PakAlumni Worldwide: The Global Social Network

The Global Social Network

Production and Sales of Cars and Televisions Rose in Pakistan in 2010-11

Automobile:

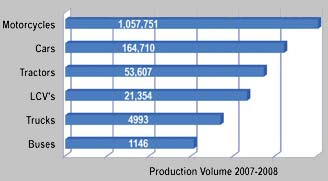

146,271 vehicles were produced in Pakistan in 8 months from July 2010 to February 2011, representing an increase of 9.2% y-o-y on the 133,918 units produced over the same period of FY09/10, according to figures from the Pakistan Automotive Manufacturers Association (PAMA). This consists of 85,924 units for passenger car production, 1,807 units truck production, 308 units bus production, 580 units jeep production, 12,000 units pick-up production and 45,652 units farm tractor production. Sales largely mirror production in Pakistan's auto market: the first eight months of FY10/11 saw a total of 143,785 new vehicles sold in the country, an increase of 7.1% y-o-y. Extrapolating the eight-month data across 12 months, total vehicle production would amount to 219,407 units, while total vehicle sales would register 215,678 units. This compares to the BMI forecast for the full fiscal year of just over 221,500 and just over 224,000 for production and sales respectively. However, these figures for FY10/11 aggregate sales and production are still considerably below the high watermark reached for both variables in FY07/08.

Although FY10/11 and FY09/10 have seen reasonably strong growth in y-o-y terms for both sales and production volumes, the industry is still recovering from a disastrous year in FY08/09, which was hit by a combination of the global economic downturn and severe internal political instability.

Consumer Electronics:

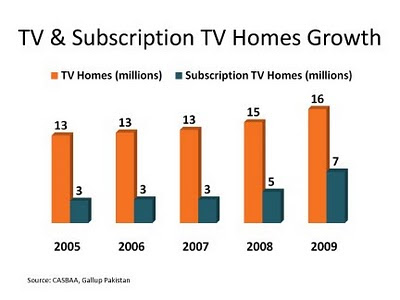

The media revolution of 24X7 news, entertainment and sports centered around rising number of television channels drove tv set sales up by 28.6% in 2010-2011.

Pakistan's consumer electronics market, including personal computers, mobile handsets and audio-video products, is now estimated at about $1.8 billion. BMI forecasts that this market will grow to $3 billion by 2015.

Computers accounted for about 20% of Pakistan's consumer electronics spending in 2010. BMI forecasts Pakistan's domestic market computer hardware sales (including notebooks and accessories) of $312 million in 2011, up from $292 million in 2010. Computer hardware CAGR for the 2011- 2015 period will be about 8%.

Mobile Handsets Pakistan's market handset sales are expected to grow at a CAGR of 16% to 29.5 million units in 2015, as mobile subscriber penetration reaches 70%. Revenues growth will be slower due to lower average selling prices (ASPs) of mobile handsets, with most handsets sold at less than $40. Another issue is the declining growth rate of mobile subscriber penetration, which is now more than 60%. 3G licenses are still expected to be awarded in 2011, but Pakistan's telecoms regulator has yet to confirm this.

Fast Moving Consumer Goods:

Fast moving consumer goods (GMCG) sector, including food, beverage and tobacco, grew by 9.3%, according to Economic Survey of Pakistan 2010-11. Adverting revenue from this sector has continued to drive proliferation of electronic mass media in Pakistan.

Conclusion:

The continuing growth in consumer spending is a testament to Pakistanis' resilience in the midst of multiple and very serious crises of energy shortages, continuing militancy and political violence and instability. The question is how long can this extraordinary resilience last if the corrupt and incompetent Pakistani politicians continue to persist in their mismanagement of the country and its economy.

