PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Nuclear Power Generation Soared 66% in 2021

Nuclear power plants in Pakistan generated 15,540 GWH of electricity in 2021, a jump of 66% over 2020. Overall, Pakistan's power plants produced 136,572 GWH of power, an increase of 10.6% over 2020, indicating robust economic recovery amid the COVID19 pandemic.

|

| Pakistan Electric Power Generation. Source: Arif Habib |

Hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It is followed by coal (20%), LNG (19%) and nuclear (11.4%).

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Nuclear offers the lowest cost of fuel for electricity (one rupee per KWH) while furnace oil is the most expensive (Rs. 22.2 per KWH).

|

| Pakistan Electric Power Generation Fuel MiX. Source: Arif Habib |

Construction of 1,100 MW nuclear power reactor K2 unit in Karachi was completed by China National Nuclear Corporation in 2019, according to media reports. Fuel is being loaded in a similar reactor unit K3 which will add another 1,100 MW of nuclear power to the grid in 2022. Chinese Hualong One reactors being installed in Pakistan are based on improved Westinghouse AP1000 design which is far safer than Chernobyl and Fukushima plants.

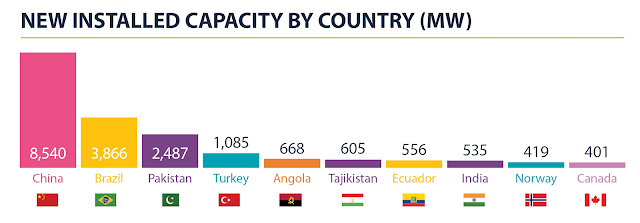

The biggest and most important source of low-carbon energy in Pakistan is its hydroelectric power plants, followed by nuclear power. Pakistan ranked third in the world by adding nearly 2,500 MW of hydropower in 2018, according to Hydropower Status Report 2019. China added the most capacity with the installation of 8,540 megawatts, followed by Brazil (3,866 MW), Pakistan (2,487 MW), Turkey (1,085 MW), Angola (668 MW), Tajikistan (605 MW), Ecuador (556 MW), India (535 MW), Norway (419 MW) and Canada (401 MW).

|

| New Installed Hydroelectric Power Capacity in 2018. Source: Hydrowo... |

Hydropower now makes up about 28% of the total installed capacity of 33,836 MW as of February, 2019. WAPDA reports contributing 25.63 billion units of hydroelectricity to the national grid during the year, “despite the fact that water flows in 2018 remained historically low.” This contribution “greatly helped the country in meeting electricity needs and lowering the electricity tariff for the consumers.”

|

| Pakistan's Current Account Balance vs International Oil Prices. Sou... |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

|

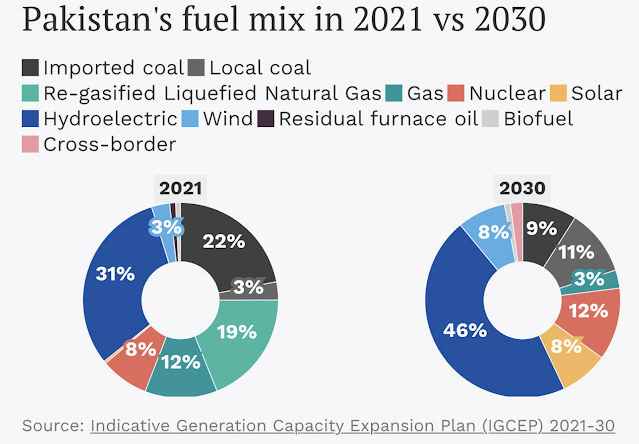

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

It is true that Pakistan has relied on imported fossil fuels to generate electricity. The cost of these expensive imported fuels like furnace oil mainly used by independent power producers (IPPs) has been and continues to be a major contributor to the "exaggerated external demand driven by its rentier economy" referred to by Atif Mian in a recent tweet. However, Pakistan has recently been adding hydro, nuclear and indigenous coal-fired power plants to gradually reduce dependence on imported fossil fuels.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Econo...

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on June 18, 2022 at 7:40pm

-

Power generation capacity expands 11.5%

Total capacity reached 41,557MW with slight drop in hydel share

https://tribune.com.pk/story/2360862/power-generation-capacity-expa...

