PakAlumni Worldwide: The Global Social Network

The Global Social Network

Double Digit Rise in Energy Consumption Confirms Pakistan's Economic Recovery in 2021

Oil consumption in Pakistan jumped 19% to 20.8 million tons in 2021, a strong indication of the country's economic recovery from the COVID-impacted 2020. In addition to oil, Pakistanis also consumed nearly 4 billion cubic foot of natural gas every day. Energy is fundamental to the functioning of any economy.

|

| Pakistan Oil Consumption. Source: Arif Habib |

|

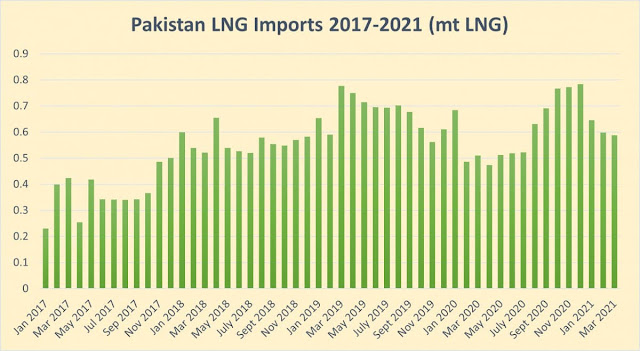

| Pakistan LNG Imports 2017-2021 in million tons |

|

| Pakistan Natural Gas Consumption in Billion Cubic Feet Per Day |

|

| Pakistan Auto Sales. Source: Arif Habib |

Motorcycle sales in the first 9 months of CY 2-21 were 1.4 million units, up 37.5% vs the 2020 and 13.0% vs the 2019. Atlas Honda dominated the motorcycle market with sales up 52.2%. Soaring cement consumption, rising auto sales and double digit increase in energy consumption in Pakistan in 2021 confirm that Pakistan's recovery from the COVID-induced slump is well underway.

-

Comment by Riaz Haq on January 8, 2022 at 7:08pm

-

Razak vows to increase IT exports to $3.7bn in FY22

https://profit.pakistantoday.com.pk/2022/01/07/razak-vows-to-increa...

Adviser to the Prime Minister on Commerce and Investment, Abdul Razak Dawood on Friday said that there is a lot of scope to increase exports in Information Technology (IT) from non-traditional sector at present, announcing that the government has set a new target of $3.5 billion exports in this regard.

“The current annual $2.5 billion IT exports are very low. We now have an annual export target of $3.7 billion this year,” he said while addressing the Technology Roundtable to highlight Investment opportunities in the IT and Information Technology Enabled Services (ITES) sector organized by Board of Investment ( BOI).

“Today is the age of Information Technology and e-commerce, our youth can take full advantage of it,” he said, adding that Pakistan’s exports can now be boosted by focusing on some of the non-traditional sectors from the traditional export sector including textile.

Razak Dawood said that there was a need to promote export culture in the country at present and the government wanted to increase exports on priority basis.

During his address, he said that Pakistan’s economy has made significant progress reflecting a blend of stabilization and structural reforms despite being challenged at economic and geo political front and is moving on a positive growth trajectory.

He added that Micro Small and Medium Enterprises (MSMEs), that use e-Commerce platforms, are around five times more likely to export than those in the traditional economy and the policy aims to pave the way for holistic growth of e-Commerce in the country by creating an enabling environment in which enterprises have equal opportunity to grow steadily.

He stressed that the way forward for Pakistan on the economic front is to focus on exports, specifically IT related exports.

Chairman BOI said that government of Pakistan is making all out efforts to put the economy on the track of long-term and sustainable economic progress.

“IT Sector Policy of Pakistan offers a generous set of incentives to investors” he said.

He also apprised the participants on “Pakistan Regulatory Modernization Initiative” (PRMI), being led by BOI that was launched by the Honorable Prime Minister of Pakistan.

“Once rolled out, it shall transform the regulatory landscape across all tiers of government,’ he said.

He added that the IT sector also allows up to 100% foreign ownership and 100% repatriation of profits.

Secretary BOI, while highlighting IT sector specific reforms introduced in Pakistan shared that the payment limit for foreign vendors of digital services has been enhanced by SBP from $100,000 to $400,000 and the approval from SBP for payment above $100,000 has been waived off for digital services.

She further added that in order to facilitate IT businesses, 62 globally recognized companies have been notified requiring no approval from the State Bank and that the State Bank has allowed commercial banks to obtain the Cloud Outsourcing Services to meet their growing customers’ needs.