Related Links:

Haq's Musings

Resilient Pakistan

Pakistan's Rural Economy Showing Strength

Pakistan's Exports and Remittances Rise to New Highs

Incompetence Worse Than Corruption

Sugar Crisis in Pakistan

Agricultural Growth in India, Pakistan and Bangladesh

Pakistan's Rural Economic Survey

Pakistan's KSE Outperforms BRIC Exchanges in 2010

High Cost of Failure to Aid Flood Victims

Karachi Tops Mumbai in Stock Performance

India and Pakistan Contrasted in 2010

Pakistan's Decade 1999-2009

Musharraf's Economic Legacy

World Bank Report on Rural Poverty in Pakistan

Copper, Gold Deposits Worth $500 Billion at Reko Diq, Pakistan

China's Trade and Investment in South Asia

India's Twin Deficits

Pakistan's Economy 2008-2010

Auto Industry in India, Pakistan and China

Media Revolution in Pakistan

-

Comment by Riaz Haq on November 3, 2012 at 5:32pm

-

Here's PakistanToday report on Pakistan's motorcycle exports:

Lahore - The domestic Motorcycle Industry has registered a remarkable recovery during the four months ending July 2011 as it has started taking its roots in international markets and exported around 10,500 units to different countries during the four months. The sources at industry said that after a steep drop in exports of around 135 percent from a peak of $3.5 million in 2009-10, the high-quality and low-priced locally produced bikes have effectively checked imports. They commended the industry efforts as the exports have picked up appreciably during April-July 2011 to 10,500 units.

They confirmed that during the said period, the industry has exported in excess of 2,500 units per month which is against an average export of around 1,200 units per month last year. If the trend continues, Pakistan will easily be able to double its motorcycle exports this year.

Motorcycle exports stood at $786,310 and surged to $3.5 million in the next year on the strength of $50 per unit Research and Development facility provided by the Government of Pakistan. The facility was withdrawn in 2010-11 after which the exports nosedived by 135 percent to $1.34 million, they said.

“The decline in exports would have been much higher but the prudent marketing strategy adopted by large motorcycle players controlled it”, said Mr. Fahad Iqbal CEO, HKF Engineering, makers of Ravi motorcycles. He said that the exports of motorcycles averaged over 2,500 units during the last four months which is a good sign for the industry. This, he added, is double the monthly export of 1,200 units in 2009-10 when record exports were witnessed. He said that the trend is expected to continue and Pakistan will easily be able to double its motorcycle exports this year.

Last year exports experienced a steep decline after a major policy shift by the Government when the Research & Development (R&D) facility was withdrawn from the motorcycle industry. The experts from the industry said that this massive recovery by motorcycle exports is testament to the resilience of this sector. The progress this sector has made over the last ten years or so is a proof that Pakistani entrepreneurs can compete with the best in the world if consistent policies are in place. Exports from Pakistan are textile dependent for the most part. Motorcycle industry provides a viable option as the next emerging export from Pakistan. “The industry is aiming to export half a million units annually by the year 2016” one expert said. “In export markets success builds on itself, especially, in motorcycles where establishment of an after sale service network and that of a secondary market creates the ground for a successful brand. Growth in sales will multiply as brands get established”, he said.

Experts pleaded that the current policy regarding motorcycles should not be disturbed as with its huge forward and backward linkages, the motorcycle industry moves the wheel of the economy. High employment creation and technology transfers make it an ideal sector for a country like Pakistan.

Growth in this sector means that upstream businesses such as part making in industries like steel, rubber, electronics and plastics etc. also get a boost. Investment comes in and jobs are created in all these industries. Similarly, this industry pushes up investment and creates additional jobs in downstream avenues like motorcycle dealerships for new and old bikes, repair and maintenance workshops and spare-parts businesses. The multiplier effect of this industry is huge.http://www.pakistantoday.com.pk/2011/09/13/news/profit/pakistan-aim...

-

Comment by Riaz Haq on November 14, 2012 at 8:33am

-

Talking about household disposable incomes in South Asia, there were 1.8 million Pakistani households (7.55% of all households) and 7.9 million Indian households (3.61% of all households) in 2009 with disposable incomes of $10,001 or more, according to Euromonitor.

This translates into 282% increase (vs 232% in India) from 1995-2009 in households with disposable incomes of $10,001 or more.

http://www.just-style.com/store/samples/2011_Euromonitor_WCIEP_Samp...

-

Comment by Riaz Haq on January 20, 2013 at 7:47pm

-

Here's ET on cost difference in Indian and Pakistani cars:

In support of his claim, he said average cost of a Pakistani car (excluding taxes) is Rs750,000. An average Pakistani car uses 60% of local components and the value of such components is around Rs450,000. This is the amount that the parts makers lost on each imported car, he said.

