PakAlumni Worldwide: The Global Social Network

The Global Social Network

Japanese Plan to Invest to Expand Business in Pakistan

Japanese companies have "strong intentions to expand their business for the reasons of “sales increase” and “high growth potential.” in Pakistan. JETRO 2013 Report

Japanese companies doing business in Pakistan have ranked the country second in the world in terms of business growth, according to a survey conducted by the Japan External Trade Organization (JETRO).

|

| Japanese Companies Reporting Profits (Source: JETRO) |

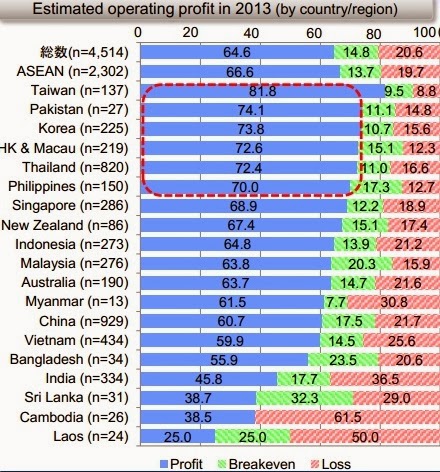

JETRO surveyed 9,371 Japanese multinational companies operating around the world and reported that Pakistan is ranked number 2 in terms of current profitability and expected sales growth. Taiwan leads with 81.8% reporting profits, followed by Pakistan with 74.1% being profitable in 2013.

|

| Japanese Companies' Sales Growth Forecast (Source: JETRO) |

Pakistan also ranks at number 2 with 81.5% forecasting future sales growth, just behind Myanmar where 84.6% see growth in the next one to two years. Other South Asian nations, including Bangladesh, India and Sri Lanka, rank much lower for both profits and sales growth.

|

| Japan to Supply Karachi Circular Railway Trains |

JETRO has been conducting such surveys for many years. Pakistan’s data is based on responses of 27 Japanese firms doing business in the country. The percentage of Japanese firms expecting improved operating profits remained the same level as last year, while varying by country and region. 64.6% of respondents expect an operating profit in 2013, remaining almost the same level as the previous year (63.9%). Looking at the results by country, the percentage for Taiwan is the

highest (81.8%), followed by Pakistan (74.1%), South Korea (73.8%), Hong Kong and Macau (72.6%) and Thailand (72.4%), among others. On the other hand, the percentage is relatively low

for Sri Lanka (38.7%), Cambodia (38.5%) and Laos (25.0%). Looking at the results by business scale, 69.4% of large-scale companies expect an operating profit, 13.2 points above the

percentage for small and medium-sized enterprises (SMEs) (56.2%).

The percentage of respondents planning to expand business operations in the next one or two years was 59.8% overall, a 2.0 point rise from the 57.8% in the previous year. Firms in emerging

countries such as Myanmar (84.6%), Pakistan (81.5%) and Cambodia (80.0%) have particularly strong intentions to expand their business for the reasons of “sales increase” and “high growth

potential.” The percentage for China increased to 54.2%, a 1.9 point rise from 2012 when it had decreased by 14.5 points from 2011. On the other hand, the percentage for Indonesia decreased

10.9 points from the previous year, the largest decrease among the surveyed countries. While the percentages for the Philippines (58.1%) and Sri Lanka (51.5%) are below overall average, they

showed significant increase (9.9 points and 14.0 points, respectively) compared to the previous year.

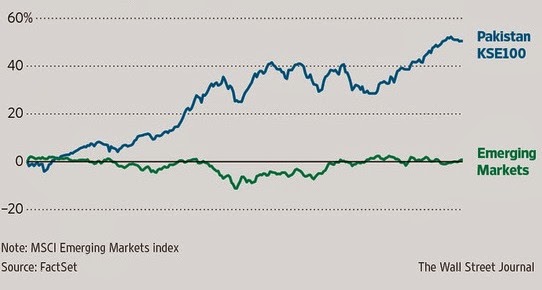

JETRO survey is the latest ray hope on the heels of impressive share market performance in 2013. Karachi's KSE-100 Stock Market Index was up 49.4% (37% in US$ terms) in 2013, beating all but four stock indices in the world. It handily beat Morgan Stanley's MSCI emerging market index which remained essentially flat. By comparison, India's main stock index rose just 8.89% in the same period. The remaining three BRIC countries--Brazil, Russia and China-- all saw their key stock indices decline in 2013.