Elaborating on some incentives introduced for the Special Technology Zones, Secretary BOI mentioned income tax exemption for 10 years including on dividends and capital gains, exemption of custom duties and taxes on capital goods for 10 years, exemption from GST on import of plant, machinery, equipment and raw-materials and exemption from property tax for 10 years.

The Technology Roundtable was a successful feat in showcasing opportunities in Pakistan’s thriving IT sector and ended with a unanimous vote of re-assurance that all stakeholders will work in close collaboration with BOI to uplift the development of IT sector to ensure export led growth and quality FDI.

-

Comment by Riaz Haq on January 10, 2022 at 2:33pm

-

One of the major initiatives of the government to encourage imports of raw materials also pushed up the import bill. Oil prices have also increased substantially, which pushed up the import bill because of the high demand for energy in the domestic market. A surge was noted in imports of vehicles, machinery as well as vaccines, pushing the import bill.

In FY21, the import bill surged by 25.8pc to $56.091bn from $44.574bn the previous year.

--------

Exports posted year-on-year growth of 24.71pc to $15.102bn in July-December 2021. In December 2021, exports saw a growth of 15.8pc to $2.740bn from $2.366bn in the same month last year. On a month-on-month basis, exports declined by 5.55pc in December.

Export proceeds went up by 18.2pc to $25.294bn in FY21 from $21.394bn over the last year.

According to the commerce ministry, the exports of fish & fish products, plastics, cement, fruits & vegetables, petroleum products, natural steatite, etc increased. In terms of market diversification, there was an increase in exports to Bangladesh, Thailand, Sri Lanka, Malaysia, Kazakhstan, South Korea, etc.

In the traditional sectors, there was an increase in the exports of men’s garments, home textiles, rice, women’s garments, jerseys & cardigans and T-shirts. However, exports of fruits & vegetables, surgical instruments, electrical & electronic equipment, tractors, pearls and precious stones decreased in December 2021 as compared to the same month last year.

https://www.dawn.com/news/1667861/trade-deficit-widens-106pc-in-jul...

--------------

Arif Habib Limited

@ArifHabibLtd

Country posted highest ever textile exports for the month of Dec.

Dec’21: $ 1.64bn, +17% YoY, -6% MoM

1HFY22: $ 9.40bn, +26% YoY

https://twitter.com/ArifHabibLtd/status/1480415138108870656?s=20

-

Comment by Riaz Haq on January 11, 2022 at 9:35am

-

Arif Habib Limited

@ArifHabibLtd

Atlas Honda Limited (ATLH) posted highest ever bikes sales of 1,352,711 units in CY21.

https://twitter.com/ArifHabibLtd/status/1480886060506832902?s=20

--------

Arif Habib Limited

@ArifHabibLtd

Auto Sales Data

Dec’21: 27,331 units +96% YoY; +46% MoM

1HFY22: 136,000 units, +70% YoY

CY21: 237,443 units, +91% YoY

https://twitter.com/ArifHabibLtd/status/1480884776399745028?s=20

-------

Arif Habib Limited

@ArifHabibLtd

·

4h

Auto sales increased by 91% YoY to 237.4K units during CY21, 3rd highest on CY basis.

https://twitter.com/ArifHabibLtd/status/1480886761651949575?s=20

-----------

Arif Habib Limited

@ArifHabibLtd

Private sector credit witnessed massive growth in CY21 which surged by PKR 1.4trn; highest in last 10 yrs. The jump in credit offtake reflecting improvement in business confidence and investment momentum.

https://twitter.com/ArifHabibLtd/status/1480917052084957193?s=20

---------------

Arif Habib Limited

@ArifHabibLtd

Highest ever monthly sales of Suzuki Alto during Dec’21 (9,195 units, +280% MoM | +211% YoY) amid favorable Govt policies.

https://twitter.com/ArifHabibLtd/status/1480888735126413315?s=20

---------------

AL Habib Capital Markets (Pvt) Ltd

@alhabibcapital

Urea Sales up by 5% YoY to 6.34mn tons during 2021

#Pakistan #Urea

https://twitter.com/alhabibcapital/status/1480787867114917890?s=20

-

Comment by Riaz Haq on January 16, 2022 at 9:54am

-

#Pakistan is not alone in switching #power generation from natural #gas to #oil. #US states in #NewEngland are now generating 25% of #electricity using oil due to natural gas shortage. https://www.bloomberg.com/news/articles/2022-01-04/boston-winter-dr...

https://www.bloomberg.com/news/articles/2022-01-04/boston-winter-dr...A third Caribbean liquefied natural gas cargo is headed for Boston, where two other await colder weather before unloading in an unprecedented bet on price spikes this winter.