Most people believe that locally assembled cars are much more expensive than vehicles manufactured in other countries, but this is a wrong perception, the industry representatives said while giving a comparison between prices of Pakistani cars and those manufactured in regional countries.

Pakistani cars are cheaper than most cars manufactured in India, Allawala claimed, adding 1,800cc Toyota Corolla is being sold in India for $16,334 (retail price excluding taxes) while the price of the same car in Pakistan is $13,253, lower by $3,081.

Including taxes, the retail price of Toyota Corolla in India is $26,744 while in Pakistan it is $19,781, a difference of $6,963.

Similarly, the retail price of 1,800cc Honda Civic in India he said was $19,216 (excluding all taxes) while the same car is being sold for $15,214 in Pakistan, a difference of $4,002, he said.

After including all taxes, the difference in prices of Honda Civic in Pakistan and India is $7,403. In India, Civic is being sold for $30,455 while it is available at $23,052 in Pakistan.

The automakers and vendors have underlined the need for revision in the import duty slabs, saying the old duty structures are favouring car importers.

In response to a question, PAMA Director General Abdul Waheed cautioned the consumers, who are opting for imported used cars, saying they were making a wrong decision.

“The buyers of used cars may spend less initially, but eventually they pay much more in terms of expensive maintenance and low resale value compared to a new car,” he said.

http://tribune.com.pk/story/478485/auto-assemblers-say-cannot-susta...

-

Comment by Riaz Haq on January 21, 2013 at 10:57pm

-

Pakistan Post Office to provide motorcycles to its staff, reports PakObserver:

Islamabad—Pakistan Post will provide motorcycles to its postmen to ensure timely delivery of mails and important parcels. In this regard a Memorandum of Understating (MoU) has signed between Pakistan Post and Bank of Khyber (BK).

Through the scheme, the employees of the Post have an option to choose each and any brand of motorcycle available in market as per their choice. Director General, Pakistan Post, Syed Ghulam Panjtan Rizvi said that the organization has earlier provided motorcycles to its staff officials to ensure provision of quality services and it will provide more motorcycles to its postmen”, he said.

-

Comment by Riaz Haq on February 28, 2013 at 10:05pm

-

Here's a Dawn report on Yamaha investment in Pakistan:

Yamaha Motors will invest US$150 million in auto sector of Pakistan to produce two-wheelers in the country.

This was stated by Sumioks, Senior Executive Officer of Yamaha Motors Pakistan (YMPK) while addressing a press conference in Islamabad on Thursday.

He said that the company would start production of motorcycles with engine capacity of 100cc and above from 2015.

“We have already submitted the application for registration to Securities and Exchange Commission of Pakistan (SECP) and 18 months after getting approved from the SECP, the company would start its production,” Sumioks added.

He said that initially YMPK will produce 40,000 units, which will be gradually increased and after five years the production would reach 400,000 units per year.

He said that the company would have its own factory and office of 50 acres at Bin Qasim Industrial Park Karachi.

“We will have high ration of localisation in manufacturing starting from 25 per cent since the first day of commercial production up to 85 per cent in five years,” he added.

He said the investment will help in boosting economic activity, increasing foreign direct investment, creating job opportunities, developing human resources and broadening the base of parts supplier industry.

He said the investment will create nearly 2000 job opportunities directly and 25,000 indirectly.

He said the motorcycles will be fuel efficient and would have new technology with Euro-II & Euro-III compliance, which were are not yet manufactured in Pakistan.

On the occasion, Feroz Shah, honorary councilor of Board of Investment (BoI) in Japan said that after producing motorcycles, Pakistan would be able to export them.

“The annual production of motorcycle is around 1.8m in Pakistan but almost all domestic models, so export is negligible.

“This plant will bring opportunity not only for the export motorcycles but vendors will also be able to export their parts as well,” he added.

http://dawn.com/2013/02/28/yamaha-to-invest-150m-in-pakistan-auto-s...

-

Comment by Riaz Haq on March 3, 2013 at 9:49pm

-

Here's an ET story on Samsung's marketing push in Pakistan:

Samsung, a global leader in consumer electronics, is aiming to secure a larger share of the Pakistani market by the end of this year. Its action plan includes advertising heavily on all platforms available, with a special focus on brand shops, providing brand awareness, and introducing a range of products under one roof.

