PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Debt Crisis: Fact or Fiction?

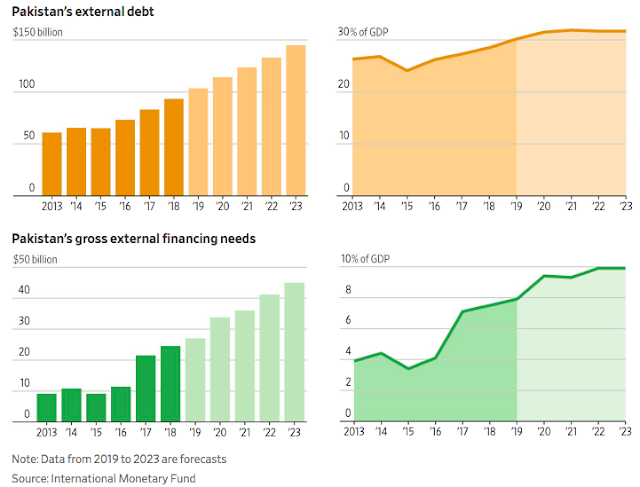

Pakistan is taking on significant amounts of domestic and foreign debt to finance its budget deficits and to support major energy and infrastructure development projects as part of China-Pakistan Economic Corridor (CPEC). Over one-third of this public debt is external debt denominated in US dollars, Euros and other hard currencies. At the same time, Pakistan's exports have declined over the last several years and the country's current account deficits have grown.

|

| Pakistan's External Debt. Source: Wall Street Journal |

Critics Warnings:

Critics believe that Pakistan is facing a severe debt crisis. They fear that it could get caught in a big debt trap laid by foreign governments. They warn that Pakistan will go broke. It will be unable to repay these mounting debts. Are they right? To answer this question, Dr. Ishrat Husain, a former central banker and governor of the State Bank of Pakistan, has analyzed Pakistan's debt as of June 30, 2017. Here are some of his key findings:

Pakistan Public Debt-to-GDP Trend. Source: Dr. Ishrat Husain |

Total Public and Private Debt:

Pakistan’s total debt and liabilities (TDL) consist of public debt and private debt. Total stock of outstanding debt and liabilities on June 30, 2017 stood at 79% of gross domestic product (GDP). Of this, Gross Public Debt accounted for 85% of the total outstanding or 67.2% of GDP. The remaining 15% is the private debt mostly to borrowers outside the country, for which the government has no fiscal obligation, but the SBP has to provide foreign exchange to service this debt. Within the gross public debt, the government’s share was predominant – almost 92% while the balance was owed by the public enterprises but guaranteed by the government. Borrowing from IMF is also included in gross public debt, although it is a liability of the SBP.

As of June, 2017, Pakistan's total public debt-to-gdp ratio is 67.2%, up from 59% in 2008 and 64% in 2013, according to an analysis by Dr. Ishrat Husain, former governor of the State Bank of Pakistan. The external debt-to-gdp ratio is 20.7%, down from 28.8% in 2008 and 21.3% in 2013. Pakistan's external debt to foreign exchange earnings ratio has shot up to 161.9% from 123.9% in 2008 and 121.3% in 2013.

Total Debt Service as Percentage of GDP. Source: Dr. Ishrat Husain |

Debt to GDP Ratio:

Public External Debt is lower in 2017 i.e. 20.7% of GDP while it was 27.1% in 2008 and 21.4% in 2013. About 93 pct of the public external debt falls under the category of Medium and Long term while 7% under the short term. Therefore the risk appetite for further short term borrowing to tide over payment difficulties cannot be ruled out as the short term public external debt to SBP reserves ratio is 5.5%. Concessional loans still form more than half of the outstanding stock and commercial loans account for only 1.6 percent of the total.

Debt Service Share of Government Revenue. Source: Dr. Ishrat Husain |

Debt Servicing as Percent of GDP:

Pakistan's current debt servicing requires 5.9% of GDP. It is down from 6% in 2008 and 6.9% in 2013. These percentages are by no means alarming. However, the external debt service component to be repaid in US dollars is of concern because of declining foreign currency earnings.