GasLog Partners LP-owned Methane Lydon Volney is expected to arrive in Boston Jan. 11 with an LNG cargo from Trinidad & Tobago, according to ship tracking data compiled by Bloomberg. The tanker will join Cadiz Knutsen and Excelerate Energy’s Exemplar, which are both anchored in Massachusetts Bay and also carrying LNG cargoes from the Caribbean nation.

-

Comment by Riaz Haq on January 16, 2022 at 8:25pm

-

Best of 2021: China’s coal exit will not end Pakistan’s reliance on dirty fuel

Pakistan will continue to develop under-construction coal plants and even turn to highly polluting local sources of the fossil fuel

https://www.thethirdpole.net/en/energy/china-coal-exit-will-not-end...

Pakistan is one of the Belt and Road Initiative countries where coal formed a major part of energy projects under the China-Pakistan Economic Corridor (CPEC).

Of the 18 ‘priority’ energy projects (11.87 GW) financed by China at around USD 19.55 million, nine (8.22 GW) were coal-fired.

Of these, four – the Huaneng Shandong Ruyi-Sahiwal Coal Power Plant, the Port Qasim Coal-fired Power Plant, the HubCo Coal-fired Power Plant and Sindh-Engro Thar Coal Power Plant – are complete and have been supplying electricity to the national grid since 2017. Together, their energy output is 4.62 GW.

Michael Kugelman, deputy director for the Asia programme at US-based think-tank the Wilson Center, said China’s exit from coal is a “blessing in disguise” with opportunities for “bilateral clean energy cooperation” a clear win for the environment.

Even Muhammad Badar-ul-Munir, the chief executive of the 100 MW Quaid-e-Azam Solar Power Pvt Ltd (QASPL) plant, said the end of China’s attachment to overseas coal projects is a “great piece of news”, as it may force the government of Pakistan to focus on the much-ignored area of solar power.

Back in 2014, QASPL made headlines. As part of the China-backed 1,000 MW Quaid-e-Azam Solar Park in Punjab province, the company set up the first 100 MW of electricity in just under a year.

Two years later, Chinese company Zonergy added another 300 MW of solar energy to the national grid.

“For the last five years, work on this first energy project under the China-Pakistan Economic Corridor (CPEC) has been at a standstill, despite the infrastructure in place for the remaining 900 MW,” Badar-ul-Munir told The Third Pole.

He added that now is a good time for the state to pursue new investment: currently solar energy in Pakistan is sold at USD 0.037 per kilowatt-hour (kWh), compared with the USD 0.14/kWh tariff that the government is stuck with buying from solar projects set up in 2014-2016 under a 25-year agreement.

“We believe green is the way to go,” Asad Umar, Pakistan’s federal minister for planning, development and special initiatives, told The Third Pole. “We have always been very critical of the imported coal plants that we inherited from the previous government,” he said.

“Even before the recent announcement by China, greening the future development pathway was practically in motion. We had shelved two negotiated imported 2,400 MW coal projects under CPEC,” Malik Amin Aslam, the federal minister for climate change, added.

But the clean energy source Badar-ul-Munir has in mind is different from the one the government has its sights set on: hydropower.

Umar, who also heads several CPEC committees, said the “big dams that are being set up will have massive hydel energy capacity” and that his government favours them.

Yet this in no way means the government is completely washing its hands of dirty fuel.

The coal projects in the pipeline under CPEC “will continue”, according to Umar. However, all “future thermal projects will be using the indigenous coal from Tharparkar only”, he said, adding this was reflected in the recently approved 10-year energy roadmap.

-

Comment by Riaz Haq on January 16, 2022 at 10:00pm

-

According to the Pakistan Economic Survey 2019–20, the installed electricity generation capacity reached 37,402 MW in 2020. The maximum total demand coming from residential and industrial estates stands at nearly 25,000 MW, whereas the transmission and distribution capacity is stalled at approximately 22,000 MW. This leads to a deficit of about 3,000 MW when the demand peaks. This additional 3,000 MW required cannot be transmitted even though the peak demand of the country is well below its installed capacity of 37,402 MW.

https://en.wikipedia.org/wiki/Electricity_sector_in_Pakistan#:~:tex....