The contribution of re-gasified liquefied natural gas (RLNG) to the total power generation increased to 23.8% from 19.7% last year.

Coal’s share remained the same, although the installed capacity went up from 4,770MW during July-April FY21 to 5,332MW in July-April FY22. Natural gas contribution declined from 12.1% in FY21 to 8.5% in FY22.

“There is an increase in the percentage share of renewable energy, which is a good sign for the economy as well as for the environment,” said the report.

The contribution of nuclear energy expanded to 8.8% in the first 10 months of FY22 from 6.7% in the corresponding period of FY21. The share of wind energy rose from 3.31% to 4.8% while solar energy’s share edged up from 1.07% to 1.4%.

“There is a slight shift in the percentage share of different sources in electricity generation,” the report said.

“Thermal has still the largest share in electricity generation, although its percentage contribution declined from 62.5% during July-April FY21 to 60.9% during July-April FY22.”

Similarly, the contribution of hydel energy in electricity generation decreased from 27.8% in July-April FY21 to 23.7% in July-April FY22.

However, the share of nuclear energy increased from 7.2% last year to 12.3% this year. The contribution of renewable energy inched up from 2.4% to 3.02%.

The first 10 months of current fiscal year did not see any major shift in the consumption pattern of electricity.

The share of household electricity consumption slightly declined from 49.1% in FY21 to 47% in FY22 while consumption in the commercial sector dropped to 7% from 7.4%.

However, the share of industry in electricity consumption expanded to 28% during July-April FY22 from 26.3% during July-April FY21.

The use of electricity in the agriculture sector slightly advanced to 9% from 8.9% whereas the consumption in other sectors, including public lighting, general services and other government traction decreased to 8% from 8.3%.

Energy sector scenario

According to the Economic Survey, Pakistan’s economic growth is constrained by bottlenecks in the energy sector. The country’s energy requirements are increasing and demand for energy in the coming decades will rise substantially.

Energy demand on this scale will put increasing pressure on energy resources and distribution networks, the report said.

“This is unsustainable without a fundamental transformation of the energy system. Dependency on the dominant fossil energy resources, especially oil is risky,” it said.

“Energy security is essential because the kind of disruption we have seen is a potential threat to our economic wellbeing. Exploration of the more indigenous and renewable resources is the key to energy security.”

According to the report, the government has been endeavouring to bring in transformational changes in the power system by exploring alternative sources of energy.

CPEC energy projects

Overall, 13 power projects of 11,648MW are being facilitated by the Private Power and Infrastructure Board (PPIB) under the China-Pakistan Economic Corridor (CPEC).

These include four hydroelectric power projects of 3,428MW, five Thar-coal-based projects of 3,960MW, four imported coal-based projects of 4,260MW, and a 660-kilovolt high-voltage direct current (HVDC) transmission line project.

Of these, three imported coal-based power projects of 3,960MW and one Thar coal-based power project of 660MW have been commissioned, while ±660kV Matiari-Lahore HVDC transmission line has also started functioning on a commercial basis with effect from September 1, 2021.

-

Comment by Riaz Haq on June 18, 2022 at 7:41pm

-

Power generation capacity expands 11.5%

Total capacity reached 41,557MW with slight drop in hydel share

https://tribune.com.pk/story/2360862/power-generation-capacity-expa...

“This is not only the first transmission line project developed by the private sector but also the first-ever HVDC transmission line in Pakistan.”

Furthermore, another nine independent power plants (IPPs) of 7,028MW, which include four hydel IPPs of 3,428MW, four Thar coal-based IPPs of 3,300MW and one imported coal-based IPP of 300MW are at different stages of processing.

Gas sector

The indigenous supply of natural gas declined around 5% and its contribution stood at 33.1% to the total primary energy supply mix of the country.

Available statistics for July-March FY22 indicate that Pakistan has an extensive gas network of over 13,513 km of transmission, 155,679 km of distribution and 41,231 km of services gas pipelines to cater to the requirement of millions of consumers.

The number of consumers has increased from 10.3 million to more than 10.7 million across the country. “The government’s policies to enhance the indigenous gas production to meet the increasing demand for energy proved effective,” the report said.