External Debt Repayment:

A major setback has been caused by stagnation in foreign exchange earnings due to a $ 4 billion drop in export receipts since 2013 .This has raised the EDL (external debt and liabilities) to FEE (foreign exchange earnings) ratio from 121 to 162 in 2017 . There has been some growth in exports in last few months but the pace is unspectacular to make a dent. The other element which is picking up is Foreign Direct Investment but that also won’t be able to lower this ratio significantly. On the fiscal side, almost 24% of government revenues were pre-empted by payments of interest and foreign loan repayments . The average interest rate is down to 6.3 percent with domestic debt being relatively expensive at 8.2 percent.

External Debt as Percentage of Foreign Exchange Earnings. Source: D... |

Summary:

As of June, 2017, Pakistan's total debt-to-gdp ratio is 67.2%, up from 59% in 2008 and 64% in 2013, according to an analysis by Dr. Ishrat Husain, former governor of the State Bank of Pakistan. The external debt-to-gdp ratio is 20.7%, down from 28.8% in 2008 and 21.3% in 2013. Pakistan's current debt servicing requires 5.9% of GDP. It is down from 6% in 2008 and 6.9% in 2013. These percentages are by no means alarming. However, the external debt service component to be repaid in US dollars is of concern because of declining foreign currency earnings. Pakistan's external debt to foreign exchange earnings ratio has shot up to 161.9% from 123.9% in 2008 and 121.3% in 2013. Of these, the critics are absolutely right about the last one---the ratio of external debt to foreign exchange earnings. Pakistan has to heed their warnings and urgently address its declining exports and rising current account deficits to avoid the potential external debt trap.

Related Links:

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last...

Pakistan's $20 Billion Tourism Industry Boom

-

Comment by Riaz Haq on February 24, 2018 at 7:41am

-

Credit take-off, remittances set to lift Pakistan economy

M. Aftab

Analysis/Islamabad

Filed on February 24, 2018 | Last updated on February 24, 2018 at 06.43 pm

https://www.khaleejtimes.com/business/economy/credit-take-off-remit...

Rising credit off-take of commercial banks indicates a significant growth of the economy, while a major campaign has been launched to ensure a fast track service for home remittances. This is confirmed in the Banks Lending Survey (BLS) just unveiled by State Bank of Pakistan (SBP), the central bank. The survey conducted during second quarter of financial year 2017-18.

------------

SBP's 'good-business' report said after receiving the feedback from senior bankers of 18 banks, the central bank identifies two main factors supporting the expansion in the credit demand. These factors include 'the need of firms for building up their inventories and working capital' and 'improved economic conditions'.

"Increase in fixed investment and seasonal increase in credit demand are two other factors," it further said.

The overseas Pakistanis sent home $11.4 billion remittances during the first 7 months of 2017-18, the SBP reported.

The inflow was 3.55 per cent higher than the like period of 2016-17. The SBP data showed that the inflow was significantly high from US, UK and EU. The remittances from Saudi Arabia at $2.914 billion were the highest, followed by the UAE with $2.512 billion and rest of the GCC countries with $1.314 billion. The remittances from UK totalled $1.585 billion followed by US $1.504 billion and EU $371 million.

In order to help the overseas Pakistani and their families back home, the government of Pakistan and the Sate Bank of Pakistan are pushing the commercial banks to reduce their handling charges to encourage the remittances inflow.

"We are urging all the commercial banks to improve their system for timely payments of remittances into the accounts of recipients," said Jamil Ahmed, deputy governor of SBP.

"We are doing our best to encourage the overseas Pakistanis so that they can transfer their money through official channels instead of 'hundi' and 'hawala'," he added.

Jamil made these remarks at the launch of a documentary film called 'hundi to kundi lagao' (Lock up the hundi), prepared by National Bank of Pakistan. It was a part of the bank's awareness campaign to encourage overseas Pakistanis to use official banking channels for remittances.