-

Comment by Riaz Haq on January 17, 2022 at 5:43pm

-

Arif Habib Limited

@ArifHabibLtd

Trade deficit increased by 107% to USD 25.5bn during 1HFY22

Textile Exports: $ 9.4bn, +26% YoY

Petroleum Imports: $ 10.2bn, +113% YoY

Transport Imports: $ 2.3bn, +105% YoY

Agriculture and others: $ 7.9bn, +96% YoY

https://twitter.com/ArifHabibLtd/status/1483063886744018945?s=20

-

Comment by Riaz Haq on January 21, 2022 at 10:40am

-

Arif Habib Limited

@ArifHabibLtd

Historic high-power generation registered in CY21, 136,572 GWh, up by 10.6% YoY. The sharp inflection in economic activity post supportive measures by the Gov’t/SBP remained instrumental in achieving this growth.

https://twitter.com/ArifHabibLtd/status/1484519832921989122?s=20

-------------------

Arif Habib Limited

@ArifHabibLtd

*Power Generation up by 9.3% YoY during 1HFY22*

Dec’21: 8,828 GWh, +12.0% YoY

1HFY22: 74,396 GWh , +9.3% YoY

https://twitter.com/ArifHabibLtd/status/1484511672001871878?s=20

-

Comment by Riaz Haq on January 24, 2022 at 10:23am

-

Arif Habib Limited

@ArifHabibLtd

Power Generation up by 10.6% YoY in CY21

Dec’21: 8,828 GWh, +12.0% YoY

CY21: 136,572 GWh, +10.6% YoY

Full Report

https://arifhabib.com/r/PowerGenDec-21.pdf

https://twitter.com/ArifHabibLtd/status/1485478323979436038?s=20

-

Comment by Riaz Haq on February 1, 2022 at 10:35pm

-

Arif Habib Limited

@ArifHabibLtd

Oil marketing industry sales surged by 18.9% YoY during Jan’22 to 1.80mn tons (7MFY22: 12.91mn tons, +14.5% YoY).

https://twitter.com/ArifHabibLtd/status/1488511560565854222?s=20&am...

-------------

https://tribune.com.pk/story/2341510/oil-sales-surge-20-to-18m-tons...

KARACHI:

The demand for petroleum oil products remained robust despite the uptrend in prices, as wheat harvesting, power generation through oil-fired plants and building of domestic reserves in anticipation of a further hike in international prices generated strong demand in January.

Besides, healthy industrial activities and growing car numbers on roads also contributed to the rising momentum in sales of petroleum products. Overall oil sales surged almost 20% to 1.8 million tons in January 2022 compared to 1.51 million tons in the previous month of December 2021, Arif Habib Limited (AHL) reported on Tuesday. “(High-speed) diesel had a major increase in demand among petroleum products in the wake of wheat harvesting in the country,” AHL Head of Research Tahir Abbas said while talking to The Express Tribune.

Secondly, three major power plants, located in Punjab, ran on diesel due to the widening gas shortfall during winter months. Besides, some other plants ran on furnace oil and its demand picked up as well. Thirdly, oil marketing companies (OMCs) and their dealers (petrol pumps) built inventories during the month in anticipation of a hike in prices of petroleum products in the global as well as domestic markets.

The building of reserves was aimed at making additional profits on likely increase in prices in the domestic market with effect from February 1, 2022. The government, however, decided to keep oil prices unchanged, which “had earlier been expected to increase by Rs12-15 per litre,” he said. The demand for petrol also remained robust in the backdrop of a significant growth in sales of cars and SUVs.

Car sales slowed down, but still remained significant despite the fact that the government took measures to cut imports of luxury cars and restricted bank financing for cars to control the current account deficit (CAD). Sales of diesel increased 20% to 0.74 million tons in January compared to 0.62 million tons in December.

Sales of petrol rose 6.2% to 0.74 million tons in the month under review compared to 0.70 million tons in the previous month. Sales of furnace oil surged 103% to 0.26 million tons in January compared to 0.13 million tons in December 2021. Cumulatively, in the first seven months (July-January) of the current fiscal year 2021- 22, oil sales increased 14.5% to 12.91 million tons compared to 11.27 million tons in the same period of previous year. The growth in demand is mostly seasonal given that wheat harvesting takes place

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 5 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network