At present, the capacity of two Floating Storage and Re-gasification Units (FSRU) for RLNG is 1,200 million cubic feet per day (mmcfd). RLNG is being imported to bridge the widening gap between demand and supply of gas in the country.

The average natural gas consumption declined from 3,723 mmcfd to about 3,565 mmcfd during July-March FY22.

It is expected that gas will be supplied to approximately 736,060 new consumers (the target is subject to approval of Ogra) during FY23.

Gas utilities have planned to invest Rs27,669 million in transmission projects, Rs77,484 million in distribution projects and Rs8,746 million in other projects, bringing total investment to Rs113,899 million during fiscal year 2022-23.

Oil sector

Pakistan generates electricity from an energy mix that includes oil, natural gas, LNG, coal and renewable sources including solar, wind, hydel, nuclear and biomass.

The energy sector is heavily dependent on imported fuel including oil and LNG and will continue to rely on its imports because of the low domestic capacity, according to the report.

Higher oil prices in the global market and massive depreciation of the Pakistani rupee make oil imports more expensive, triggering external sector pressure and widening the trade deficit. The surge in the oil import bill is attributed to the increase in value as well as increase in the quantity demanded. The oil import bill increased 95.9% to $17.03 billion in July-April FY22 compared to $8.69 billion during the corresponding period of last year.

Further breakdown showed that the import of petroleum products went up 121.15% in value and 24.18% in quantity. During July-April FY22, the import of petroleum products increased to $8.55 billion compared to $3.87 billion during July-April FY21. Crude oil imports rose 75.1% in value and 1.4% in quantity during the period under review.

Petroleum crude reached $4.22 billion in July-April FY22 against $2.41 billion in the same period in FY21. During July-March FY22, the total processed imported crude stood at one million tons while the processed local crude was recorded at 2.31 million tons.

-

Comment by Riaz Haq on July 26, 2022 at 4:41pm

-

Pakistan on Tuesday raised electricity prices to match rising generation costs amid a global energy crisis and a heatwave, even as the country grapples with its highest inflation in over a decade, the power minister said.

https://www.reuters.com/business/energy/pakistan-raises-power-price...

Inflation last month reached 21.3%, driven mainly by rising food costs, and the country also faces fast-depleting foreign reserves, a depreciating currency and widening current account deficit.

"Cabinet has approved an increase in electricity tariffs but lifeline (poor) consumers will not be affected,” Power Minister Khurram Dastagir Khan told reporters in Islamabad, adding that the increase would not apply to them.

Pakistan's monthly fuel oil imports are set to hit a four-year high in June, Refinitiv data shows, as the country struggles to buy liquefied natural gas for power generation amid a heatwave that is driving demand.

Higher energy imports have hit the economy as the country struggles to boost foreign exchange. The rupee has lost 20% of its value in 2022. Reserves have fallen to as low as $9.3 billion, hardly enough to pay for 45 days of imports.

Pakistan this month reached a staff-level agreement with the IMF for $1.17 billion in critical funding under a resumed bailout package.

The country is also pushing to tap other avenues for power. The minister said that nuclear power production had risen after the refuelling of one plant.

From the beginning of July, the K2 plant has been operating at full capacity

-

Comment by Riaz Haq on August 6, 2022 at 6:39pm

-

SECMC has already commissioned a study for converting the China-Pakistan Economic Corridor coal plants in Hub, Jamshoro and Sahiwal to indigenous lignite. A 105km long Thar Rail project is being planned to connect Thar coal fields with Main Line at the New Chhor Halt Station to transport lignite to the power plants in the rest of the country.

The transportation of lignite by trucks to Karachi and Kallar Kahar shows its movement by road and rail is feasible and safe despite higher moisture. “Transportation is manageable; no combustion encountered during mining or transportation,” he adds.

https://www.dawn.com/news/1702647————“The (Lucky)power plant has been designed to operate on Thar Lignite Coal, subject to its availability; however, during the interim period, it will mainly operate on imported Lignite Coal till the completion of Phase III of Sindh Engro Coal Mining Company (SECMC), which is expected in the second quarter of CY 2023,” read the notice.————The government has decided to convert 3,960 MW of electricity generated from imported coal onto local coal of Thar to stop consuming the costly foreign exchange reserves for the import of coal, which is no longer available at low prices. The coal price has shot up to $400 per metric ton, a senior official at the Energy Ministry told The News.—————-The (2nd CPEC coal power) project is likely to start its full commercial operations by the end of the current month. With the launch of the new power plant, 990 MWs of Thar coal-based electricity is being produced to overcome the power shortfall in the country.

