PakAlumni Worldwide: The Global Social Network

The Global Social Network

Production and Sales of Cars and Televisions Rose in Pakistan in 2010-11

Automobile:

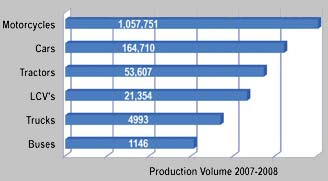

146,271 vehicles were produced in Pakistan in 8 months from July 2010 to February 2011, representing an increase of 9.2% y-o-y on the 133,918 units produced over the same period of FY09/10, according to figures from the Pakistan Automotive Manufacturers Association (PAMA). This consists of 85,924 units for passenger car production, 1,807 units truck production, 308 units bus production, 580 units jeep production, 12,000 units pick-up production and 45,652 units farm tractor production. Sales largely mirror production in Pakistan's auto market: the first eight months of FY10/11 saw a total of 143,785 new vehicles sold in the country, an increase of 7.1% y-o-y. Extrapolating the eight-month data across 12 months, total vehicle production would amount to 219,407 units, while total vehicle sales would register 215,678 units. This compares to the BMI forecast for the full fiscal year of just over 221,500 and just over 224,000 for production and sales respectively. However, these figures for FY10/11 aggregate sales and production are still considerably below the high watermark reached for both variables in FY07/08.

Although FY10/11 and FY09/10 have seen reasonably strong growth in y-o-y terms for both sales and production volumes, the industry is still recovering from a disastrous year in FY08/09, which was hit by a combination of the global economic downturn and severe internal political instability.

Consumer Electronics:

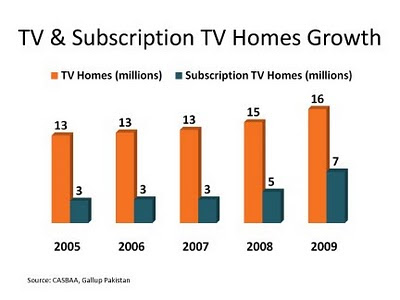

The media revolution of 24X7 news, entertainment and sports centered around rising number of television channels drove tv set sales up by 28.6% in 2010-2011.

Pakistan's consumer electronics market, including personal computers, mobile handsets and audio-video products, is now estimated at about $1.8 billion. BMI forecasts that this market will grow to $3 billion by 2015.

Computers accounted for about 20% of Pakistan's consumer electronics spending in 2010. BMI forecasts Pakistan's domestic market computer hardware sales (including notebooks and accessories) of $312 million in 2011, up from $292 million in 2010. Computer hardware CAGR for the 2011- 2015 period will be about 8%.

Mobile Handsets Pakistan's market handset sales are expected to grow at a CAGR of 16% to 29.5 million units in 2015, as mobile subscriber penetration reaches 70%. Revenues growth will be slower due to lower average selling prices (ASPs) of mobile handsets, with most handsets sold at less than $40. Another issue is the declining growth rate of mobile subscriber penetration, which is now more than 60%. 3G licenses are still expected to be awarded in 2011, but Pakistan's telecoms regulator has yet to confirm this.

Fast Moving Consumer Goods:

Fast moving consumer goods (GMCG) sector, including food, beverage and tobacco, grew by 9.3%, according to Economic Survey of Pakistan 2010-11. Adverting revenue from this sector has continued to drive proliferation of electronic mass media in Pakistan.

Conclusion:

The continuing growth in consumer spending is a testament to Pakistanis' resilience in the midst of multiple and very serious crises of energy shortages, continuing militancy and political violence and instability. The question is how long can this extraordinary resilience last if the corrupt and incompetent Pakistani politicians continue to persist in their mismanagement of the country and its economy.

Related Links:

Haq's Musings

Resilient Pakistan

Pakistan's Rural Economy Showing Strength

Pakistan's Exports and Remittances Rise to New Highs

Incompetence Worse Than Corruption

Sugar Crisis in Pakistan

Agricultural Growth in India, Pakistan and Bangladesh

Pakistan's Rural Economic Survey

Pakistan's KSE Outperforms BRIC Exchanges in 2010

High Cost of Failure to Aid Flood Victims

Karachi Tops Mumbai in Stock Performance

India and Pakistan Contrasted in 2010

Pakistan's Decade 1999-2009

Musharraf's Economic Legacy

World Bank Report on Rural Poverty in Pakistan

Copper, Gold Deposits Worth $500 Billion at Reko Diq, Pakistan

China's Trade and Investment in South Asia

India's Twin Deficits

Pakistan's Economy 2008-2010

Auto Industry in India, Pakistan and China

Media Revolution in Pakistan

-

Comment by Riaz Haq on May 4, 2015 at 7:28am

-

KARACHI: Car sales are expected to reach their highest level in three years by the end of June 2015, analysts have predicted, stressing that the growth is depended on the sustained success of new models.