Jamil advised the bankers to use social media for marketing services. He said the amount sent by overseas Pakistanis through official channels rose 16 per cent between 2009 and 2017, making Pakistan. It is indeed heartening to note that the focused efforts of all stakeholders resulted in an increase of 13.2 per cent during the first two months of 2017-18 as against a fall of 3.1 per cent in 2016-17.

"Now there is a need to maintain this momentum and a positive growth trajectory in the coming months," he said, adding that the "focused area of inflow of remittances are the UAE, Saudi Arabia and other Gulf countries, which contribute 87 per cent to the remittances we receive."

Seed Ahmed, president of National Bank of Pakistan, speaking on the occasion said Pakistan is facing the challenge of balance of payment deficit and to meet this challenge the remittances play an important role.

"Inflow of remittances can be much improved if banks adopt the system of the fastest payment of remittances to the recipients," he said, adding that the idea behind making this movie is to urge the people that whatever money is coming into Pakistan, it should be routed through legal channels.

"Banks will serve the customers with an exceptional efficiency."

The banking industry is now doing its utmost to help the overseas Pakistanis with transfer of their remittances through fast track legal channels. That is a good news.

-

Comment by Riaz Haq on April 28, 2018 at 11:23am

-

Adviser to the Prime Minister on Finance Miftah Ismail, Thursday, said that Pakistan’s net debt has increased from 60.2 per cent to 61.4 per cent while liquid forex reserves have declined by $4.5 billion.

Miftah Ismail said net debt has increased from 60.2 per cent to 61.4 per cent, while the external debt has decreased from 21.4 per cent of Gross Domestic Product (GDP) to 20.5 per cent of the GDP during FY17-18. He said the government has had to take on external debt to finish projects that the previous governments had taken on and not completed.

On Thursday, the adviser to the Prime Minister on Finance along with the Minister for Planning and Development Ahsan Iqbal revealed the economy’s performance over the fiscal year 2017-18 (FY17-18), a day before the announcement of federal budget FY 2018-19.

According to the Pakistan Economic Survey (PES), the total public debt stood at Rs22.82 trillion by the end of December 2017 and it recorded an increase of Rs1.4 trillion during the first six months of the current fiscal year.

“With the current account deficit widening and not being fully offset by financial inflows, the country’s total liquid forex reserves fell by $4.5 billion during July-March FY17-18,” the PES said.

“Pakistan’s current account deficit contracted by 9.2 per cent on a month-on-month basis in March 2018 and reached $1.16 billion compared to $1.28 billion in February 2018. However, the current account deficit widened by 50.5 per cent and reached $12.03 billion (3.8 per cent of GDP) during July-March FY17-18,” according to the PES.

The PES also said that this was mainly due to 20.7 per cent widening in the trade deficit, amounting to $22.3 billion. The widening of trade deficit is mainly due to a surge in the import bill by 16.6 per cent, reaching $40.6 billion.

About fiscal position, PES said that total revenues grew by 19.8 per cent to reach Rs2.38 trillion (6.9 per cent of the GDP) during July-December, FY17-18 against Rs1.99 trillion (6.2 per cent of the GDP) in the same period last fiscal year.

“The impressive performance both in tax and non-tax revenues is attributed to a significant rise in total revenues. During the first nine months of the current fiscal year, the Federal Bureau of Revenue has been able to collect around Rs2.63 trillion against Rs2.27 trillion during the same period of FY16-17, posting growth of 15.8 per cent,” according to the survey.

“Total expenditure increased by 14 per cent during July-December, FY17-18 and stood at Rs3.18 trillion (9.2 per cent of GDP) against Rs2.79 trillion (8.7 per cent of GDP) in the same period of FY16-17. Within total expenditure, development spending (excluding net lending) increased sharply and were recorded at 23.4 per cent to reach Rs613.8 billion during July-December FY17-18 as compared to Rs497.4 billion in the comparable period of FY16-17,” the PES said.

The fiscal deficit in the first six months of FY17-18 was restricted to 2.3 per cent of the GDP compared to 2.5 per cent during the corresponding period last year due to strong growth in revenues relative to expenditures, according to the PES 17-18.

