under the agreement, a collaborative research will be conducted in areas of cybersecurity, authentication, fraud prevention, financial education, financial management, data analytics, and customer experience studies in digital financial services. The FinTech center will also promote the digitization of Government-to-Person (G2P) and Person-to-Government (P2G) payments in Pakistan.

Dr. Richard Anderson said that it was the first ever collaboration in the World with Pakistan, which will be extended to the Africans and other Asian countries. Dr. Umar Saif stated that it would facilitate the smartphone transactions and establish transparency in the system.

DFSRG is a research group at Washington University supported by the Bill and Melinda Gates Foundation. It aims to improve the abilities of banks and mobile operators by deploying Digital Financial Service (DFS) products and providing technological solutions.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Can Pakistan's JF-17 Become Developing World's Most Widely Deployed Fighter Jet?

Worldwide demand for the JF-17 fighter jet, jointly developed by Pakistan Aeronautical Complex (PAC) and China’s Chengdu Aircraft Industry Group (CAIG), is surging. It is attracting buyers in Africa, Asia and the Middle East. At just $40 million a piece, it is a combat-proven flying machine with no western political strings attached. It has enormous potential as the lowest-cost 4.5…

ContinuePosted by Riaz Haq on February 4, 2026 at 8:00pm

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network