|

| KSE-100 vs MSCI Emerging Markets Index Source: Wall Street Journal |

This is a continuation of the bullish trend seen in 2012 when KSE-100 also rose nearly 50% to top all Asian market indices. As of December 31, 2013, KSE-100 is up 329% since the end of 2008. It is being driven mainly by rapid growth in revenue and profits of the listed companies. Even after the strong run-up, the market still remains cheap—currently trading at over nine times trailing 12 month earnings—a common valuation measure used by stock analysts, according to Wall Street Journal.

|

| World Stock Indices Performance 2013 Source: Seeking Alpha |

Dubai finished up the most in 2013 with a gain of 107.69%. Japan was up the fourth most with a gain of 56.72%, making it the best performing G7 country. The US ended up in 9th place globally with a gain of 29.6%. Of the other G7 countries, Germany finished third with a YTD gain of 25.48%, followed by France (17.99%), Italy (16.56%), the UK (14.43%) and Canada (9.55%), according to Seeking Alpha.

The fresh investor optimism in 2013 was triggered by the election of Prime Minister Nawaz Sharif whose government is seen to be business-friendly by investors and businessmen. His finance minister Ishaq Dar claimed that Pakistan's gdp growth accelerated to 5% in July-Sept quarter in 2013. It was driven by large-scale manufacturing (LSM) which grew 12.76 per cent in September 2013 from a year ago.

"Pakistan has a fairly diverse economy with a large and young population that needs to be fed and supplied basic infrastructure such as electricity," Wall Street Journal quoted Caglar Somek, global portfolio manager at Caravel Management in New York, as saying. He manages around $650 million of investments. "If you find the companies that supply those basic needs, growing at double digit with high profitability, you can buy them at valuations that are on average 30% to 40% cheaper than their emerging market peers," said Mr. Somek.

Since the general elections of May, 2013, Pakistan has seen smooth power transfer from one civilian government to another. Other major transitions include the change of President, Army Chief and the nation's powerful Chief Justice of the Supreme Court.

Power cuts are now less frequent after payment of power generation companies overdue bills by the federal government. Financing has been closed on several power projects, including ADB financing of a major coal-fired plant in Jamshoro and Chinese loans for the nation's largest nuclear power plant planned for Karachi.

The good news for Pakistan in the JETRO report is that the Japanese companies have "strong intentions to expand their business for the reasons of “sales increase” and “high growth potential.”" Let's hope this results in a significant increase in foreign direct investment (FDI) in the country.

Progress on economic front, however, needs to be matched by similar progress on the security front which remains the biggest concern for the future of the country and its economy. What is needed is a comprehensive anti-terrorism strategy and plan of action soon.

Related Links:

Haq's Musings

Pakistan Stock Market Among World's Top 5 Performers in 2013

Foreign Investment Up, Load-shedding Down in Nawaz Sharif's First 1...

Pakistan to Beg and Borrow Billions More in 2013-14

Power Companies Profits Soar at Taxpayer's Expense

Does Nawaz Sharif Have a Counter-terrorism Strategy?

Pakistan's Tax Evasion Fosters Aid Dependence

Pakistan's Vast Shale Oil and Gas Reserves

Pak IPPs Make Record Profits Amid Worst Ever Load Shedding

Global Power Shift Since Industrial Revolution

Massive Growth in Electrical Connections in Pakistan

Finance Minister Ishaq Dar's Budget 2013-14 Speech

-

Comment by Riaz Haq on February 11, 2014 at 9:49am

-

Here's a Railway Tech story on Karachi Circular Railway (KCR):

..."The total length of the railway line is expected to be 50km and will cost about $1.58bn."

The execution of the project, however, is facing a few hurdles in land acquisition. Several households have been illegally living along the right of way of the proposed KCR. A resettlement action plan study was proposed to identify and provide land for the people affected by the project.

Following completion of the study, the land needed for the project was to be transferred to the KUTC. The resettlement study, however, has not been completed, and therefore, the project can not yet begin.

Karachi circular railway (KCR) revival project

A feasibility study for the revival of the KCR was conducted by Japan External Trade Organisation (JETRO) in 2006. UK-based Scott Wilson Railways was appointed to validate the report prepared by JETRO.

Japan International Co-operation Agency (JICA), which is funding the project, sponsored a final study prepared by Special Assistance for Project Formulation (SAPROF). US-based consultants Louis Berger validated the final report.