With a 24% improvement during the first nine months (Jul-Mar) of fiscal year 2015 (FY15), sales of new and used vehicles picked up in March and are now expected to reach their highest in three years by the end of the current fiscal year.

“Auto sales are expected to grow in double-digits but they are highly dependent on automaker’s new models,” Global Research analyst Asad Raza Nayani told The Express Tribune.

“The sales depend on the new make of Toyota Corolla and Punjab government’s Apna Rozgar Scheme,” Nayani added.

The growth of automobiles in FY15 is expected to touch 165,000 units, 23% compared to last year, he said. But, that will still be low compared to 175,000 units sold in FY12.

Looking at March 2015 sales alone, one can be a little more bullish in the remaining three months (April-June) of FY15.

According to latest figures posted by the Pakistan Automotive Manufacturers Association, local auto sales, including light commercial vehicles, shot up by an impressive 72% to 21,147 units compared to 12,269 units during the same month last year.

According to Sherman Securities, car sales in March are possibly the highest-ever sales posted by the Pakistan auto industry in a single month.

If monthly car sales grow at the same rate as they did in March 2015, which it possibly can, cumulative car sales may touch a six-year high.

However, analysts are not yet entirely optimistic as the auto industry is still facing considerable challenges despite many positives including growing margins of auto companies, declining interest rates and double-digit growth in sales.

“The interests rates have come down considerably in the last four months, but banks are still cautious when it comes to auto financing which is not helping car sales considering its potential,” Nayani added.

Industry officials and analysts estimate that car financing still stands at a mere 30-35% of the total car sales in the country, which is considerably low, compared to other countries.

Banks are reluctant when it comes to car financing due to its bad experiences during the last few years when Non-Performing Loans (NPL) ballooned and considerably hurt the financial health of banks.

The cumulative sales during the first nine months (Jul-Mar) of FY15 stood at 124,000 units, up 24% compared to 100,000 units in the same period of previous year. However, sales growth drops to 19% if car sales under the Punjab taxi scheme that was launched in February 2015 is excluded.

http://tribune.com.pk/story/868357/ongoing-fiscal-year-auto-sales-e...

-

Comment by Riaz Haq on July 27, 2015 at 8:00am

-

Car manufacturers had a blissful 2014-15 as they saw sales jump to 151,134 units from 118,102 in the preceding fiscal year, media reports said on Saturday.

The launch of new Toyota Corolla brought a big relief to its assembler, pushing up the company’s sales to 51,398 units from 29,087 and also making a positive impact in overall sales figures, Pakistan Automotive Manufacturers Association (PAMA) said on Friday.

Another uplift in overall sales came from Punjab government’s taxi scheme that helped sales of Suzuki Bolan rise to 23,582 units from 14,088, and that of Suzuki Ravi to 22,815 from 12,419.

Even increase in car prices by the manufacturers did not dampen buyers’ enthusiasm. Moreover, a decline in interest rates to seven per cent from 10pc by the State Bank of Pakistan (SBP) in the last one year also pushed up sales by at least 10pc on cars being sold under bank financing.

Launched in March 2014, Suzuki Wagon R compensated the 32pc sales loss in Swift. Wagon R’s sales more than tripled to 5,246 units in FY15 from 1,621 a year ago, while Swift sales dropped to 3,490 from 5,128.

Facing stiff competition with thriving used-car imports of small engine power, Suzuki Mehran sales slightly inched up to 29,886 from 29,509 units, while Cultus sales fell to 13,837 from 14,682.

The just-ended fiscal year proved a bit difficult for Honda Civic in the wake of Toyota Corolla’s launch, as its sales dropped to 7,806 units from 9,933 in FY14.

Pak Suzuki Motor Company Limited (PSMCL) did not officially announce halt in Liana production despite the fact that no car was rolled out during FY15. However, sales from old stocks stood at 23 units in 2014-15 compared to 161 a year earlier. Only 72 Lianas were produced each in October and December 2013.

Hyundai Santro also faced the same fate as only 82 and 128 units were produced in January and February 2014, respectively, while no car was assembled in the 2014-15. Its sales from some old stocks were 50 units in FY15 compared to 152 in FY14.