Speaking on the occasion, Minister for Planning and Development Ahsan Iqbal said the current fiscal year has seen continued exports growth in all nine months as the exports increased by 12 per cent while imports have slowed down to 16.6 per cent as compared to 48 per cent at the start of the current financial year.

The PES said that exports from July-March in FY17-18 had reached $17.1 billion, compared to $15.1 billion in the corresponding period last year, registering 13.1 per cent growth.

Imports grew 15.7 per cent during the same period, rising from $38.37 billion in FY16-17 to $44.38 billion this year, registering an increase of $6.01 billion in absolute terms, the PES said.

https://profit.pakistantoday.com.pk/2018/04/26/economic-survey-2017...

-

Comment by Riaz Haq on May 3, 2018 at 3:58pm

-

From Express Tribune:

https://tribune.com.pk/story/1696282/2-pakistan-posts-5-8-growth-rate/“Every statistic has improved and we have managed to increase gross domestic product growth rate and at the same time contained the budget deficit and inflation,” said Ismail. Pakistan’s economy expanded to $313 billion, the highest in history.

--------Ismail admitted problems on the external front and expressed the hope that the recent two devaluations of the rupee against the US dollar would help narrow down the widening current account deficit. He said that the government did not want to curtail imports but was trying to bridge this gap by increasing exports and remittances.

--------------Investment and savings

The investment-to-GDP ratio stood at 16.4% against the five-year target of 22.8%. This ratio was slightly better than last year’s revised rate of 16.1%. Savings slipped below last year’s level of 12% and stood at 11.4% of GDP, far below the five-year target of 21.3% of GDP.

Fixed investment remained at 14.8%. Public investment increased to 5% of GDP, which was better than the previous year. The target of private investment was also missed by a wide margin, which stood at 9.8% of GDP against the five-year target of 16.7%. Results for private investment are worse than last year when they had been estimated at 10%.

GDP growth

The PML-N government claimed to achieve an economic growth rate of 5.8% in its last year in power that is the highest over the past 13 years. But it is significantly lower than the 7% target the incumbent government wanted to achieve when it came to power in 2013.

However, the current growth rate is decent enough to give a political advantage to the ruling party in the upcoming general elections.

In 2012-13, which was the last year of the PPP tenure, the economic growth rate was 3.7%.

Just under than two-thirds of growth — 66.4% to be precise — came from the services sector, which performed slightly better than the expectations. The government achieved growth targets for services and agriculture sectors but missed the industrial sector growth target again.

Despite a better economic performance, the growth rate was still insufficient to absorb the youth bulge — Any pace of growth below 7% rate would increase unemployment.

-

Comment by Riaz Haq on May 17, 2018 at 7:25am

-

Pakistan’s external debt soars to record $91.8b

By Shahbaz Rana /

https://tribune.com.pk/story/1711866/2-pakistans-external-debt-soar...

Pakistan’s external debt and liabilities have soared to a record $91.8 billion, showing an increase of over 50% or nearly $31 billion in the past four years and nine months, the State Bank of Pakistan (SBP) has reported.

The external debt and liabilities of $91.8 billion as of March-end suggest that the figure may touch $100 billion very soon as the country faces grave challenges in meeting growing external financing requirements. Pakistan is scheduled to make some bullet debt and interest payments in the last quarter (April-June) of the current fiscal year, according to sources in the finance ministry.

The $91.8-billion external debt and liabilities were higher by $30.9 billion or 50.6% compared to the level recorded in June 2013 when the Pakistan Muslim League-Nawaz (PML-N) government came to power.

Of the total external debt and liabilities, the government’s public debt obligations including foreign exchange liabilities were $76.1 billion at the end of March.

In the past four years and nine months, the public debt-related obligations increased 42.5% or $22.7 billion, showed the central bank data. In June 2013, the external public debt including foreign exchange liabilities stood at only $53.4 billion.

A major hike came in the external debt contracted by issuing sovereign bonds and taking expensive commercial loans.