---

The study prepared by JETRO recommended that the project should be executed in two phases. Phase I of the project will include a 28.3km circular section from Karachi Cantt to a proposed station at Gulistan-e-Johar. About 9km of this section will be elevated.

Phase II will consist of the 14.8km circular section from Gulistan-e-Johar to the proposed station at Liaquatabad. This section will have two dedicated tracks along the main line.

Phase II also includes a 5.9km airport line from Drigh Road to Jinnah Airport. This extension will either have an elevated or underground track. Other bridges, culverts and underpasses, wherever necessary, will be constructed for the project.

Japan International Co-operation Agency (JICA) is providing the entire funding for the project through a soft loan. The loan is payable in 40 years by the stakeholders of the City District Government Karachi, Pakistan Railways and Government of Sindh (KUTC). The KUTC is planning an international tendering process for the project, which will be awarded on a turnkey basis. The winning contractors will operate it for the first two years of operation.

KCR line routes

The modernised KCR will follow a circular path, covering Karachi Cantt, Karachi city, Wazir mansion, Liaquatabad, Depot Hill, Drigh Road and Departure Yard. The extension towards the airport will start from Drigh Road and follow the path of the Pakistan Railways towards the airport.

KCR infrastructure

"About 23 stations are planned for the project."

The project will include the construction of 19 underpasses and three overhead bridges.

About 23 stations are planned for the project. The stations will feature computerised ticketing and vending machines, automated ticket gates and elevators.

The existing KCR has about 22 level crossings. Since the railway line passes through the major commercial areas of the city, these level crossings need to be removed to ensure that trains can operate at the proposed 6min headway. The level crossings are expected to be removed and replaced by underpasses or overpasses.

Rolling stock

The new KCR will be served by electric multiple units (EMU) with a capacity to carry 1,400 passengers. The maximum speed of the EMUs will be 100km/h. About 290 trains are expected to operate daily at a six-minute headway.

KCR signalling and communications

The project will feature modern signalling and telecommunication system. An automatic train control (ATC) system will also be set up for the railwayhttp://www.railway-technology.com/projects/karachicircularrailw/

-

Comment by Riaz Haq on April 1, 2016 at 4:47pm

-

#Japan's Ajinomoto to offer #halal seasonings in #Pakistan in collaboration with Lakson Group- Nikkei Asian Review http://s.nikkei.com/1SsHHLV

TOKYO -- Ajinomoto will set up a company in Pakistan to sell halal-certified seasonings, aiming to tap a market of nearly 200 million people as well as gain a firmer foothold near the Middle East and its heavily Muslim population.

The Japanese company will form a joint venture with Pakistani conglomerate Lakson Group in Karachi, Pakistan's largest commercial center. The venture will be capitalized at about 1.2 billion yen ($10.7 million), with Ajinomoto owning 85% and Lakson 15%. It will import such products as fried chicken coating and meat-flavored Masako seasoning from Indonesia and market them across Asia using Lakson's sales network. The two companies are targeting about 1.3 billion yen in sales by fiscal 2022, aiming to eventually turn this into a 10 billion yen business.

Ajinomoto set up an office in Pakistan in July 2014 and has studied trends in the country's food markets and logistics industry. Although it sells its namesake monosodium glutamate flavoring through local stores, it apparently faces an uphill battle against more established Chinese rivals.

Lakson, which works in finance and information technology, also partners with foreign companies to manufacture and sell such items as tea, detergents and soap. Its products are carried by 180,000 retailers across the country. The partnership with Ajinomoto will add high-value-added seasonings such as meat flavorings for lentil soup -- an important part of home cooking -- to Lakson's portfolio.

Ajinomoto expects to report group sales of 1.26 trillion yen for fiscal 2015, with the food segment accounting for about 70%. Domestic food sales are seen totaling 404.5 billion yen and overseas sales 502.7 billion yen. The company has focused on such countries as Brazil, the Philippines and Indonesia as foreign growth drivers. It considers Indonesia key to future growth, positioning it as a base for cultivating the Muslim market.

The company will spend 360 billion rupiah ($27.3 million) to boost Masako production capacity by 30% in Indonesia, where it has had success making and selling halal products. For Pakistan, whose Muslim population is second only to Indonesia's, Ajinomoto will develop products tailored to Muslim dietary habits as well as consider local production.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 11 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network