-

Comment by Riaz Haq on August 7, 2022 at 11:16am

-

IS THERE A SOLUTION TO PAKISTAN’S ENERGY PUZZLE?

Countries around Asia weigh up the costs and benefits of nuclear power over coal and LNG

https://tribune.com.pk/story/2369846/is-there-a-solution-to-pakista...

According to data released at the beginning of August, out of 18,400MW of energy generated, almost 11,000MW are from hydro power plants and nuclear power plants. The remaining 7,400MW of energy was mostly from gas and coal fired power plants.

These figures show that decision-makers have learnt how to produce cheaper energy. At least 1000MW of energy is produced by wind. In 2020, the US Energy Information Administration predicted that by 2025, coal would cost slightly more than $90 per megawatt-hour, compared to $63 for onshore wind and $48 for solar. Still, Pakistan and most of the Asian countries rely heavily on nuclear, hydro and/or coal power options.

Pakistan is relying too much on coal-fired power plants which are volatile options considering the climate crisis and the environmental cost of carbon emission. Before, Pakistan relied too much on liquified natural gas (LNG) to fulfill its energy shortcomings but because of the Russia-Ukraine war, LNG is not available in the market. At the moment, all of the LNG is going to Europe due to a ban on Russian petroleum products. Over time, Pakistan increased its generation capacity through the installation of new RLNG and coal-fired power plants. However, the country does not have enough funds to purchase fuel for these plants. Gas and coal-fired power plants are extremely sensitive to price fluctuations in the international market.

To address the shortage of electricity, the government recently issued a tender for the purchase of ten LNG cargos on the spot market. But as expected, none of the companies submitted bids due to high demand and higher prices in Europe. Given the current scenario, expensive LNG and coal-based power plants are proving difficult options, suggesting Pakistan should have focused more on nuclear power facilities.

-------

In the fiscal year 2019-2020, four coal-fired CPEC power plants generated 19 percent of Pakistan’s electricity. The 4.62 GW of coal-fired generation funded by CPEC includes the 1,320 MW Huaneng Shandong Ruyi-Sahiwal Coal Power Plant, the 1,320 MW Port Qasim Coal Fired Power Plant, the 1,320 MW HubCo Coal Fired Power Plant, and the 660 MW Engro Thar Coal Power Plant, all of which began supplying electricity to the national grid between 2017 and 2019. Construction on the Thal Nova, Thar Energy (HubCo), and Shanghai Electric (SSRL Thar Coal Block I) power plants to increase 1,980 MW of capacity is currently underway.

-----------

Coal consumption increased at a rapid rate in 2018-19, owing to increased use of cement and other enterprises. Local coal production was 5.5 million tons between 2018 and 2019, while imports totaled 15.7 million tons. During this time-period, the residential sector consumed nearly half of total electricity usage, while hydroelectric power supplied 21.3 percent of Pakistan's power generated.

-

Comment by Riaz Haq on September 15, 2022 at 4:14pm

-

Surge in services demand helps steady India’s economy in August | Mint

https://www.livemint.com/news/india/surge-in-services-demand-helps-...

Electricity consumption, a widely used proxy to gauge demand in industrial and manufacturing sectors, showed activity is picking up. Numbers from India’s power ministry showed peak demand met in August jumped to 185 gigawatt from 167 gigawatt a month ago. However, rising unemployment numbers tempered the overall optimism, with data from the Centre for Monitoring Indian Economy Pvt. showing the jobless rate climbed to 8.3 percent -- the highest level in a year. That shows the current pace of expansion isn’t enough to create jobs for the million plus people joining the workforce every month.

------------

https://www.reuters.com/article/us-pakistan-energy-climate-change-f...