Muhammad Tahir Saeed of Topline Securities told Dawn that local car assemblers registered “an excellent” year-on-year growth of 31pc during FY15 versus just 1pc growth in FY14 and a compound annual growth rate (CAGR) of 5.3pc during the last five years (FY11-15).

http://www.pakistantoday.com.pk/2015/07/11/business/car-sales-cross...

-

Comment by Riaz Haq on August 1, 2015 at 10:03pm

-

#Pakistan's #Japan-dominated car market poised 4 new entrants from #Europe, #Korea. #Automobiles -The Economic Times http://economictimes.indiatimes.com/news/international/world-news/p... …

Pakistan's car market has been dominated by Japanese automakers for decades, but a mini-economic revival looks set to attract new players from Europe and Korea into the mix.

Despite heavy taxation on imported vehicles, enthusiasm for owning a car in Pakistan has remained undented -- thanks in part to underdeveloped public transport in the country's sprawling cities, but also the social status it brings.

Toyota, Suzuki and Honda car assembly plants already work around the clock in Karachi to satisfy demand but still customers have to wait for about 4 months to get delivery

-

Comment by Riaz Haq on August 20, 2015 at 7:43am

-

#Pakistan's monthly auto sales up 129pc to 15,909 in units in July 2015 https://shar.es/1tTkru via @sharethis

Pakistan local car assemblers have started the new fiscal year with a positive growth of around 129 percent year on year (YoY), according to the data released by Pakistan Automotive Manufacturers Association (PAMA).

During July 2015, the local vehicle sales including LCVs, Vans and Jeeps stood at 15,909 units. It is important to note that in July 2014, sales dropped abnormally due to increase in advance motor vehicle tax and imposition of advance income tax on transfer of motor vehicles in Federal Budget FY15, said Muhammad Tahir Saeed, an analyst at Topline Research.

“Furthermore, anticipated new ‘Corolla’ model and less working hours due to Ramadan were other factors contributing to the historical low sales in last July,” he added.

Overall healthy growth in auto sector is indicative of increase in per capita income, improved farmer economics and overall recovery of the economy. Car financing is also picking up gradually, currently estimated at 30 percent versus 5.0 percent few years ago. To recall, car sales in Pakistan grew at a 5-year (FY11-15) CAGR of 5.3 percent to 179,953 units while volumes surged by 31 percent in FY15 on the back of a new model of Toyota Corolla, Taxi Scheme of Punjab government and an increase in car financing due to 42-year low interest rates in the country.

“We forecast car sales to grow at 13 percent in FY16 to reach at 203,653 units,” the analyst added.

Among individual companies, Pak Suzuki Motors (PSMC) sales increased by 119 percent YoY to 9,464 units in Jul 2015 primarily due to Punjab government’s Taxi Scheme. Volumes declined by three percent on Month-on-Month (MoM) basis due to extended Eid holidays.

Indus Motors Company (IMC) sold around 4,259 units in Jul 2015 compared to 1,106 units in the same month last year. It is pertinent to note that customers were waiting for the new model of Toyota Corolla in the same month last year which was the main reason for such an abnormally low base. On MoM basis, INDU sales decreased by 22 percent from 5,458 units it sold in Jun 2015.

Saeed attributed this decline to less working hours during Ramadan and extended Eid holidays. Just to highlight, Toyota’s new Corolla model is sold out for next 3-4 months, according to the sources in the industry.

HCAR sold 2,181 units in Jul 2015 compared to 1,505 units in the same month last year. On MoM basis, HCAR sales decreased by 12 percent in Jul 2015 from 2,488 units in Jun 2015.

It is important to note that HCAR is consistently posting sales growth despite the new model of Toyota Corolla launched by its competitor Indus Motors. This indicates that overall market size of Pakistan automobile sector is growing.

Millat Tractors (MTL) and Al Ghazi (AGTL) sales have been affected due to the floods.

MTL sold 743 units in July 2015 compared to 1,703 units in the same month last year. On Month-on-Month basis, MTL sales decreased by 71 percent in July 2015 from 2,556 units in June 2015.

AGTL sold 820 units in Jul 2015 compared to 1,056 units in the same month last year. On Month-on-Month basis, AGTL sales decreased by 40 percent in Jul 2015 from 1,375 units in Jun 2015.

-

Comment by Riaz Haq on November 29, 2021 at 10:08am

-

Iron, steel output swells to 4.7m tonnes

https://www.dawn.com/news/1646475

KARACHI: The production of iron and steel, with billets/ingots mainly used in the construction industry, in the last 10 years swelled by 196 per cent to 4.777 million tonnes in FY21 from 1.616m tonnes in FY12.