Since June 2013, the PML-N government has acquired a whopping $42.6 billion in external loans, which is taking its toll on the national exchequer due to the mounting debt servicing cost.

Starting from July 2013, with every passing year, the quantum of external debt has kept growing due to the government’s inability to implement policies that could have ensured sufficient non-debt creating inflows.

The International Monetary Fund (IMF)’s first post-programme monitoring report shows Pakistan’s gross external debt in terms of exports was 193.2% in 2013, which is projected to deteriorate to an alarming 316% in June this year.

During this period, Pakistan’s gross external financing requirements have swelled from $17.2 billion to $24 billion.

-

Comment by Riaz Haq on May 28, 2018 at 6:18pm

-

#China’s #loans to #Pakistan should drive #economic development, boost its #manufacturing, #exports and #debt repayment ability. #CPEC - Global Times

https://www.thenews.com.pk/print/322593-china-s-loans-to-pakistan-t...

Pakistan expects to obtain $1 billion to $2 billion of fresh Chinese loans to help it avoid a balance-of-payments crisis, Reuters reported. Some observers hope China's economic assistance will help the country avoid having to go to the IMF for a bailout, but the key issue is the sustainability of China's financial help.

China will not be stingy in offering help to Pakistan to strengthen its infrastructure, but China's bank loan is a market-driven commercial decision in line with international practices. The main point is Pakistan's debt repayment ability.

China-based financial organizations stick to a principle of not imposing additional political conditions when providing loans to other countries, distinguishing them from most Western financial institutions like the IMF.

This might be one reason why Chinese loans are welcomed in Pakistan. China is likely to continue to finance new projects in the country but will also assess their debt repayment ability to avert the risk of bad debt. After all, Chinese loans to Pakistan are not a gift.

The multi-billion dollar China-Pakistan Economic Corridor (CPEC) has begun to bring tangible benefits to Pakistan's economy, which is likely to boost Pakistan's debt repayment ability. It's possible that we're entering a virtuous cycle in which Chinese loans promote the development of the CPEC, and this then improves Pakistan's debt repayment ability. However, the South Asian country may need to propel economic reforms to ensure the effectiveness of the loans and allow the local economy to benefit more from CPEC projects.

It is hoped that people will learn a lesson from the IMF's operations. In 2013, the IMF approved a loan plan for Pakistan to support its program to stabilize and rebuild the economy, but the multilateral lender failed to strictly monitor the use of the loans, and in the end they did little for Pakistan's economic development.

Now Pakistan's economy is on an upswing with the help of Chinese loans. Nadeem Javaid, who advises Prime Minister Nawaz Sharif's government and works closely on the CPEC program, was quoted by Reuters as saying last year that debt repayments and profit repatriation from CPEC projects will reach $1.5 billion to $1.9 billion in 2019, rising to $3 billion to $3.5 billion by the following year.

China is likely to strengthen economic collaboration with Pakistan under the CPEC program, in a bid to ensure the effectiveness of the loans. The key to stronger cooperation between the two countries lies in how to improve Pakistan's economic innovation capability and allow the country to develop its own capacity for long-term economic sustainability.

China's loans to Pakistan essentially aim to drive Pakistan's economic development, and thus the loans should be offered in a way that aligns with the local economy and helps restructure the South Asian economy and boost its manufacturing and exports.

-

Comment by Riaz Haq on May 30, 2018 at 4:33pm

-

https://twitter.com/haqsmusings/status/1001967923735515136

IMF Bailout Looms For Pakistan as Debt Surge Raises Alarm

By Kamran Haider and Faseeh Mangi

https://www.bloomberg.com/news/articles/2018-05-30/imf-bailout-loom...

For many in Pakistan it’s a question of when -- rather than if -- the nation will go to the International Monetary Fund for financial support to pay its soaring foreign debt as reserves dwindle.

External debt and liabilities has increased 76 percent to 10.6 trillion rupees ($92 billion) since June 2013, taking the ratio up to 31 percent of gross domestic product, the highest in almost six years. Pakistan’s debt will continue to grow as it has the highest financing need as a percentage of GDP in emerging markets over the next two years, according to IMF projections.