“In the televisions market, Samsung in Pakistan currently enjoys a 38% share, which we are aiming to increase up to 50% by the end of 2013,” Amir Shahzad, Samsung Pakistan’s Retail and Channel Management head (Consumer Electronics) recently told The Express Tribune.

Though Samsung offers a wide range of products, including smartphones, personal computers, printers, cameras, home appliances, medical devices, semiconductors and LED solutions, the company’s Pakistani management is focusing specifically on the television segment by introducing the latest plasma TVs, LED TVs, home theatres and other home appliances.

The management says the company is benefitting from the rise of the Pakistani middle class. The global economic downturn – which forced many other electronic brands like Sony, Sharp and JVC to minimise operations in Pakistan – is another factor that has provided Samsung the opportunity to step in and capture the large domestic market.

Samsung operates through 550 dealerships in Pakistan, spread over the length and breadth of the country, through which a complete range of products is available to consumers. More recently, the rising trend of multinational retail outlets in large cities has forced the management to introduce brand shops in the country which showcase the latest Samsung products. The 30 “strategically-located” brand shops offer genuine Samsung warranties for 3D Smart TVs, LED and LCD TVs, monitors, plasma display panels, IT products, cameras and home appliances.

“Our latest appliances are relatively higher-end, but we are also targeting the rising middle class. These retail outlets are providing us a wonderful platform to promote our brand,” Shahzad said.

The staff in each shop guides consumers in buying the right products according to their demands and budgets, Shahzad explained. “Such shops also provide technical assistance and after-sales guarantee and maintenance facilities to the customer,” he added.

“The Samsung Brand Shop is a revolutionary business model for the Samsung retail brand, from where all retailers can learn and emulate building a consistent branding approach,” Shahzad claimed.

However, like other multinationals, Samsung is reluctant to invest directly in Pakistan. At this stage, it is not even considering starting a proper assembling or manufacturing plant for its products in the country. It does assemble a handful of its products in country, but that is a tiny operation compared to its global operations, and Shahzad says the sole purpose of this business is to circumvent import duties and enable Samsung to compete in the local market at better rates.

That leaves Samsung’s sole focus on heavy advertisement in order to register itself in the minds of the masses. “We want every Pakistani to use Samsung products, for which we are using every possible advertising channel, whether electronic and print media, road shows, brand shops, social media, promotion schemes, online advertisements,” Shahzad said.

“We believe that advertising heavily is a strategy which will help us achieve our targets and make Samsung the country leader in all the different products offered by the company,” he added.

http://tribune.com.pk/story/514943/samsung-looks-to-capture-pakista...

-

Comment by Riaz Haq on March 19, 2015 at 8:12pm

-

The Emerging Middle Class in Pakistan: How it Consumes, Earns, and Saves

Dr. Jawaid Abdul Ghani

Professor, Strategy and Marketing Research,

Karachi School of Business and Leadership

jawaid.ghani@gmail.comDuring the first decade of the twenty first century, and for the first time in the history of

Pakistan, over half of the households in the country belonged to the middle class (M-class).

During this period (2002-2011) the M-class, defined as households with daily per capita

expenditures of $2-$10 in 2005 purchasing power parity dollars1

, grew from 32 percent to 55

percent of all households in the country, and the number of people in this class doubled from 38

million to 84 million. Real aggregate national consumption increased by about $60 billion, of

which $55 billion was accounted for by the increase in consumption of the M-class. As a result

90 percent of the increase in national consumption during this decade came from the increase in

consumption of the M-class2

. It is not surprising that the Asian Development Bank listed

Pakistan as among the top five countries3

in the Asia Pacific region with the fastest growing Mclass

during 1990-2008 (Chun 2010).

What characterizes the M-class? Bannerjee and Duflo (2008) suggest that holding a relatively

secure job is the single most important characteristic of the M-class. Individuals with higher

levels of “permanent income” are less vulnerable to economic shocks, have lower discount rates

for future rewards and thus invest more in health, education, and other “rent generating”

credentials. Professionals and others in the “service class” with large amounts of human capital

and stable employment relationships are considered the most likely to invest in securing their

own and children‟s future. Indeed, according to Sorenson (2000) it is the level of uncertainty in

“lifetime wealth” and resulting living conditions which result in differences among social

classes4

. M-class values are described as optimism and confidence regarding the future, a

preference for moderation and stability, a willingness to pay a little extra for quality, the “ability

to defer gratification”, and income often based on specialized skills. As a result the M-class has

the “base amount of income to invest in productive activities that contribute to economy-wide

welfare” (Chun 2010), and is more likely to accumulate human capital and savings, and more

inclined towards entrepreneurship (Lopez 2012, Meyer 2012).http://iba.edu.pk/testibaicm2014/parallel_sessions/ConsumerBehavior...