When electricity projects now in the pipeline are completed in the next few years, Pakistan will have about 38,000 MW of capacity, Gauhar said. But its current summertime peak demand is 25,000 MW, with electricity use falling to 12,000 MW in the winter, he said.

-

Comment by Riaz Haq on September 15, 2022 at 6:07pm

-

Pakistan's power production hits record high at 24,284MW in 2021

https://tribune.com.pk/story/2309291/pakistans-power-production-hit...

----------------------

Economic Survey 2021-22: Pakistan installed capacity 41,557 MW in 2022

https://www.finance.gov.pk/survey/chapter_22/PES14-ENERGY.pdf

Pakistan's Electricity Generation Capacity

The total electricity generation capacity during July-April 2022 has increased by 11.5 percent and it reached 41,557 MW from 37261 MW during the same period last fiscal

-

Comment by Riaz Haq on September 17, 2022 at 10:19am

-

Arif Habib Limited

@ArifHabibLtd

Power Generation Aug’22

Power Generation

Aug’22: 14,053 GWh (18,888 MW), -12.6% YoY | -0.7% MoM

2MFY23: 28,203 GWh (18,954 MW), -11.2% YoY

Fuel Cost

Aug’22: PKR 10.06/KWh, +57% YoY | -6% MoM

2MFY23: PKR 10.39/KWh, +61% YoY

https://twitter.com/ArifHabibLtd/status/1571073410486407169?s=20&am...

-

Comment by Riaz Haq on November 9, 2022 at 2:32pm

-

Unit 3 of the Karachi nuclear power plant in Pakistan - a Chinese-supplied Hualong One reactor - reached 100% capacity for the first time on 31 March. The 1100 MWe pressurised water reactor is currently undergoing power ascension testing prior to entering commercial operation.

https://www.world-nuclear-news.org/Articles/Worlds-fourth-Hualong-O...

Construction of Karachi 3, the second of two Hualong One units to be built near Paradise Point in the province of Sindh, began in May 2016. Hot functional testing of Karachi 3 - which simulate the temperatures and pressures that the reactor systems will be subjected to during normal operation and are carried out before loading nuclear fuel - was completed ahead of schedule on 4 November last year. It achieved first criticality on 21 February and was connected to the grid on 4 March.

Various performance and commissioning tests have since been carried out at power levels of 25%, 30%, 50%, 75% and 87% capacity, China National Nuclear Corporation (CNNC) said.

Once testing at full capacity is completed, Karachi 3 will perform a 100-hour demonstration run, after which it will enter commercial operation.

Karachi 2 entered commercial operation in May last year. The units are the first exports of CNNC's Hualong One, which is also promoted on the international market as HPR1000.

The Karachi site - also sometimes referred to as KANUPP - was home to Pakistan's first nuclear power reactor, Karachi 1 - a small 100 MWe (90 MWe net) Canadian pressurised heavy water reactor which shut down in 2021 after 50 years of operation.

The first domestic demonstration plants of CNNC's Hualong One design are Fuqing 5 and 6, in China's Fujian province. The units entered commercial operation in January 2021 and March this year, respectively.

Nuclear energy currently provides around 8% of Pakistan's energy mix from five reactors: four CNNC-supplied CNP-300 pressurised water reactors at Chashma in Punjab, and Karachi 2. CNNC in 2017 signed a cooperation agreement with the Pakistan Atomic Energy Commission on the construction of a Hualong One as a fifth unit at Chashma.

In February, Nucleoeléctrica Argentina and CNNC signed an engineering, procurement and construction contract for the development of the Atucha 3 nuclear power plant. The plant, to be sited near Lima, about 100 kilometres north west of Argentina's capital, Buenos Aires, will use the Hualong One technology.

-

Comment by Riaz Haq on November 18, 2022 at 6:52am

-

Arif Habib Limited

@ArifHabibLtd

Power Generation DataPower Generation

Oct’22: 10,705 GWh (14,388 MW), -5% YoY | -17% MoM

4MFY23: 51,786 GWh (17,543 MW), -9% YoYFuel Cost

Oct’22: PKR 9.02/KWh, -3% YoY | -9% MoM

4MFY23: PKR 9.99/KWh, +41% YoYhttps://twitter.com/ArifHabibLtd/status/1593521259626737665?s=20&am...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network