It’s not an unusual situation for Pakistan, which has gone through decades of debt blowouts and balance-of-payment imbalances. South Asia’s second-largest economy has received 12 IMF bailouts since the late 1980s and completed its last loan program just two years ago.

The nation is once again facing a crunch after foreign-exchange reserves dropped to the lowest in more than three years, forcing authorities to devalue the currency twice in recent months and hike interest rates. To help repay debts and keep the economy going, another IMF loan is possibly the next step.

“It’s a familiar situation,” said Yousuf Nazar, a former Citigroup Inc. banker and author of The Gathering Storm: Pakistan. “We have rising debt servicing and faltering growth -- the short-term solution is the IMF, it’s probably a matter of months.”

Pakistan’s economic picture was generally rosy up until the past year. The current government, which will hand over to a caretaker administration on Friday ahead of July 25 elections, has managed to boost economic growth to its highest level in a decade. That was aided in part by low oil prices, the completion of a $6.6 billion IMF program in September 2016 and the Chinese financing of about $60 billion in infrastructure across the country as part of Beijing’s flagship Belt and Road initiative.

The growth boom has come with rising imports of Chinese machinery and other goods, widening Pakistan’s current-account deficit by 50 percent this year. Added to that is Islamabad’s mounting debt to Beijing and questions over how it will eventually repay billions of dollars over the medium to long term.

Surging oil prices are making matters worse. The central bank recently warned that “the balance of payments has further deteriorated” because of rising crude and investor inflows remaining limited.

-

Comment by Riaz Haq on May 30, 2018 at 4:37pm

-

For many in Pakistan it’s a question of when -- rather than if -- the nation will go to the International Monetary Fund for financial support to pay its soaring foreign debt as reserves dwindle.

External debt and liabilities has increased 76 percent to 10.6 trillion rupees ($92 billion) since June 2013, taking the ratio up to 31 percent of gross domestic product, the highest in almost six years. Pakistan’s debt will continue to grow as it has the highest financing need as a percentage of GDP in emerging markets over the next two years, according to IMF projections.

It’s not an unusual situation for Pakistan, which has gone through decades of debt blowouts and balance-of-payment imbalances. South Asia’s second-largest economy has received 12 IMF bailouts since the late 1980s and completed its last loan program just two years ago.

The nation is once again facing a crunch after foreign-exchange reserves dropped to the lowest in more than three years, forcing authorities to devalue the currency twice in recent months and hike interest rates. To help repay debts and keep the economy going, another IMF loan is possibly the next step.

“It’s a familiar situation,” said Yousuf Nazar, a former Citigroup Inc. banker and author of The Gathering Storm: Pakistan. “We have rising debt servicing and faltering growth -- the short-term solution is the IMF, it’s probably a matter of months.”

Pakistan’s economic picture was generally rosy up until the past year. The current government, which will hand over to a caretaker administration on Friday ahead of July 25 elections, has managed to boost economic growth to its highest level in a decade. That was aided in part by low oil prices, the completion of a $6.6 billion IMF program in September 2016 and the Chinese financing of about $60 billion in infrastructure across the country as part of Beijing’s flagship Belt and Road initiative.

The growth boom has come with rising imports of Chinese machinery and other goods, widening Pakistan’s current-account deficit by 50 percent this year. Added to that is Islamabad’s mounting debt to Beijing and questions over how it will eventually repay billions of dollars over the medium to long term.

Surging oil prices are making matters worse. The central bank recently warned that “the balance of payments has further deteriorated” because of rising crude and investor inflows remaining limited.

Yet the ruling Pakistan Muslim League-Nawaz party, which will face a heated election battle against its main opposition rival and former cricket star Imran Khan, has continually denied that it will need to go to the IMF for help. Finance ministry officials didn’t respond to calls seeking comment.

The government is instead borrowing more. It plans to raise 1.1 trillion rupees of foreign debt in the fiscal year starting from July 1 compared with a budgeted 810.7 billion rupees. Major lending sources will be commercial banks, global bonds and China, according to finance ministry data.