H/CR sheets/strips, coils/plates, also known as flat steel products for production of electronics, surged to 3.296m tonnes in FY21 from 1.850m tonnes in FY12, Pakistan Bureau of Statistics (PBS) data of Large-Scale Manufacturing (LSM) showed.

Rising production of steel related products has led to higher imports of raw materials. For making steel bars, the country’s iron and steel scrap imports in FY21 rose to 4.719m tonnes costing $1.86bn from 1.568m tonnes valuing $538m in 2011-12, the PBS figures showed.

Besides, iron and steel imports swelled to 2.992m tonnes amounting to $1.959bn in FY21 from 1.755m tonnes ($1.4bn) in 2011-12.

Commenting on rising demand for steel bars, Pakistan Association of Large Steel Producers Secretary General Syed Wajid Bukhari said steel bar production till 2011-12 was about three to 3.5m tonnes while the current demand now hovers between 6.5m tonnes to 7m tonnes.

He attributed increase in steel bar prices to soaring scrap prices in the world market to $550 per tonne from $300 per tonne while one dollar is now equal to 168 as compared to Rs85 in 2011-12.

He said gas price increased to Rs97 per unit from Rs15 per unit in the last 10 years followed by power tariff to Rs21 per unit from Rs6 per unit. Freight charges are 100 per high now.

Mr Bukhari was of the view that steel bar demand would soar to nine to 10 million tonnes by 2023-24 in view of rising construction activities.

Private sector consumes 80pc of total steel bar production as compared to 20pc by the public sector, he added.

Hassan Bakhshi, former chairman Association of Builders and Developers (ABAD), said a multi-storey high project to be built on 1,000 yards plot with three floors for car parking requires around 1,100 tonnes of steel bars.

He claimed that steel bar demand has been on the rise due to 80pc construction work on highrise projects in Punjab while the Sindh Building Control Authority (SBCA) has been creating problems in clearing new projects.

“Only 91 projects have been cleared by the SBCA in the last two years in Karachi as compared to 500-7,000 projects a year some 10 years back,” he said.

The projects being promoted on the social, print and electronic media belong to Punjab while in Karachi, advertisement campaigns have been running for old projects which had been approved very late.

Pakistan Association of Parts and Accessories Manufacturers Association chairman Abdul Rehman Aizaz was of the view that auto assemblers and their vendors consume 15,000-20,000 tonnes per month of iron and steel in different forms which are used in making different parts by the vendors and the assemblers.

Bike production swelled to 2.475m units from 1.645m units in FY12, while jeeps/cars production rose to 163,122 units from 154,706 units in FY12.

Trucks and buses production in FY21 jumped to 3,808 and 570 units from 2,597 and 568 units FY12.

Domestic appliances and electronic products have shown phenomenal growth in the last 10 years. For example, production of refrigerators, deep freezers and air conditioners has swelled to 1.337m units, 109,029 units and 505,493 units from 1.062m units, 56,313 units and 240,338 units in FY12. Electric fans production rose to 2.498m units from 1.908m units.

-

Comment by Riaz Haq on June 11, 2022 at 5:00pm

-

Bilal I Gilani

@bilalgilani

Pakistan produced 2.4 million motorcycles last year200k in a month 8000 in a day 1000 every hour

https://twitter.com/bilalgilani/status/1535717946273804299?s=20&...

--------------

Bilal I Gilani

@bilalgilani

In one decade motorcycle on road increases from 5 million to 25 million !https://twitter.com/bilalgilani/status/1535718216215011328?s=20&...

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan Household Survey HIES 2024-25 Raises More Questions Than It Answers

Recently released HIES 2024-25 household integrated economic survey by Pakistan Bureau of Statistics (PBS) raises more questions than it answers. For example, it shows that Pakistani household are buying lower amounts of basic food ingredients like wheat, meat and eggs in the last four years, implying that people are eating less to cover other expenses, like electricity and gas. But it doesn't explain why the households have reported significantly lower purchases of these items than…

ContinuePosted by Riaz Haq on January 6, 2026 at 5:16pm

Happy New Year 2026: Pakistan's Year 2025 in Review

As we enter the year 2026, it is time to review the year 2025 and wish you all Happy New Year 2026! May it bring peace, prosperity and happiness to all!!

The year 2025 saw Pakistan defeat a brazen Indian attack on its soil, while reviving its economy and…

ContinuePosted by Riaz Haq on December 30, 2025 at 9:30pm — 4 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network