-

Comment by Riaz Haq on April 25, 2015 at 8:51am

-

Pew Survey: Car, bike or motorcycle? Depends on where you live

Only 3% of Pakistani households (vs 6% in India) own a car but 43% (vs 47% of Indians) respondents own motorcycles.

If you’ve ever witnessed traffic in Ho Chi Minh City, it’s clear that motorcycles and scooters dominate transportation there. While less common than cars and bicycles, these relatively inexpensive two-wheelers are especially popular in South and Southeast Asia. More than eight-in-ten in Thailand, Vietnam, Indonesia and Malaysia own a scooter. And the next tier of motorcycle owners are all in Asia: China at 60%, India at 47% and Pakistan at 43%.

http://www.pewresearch.org/fact-tank/2015/04/16/car-bike-or-motorcy...

-

Comment by Riaz Haq on April 25, 2015 at 8:51am

-

Pew Survey: Car, bike or motorcycle? Depends on where you live

Only 3% of Pakistani households (vs 6% in India) own a car but 43% (vs 47% of Indians) respondents own motorcycles.

If you’ve ever witnessed traffic in Ho Chi Minh City, it’s clear that motorcycles and scooters dominate transportation there. While less common than cars and bicycles, these relatively inexpensive two-wheelers are especially popular in South and Southeast Asia. More than eight-in-ten in Thailand, Vietnam, Indonesia and Malaysia own a scooter. And the next tier of motorcycle owners are all in Asia: China at 60%, India at 47% and Pakistan at 43%.

http://www.pewresearch.org/fact-tank/2015/04/16/car-bike-or-motorcy...

-

Comment by Riaz Haq on April 27, 2015 at 4:50pm

-

“#Pakistan is all set to become one of the top global markets of #motorcycles" #Yamaha President Hiroyuki Yanagi http://tribune.com.pk/story/876873/investment-yamaha-resumes-assemb... … Yamaha Motor Pakistan (Pvt) Ltd, a newly formed company with 100% equity from Yamaha Motor Company, Japan, is expected to produce 30,000 units in year 2015.

The factory has been established with an initial investment of Rs5.3 billion and its current production capacity is 40,000 units per year. It has hired 200 employees in the first phase.

In its initial phase, the company has introduced the “YBR125” model, a 125cc engine motorcycle, with a network of 140 dealerships in different parts of the country. Equipped with new technology, industry analysts say the initial price of YBR125 (Rs129,400) is competitive enough for its rival models in the market. Pak Suzuki’s GS150 is available in Rs128,500 while Atlas Honda’s CG125 and CG125 Deluxe is available in Rs102,900 and Rs124,000, respectively.

Japanese Ambassador to Pakistan Hiroshi Inomata said that the presence of the top leadership of Pakistan in the inauguration ceremony signifies the importance of the investment Yamaha has brought into Pakistan.

“We appreciate the efforts of the government of Pakistan in bringing FDI in the country. We believe this is a win-win situation for both Japan and Pakistan,” Inomata added.

Board of Investment Chairman Dr Miftah Ismail said the middle class of Pakistan was growing at a rapid pace. From the current level of 70 million, it will touch 100 million by 2025, making Pakistan one of the top six countries with the largest middle class in the world, he added.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm

Can Pakistan's JF-17 Become Developing World's Most Widely Deployed Fighter Jet?

Worldwide demand for the JF-17 fighter jet, jointly developed by Pakistan Aeronautical Complex (PAC) and China’s Chengdu Aircraft Industry Group (CAIG), is surging. It is attracting buyers in Africa, Asia and the Middle East. At just $40 million a piece, it is a combat-proven flying machine with no western political strings attached. It has enormous potential as the lowest-cost 4.5…

ContinuePosted by Riaz Haq on February 4, 2026 at 8:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network