Pakistan has already borrowed at least $1.2 billion from China and Middle Eastern banks since April to help bridge a $3 billion gap this financial year, junior Finance Minister Rana Muhammad Afzal Khan, said in an April interview.

“If you don’t take loans your growth will be the lowest, debt brings growth world over,” Prime Minister Shahid Khaqan Abbasi said in Islamabad this week.

In the next five months about $3 billion will need to be paid to creditors including the IMF, World Bank, Paris Club and China and the nation may try to reschedule some of those, said Vaqar Ahmed, the deputy executive director of the Sustainable Development Policy Institute in Islamabad.

Bank Loans

Pakistan's lending from commercial banks rise almost four times

Source: State Bank of Pakistan; Pakistan fiscal year runs July-June

As such, Pakistan is close to bankruptcy and will need a bailout that may come from the IMF, said Asad Umar, the former chief executive officer of Engro Corp. -- one of the nation’s largest conglomerates -- who is now a senior politician in Khan’s party and pegged as the likely finance minister if they win the election.

“The pressure has started to come in the numbers now,” said Umair Naseer, an analyst at Topline Securities Pvt. in Karachi. “Avoiding an IMF loan program is very difficult.”

Debt Level

Highest government debt as percentage of GDP in Asia

Source: International Monetary Fund 2018 forecast

-

Comment by Riaz Haq on June 29, 2018 at 4:58pm

-

#India's Foreign #Debt Rises By 12% To Over $529 Billion. Foreign debt to #GDP ratio stood at 20.5% at end-March 2018, up from 20% at end-March 2017." https://www.ndtv.com/india-news/indias-external-debt-rises-by-12-to... … via @ndtv

The increase is debt is primarily on account of a rise in commercial borrowings and NRI deposits.

MUMBAI: India's total external debt for the quarter ended March 2018 rose on a year-on-year basis by over 12 per cent to $529.7 billion, official data showed on Friday.

According to the RBI, external debt rose to $529.7 billion from $471.3 billion reported for the corresponding period of 2017, on the back of an increase in commercial borrowings, short-term debt and non-resident Indian (NRI) deposits.

"At end-March 2018, India's external debt witnessed an increase of 12.4 per cent over its level at end-March 2017, primarily on account of an increase in commercial borrowings, short-term debt and NRI deposits," the RBI said in a statement on "India's External Debt as at the end of March 2018".

"The increase in the magnitude of external debt was partly due to valuation loss resulting from the depreciation of the US dollar against major currencies. The external debt to GDP ratio stood at 20.5 per cent at end-March 2018, higher than its level of 20 per cent at end-March 2017."

As per the statement, valuation loss worth $5.2 billion occurred due to depreciation of the US dollar vis-a-vis major currencies like Euro, SDR (special Drawing Right), Japanese Yen and Pound Sterling.

"Excluding the valuation effect, the increase in external debt would have been US$ 53.1 billion instead of $58.4 billion at end-March 2018 over end-March 2017," the statement said.

"Commercial borrowings continued to be the largest component of external debt with a share of 38.2 per cent, followed by NRI deposits (23.8 per cent) and short-term trade credit (19 per cent)."

-

Comment by Riaz Haq on June 30, 2018 at 7:51pm

-

Pakistan has received nearly $10 billion in foreign loans in the past 11 months, and almost three-fourths have been utilised for budgetary support and meeting external financing requirements, underscoring that the amount cannot be returned without resorting to fresh borrowing.

The total loan disbursement from July through May of fiscal year 2017-18 stood at $9.98 billion, reported the Economic Affairs Division on Monday. The 11-month disbursements were significantly higher than the budgetary estimate of $7.7 billion.

As compared to five years ago, when about two-thirds of the loans used to be taken for project financing, now around 75% are obtained for budgetary support and building foreign currency reserves. This suggests that these loans have not been put into productive sectors of the economy, making it impossible to retire them without taking new loans.

From July through May, project financing stood at a mere $2.8 billion or 28% of the total disbursements, according to the EAD – a division working under the Ministry of Finance. Over half of the project financing went into only three projects – Orange Line Metro project, Thakot-Havelian project of the China-Pakistan Economic Corridor (CPEC) and Multan-Sukkur section of the CPEC – showed official statistics.China disbursed $836 million for the Multan-Sukkur project, $296 million for Thakot-Havelian and $334 million for the Orange Line project, Lahore – the flagship scheme of former chief minister Shehbaz Sharif.

Overall, the government of China and its financial institutions provided $3.8 billion or 38.5% of the total loans received during the first 11 months of the current fiscal year. This includes $1.64-billion project financing from China and $2.2 billion as commercial loans by Chinese banks.In addition to $3.8 billion direct disbursement of loans, China has also extended a $3-billion credit facility that Pakistan has also almost fully utilised to stabilise its nose-diving foreign currency reserves.

In May, Pakistan received another $493 million as foreign commercial loan from a consortium of Credit Suisse AG, taking the European bank’s contribution to $750 million during the current fiscal year.

Pakistan received $3.5 billion in foreign commercial loans in 11 months, which is equal to 35% of the total loans received during this period. It also floated $2.5 billion Eurobonds during the current fiscal year.

With the fresh borrowing of $10 billion, total foreign loans the last PML-N government obtained during its third stint (July 2013 to May 2018) have now increased to a record $44.8 billion.

Most of these loans have been obtained to help boost foreign currency reserves, finance a bulging current account deficit and for budgetary support.Pakistan’s external debt and liabilities have soared to a record $92 billion as of March-end, an increase of over 50% or nearly $31 billion in the past four years and nine months, according to the State Bank of Pakistan (SBP). Out of total external debt and liabilities, the government’s public debt obligations including that of foreign exchange liabilities were $76.1 billion as of end March.

https://tribune.com.pk/story/1742368/2-pakistans-foreign-borrowing-...

-

Comment by Riaz Haq on June 30, 2018 at 8:02pm

-

#China lends $1 billion to #Pakistan to boost plummeting FX reserves. In first 10 months of FY2017-18 China lent Pakistan $1.5 billion in bilateral loans. Pakistan also received $2.9 billion in commercial bank loans mostly from Chinese banks #CPEC #debt https://reut.rs/2MyR7u2

China has lent Pakistan $1 billion to boost the South Asian country’s plummeting foreign currency reserves, two sources in Pakistan’s finance ministry told Reuters, amid growing speculation of another International Monetary Fund bailout.

The latest loan highlights Islamabad’s growing dependence on Chinese loans to buffer its foreign currency reserves, which plunged to $9.66 billion last week from $16.4 billion in May 2017.

The lending is the outcome of negotiations for loans worth $1-$2 billion that was first reported by Reuters in late May, the two sources told Reuters.

“Yes, it is with us,” said one finance ministry source, in reference to the Chinese money. The second source added that the “matter stands complete”.

The finance ministry spokesperson did not respond to a Reuters request for comment.

With the latest loan, China’s lending to Pakistan in this fiscal year ending in June is set to breach $5 billion.

In the first 10 months of the fiscal year China lent Pakistan $1.5 billion in bilateral loans, according to a finance ministry document seen by Reuters. During this period Pakistan also received $2.9 billion in commercial bank loans mostly from Chinese banks, ministry officials told Reuters.

Beijing’s attempts to prop up Pakistan’s economy follow a strengthening of ties in the wake of China’s pledge to fund badly-needed power and road infrastructure as part of the $57 billion China-Pakistan Economic Corridor (CPEC), an important cog in Beijing’s vast Belt and Road initiative.

But analysts say China’s help will not be enough and predict that after the July 25 national election the new administration will likely seek Pakistan’s second bailout since 2013, when it received a package worth $6.7 billion from the IMF.

“Looking at the current scenario, it is likely after the new government comes in that they will go to the IMF,” said Suleman Maniya, head of research at local brokerage house Shajar Capital.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 9 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network